|

Extraordinary Meeting of Council - 28 June 2019 - Attachments

|

Item 1 Attachments a |

Extraordinary Meeting of Council

Open Agenda

|

Meeting Date: |

Friday 28 June 2019 |

|

Time: |

3.00pm |

|

Venue: |

Council Chamber |

|

Council Members |

Acting Mayor White (In the Chair), Councillors Boag, Brosnan, Dallimore, Hague, Jeffery, McGrath, Price, Tapine, Taylor, Wise and Wright |

|

Officer Responsible |

Chief Executive |

|

Administrator |

Governance Team |

|

|

Next Council Meeting Thursday 11 July 2019 |

Extraordinary Meeting of Council - 28 June 2019 - Open Agenda

ORDER OF BUSINESS

Apologies

Mayor Dalton

Conflicts of interest

Public forum

Nil

Announcements by the Acting Mayor

Announcements by the management

Agenda items

1 Adoption of Annual Plan 2019/20.................................................................................... 3

2 Resolution to set the rates for 2019/20.......................................................................... 26

Public excluded ............................................................................................................. 33

Extraordinary Meeting of Council - 28 June 2019 - Open Agenda Item 1

1. Adoption of Annual Plan 2019/20

|

Type of Report: |

Legal |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

724867 |

|

Reporting Officer/s & Unit: |

Caroline Thomson, Chief Financial Officer |

1.1 Purpose of Report

To adopt the 2019/20 Annual Plan in accordance with the Local Government Act 2002.

|

That Council: a. Note and action where necessary any feedback from the Audit and Risk Committee b. Agree the Annual Plan 2019/20 has been developed in accordance with section 95 of the Local Government Act 2002 and meets all requirements under the Act. c. Adopt the Annual Plan 2019/20 as attached in Attachment A. d. Delegate responsibility to the Chief Financial Officer to approve any final edits required to the Annual Plan and supporting information in order to finalise the documents for uploading online and physical distribution. e. Direct officers to comply with section 95 (7) of the Local Government Act 2002 and make the annual plan publicly available.

|

|

That the Council resolve that the officer’s recommendation be adopted. |

1.2 Background Summary

Overview

The Council has completed all the relevant provisions contained within the Local Government Act 2002 regarding the preparation of an Annual Plan. This report is an administrative matter and concludes the Council’s annual planning process by recommending that the 2019/20 annual plan be adopted. This is the final step in the annual plan process and is one of technical compliance with the provisions of the Local Government Act 2002. The annual plan is not audited and does not require audit approval prior to adoption.

As outlined in previous Council reports, Council followed the following broad process for developing the annual plan:

· Officers undertook budget reviews

· Seven seminars with Councillors including 6 focused on budget development were held between November 2018 – March 2019. The purpose of these seminars was to provide time for Councillors to discuss and set direction on any changes from the LTP.

· Council meetings to consider and make decision on supporting information, consultation approach and consultation document (15 March 2019, 2 April 2019).

· Consultation period – 8 April-13 May including 3 community meetings.

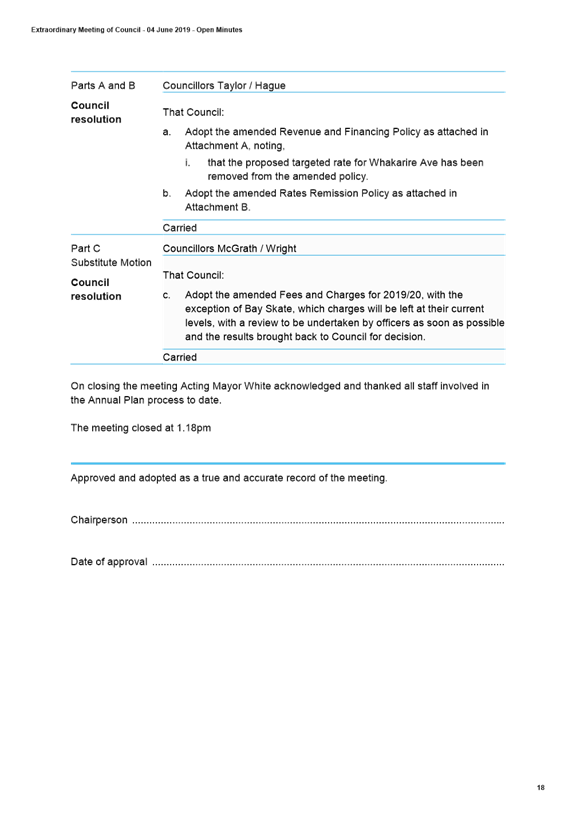

· Consideration of submissions – Officers provided to Council all individual submissions and an officer’s report containing all submissions, a summary of submissions, and officer’s consideration of the submissions, and officer’s recommendation. Council altered some of the officer’s recommendations and added to them (4 June 2019). For record purposes, the minutes of the 4 June meeting are attached as attachment B.

On 4 June 2019, following the consideration of feedback received and Council deliberations, Council agreed decisions to finalise the annual budget for 2019/20. The Annual Plan 2019/20 has been prepared reflecting these decisions. In particular, it includes:

· Prospective financial statements and other financial information based on year 2 of the LTP 2018-28 updated to reflect the budget decisions made on 4 June 2010

· Rating policy, reflecting decisions made on 4 June 2019.

The Local Government Act 2002 requires that Council adopt the annual budget 2019/20 before 1 July 2019. Following adoption, officers will finalise documentation for distribution and also undertake activity to update Napier residents, particularly submitters of the decision.

The final overall budget position for the 2019/20 is a 6.4% average increase in rate requirement for existing ratepayers as agreed at the 4 June 2019 meeting. Before Council can resolve to set the rates for the 2019/20, Council must first adopt the Annual Plan which confirms the budget for the year. The resolution setting the rates for 2019/20 will be considered as a separate report on this agenda, following adoption of the Annual Plan 2019/20.

1.3 Issues

When preparing, consulting on and making decisions on the Annual Plan 2019/20, the council has followed a thorough process, including considering:

· significance or materiality of the differences to year two of the LTP

· whether any formal amendment to the LTP is necessary

· extent of the council’s resources

· statutory decision-making practices in the Local Government Act 2002 (Part 6)

· decisions that are required for this annual budget

· financial management requirements.

Officers have reviewed the processes outlined above and confirm that Council has complied with all legal requirements for adoption of the annual budget today.

Of note, Council cannot delegate the power to adopt an annual plan to a Committee, and this is why all the annual plan reports have been submitted directly to Council and not through a Committee.

Relating to making a decision on a Long-term plan, or an Annual Plan, the effect of adopting an Annual Plan is to provide a formal and public statement of Council’s intentions in relation to the matters covered by the plan. A resolution to adopt a Long-term plan or annual plan does not constitute a decision to act on any specific matter included within the plan (Section 96 of the Local Government Act 2002 refers).

In addition a number of projects, for which funding was approved 2018/19, were identified as needing to be carried forward in the last quarterly financial report to Council. The final schedule of projects to be carried forward will be presented with Council’s end of year report. The carry forwards will be included in the 2019/20 revised budget and reported through the quarterly reports to Council.

1.4 Significance and Engagement

Officers assessed the changes from year 2 of the Long-Term plan 2018-28 and advised Council of the significant and material changes. Consultation has occurred in accordance with the Local Government Act 2002.

1.5 Implications

Financial

When considering the changes to the Annual Plan 2019/20 from the Long Term Plan 2018-28, Council officers reviewed its compliance against the Councils Financial Strategy and its Financial Prudence benchmarks.

As part of the Long Term Plan 2018-28 Council approved the Local Government Cost Index (LGCI) + 5% as its cap for rates increases. The proposed Annual Plan rates increase of 6.4% is within this level (including the recycling level of service adopted as part of WMMP).

Another key benchmark for Council is the Rates limit Benchmark, which is a measure of the rates income limits. The Council budget complies with this requirement.

In addition, the Balanced Budget Benchmark has been met.

There are ongoing financial implications from the introduction of the enhanced kerbside recycling collection service and rubbish collection service as per the Joint Waste Management and Minimisation Plan 2018-24. The exact cost of the new contracts for recycling and rubbish collection will not be known until they are tendered for.

At the 4 June 2019 Council meeting, Council allocated 200K to be funded from loans-rates to undertake an independent review of the options and costings for the supply of un-chlorinated water for Napier.

Looking ahead to 2020/21

There are also financial implications from bringing forward projects without these having a direct impact on the 2019/20 year rates, and new capital work, including the War Memorial and Kennedy Park ablution block. In the development of future Annual Plans there is the ability to further refine the annual budgets contained in that year within the Council’s Long Term Plan (year 3 of the LTP). This will be at the discretion of the new Council to be elected October 2019. The following items have been approved as part of the Annual Plan and impact future years.

Cost of servicing additional loans

· New War Memorial spending proposal (0.2%)

· Kennedy Park ablution block (0.3%)

· Changes to water projects (0.7%)

· Independent assessment – water (0.02%)

Waste Minimisation and Management Plan impacts – these impacts are ongoing.

· Impact of phasing in kerbside recycling over 3 years (0.5% in 2020/21 and a further 1.15% in 2021/22) to be confirmed after confirmation of tender.

· Rubbish collection service changes (to be confirmed with tendering).

Social & Policy

The annual plan 2019/20 aligns with all Council policy including the Joint Waste Management and Minimisation Plan 2018-24.

Changes to the Revenue and Financing Policy and Rates Remission Policy have been consulted on concurrently but separately to the Annual Plan and Council adopted the amended policies on 4 June 2019.

Risk

The following risks were noted as part of the development of the Annual Plan 2019/20

- Strong Construction market demand – pressure on capital programme

- Climate change – Central Government requirements

- Government Healthy Home requirements

- Living wage/Min Wage changes

- Wellbeing legislation

- Insurance market (costs escalating as market making a loss)

- Outstanding detailed seismic assessments on Council owned buildings

- Timing of sections sold for Parklands development

- Elections and new Council requirements

- Limited general reserves

- The impact on rates in future years from loan funding capital projects in 2019/20

- Implementing WMMP waste recommendations could result in an average rates increase of between 1% and 2% for 2020/21

- Implementing WMMP recycling recommendations will result in an average rates increase of 1.7% (0.5% in 2020/21 and a further 1.15% in 2021/22)

- Provincial Growth Fund projects:

o ongoing costs

o cap on Government support

o impact on current programme of work resulting from pressure to get work completed before Central government elections

1.6 Options

The options available to Council are as follows:

a. Adopt the Annual Plan 2019/20

b. Not adopt the Annual Plan 2019/20 (which would mean that rates cannot be struck)

1.7 Development of Preferred Option

Option A. A robust process has been undertaken to develop the budget and Council has considered public feedback and made decisions to proceed to develop the final plan. A plan can be modified during the year within the parameters of section 96.

Adopt the annual plan 2019/20 as a robust process has been undertaken and Council has considered public feedback and made decisions to proceed to develop the final plan.

a Minutes - Council meeting, 4 June 2019 ⇩

b Annual Plan 2019/20 (Under Separate Cover) ⇨

2. Resolution to set the rates for 2019/20

|

Type of Report: |

Legal |

|

Legal Reference: |

Local Government (Rating) Act 2002 |

|

Document ID: |

762298 |

|

Reporting Officer/s & Unit: |

Ross Franklin, Consultant |

2.1 Purpose of Report

To set rates for 2019/20 in accordance with the Local Government (Rating) Act 2002 and with the Funding Impact Statement.

|

That Council: a. Resolve that the Napier City Council set the following rates under the Local Government (Rating) Act 2002, on rating units in the city for the financial year commencing on 1 July 2019 and ending on 30 June 2020, and that all such rates shall be inclusive of Goods and Services Tax (GST).

(A) GENERAL RATE A general rate set under Section 13 of the Local Government (Rating) Act 2002 made on every rating unit, assessed on a differential basis on the rateable land value to apply to the Differential Groups as follows:

(B) UNIFORM ANNUAL GENERAL CHARGE A Uniform Annual General Charge of $368.00 per separately used or inhabited part of a rating unit for all rateable land set under Section 15 of the Local Government (Rating) Act 2002.

(C) WATER RATES as follows: 1. Fire Protection Rate A targeted rate for fire protection, set under Section 16 of the Local Government (Rating) Act 2002 on a differential basis and on the rateable capital value on every rating unit connected to or able to be connected and within 100 metres of either the City Water Supply System, or the Bay View Water Supply System. This rate will apply to the Differential Groups and Categories as follows:

2. City Water Rate A targeted rate for Water Supply, set on a differential basis under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit connected to or able to be connected to and within 100 metres of the City water supply system. This such rate will apply as follows:

3. Bay View Water Rate A targeted rate for Water Supply, set on a differential basis under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit connected to or able to be connected to and within 100 metres of the Bay View water supply system This rate will apply as follows:

4. Water by Meter Rate A targeted rate for water supply, set under Section 19 of the Local Government (Rating) Act 2002, on a differential basis per cubic metre of water consumed after the first 300m3 per annum, to all metered rating units as follows:

(D) REFUSE COLLECTION AND DISPOSAL RATE A targeted rate for refuse collection and disposal, set under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit, for which a weekly rubbish collection service is available, with the rate being 2 or 3 times the base rate for those units where 2 or 3 collections per week respectively is available. This rate will apply as follows:

(E) KERBSIDE RECYCLING RATE A targeted rate for Kerbside Recycling, set under Section 16 of the Local Government (Rating) Act 2002, as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit for which the Kerbside recycling collection service is available. This rate will apply as follows:

(F) SEWERAGE RATE A targeted rate for sewerage treatment and disposal, is set on a differential basis under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis. The rate is applied to each separately used or inhabited part of a rating unit connected or able to be connected and within 30 metres of the City Sewerage system (including the Bay View Sewerage Scheme). This rate will apply as follows:

(G) BAY VIEW SEWERAGE CONNECTION RATE A targeted rate for Bay View Sewerage Connection, set under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit connected to the Bay View Sewerage Scheme, where the lump sum payment option was not elected. The rate to apply for 2019/20 is $941.36

(H) CBD OFF STREET CARPARKING RATE A targeted rate to provide funding for additional off street carparking in the Central Business District set under Section 16 of the Local Government (Rating) Act 2002 on a differential basis on the rateable land value, to apply to rating units in the Central Business District. The rate to apply to the Differential Groups is as follows:

(I) SUBURBAN OFF STREET CARPARKING RATE A targeted rate to provide funding for additional off street carparking in Suburban Shopping and commercial areas and to maintain existing offstreet parking areas in suburban shopping and commercial areas, set under Section 16 of the Local Government (Rating) Act 2002 as a rate in the dollar on Land Value as follows:

(J) TARADALE OFF STREET CARPARKING RATE A targeted rate to provide funding for additional off street carparking in the Taradale Shopping and commercial area and to maintain existing offstreet parking areas in Taradale, set under Section 16 of the Local Government (Rating) Act 2002 as a rate in the dollar on Land Value as follows:

(K) CBD PROMOTION RATE A targeted rate to fund at least 70% of the cost of the promotional activities run by the Napier City Business Inc, set under Section 16 of the Local Government (Rating) Act 2002, and applied uniformly on the rateable land value of all rating units in the area defined as the Central Business District, such rate to apply to applicable properties within the Differential Groups and Differential Codes as follows:

(L) TARADALE PROMOTION RATE A targeted rate to fund the cost of the Taradale Marketing Association’s promotional activities, set under Section 16 of the Local Government (Rating) Act 2002 and applied uniformly on the rateable land value of all rating units in the Taradale Suburban Commercial area, such rate to apply to the Differential Groups and Differential Codes as follows:

(M) SWIMMING POOL SAFETY RATE A targeted rate to fund the cost of pool inspections and related costs, set under Section 16 of the Local Government (Rating) Act 2002, as a fixed amount on every rating unit where a swimming pool or small heated pool (within the meaning of the Building (Pools) Amendment Act 2016) is located, of $51 per rating unit.

(N) DUE DATES FOR PAYMENT AND PENALTY DATES (For Rates other than Water by Meter Rates) That rates other than water by meter charges are due and payable in four equal instalments. A 10% penalty will be added to any portion of rates (except for Water by Meter) assessed in the current year that remains unpaid after the relevant instalment date, on the respective penalty date as shown in the following table as provided for in section 57 and 58(1)(a) of the Local Government (Rating) act 2002

Any portion of rates assessed in previous years (including previously applied penalties) which remains unpaid on 30 July 2019 will have a further 10% added, firstly on 31 July 2019, and if still unpaid, again on 31 January 2020. (O) WATER RATES Targeted rates for metered water supply will be separately invoiced from other rates invoices. Metered water supply for commercial properties is invoiced quarterly and metered water for domestic (residential) water supply is invoiced annually. A 10% penalty will be added to any part of the water rates that remain unpaid by the due date as shown in the table below as provided for in section 57 and 58(1)(a) of the Local Government (Rating) Act 2002. Metered Water Supply rates are due for payment as follows:

A penalty of 10% will be added to any portion of water supplied by meter, assessed in the current year, which remains unpaid by the relevant instalment due date, on the respective penalty date above. Any portion of water rates assessed in previous years (including previously applied penalties) which are unpaid by 30 July 2019 will have a further 10% added, firstly on 31 July 2019, and if still unpaid, again on 31 January 2020. Any water payments made will be allocated to the oldest debt. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

That the Council resolve that the officer’s recommendation be adopted. |

2.2 Background Summary

Once the Annual Plan for the year has been adopted Council needs to pass a resolution to set the rates for the year to enable the required rates revenue to be collected to fund Council’s budgeted activities for the year.

The resolution is drafted to comply with the requirements of the Local Government (Rating) Act 2002

2.3 Issues

These resolutions are procedural in nature in that they follow the legal process to collect the revenue as proposed in the Annual Plan.

The proposed rates are as set out in the Funding Impact Statement which is included in the Annual Plan document. The rates vary slightly from those published in the draft Annual Plan however the overall effect remains at an average increase of 6.4% for existing ratepayers. Examples of the impact for different categories are shown on page 61 of the Annual Plan.

2.4 Significance and Engagement

This report implements a decision of council made following consultation on the 2019/20 Annual Plan. No further action is required in relation to Council’s significance and engagement policy.

2.5 Implications

Financial

The recommendations in this report enable council to collect rates revenues of $60.326 million as outlined in the 2019/20 Annual plan.

Social & Policy

The are no social or policy implications

Risk

If council does not pass the proposed resolutions the required revenue to fund Council’s activities for 2019/20 would not be able to be collected.

2.6 Options

The options available to Council are as follows:

a. Adopt the resolutions as proposed

b. Adopt an amended resolution

c. Do not adopt the resolution

2.7 Development of Preferred Option

As explained in the report these resolutions are procedural in nature in that they implement a decision already made by Council when the 2019/20 Annual Plan was adopted. Therefore the preferred decision is to adopt the resolutions as proposed without any alteration.

Extraordinary Meeting of Council - 28 June 2019 - Open Agenda

That the public be excluded from the following parts of the proceedings of this meeting, namely:

Agenda Items

1. Contract 1215 - Road Maintenance and Renewal Contract

The general subject of each matter to be considered while the public was excluded, the reasons for passing this resolution in relation to each matter, and the specific grounds under Section 48(1) of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution were as follows:

|

General subject of each matter to be considered. |

Reason for passing this resolution in relation to each matter. That the public conduct of the whole or the relevant part of the proceedings of the meeting would be likely to result in the disclosure of information where the withholding of the information is necessary to: |

Ground(s) under section 48(1) to the passing of this resolution. 48(1)(a) That the public conduct of the whole or the relevant part of the proceedings of the meeting would be likely to result in the disclosure of information for which good reason for withholding would exist: |

|

Agenda Items |

||

|

1. Contract 1215 - Road Maintenance and Renewal Contract |

7(2)(h) Enable the local authority to carry out, without prejudice or disadvantage, commercial activities 7(2)(i) Enable the local authority to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) |

48(1)A That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding would exist: |