|

Audit and Risk Committee - 12 June 2020 - Attachments

|

Item 4

Attachments d

|

|

Rates

Remission Policy

|

|

Approved by

|

Pending Approval by Council

|

|

Department

|

Finance

|

|

Original Approval Date

|

30 June 2019

|

Review Approval Date

|

June 2020

|

|

Next Review Deadline

|

June 2023

|

Document ID

|

|

|

Relevant Legislation

|

Local Government Act 2002, Local Government

(Rating) Act 2002

|

|

NCC Documents Referenced

|

Published in the Long Term Plan 2018-2028

which was reviewed between March/Apr 2018 and adopted on 29-06-18

Reviewed and amended as part of 2019/20

Annual Plan

Reviewed and amended as part of 2020/21

Annual Plan

|

Purpose

To enable Council to remit all or part of

the rates on a rating unit under Section 85 of the Local Government (Rating)

Act 2002 where a Rates Remission Policy has been adopted and the conditions and

criteria in the policy are met.

Policy

1. Remission of Penalties

Objective

The objective of this part of the Rates

Remission Policy is to enable Council to act fairly and reasonably in its

consideration of rates which have not been received by the Council by the

penalty date due to circumstances outside the ratepayer’s control.

Conditions and Criteria

Penalties incurred will be automatically

remitted where Council has made an error which results in a penalty being

applied.

Remission of one penalty will be

considered in any one rating year where payment has been late due to

significant family disruption. This will apply in the case of death, illness,

or accident of a family member, at about the times rates are due.

Remission of the penalty will be

considered if the ratepayer forgets to make payment, claims a rates invoice was

not received, is able to provide evidence that their payment has gone astray in

the post, or the late payment has otherwise resulted from matters outside their

control. Each application will be considered on its merits and remission will

be granted where it is considered just and equitable to do so

Remission of a penalty will be considered

where sale has taken place very close to due date, resulting in confusion over

liability, and the notice of sale has been promptly filed, or where the

solicitor who acted in the sale for the owner acted promptly but made a mistake

(e.g. inadvertently provided the wrong name and address) and the owner cannot

be contacted. Each case shall be treated on its merits.

Penalties will also be remitted based on

the application, by officers, of Council criteria established after Council has

identified that Significant Extraordinary Circumstances have occurred that

warrants further leniency in relation to the enforcement of penalties that

would otherwise have been payable. The criteria to be applied will be set out

in a council resolution that will be linked to the specific Significant

Extraordinary Circumstances that have been identified by Council.

Penalties will also be remitted where

Council’s Chief Financial Officer considers a remission of the penalty,

on the most recent instalment, is appropriate as part of an arrangement to

collect outstanding rates from a ratepayer.

2. Remission for Residential Land in

Commercial or Industrial Areas

Objective

To ensure that owners of rating

units situated in commercial or industrial areas are not unduly penalised by

the zoning decisions of this Council and previous local authorities.

Conditions and Criteria

To qualify for remission under

this part of the policy the rating unit must:

· Be situated within an area of land that has

been zoned for commercial or industrial use. Ratepayers can determine where

their property has been zoned by inspecting the City of Napier District Plan,

copies of which are available from the Council office.

· Be listed as a ‘residential’

property for differential rating purposes. Ratepayers wishing to ascertain

whether their property is treated as a residential property may inspect the

Council’s rating information database at the Council office.

Rates will be automatically

remitted annually for those properties which had Special Rateable Values

applied under Section 24 of the Rating Valuations Act 1998 up to 30 June 2003,

and for which evidence from Council’s Valuation Service Provider

indicates that, with effect from the 2002 revaluation of Napier City, the land

value has been penalised by its zoning. The amount remitted will be the

difference between the rates calculated on the equivalent special rateable

value provided by the Valuation Service Provider and the rates payable on the

Rateable Value.

Other ratepayers wishing to

claim remission under this part of the policy must make an application in

writing addressed to the Chief Financial Officer.

The application for rates

remission must be made to the Council prior to the commencement of the rating

year. Applications received during a rating year will be applicable from the

commencement of the following rating year. Applications will not be backdated.

Where an application is

approved, the Council will direct its Valuation Service Provider to inspect the

rating unit and prepare a valuation that will treat the rating unit as if it

were a comparable rating unit elsewhere in the district. The ratepayer may be

asked to contribute to the cost of this valuation. Ratepayers should note that

the Valuation Service Provider’s decision is final as there are no

statutory right of objection or appeal for values done in this way.

3. Remission for Land Subject to Special Preservation

Conditions

Objective

To preserve and encourage the

protection of land and improvements which are the subject of special

preservation conditions.

Conditions and Criteria

Rates remission under this Section of the

policy relates to land that is subject to:

· A heritage covenant under the Historic

Places Act 1993; or

· A heritage order under the Resource

Management Act 1991; or

· An open space covenant under the Queen

Elizabeth the Second National Trust Act 1977; or

· A protected private land agreement or

conservation covenant under the Reserves Act 1977; or

· Any other covenant or agreement entered

into by the owner of the land with a public body for the preservation of

existing features of land, or of buildings, where the conditions of the

covenant or agreement are registered against the title to the land and are

binding on subsequent owners of land.

Ratepayers who own Rating Units meeting

this criteria may qualify for remission under this part of the policy.

Rates will automatically be remitted

annually for those properties which had Special Rateable Values applied under

Section 27 of the Rating Valuations Act up to 30 June 2003, and which meet the

above criteria. The amount remitted will be the difference between the rates

calculated on the equivalent special rateable value provided by the Valuation Service

Provider and the rates payable on the Rateable Value.

Other ratepayers wishing to claim

remission under this part of the policy must apply in writing to the Council

office, and must provide supporting documentary evidence of the special

preservation conditions, e.g. copy of the Covenant, Order or other legal

mechanism.

The application for rates remission must

be made to the Council prior to the commencement of the rating year.

Applications received during a rating year will be applicable from the commencement

of the following rating year.

Applications for remission under this part

of the policy will be approved by the Council. The Council may specify certain

conditions before remission will be granted. Applicants will be required to

agree in writing to these conditions and to pay any remitted rates if the

conditions are violated.

Where an application is approved, the

Council will direct its Valuation Service Provider to inspect the Rating Unit

and provide a special valuation. The ratepayer may be asked to contribute to

the cost of this valuation. Ratepayers should note that the Valuation Service

Provider’s decision is final as there is no statutory right of objection

or appeal for values done in this way.

The equivalent special rateable value will

be determined by the Valuation Service Provider on the assumption that:

· The actual use to which the land is being

put at the date of valuation will be continued; and

· Any improvements on the land will be

continued and maintained or replaced in order to enable the land to continue to

be so used.

It will be assessed taking into account

any restriction on the use that may be made of the land imposed by the

mandatory preservation of any existing tenements, hereditaments, trees,

buildings, other improvements, and features.

4. Remission of Uniform Annual General Charges (UAGC) and

Targeted Rates of a Fixed Amount on Rating Units Owned by the Same Owner

Objective

To provide for relief from UAGC and

Targeted Rates of a fixed amount per Rating Unit or Separately Used or

Inhabited Parts of a Rating Unit, where two or more Rating Units are owned by

the same person or persons, and are:

· part of a subdivision plan which has been

deposited for separate lots, or separate legal titles exist; or

· but the Rating Units may not necessarily be

used jointly as a single unit, and each Rating Unit does not benefit separately

from the services related to the UAGC and Targeted Rates.

Conditions and Criteria

Remission of UAGC and Targeted Rates of a

fixed amount applies in the following situations:

· Unsold subdivided land, where as a result

of the High Court decision of 20 November 2000 ‘Neil Construction and

others vs. North Shore City Council and others’, each separate lot or

title is treated as a separate Rating Unit, and such land is implied to be not

used as a single unit.

All remissions under this part of the

policy will be approved by the Chief Financial Officer.

5. Remission for Water Rates (by meter)

Objective

To provide ratepayers with a measure of relief

by way of partial rates remission where, as a result of the existence of a

water leak on the Rating Unit which they occupy the payment of fuller rates is

inequitable, or where officers are convinced that there are errors in the data

relating to water usage.

Conditions

and Criteria

· The existence of a significant leak on the occupied

Rating Unit has been established and there is evidence that steps have been

taken to repair the leak as soon as possible after the detection, or officers

have reviewed the usage data and are convinced that the usage readings are so

abnormal as to require adjustment.

· The Council or its delegated officer(s) as determined

from time to time and set out in the Council’s delegations register shall

determine the extent of any remission based on the merits of each situation.

6. Remission to smooth the effects of change in rates on

individual or groups of properties

Objective

To enable Council to provide rates

remission where, as a result of a change in Council policy or other change that

results in a significant increase in rates, Council decides it is equitable to

smooth or temporarily reduce the impacts of the change by reducing the amount

payable.

Conditions and Criteria

· Remission of part of the value based rates to enable

the impact of a change in rates to be phased in over a period of no more than 3

years.

To continue with any existing rates

adjustment where, due to change in process, policy or legislation Council

considers it equitable to do so subject to a maximum limit of 3 years to a

remission made under this clause in the policy.

7. Remission for Special Circumstances

Objective

To enable Council to provide rates

remission for special and unforeseen circumstances, where it considers relief

by way of rates remission is justified in the circumstances.

Conditions and Criteria

Applications for rates remission must be

made in writing by the ratepayer or their authorised agent.

Each circumstance will be considered by

Council on a case by case basis. Where necessary, Council consideration and

decision will be made in the Public Excluded part of a Council meeting.

The terms and conditions of remission will

be decided by Council on a case by case basis. The applicant will be advised in

writing of the outcome of the application.

8. Remission of Rates in Response to Significant

Extraordinary Circumstances being identified by Council.

Objective

To enable Council to provide rates

remission to assist ratepayers in response to Significant Extraordinary

Circumstances impacting Napier’s ratepayers.

Definitions

Financial Hardship: for the purpose of

this provision is defined as the inability of a person, after seeking recourse

from Government benefits or applicable relief packages, to reasonably meet the

cost of goods, services and financial obligations that are considered necessary

according to New Zealand standards. In the case of a ratepayer who is not a

natural person, it is the inability, after seeking recourse from Government

benefits or applicable relief packages, to reasonably meet the cost of goods,

services and financial obligations that are considered essential to the

functioning of that entity according to New Zealand standards.

Conditions and Criteria

For this policy to apply Council must

first have identified that there have been Significant Extraordinary

Circumstances affecting the ratepayers of Napier, that Council wishes to

respond to.

Once Significant Extraordinary

Circumstances have been identified by Council, the criteria and application

process (including an application form, if applicable), will be made available.

For a Rating Unit to receive a remission

under this policy it needs to be an “Affected Rating Unit” based on

an assessment performed by officers, following guidance provided through a

resolution of Council.

Council resolution will include:

1. That the resolution applies under the

Rates Remission Policy; and

2. Identification of the Significant

Extraordinary Circumstances triggering the policy (including both natural and

man-made events); and

3. How the Significant Extraordinary

Circumstances are expected to impact the community (e.g. financial hardship);

and

4. The type of Rating Unit the remission

will apply to; and

5. Whether individual applications are

required or a broad based remission will be applied to all affected Rating

Units or large groups of affected Rating Units; and

6. What rates instalment/s the remission

will apply to; and

7. Whether the remission amount is either a

fixed amount, percentage, and/or maximum amount to be remitted for each qualifying

Rating Unit.

Explanation

The specific response and criteria will be

set out by Council resolution linking the response to specific Significant Extraordinary Circumstances. The criteria may apply a remission broadly to all

Rating Units or to specific groups or to Rating Units that meet specific

criteria such as proven Financial Hardship, a percentage of income lost or some

other criteria as determined by council and incorporated in a council

resolution.

Council will indicate a budget to cover the

value of remissions to be granted under this policy in any specific financial

year.

The types of remission that may be applied

under this policy include:

· The remission of a fixed amount per Rating Unit either

across the board or targeted to specific groups such as:

o A fixed amount per residential Rating Unit

o A fixed amount per commercial Rating Unit

Policy Review

This policy will be reviewed at least once

every three years.

Document History

|

Version

|

Reviewer

|

Change Detail

|

Date

|

|

2.0.0

|

Caroline Thomson

|

Updated and approved by

Council with LTP

|

29 June 2018

|

|

3.0.0

|

Caroline Thomson

|

Updated in conjunction with

2019-20 Annual Plan

|

4 June 2019

|

|

4.0.0

|

|

Updated in conjunction with

2020-21 Annual Plan

|

|

|

Audit and Risk Committee - 12 June 2020 - Attachments

|

Item 4

Attachments e

|

|

Rates Postponement Policy

|

|

Approved By

|

Pending Approval by Council

|

|

Department

|

Finance

|

|

Original Approval Date

|

29 June 2018

|

Review Approval Date

|

Pending

|

|

Next Review Deadline

|

June 2023

|

Document ID

|

346038

|

|

Relevant Legislation

|

Local Government (Rating) Act 2002

Local Government Act 2002

Income Tax Act 2007

|

|

NCC Documents Referenced

|

Published in the Long Term Plan

2018-2028 which was reviewed between March/April 2018 and adopted on 29-06-18

Reviewed and amended in response to

COVID-19

Rating – Delegations under

Local Government (Rating) Act 2002

|

Purpose

Section

1: To

enable Council to postpone the requirement to pay all or part of the rates on a

Rating Unit under Section 87 of the Local Government (Rating) Act 2002 where a

rates postponement policy has been adopted and the conditions and criteria in

the policy are met.

Policy

Postponement

for Farmland

Objective

Section

2: To

support the District Plan by encouraging owners of farmland around urban areas

to refrain from subdividing their land for residential purposes.

Conditions

and Criteria

Section

3: To

initially qualify, or continue qualifying, for postponement of rates under this

policy the Rating Unit must be classified, or continue to be classified, as

farmland for differential purposes (ratepayers wishing to ascertain their

classification are welcome to inspect the Council’s rating information

database at the Council office).

Section

4: Rates

postponement will continue to apply on those properties that were subject at 30

June 2003 to postponement under Section 22 of the Rating Valuations Act 1998.

Other rural ratepayers wishing to take advantage of this part of the policy

must make application in writing, addressed to the Director Corporate Services.

The application for postponement must be made to the Council prior to the

commencement of the rating year. Applications received during a rating year

will be applicable from the commencement of the following rating year.

Applications will not be backdated.

Section

5: For

properties currently subject to rates postponement and for new applications

approved, Council will postpone the difference between rates payable on the

equivalent Rates Postponement Value advised by its Valuation Service Provider

and rates payable on the Rateable Value of the land each year.

Section

6: The

Council may charge an annual fee on postponed rates for the period between the

due date and the date they are paid. This fee is designed to cover the

Council’s administrative and financial costs and may vary from year to

year. The amount of the fee is included in Council’s Schedule of Fees and

Charges.

Section

7: If the

Rating Unit is subdivided then postponed rates and any accumulated fees will be

payable. The ratepayer will be required to sign an agreement acknowledging

this. Postponed rates will be registered as a charge against the land (i.e. in

the event that the property is sold the Council has first call against any of

the proceeds of that sale). Again, the ratepayer will be required to sign an

agreement acknowledging this.

Section

8: Authority

to approve applications will be delegated by Council to the Director of

Corporate Services, Chief Financial Officer and Investment and Funding Manager.

Postponement

for Older Persons

Objective

Section

9: The

objective of this part of the policy is to assist ratepayers who are Older Persons

with a fixed level of income to meet rates particularly, but not exclusively,

resulting from increasing levels of rates.

Definition

Section

10: Older Persons are

those who are old enough to qualify to receive NZ Superannuation.

Section

11: For the purpose of

this provision, Financial Hardship is defined as the inability of a person, to

reasonably meet the cost of goods, services and financial obligations that are

considered necessary according to New Zealand standards.

Conditions

and Criteria

Section

12: Postponement will

only apply to Older Persons on a fixed income.

Section

13: Only Rating Units

used solely for residential purposes will be eligible for consideration for

rates postponement under this policy.

Section

14: Only the person

entered as the ratepayer, or their authorised agent, may make an application

for rates postponement for Financial Hardship. The ratepayer must be the

occupant and current owner of, and have owned for not less than five years, the

Rating Unit which is the subject of the application. The person entered on the

Council’s rating information database as the ‘ratepayer’ must

not own any other Rating Units or investment properties (whether in the

district or elsewhere).

Section

15: The ratepayer (or

authorised agent) must make an application to Council on the prescribed form

(copies can be obtained from the Council Office).

Section

16: The Council will

consider, on a case by case basis, all applications received that meet the

criteria outlined under this section. The following factors will be considered

– age, income source and level, annual rates payable, period of

postponement, equity in the property owned, and the amount of rates postponed.

Section

17: Authority to

approve applications will be delegated by Council to the Director of Corporate

Services, Chief Financial Officer and Investment and Funding Manager.

Section

18: Applicants seeking

rates postponement will be encouraged to seek independent advice before

formally accepting any offer for postponement made by the Council.

Section

19: As a general rule

postponement will not apply to the first $500 per annum of the rate account

after any rates rebate has been deducted.

Section

20: Where the Council

decides to postpone rates the ratepayer must first make acceptable arrangements

(e.g. by setting up a system to meet agreed minimum regular payments) for

payments required under the terms of the postponement approval for the current

rating year, and future payment years.

Section

21: Postponement will

only apply on properties on which houses have been insured. Annual proof may be

required that insurance has been maintained.

Section

22: Where rates

postponement is approved for a property with an outstanding mortgage, the

mortgagee will be advised by Council that rates postponement has been granted

by the Council.

Section

23: Any postponed rates

will be postponed until:

Section

24: The death of the

ratepayer(s); or

· Until the

ratepayer(s) ceases to be either the owner or occupier of the Rating Unit; or

· Until a date

specified by the Council.

Section

25: The Council will

charge an annual postponement fee. The annual postponement fee will cover

Council’s administrative costs including finance costs. The finance cost

will be charged at the average return on investments rate for Council for that

year.

Section

26: All postponement

fees payable (including finance costs) will be added to the amount of postponed

rates annually and be paid at the time postponed rates are paid.

Section

27: The policy will

apply from the beginning of the rating year in which the application is made

although the Council may consider backdating past the rating year in which the

application is made depending on the circumstances.

Section

28: The postponed

rates, inclusive of any accumulated postponement fees, or any part thereof may

be paid at any time. The applicant may elect to postpone the payment of a

lesser sum than that which they would be entitled to have postponed pursuant to

this policy.

Section

29: Postponed rates

will be registered as a statutory land charge on the Rating Unit title. This

means that the Council will have first call on the proceeds of any revenue from

the sale or lease of the Rating Unit. In addition to the annual fee and

interest, Council will charge any other costs or one-off fees incurred in

relation to registration of the postponement as part of the postponement.

Section

30: This policy will

not affect any rates postponement provisions approved prior to 1 July 2009,

which will continue to apply in accordance with the conditions related to each

case.

Section

31: This policy does

not apply to non-elderly ratepayers experiencing financial hardship.

Section

32: Council will assist

in the referral of any other ratepayer on a fixed income facing long term

financial hardship to the appropriate agency.

Postponement

for Significant Extraordinary Circumstances

Objective

Section

33: To provide a rates

postponement to ratepayers experiencing financial hardship directly resulting

from Significant Extraordinary Circumstances that affects their ability to pay

rates.

Section

34: For the purpose of

this policy the following definitions will apply:

· Significant

Extraordinary Circumstances: as defined by Council resolution. Significant

Extraordinary Circumstances may be natural or economic in nature, and will identify

the type and location of properties affected.

· Financial

Hardship: for the purpose of this provision is defined as the inability of

a person, after seeking recourse from Government benefits or applicable relief

packages, to reasonably meet the cost of goods, services and financial

obligations that are considered necessary according to New Zealand standards.

In the case of a ratepayer who is not a natural person, it is the inability,

after seeking recourse from Government benefits or applicable relief packages,

to reasonably meet the cost of goods, services and financial obligations that

are considered essential to the functioning of that entity according to New

Zealand standards.

· Small

Business: a business operated by a small business person, small partnership

or close company as defined in section YA 1 of the Income Tax Act 2007.

Conditions

and Criteria

Section

35: This part of the

policy will only apply to Rating Units used for residential purposes or by

Small Businesses.

Section

36: Once Significant

Extraordinary Circumstances have been identified by Council, the criteria and

application process (including an application form, if applicable), will be

made available. Council may set a timeframe for the event. Council may review

the criteria and/or timeframe of Significant Extraordinary Circumstances

through subsequent resolutions.

Section

37: Council resolution

will include:

a. that

the resolution applies under the Rates Postponement Policy; and

b. the

Significant Extraordinary Circumstances triggering the policy (e.g. including,

but not limited to, flood, pandemic, earthquake); and

c. how

the Significant Extraordinary Circumstances are expected to impact the

community (e.g. hardship); and

d. the

types or location of properties effected by the Significant Extraordinary

Circumstances; and

e. timeframe

for postponement in relation to the Significant Extraordinary Circumstances.

Section

38: No application for

postponement can be made under this policy unless Significant Extraordinary

Circumstances have been identified by Council.

Section

39: Any requests for

rates postponement for Rating Units with a land value greater than $1.5m will

be decided upon at the discretion of Council and requests for rate postponement

for Rating Units with a land value less than $1.5m will be delegated to Council

officers.

Section

40: The ratepayer must

demonstrate, to the Council’s satisfaction, that paying the rates would

result in Financial Hardship.

Section

41: The applicant must

demonstrate to Council’s satisfaction that the ratepayer has taken all

necessary steps to claim any central government benefits or allowances

the ratepayer is properly entitled to receive that would assist the ratepayer

to meet their financial commitments. Evidence such as official correspondence

must be provided with the application.

Section

42: Council will

consider applications where the same ratepayer is liable for rates for multiple

Rating Units. In such instances, Council will look at the collective impact to

the ratepayer.

Section

43: Only the person/s

entered as the ratepayer (in the case of a close company every director must

sign the application form), or their authorised agent, may make an application

for rates postponement for Significant Extraordinary Circumstances that

resulted in Financial Hardship. However, where the ratepayer is not the owner

of the Rating Unit, the owner must also provide written approval of the

application.

Section

44: The ratepayer must

be the current ratepayer for the Rating Unit at the time Significant

Extraordinary Circumstances are identified by Council.

Section

45: Where the Council

decides to postpone rates the ratepayer must make acceptable arrangements for

payment of rates, for example by setting up a system for regular payments. Such

arrangements will be based on the circumstances of each case.

Section

46: Council may charge

a fee on postponed rates for the period between the due date and the date they

are paid. This fee is designed to cover Council’s administrative and

financial costs. The fees will be set as part of the Council resolution

identifying Significant Extraordinary Circumstances.

Section

47: Postponed rates

will remain postponed until the earlier of:

a. The

ratepayer/s ceases to be the owner or occupier of the Rating Unit; or

b. A

date specified by Council in the Council resolution identifying Significant

Extraordinary Circumstances.

Postponement

for Special Circumstances

Objective

Section

48: To enable Council

to provide rates postponement for special and unforeseen circumstances, where

it considers relief by way of rates postponement is justified in the

circumstances.

Conditions

and Criteria

Section

49: Application for

rates postponement must be made in writing by the ratepayer or their authorised

agent.

Section

50: Each circumstance

will be considered by Council on a case by case basis. Where necessary, Council

consideration and decision will be made in the Public Excluded part of a Council

meeting.

Section

51: The terms and

conditions of postponement including any application of an annual fee will be

decided by Council on a case by case basis.

Section

52: The applicant will

be advised in writing of the outcome of the application.

Policy

Review

Section

53: This policy will be

reviewed at least once every three years.

Document

History

|

Section 54: Version

|

Section 55: Reviewer

|

Section 56: Change Detail

|

Section 57: Date

|

|

Section 58: 2.0.0

|

Section 59: Caroline Thompson

|

Section 60: Updated and approved by Council

|

Section 61: 29 June 2018

|

|

Section 62: 3.0.0

|

Section 63:

|

Section 64: Updated and approved by Council

|

Section 65:

|

|

Audit and Risk Committee - 12 June 2020 - Attachments

|

Item 4

Attachments f

|

Statement

of Proposal

Local Government Funding Agency

Key Dates

Consultation opens

Xxxxxx

Consultation closes

Xxxxxxxxxx

Hearings

Xxxxxxxx

Deliberations

Xxxxxxxx

Adoption

Xxxxxxxx

Please Note: If hearings are not required, deliberations and adoption

(if adopted) may take place at an earlier date.

Where can I get more information?

· Visit

Council’s website www.napier.govt.nz

· Contact one

of your elected representatives

Application to join the Local Government

Funding Agency

Introduction

Napier City Council is considering participating as an “Unrated

Guaranteeing Borrower” in the

New Zealand Local Government Funding Agency Limited (LGFA) scheme.

The LGFA scheme was set-up in 2011 by a group of local authorities and

the Crown to enable local authorities to borrow at lower interest margins than

would otherwise be available. The LGFA scheme is recognised in legislation,

which modifies the effect of some statutory provisions and allows the scheme to

provide lower cost lending than would otherwise be the case. Currently 54 of

the 78 local authorities in NZ participate in the LGFA scheme.

Under the scheme, all participating local authorities are able to

borrow from the LGFA, but different benefits apply depending on the level of

participation. Napier City Council intends to participate as an Unrated

Guaranteeing Borrower.

Being a member of the LGFA, Napier City Council has the option to

borrow, but is not bound to use the LGFA to do so.

An Information Memorandum, describing the arrangement in detail, is

attached as Appendix A, and forms part of this proposal. A number of terms that

are used in this proposal are defined in that Information Memorandum.

Statutory Considerations

Section 56 of the Local Government Act 2002 (LGA 2002) requires that a

local authority must carry out a consultation process before acquiring shares in

a Council-Controlled Organisation (CCO). The LGFA is a CCO and there are

circumstances in which, under the LGFA scheme, shares in the LGFA may be issued

to participants in the scheme.

Consequently, it is prudent for a local authority to carry out a consultation

process before joining the scheme.

Analysis of Reasonably Practicable Options

Part C of the Information Memorandum sets out an analysis of the costs

and benefits of participating in the LGFA Scheme. A summary of those costs and

benefits and a brief rationale based on consideration of the Council’s

specific circumstances is set out below.

|

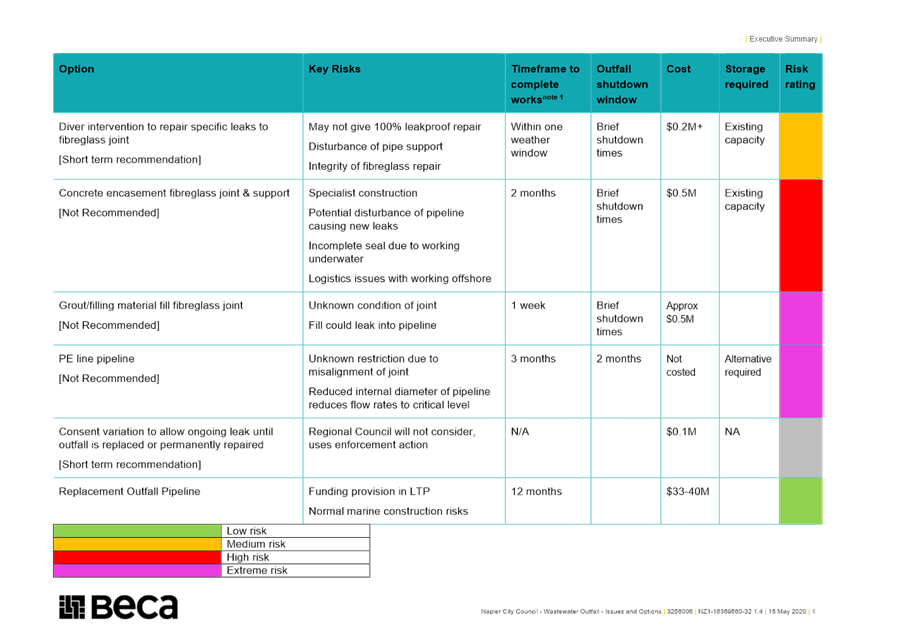

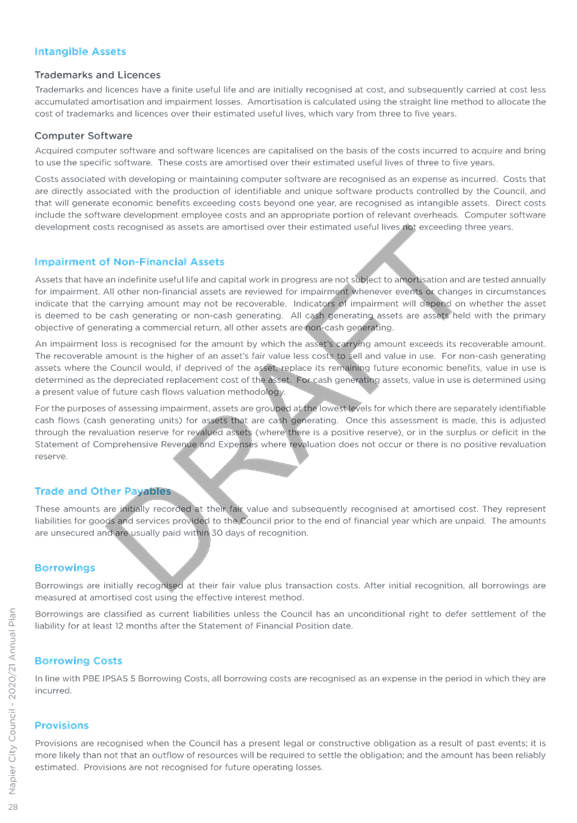

Options – LGFA

|

Additional Spend

|

Impact on Rates

|

Impact on Debt

|

|

1) No change. Not join the LGFA. No

other institutions are approached for lending.

|

$0

|

Rates will need to be increased to fund

revenue lost due to the pandemic.

|

No debt

|

|

2) Not join the LGFA. Borrowing sourced

from an approved lending institution.

|

Between $3,500 and $5,000 per $1m per

annum to ensure facility is available. Approximately 1.7%pa for any utilised

facility.

|

No impact on rates

|

Debt will increase by the amount

borrowed (estimated at $33m total).

|

|

3) Join the LGFA as a non-guaranteeing

local authority. This allows NCC to borrow up to $20m through the LGFA.

|

Associated legal fees. Ongoing trustee

fees.

|

Potential reduced rates due to savings

in facility and interest rate costs.

|

Debt will increase by the amount

borrowed (up to $20m with LGFA and any balance sourced from an approved

lending institution).

|

|

4) Join the LGFA as an unrated guaranteeing

local authority. This allows NCC to borrow more than $20m, but with higher

risk.

|

Associated legal fees. Ongoing trustee

fees.

|

Potential reduced rates due to savings

in facility and interest rate costs.

|

Debt will increase by the amount

borrowed (estimated at $33m total).

|

|

5) Join the LGFA as a principal

shareholding local authority. This allows NCC to both borrow more than $20m

and invest in LGFA shares, but with higher risk than option 4.

|

Associated legal fees. Ongoing trustee

fees.

The cost of any shares purchased.

|

Potential reduced rates due to savings

in facility and interest rate costs.

A modest return may be received from

shares held in the LGFA. It is likely that any share purchase would be

debt-funded.

|

Debt will increase by the amount

borrowed (estimated at $33m total) plus the cost of any shares purchased.

|

Our preferred option is Option 4 – join the LGFA as an unrated

guaranteeing local authority.

Rationale

To date Napier has been in the fortunate position

of not needing to borrow. However, ongoing demand from operational and capital

costs combined with the impact of the COVID-19 pandemic has led to Council

budgeting a $33 million shortfall over the next 12 months.

The benefits of lower interest margins are

significant.

Based on a comparison of borrowing available from

approved lending institutions, Council anticipates interest savings of

approximately $7,900 or 0.79% for every $1 million of debt[1]. At an anticipated peak debt

level of $33 million this equates to approximately $260,700 per annum.

If Council was to join as a non-Guaranteeing Local

Authority (option 3 on page 3) there

would be a $20m limit in its total borrowing capacity.

There are one-off up-front legal costs associated

with joining the LGFA of approximately $26,000 and annual ongoing trustee fees

of approximately $8,000. There are no LGFA fees (either up front or ongoing).

Council believes that the benefit of these savings outweigh the costs referred

to in the cost/benefit analysis in Part C of the Information Memorandum. There

is a low risk to Council by joining LGFA as a guarantor. This is discussed in

the Information Memorandum, Appendix, Part A

paragraphs 24 to 32.

As a Guaranteeing Local Authority, Napier City

Council would be guaranteeing LGFA’s obligations to its creditors and not

the obligations of individual councils. There has never been a default by a New

Zealand local authority and there is strong oversight of the sector. The LGFA is

also well-capitalised. The lending undertaken by LGFA to local authorities is

with a security charge over rates.

Should the Council participate in the LGFA Scheme as a Guaranteeing

Local Authority?

Council is proposing to join the LGFA Scheme as a

Guaranteeing Local Authority, which

• will cost Council an estimated $26,000 in

legal fees and an estimated $8,000 per year ongoing trustee fees,

• will save Council $7,900 in interest for

every $1m of debt (potentially $260,700 per annum),

• does not restrict borrowing to $20m.

How do I have my say?

Online: xxxxx

By email: xxxxx@napier.govt.nz

By post: LGFA Application

Napier City Council

Private Bag 6010

Napier 4142

Feedback will need to get back to us by

xxxxxxxxx.

Information Memorandum

PART A – INTRODUCTION AND PURPOSE

Purpose of Information Memorandum

1. This

Information Memorandum provides a description of a funding structure for local

authorities (LGFA Scheme), which was designed to enable participating local

authorities (Participating Local Authorities) to borrow at lower interest margins than they would

otherwise pay.

2. The

purpose of this Information Memorandum is to provide information to supplement any consultation materials

prepared by local authorities consulting on whether to participate in the LGFA

Scheme.

3. This

Information Memorandum is divided into three

parts:

a) This Part A (Introduction and Purpose), which sets out the purpose

of the Information Memorandum and provides some background on the purpose of, and rationale for, the LGFA Scheme.

b) Part

B (How the LGFA Scheme Works), which sets out the characteristics of the LGFA

Scheme, and the transactions that Participating Local Authorities will be

entering into as part of their participation in the LGFA Scheme.

c) Part C (Local Authority Costs and Benefits), which sets out the costs and

benefits to individual local authorities of participating in the LGFA Scheme.

Origin of the LGFA Scheme

4. There

are a number of LGFA style schemes around the world, with the oldest in Denmark

(KommuneKredit founded in 1898). Global LGFA style schemes all utilise a

cross-guarantee structure by member councils similar to the structure of LGFA.

There has never been a call under the guarantee in any of these countries.

5. Local

Government Funding Agencies are vehicles that allow local governments to source

capital for operational purposes or capital projects. LGFAs typically operate

as a co-operative between members. The scheme allows members to source capital

more cheaply than if they sourced it alone.

6. Several

attempts to create a borrowing collective were made in the 1980s and 1990s in

New Zealand. Prompted by the Global Financial Crisis, a proposal made in 2009

received strong support. The LGFA Scheme was incorporated by a group of New Zealand local authorities

and the Crown on 1 December 2011.

At the time, Standard and Poor’s and Fitch both assigned LGFA a

preliminary domestic credit rating of AA+ (the same as the New Zealand

government).

7. The

development of the LGFA

involved:

a) undertaking a

detailed review and analysis of:

i) the then current borrowing

environment in which

New Zealand local authorities borrow; and

ii) centralised local authority debt vehicle structures

that have been developed offshore to successfully lower the cost of local authority

borrowing;

b) using

this review and analysis to develop a funding structure (the LGFA Scheme),

which was anticipated to deliver significant benefits to New Zealand local authorities;

c) confirming

with rating agencies that the proposed LGFA Scheme could achieve a high enough credit rating to deliver the

anticipated benefits;

d) obtaining formal

central government support

to facilitate establishment of the LGFA Scheme.

8. Currently there are 67 participating Council’s and at 23 April 2020 the LGFA has lent $10.8 billion to the local authority sector.

Rationale for LGFA Scheme

New Zealand Local Authority debt market

8. At the time the LGFA Scheme was developed, New Zealand

local authorities faced a number of debt related issues.

9. First, local

authorities had significant existing and forecast

debt requirements. Councils 2009-2019

long-term plans indicated that local authority

debt would double over the next five years to over $9 billion.

10. Secondly,

pricing, length of funding term and other terms and conditions varied

considerably across the sector and were less than optimal. This was due to:

a) Limited debt sources – Local authorities’ debt funding options were limited to the banks, private

placements and wholesale bonds (issuance to wholesale investors), and, to a lesser extent, retail bonds. Increasing

local authority sector funding

requirements and domestic

funding capacity constraints were likely to further negatively

impact pricing, terms and

conditions and flexibility of local

authority sector debt.

b) Fragmented

sector – There were 78 local authorities. Individually, a significant

proportion of these local authorities lacked scale – the 10 largest

accounted for ~68% of total sector borrowings.

The remaining 68 councils had 32% of sector borrowings.

c) Regulatory

restrictions – Offshore (foreign currency) capital markets were closed to

local authorities with the exception of Auckland Council and the compliance

process for local authority retail bond issuance was burdensome and generally restricted issuance to a six month

window.

Addressing the local authority debt issues

11. Each

of these issues needed to be addressed to rectify this situation. This was not

likely to happen without an intervention like the LGFA Scheme for the following reasons:

a) The

New Zealand debt markets (at least in the foreseeable future) were likely to

maintain the status quo.

b) Individually,

local authorities were not be able to attain significant scale.

c) At a sector

level it might have been possible to address the issue regarding regulation,

but regulators were likely to remain reluctant to significantly ease

restrictions on financial management across the sector without gaining significant

comfort as to the sophistication of the financial management of all local

authorities. Even if this issue was addressed by regulators, this change alone

would have been insufficient to provide a major step change.

12. The LGFA Scheme was developed because

of the homogenous nature of local

authorities; the large sector borrowing

requirements and the high credit quality / strong

security position (i.e. charge over rates) of local authorities. This created the opportunity for a centralised local authority debt vehicle to generate

significant benefits.

13. There

were numerous precedents globally of successful vehicles that pooled local

authority debt and funded themselves through issuing their own financial

instruments to investors. Such vehicles achieved success through:

a) “Credit rating

arbitrage” – Attaining

a credit rating

higher than that of the individual underlying assets (local authority borrowers) and therefore being able to borrow at lower margins.

b) “Economies of scale” –

By pooling debt the vehicles

could access a wider

range of debt sources and spread fixed operating costs,

thereby reducing the dollar cost per dollar of debt raised.

c) “Regulatory

arbitrage” – The vehicles could receive different regulatory

treatment than the underlying local authorities, improving their ability to

efficiently raise debt, e.g. through access to offshore foreign currency debt markets.

14. The

offshore precedents were typically owned by the local authorities in the

relevant jurisdiction (often with central government involvement), and that is

what was proposed here through the LGFA Scheme.

15. The

LGFA Scheme has now been successfully operating for eight years. It has exceeded the original lending and

profit targets that were forecast in 2011.

PART B – HOW THE LGFA SCHEME WORKS

Basic structure of the LGFA Scheme

16. The

basic structure of the LGFA Scheme is that a company has been established that

borrows funds and lends them on to local authorities at lower interest margins

than those local authorities would pay to other lenders.

New Zealand Local Government Funding Agency

Limited

17. The

company that lends to local authorities under the LGFA Scheme is called the New

Zealand Local Government Funding Agency Limited (LGFA). It is a limited liability

company, and its shares are held entirely by the Crown and by local authorities.

18. 20%

of the shares in the LGFA are held by the Crown and the remaining 80% by 30

individual local authorities. Thus the LGFA is a Council Controlled Trading Organisation (CCTO).

19. The

LGFA was established solely for the purposes of the LGFA Scheme, and its

activities are limited to performing its function under the LGFA Scheme.

20. 30

local authorities (Principal Shareholding Local Authorities) hold those shares

that are not held by the Crown. The

Principal Shareholding Local Authorities contributed capital and, as

compensation for their capital contribution, receive a predetermined return on

this capital. However, the over-arching objective is that the benefits of the

LGFA Scheme are passed to local authorities as lower borrowing margins, rather

than being passed to shareholders as maximised profits.

Design to minimise default risk

21. One of the features

that is critical to the LGFA Scheme

delivering its benefit

to the sector is the achievement of a high credit rating for the LGFA. Currently

it is rated ‘AA+’ long term from Standard and Poor’s, which enables it to achieve

the credit rating arbitrage

referred to in paragraph 13(a). Consequently there are a number

of features of the LGFA Scheme that are included

to provide the protections for creditors that rating agencies

require before agreeing

to a high credit rating. These features are described in paragraphs 23 to 53 below.

22. Before

agreeing to a high credit rating, rating agencies will consider the risks of

both short term and long term default. Short term default is where a payment

obligation is not met on time. Long term default is where a payment obligation

is never met. In many cases short term

default will inevitably translate into long term default, but this is not

always the case – a short term default may be caused by a temporary

shortage of readily available cash.

Features of the LGFA Scheme designed to

reduce short term default risk

23. When a local authority borrows, the risk of short

term default, although

low, is probably significantly higher than its risk of long term default. In the long term it

can assess and collect sufficient rates revenue to cover almost any shortfall, but such revenue cannot

be collected quickly.

Consequently, there is a risk that

inadequate liability and revenue management could lead to temporary liquidity problems and short term default.

24. The

principal asset of the LGFA will be loans to participating local authorities,

so such temporary liquidity risks are effectively passed on to the LGFA.

Consequently, the rating agencies look for safeguards to ensure that liquidity

problems of a Participating Local Authority will not lead to a default by the LGFA.

25. There are two principal

safeguards that the LGFA has in place to manage short

term default (liquidity) risk:

a) It

holds cash and other liquid investments (investments which can be quickly

turned into cash). As at 23 April

2020 LGFA held $872 million of cash and liquid investments.

b) It

currently holds a $1 billion borrowing facility with central government that

allows it to borrow funds from central government if required.

26. It

is expected that these safeguards will sufficiently reduce any short term

default risk.

Features of the LGFA Scheme designed to

reduce long term default risk

27. There are a number

of safeguards that the LGFA has in place to manage long term

default risk, the most important

of which are set out below:

a) The

LGFA requires all local authorities that borrow from it to secure that borrowing with a charge over that

local authority’s rates and rates revenue (Rate Charge).

b) The LGFA

maintains a minimum capital adequacy ratio.

c) The Principal

Shareholding Local Authorities have subscribed for $20

million of uncalled capital in an equal proportions to their paid up equity contribution.

d) As

at 23 April 2020, 54 Participating Local Authorities (Guaranteeing Local Authorities) guarantee the obligations of

the LGFA.

e) Guaranteeing

Local Authorities commit to contributing additional equity to the LGFA if there

is an imminent risk that the LGFA will default.

f) The

LGFA hedges any exposure to interest rate and foreign currently fluctuations to

ensure that such fluctuations do not significantly affect its ability to meet its payment

obligations.

g) The LGFA puts in place risk management policies

in relation to its

borrowing and lending designed to minimise its risk. For example, it imposes limits on the percentage of lending that is made to any one local authority to ensure that its credit

risk is suitably diversified.

h) The

LGFA ensures that its operations are run in a way that minimises operational risk.

i) Additional detail in relation to the features referred

to in paragraphs 27(a) to 27(e) is set

out below.

Rates Charge

28. All

local authorities borrowing from the LGFA are required to secure that borrowing with a Rates Charge.

29. This is a powerful

form of security for the LGFA, because

it means that, if the relevant local authority defaults, a receiver appointed

by the LGFA can assess and collect sufficient rates in the relevant district

or region to recover the defaulted payments. Consequently, it significantly reduces

the risk of long term default by a local authority borrower.

30. From

a local authority’s point of view it is also advantageous, because, so

long as the local authority adheres to LGFA’s financial covenants, it is

entitled to conduct its affairs without any interference or restriction. This

contrasts with most security arrangements, which involve restrictions being

imposed on a borrower’s use of its own assets by the relevant lender.

Minimum capital

31. One

important factor in LGFA obtaining its high credit rating (AA+ from S&P and

Fitch) is the LGFA having a minimum capital adequacy ratio (a ratio that

measures the relative amounts of equity and debt-based assets that an entity

has). A strong credit rating is

important, because it provides an indication of the ability of the LGFA to

ultimately repay all of its debts.

32. The

minimum capital adequacy ratio requirement is an amount equal to at least 1.6%

of its total assets. As at December

2019 the actual ratio was 2.2%.

Sources of equity for capital adequacy purposes

33. The

equity held by the LGFA to ensure that it meets its minimum capital adequacy

ratio requirement comes from two sources. First, the Crown and the Principal

Shareholding Local Authorities contributed $25 million of initial equity as the

issue price of their initial shareholdings. Retained

earnings have seen the value of this equity rise to $79.1 million as at 30

December 2019. Secondly, each Participating Local Authority must, at the time

that it borrows from the LGFA, contribute some of that borrowing back as

equity. This source of equity is called borrower notes.

34. The

way the borrower notes works is that, whenever a Participating Local Authority

borrows, it does not receive the full amount of the borrowing in cash. Instead, a small percentage of the borrowed

amount is invested by the local authority into borrower notes. LGFA pay

interest on borrower notes. That

percentage is 1.6% of the amount borrowed.

35. Borrower

notes are repaid when the borrowing is repaid, so, in effect, the amount that

must be repaid equals the cash amount actually

advanced.

36. Borrower notes are

convertible in some circumstances into shares in the LGFA.

37. To

illustrate with an example, if a local authority borrowed $1,000,000 for five

years from the LGFA, it would receive $984,000 in cash and $16,000 of Borrower

Notes. At the end of the five years, it would repay $1,000,000, but would

simultaneously redeem its Borrower Notes of $16,000, meaning its net repayment

was equal to the $984,000 it initially received in cash.

38. A

return is paid on the Borrower Notes, However, while it is anticipated that this return will be paid, it is paid at

the discretion of the LGFA.

39. There is some additional risk to Participating Local Authorities

from this arrangement, because redemption of the Borrower Notes will only occur

if the LGFA is able to pay its other debts. For example, if at the end of five

years, the LGFA was insolvent, the local authority would have to repay

$1,000,000, but would not receive its $16,000 back for redeeming its Borrower

Notes. To date, LGFA have fully repaid all borrower notes that have matured.

Guarantee

40. Most

Participating Local Authorities entered into a guarantee when they join the

LGFA Scheme (Guarantee). Under the Guarantee the Guaranteeing Local Authorities guarantee the payment

obligations of the LGFA.

41. The

purpose of the Guarantee is to provide additional comfort to lenders (and

therefore credit rating agencies) that there will be no long term default,

though it may also be used to cover a short term default if there is a default

that cannot be covered using the protections described in paragraphs 23 to 25 above, but which will ultimately be

fully covered using the rates charge described in paragraphs 28 to 30. The Guarantee allows the LGFA to

draw upon the resource of all guaranteeing Local Authorities to avoid defaults.

LGFA Guarantee

42. The Guarantee

will only ever be called if

the LGFA defaults. Consequently, a call on the Guarantee will only occur if the numerous safeguards put in place to

prevent an LGFA default fail. This is highly unlikely to happen.

43. To provide some perspective on default, based on Standard

& Poor’s research on 39 years of global data (1981-2018), a AA+ rated

bond is expected to have a cumulative default risk of 0.32% over 5 years.

44. If

any such default did occur, and the Guaranteeing Local Authorities were called

on under the Guarantee they could potentially be called on to cover any payment

obligation of the LGFA. Such payment obligations may (without limitation) include obligations under the

following transactions:

a) A failure by the

LGFA to pay its principal lenders.

b) A failure

by the LGFA to repay drawings under the liquidity facility with central government.

c) A failure

by the LGFA to make payments under the hedging

transactions referred to in paragraph 27(f).

Guarantee risk shared

45. There

is a mechanism in the LGFA Scheme to ensure that payments made under the

Guarantee are shared between all Guaranteeing Local Authorities. The proportion

of any payments borne by a single Guaranteeing Local Authority is based on the annual rates revenue in

its district or region.

Rates Charge

45. All participating Local Authorities must provide a Rates Charge

to secure their obligations under the Guarantee.

Benefits of being a Guaranteeing Local Authority

46. Participating

Local Authorities that are not Guaranteeing Local Authorities may only borrow

up to $20,000,000 and pay a higher interest margin for their borrowing.

47. Therefore,

Guaranteeing Local Authorities have the benefit of not having this low limit on

borrowing, and paying lower funding costs.

Additional equity commitment

48. In

addition to the equity contributions made in conjunction with borrowing, all

Guaranteeing Local Authorities are required to commit to contributing equity if

required under certain circumstances. It is expected that calls on any such

commitments will be limited to situations in which there is a risk of imminent

default by the LGFA.

49. A

call for additional equity contributions will only be made if calls on the

uncalled Capital and on the Guarantee will not be sufficient to eliminate the

risk of imminent default by the LGFA. Consequently, the factors that limit the

risk in relation to the Cross

Guarantee also apply here.

50. All

participating Local Authorities are required to provide a Rates Charge to

secure their obligations to contribute additional equity.

Characteristics designed to make the LGFA

Scheme fair for all Participating Local Authorities

51. The

principal risk involved with the LGFA Scheme is that Participating Local

Authorities will default on their payment obligations. The greater this risk

is, the less attractive participation in the LGFA Scheme is for all

Participating Local Authorities.

52. The Participating Local Authorities do not create

this risk in equal amounts. There are some that carry a greater default

risk than others,

and therefore contribute

disproportionately to the overall risk in the LGFA Scheme. Those local

authorities are also the local authorities that would be likely to pay the highest

interest margins if they borrowed

outside the LGFA Scheme, and so potentially benefit the most from the LGFA Scheme.

53. To

avoid, or at least minimise,

what is effectively cross

subsidisation of the higher

risk local authorities by the lower risk local authorities, different interest margins are paid by different

local authorities when they borrow

from the LGFA, with

margins based on if a local authority has an external

credit rating and what the actual external credit rating is. For example a “AA” rated local authority will pay a slightly lower interest

margin than a “AA-“ rated local authority. An unrated local authority will pay a slightly higher

margin than a rated local authority.

Summary of transactions a Local Authority

will enter into if it joins the LGFA Scheme

54. If

a Local Authority joins the LGFA Scheme as a Guaranteeing Local Authority, it

will:

a) subscribe for

Borrower Notes (refer to paragraphs 33 to 39);

b) enter into the

Guarantee (refer to paragraphs 40 to 47);

c) commit to

providing additional equity to the LGFA under certain circumstances (see paragraphs 48 to 50); and

d) provide a

Rates Charge to secure its obligations under the LGFA Scheme (see discussion in paragraphs

28 to 30, and 45).

PART C – LOCAL AUTHORITY COSTS AND

BENEFITS

Benefits to local authorities that borrow

through the LGFA Scheme

55. It

is anticipated that the LGFA will be able to borrow at a low enough rate for

the LGFA Scheme to be attractive because of the three key advantages the LGFA

will have over a local authority borrower described in paragraph 13. That is – exploiting a credit rating

arbitrage, economies of scale and a regulatory arbitrage.

56. In

addition, the LGFA will provide local authorities with increase certainty of access

to funding and terms and conditions (including the potential access to longer

funding terms. LGFA currently offers borrowing terms out to 15 years.

57. The

potential savings for a local authority in terms of funding costs will depend

on the difference between the funding cost to that local authority when it

borrows from the LGFA and the funding cost to the local authority when it

borrows from alternative sources. This difference will vary between local

authorities.

58. As

at 23/04/2020 Napier City Council is expected to save approximately $7,900 per

$1 million dollars borrowed by using LGFA (versus approved borrowing

institution facilities).

59. The

funding costs each local authority pays when it borrows from the LGFA will be

affected by the following factors, some of which are specific to the local

authority:

e) the borrowing

margin of the LGFA;

f) the

operating costs of the LGFA;

g) whether a local

authority has an external credit rating

Costs to local authorities that borrow

through the LGFA Scheme

60. The

costs to Participating Local Authorities as a result of their borrowing through

the LGFA Scheme take two forms:

a) First,

there are some risks that they will have to assume to participate in the

scheme, which create contingent liabilities (i.e. costs that will only

materialise in certain circumstances).

b) Secondly, there

is a minor cost associated with the Borrower Notes.

Risks

61. The

features of the LGFA Scheme described above which are included to obtain a high

credit rating are essentially steps that remove risk from lenders to make their

residual risk low enough to justify the high credit rating. These features

remove risk, in part, by transferring it to Participating Local Authorities.

62. These

risks are that:

a) in

the case of Guaranteeing Local Authorities, a call is made under the Guarantee

(refer to paragraphs 42 to 44);

b) in

the case of Guaranteeing Local Authorities, a call is made for a contribution of additional equity to the

LGFA (refer to paragraphs 48 to 50); and

c) in the case of all Participating Local Authorities, the LGFA is not able to

redeem their Borrower Notes (refer to paragraphs 35 to

39).

63. Each

of these risks is discussed in some detail in the paragraphs indicated next to

the relevant risk. For the reasons set out in those discussions, it is

anticipated that each of the risks is low.

Cost of

Borrower Notes

64. As

discussed in paragraphs 33 to 39, all

Participating Local Authorities are required to invest in Borrower Notes when

they borrow from the LGFA. This carries a small cost, because the investment in

Borrower Notes is funded by borrowing from the LGFA, and the cost of this

funding will be slightly higher than the return paid on the Borrower Notes.

65. As

noted in paragraph 38, while it is the

intention for the LGFA to always pay interest on the Borrower Notes, such

payments are at the LGFA’s discretion so, in some situations, those

payments may not be made.