Audit and Risk Committee

Open Agenda

|

Meeting Date:

|

Thursday 5 December 2019

|

|

Time:

|

1pm

|

|

Venue:

|

Council Chamber

Hawke's Bay Regional Council

159 Dalton Street

Napier

|

|

Committee Members

|

John Palairet (In the

Chair), Mayor Kirsten Wise, David Pearson, Councillor Nigel Simpson and Councillor

Graeme Taylor

|

|

Officer Responsible

|

Director Corporate Services

|

|

Administration

|

Governance Team

|

|

|

Next Audit

and Risk Committee Meeting

To be confirmed

|

Audit and Risk

Committee - 05 December 2019 - Open Agenda

ORDER OF BUSINESS

Apologies

Nil

Conflicts of interest

Public forum

Nil

Announcements by

the Mayor

Announcements by

the Chairperson

Announcements by

the management

Confirmation of minutes

That the Minutes of the Audit

and Risk Committee meeting held on Friday, 13 September 2019 be taken as a true

and accurate record of the meeting.................................................................................... 120

Agenda items

1 Health

and Safety Report................................................................................................ 3

2 Risk

Management Report November 2019...................................................................... 8

3 Audit

and Risk Committee Charter................................................................................ 15

4 Proposed

Audit and Risk Committee 2020 meeting calendar........................................ 23

5 Financial

Delegation..................................................................................................... 25

6 Sensitive

Expenditure: Mayor and Chief Executive....................................................... 35

7 External

Accountability: Audit New Zealand Management Report................................. 46

8 External

Accountability: Investment and Debt Report.................................................... 93

9 Internal

Audit: Community Grants Management............................................................ 95

Public Excluded

Nil

Audit and Risk

Committee - 05 December 2019 - Open Agenda Item

1

Agenda Items

1. Health

and Safety Report

|

Type of Report:

|

Operational

|

|

Legal Reference:

|

N/A

|

|

Document ID:

|

871748

|

|

Reporting Officer/s & Unit:

|

Sue Matkin, Manager People & Capability

|

1.1 Purpose of Report

The purpose of the report is to

provide the Audit and Risk Committee with an overview of the health and safety

performance as at 31 October 2019.

|

Officer’s

Recommendation

The Audit

and Risk Committee:

a. Receive

the Health and Safety report as at 31 October 2019.

|

|

Chairperson’s

Recommendation

That the Committee resolve that the

officer’s recommendation be adopted.

|

1.2 Background Summary

The Health and Safety report as

at 31 October 2019 is shown at Attachment A

1.3 Attachments

a Health and

Safety report as at 31 October 2019 ⇩

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

Item 1

Attachments a

|

INFORMATION

PAPER

|

TO:

|

NCC Staff

|

|

REPORT DATE:

|

1 November 2019

|

|

PREPARED BY:

|

Michelle Warren

|

|

SUBJECT:

|

Health & Safety

Statistics

|

|

AGENDA ITEM

|

OCTOBER H&S REPORTING

|

PURPOSE

The purpose

of this report is to provide all NCC Staff, Council and Risk & Audit with

an overview of the health and safety performance as at 31st

October 2019.

SUMMARY

– KEY PERFORMANCE INDICATORS

October

LTIs = 0

|

Reported Incidents (Total Company)

|

Aug

2018

|

Aug

2019

|

Sept

2018

|

Sept

2019

|

Oct

2018

|

Oct

2019

|

YTD

2018

|

YTD

2019

|

Targets

FY20

|

On Target

|

|

Lost time injuries (LTIs):

|

1

|

0

|

0

|

0

|

0

|

0

|

1

|

1

|

<=8

|

·

|

|

Medically treated injuries

(MTIs):

|

2

|

0

|

5

|

3

|

1

|

3

|

9

|

3

|

<=40

|

·

|

|

Total recordable injuries

(MTIs + LTIs):

|

3

|

0

|

5

|

3

|

1

|

3

|

10

|

4

|

<=48

|

·

|

|

Near miss/hit & property

damage reporting

|

15

|

14

|

10

|

16

|

11

|

13

|

50

|

48

|

>=180

|

·

|

|

Incidents Involving Public

using our facilities

|

4

|

5

|

4

|

11

|

16

|

13

|

38

|

30

|

<=200

|

·

|

|

Significant Incidents or

Accidents involving Contractors

|

1

|

0

|

1

|

1

|

0

|

0

|

3

|

1

|

<=5

|

·

|

|

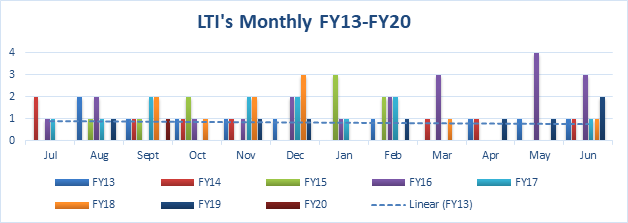

LTIs and MTIs YTD

as at 31 October 2019 (Comparison between FY19 and FY20)

· No change to

LTIs

54 days since last LTI

· 66.6% decrease MTIs

· 60% decrease in TRIs

|

|

|

Jul

|

Aug

|

Sept

|

Oct

|

Nov

|

Dec

|

Jan

|

Feb

|

Mar

|

Apr

|

May

|

Jun

|

Total

|

|

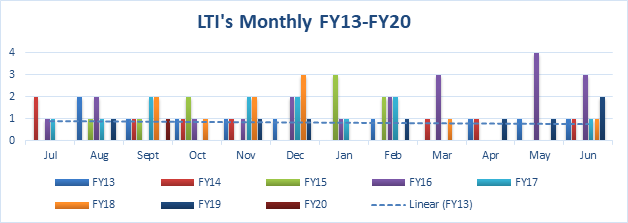

FY13

|

0

|

2

|

1

|

1

|

1

|

1

|

0

|

1

|

0

|

1

|

1

|

1

|

10

|

|

FY14

|

2

|

0

|

1

|

1

|

1

|

0

|

0

|

0

|

1

|

1

|

0

|

1

|

8

|

|

FY15

|

0

|

1

|

1

|

2

|

0

|

0

|

3

|

2

|

0

|

0

|

0

|

0

|

9

|

|

FY16

|

1

|

2

|

0

|

1

|

1

|

2

|

1

|

2

|

3

|

0

|

4

|

3

|

20

|

|

FY17

|

1

|

1

|

2

|

0

|

2

|

2

|

1

|

2

|

0

|

0

|

0

|

1

|

12

|

|

FY18

|

0

|

0

|

2

|

1

|

2

|

3

|

0

|

0

|

1

|

0

|

0

|

1

|

10

|

|

FY19

|

0

|

1

|

0

|

0

|

1

|

1

|

0

|

1

|

0

|

1

|

1

|

2

|

8

|

|

FY20

|

0

|

0

|

1

|

0

|

|

|

|

|

|

|

|

|

1

|

Health and Safety Performance

Lead Indicators as at october 2019

|

Lead Indicators

|

Detail

|

Aug

19

|

Sept

19

|

Oct

19

|

YTD

FY20

|

Full Year Target

FY20

|

On Target

|

|

Body discomfort reporting

(1 in 5 people)

|

An early intervention

programme to resolve the cause of the discomfort in the workplace and/or

medical treatment before developing into chronic pain and an injury.

Online e-learning videos are

part of the programme.

Resolutions:

|

4

|

1

|

2

|

10

|

=>50

|

·

|

|

Work Station Assessments

(10 / 10)

|

New employees receive

workstation assessments and e-learning videos. Re assessments completed

as required or where new areas or equipment set up.

· New Employees

· Existing Employees in different

BU/Area/New desks or chairs

|

7

|

2

|

4

|

16

|

100%

|

·

|

|

Near miss incident

reporting

|

Near miss incidents reported

|

14

|

16

|

13

|

58

|

180

|

·

|

|

Incident investigations

|

All LTIs and MTIs

investigations commenced within seven days of the event.

· N/A

|

0

|

0

|

0

|

0

|

100%

|

·

|

|

Health and Safety

Meetings

|

Health

and safety meetings at each workplace.

· N/A

|

4

|

0

|

4

|

12

|

30

|

·

|

|

Internal Health and

Safety Audits

(1 per week)

|

Health and safety audit of health

and safety management system at nominated workplaces.

· Waterworks – Chlorine Dosing

· City Strategy – Mural Painting

|

1

|

4

|

2

|

11

|

48

|

·

|

|

Contractor Health &

Safety Audits and/or Safety Observations

|

Contractor Audits /

Safety Observations

· Demo 1 Asbestos Removal

· Berkett Earthmovers – New Aquatic

· Rocket Scaffolding – Post Office

Bldg

· Garden Depot – Tree Planting Te Awa

|

3

|

5

|

4

|

17

|

26

|

·

|

|

Planned visible

leadership - workplace health & safety observation &conversation

|

Workplace health and safety

observations, including a conversation with staff during a workplace visit by

a core management team member.

Walk around chats

HS safety observation 1 per

quarter

Attend HS mtgs e.g. toolbox

3 per year

|

36

|

33

|

38

|

154

|

240

|

·

|

|

Planned visible

leadership – participating in a health and safety meeting

|

SLT team member

participating in a workplace or work group health and safety meeting at the

workplace or joining a conference call.

|

31

|

50

|

25

|

121

|

250

|

·

|

|

Inductions

|

New Staff inducted to Napier

City Council or staff who have moved business unit and re-inducted

|

5

|

7

|

6

|

28

|

100%

|

·

|

|

Safety Alerts

|

Safety alerts published to

educate and prevent the same or similar injury occurring again.

· N/A

|

0

|

0

|

0

|

0

|

6

|

·

|

|

|

|

|

|

|

|

|

|

Health and Safety Other

Reporting

|

Other

|

Detail

|

Aug

19

|

Sept

19

|

Oct

19

|

Full Year Target

FY20

|

|

Significant

incident

|

An event

in a different circumstance may result in serious harm.

· N/A

|

1

|

0

|

0

|

0

|

|

Significant Issues or

Incidents Involving Contractors

|

An event involving a

Contractors causing significant concern.

· N/A

|

0

|

0

|

0

|

0

|

|

HSWA, Regulations,

WorkSafe Updates and/or notifications

|

Any updates communicated to

management.

· N/A

|

2

|

0

|

0

|

N/A

|

|

Return To Work in

Progress

|

Employees who are on a

return to work programme.

· Aquarium 2

· MTG 1

· Kennedy Park 1

· Depot 4

|

13

|

15

|

8

|

|

|

Training

|

No

Staff

|

|

First

Aid

Traffic

Controller

Total trainings

|

11

1

12

|

Wellbeing

· Health Monitoring

o Asbestos Register

o Hearing screening

o Vaccination follow ups

Audit and Risk Committee - 05

December 2019 - Open Agenda Item

2

2. Risk Management Report

November 2019

|

Type of Report:

|

Information

|

|

Legal Reference:

|

N/A

|

|

Document ID:

|

873301

|

|

Reporting Officer/s & Unit:

|

Ross Franklin, Consultant

|

2.1 Purpose of Report

To provide the Audit and Risk

Committee with an update on progress with risk management work and to report on

the highest paid risks.

|

Officer’s Recommendation

The Audit

and Risk Committee:

a. Note the Risk

Management Work being undertaken by Napier City Council staff and management.

b. Note the current

Major risks.

c. Receive the Risk

Report dated 22 November 2019.

|

|

Chairperson’s Recommendation

That the Committee resolve that the

officer’s recommendation be adopted.

|

2.2 Background Summary

Napier City Council (NCC) has a

programme of work to develop and mature its enterprise risk capability. A risk

maturity roadmap has been developed to guide this work.

The Committee supports this work

by acting in a monitoring and advisory role. This report provides an update to

the Committee on progress against the roadmap and reports the highest rated

risks to ensure they are being actively managed.

NCC has a Risk Management

Framework document together with a Risk Management Strategy. These

document set out the NCC risk appetite and the risk management roles,

responsibilities and reporting requirements.

NCC risks are recorded in a risk

management software solution known as “Sycle”. Each risk is

assigned a risk owner and the risk is rated based on an assessment against the

NCC risk matrix and based on the level of residual risk once any control

measures and actions (or work programmes) designed to prevent or mitigate the

risk have been identified and implemented.

NCC has an internal Risk

Committee made up of officers from different areas of the organisation.

The role of the risk committee is to coordinate the risk management process;

monitor the risk profile, risk appetite and effectiveness of controls; monitor

& review high and extreme risks and report extreme and high risks to

Council’s senior leadership team. The committee is chaired by the

Manager Business Excellence & Transformation.

The Risk Management Strategy

requires high and extreme risks to be reported to the Audit & Risk

Committee. Recognising the level or NCC risk maturity all high\extreme

strategic risks and extreme operational risks are reported to each Audit &

Risk Committee meeting.

2.3 Issues

The following are specific items

on the work programme:-

· Development

of the Sycle Projects module

· Continuation

of a Business Continuity Management programme of work

· Review

risk processes, systems and of the risk register

Sycle Projects Module

work continues to progress on the

implementation of the projects module in Sycle.

Business Continuity Management

A draft Business Continuity

Management (BCM) policy and the draft Business Impact Analysis were presented

to the committee at the March meeting. The next stage is to identify the

BCM risks for each site, based on the business impact analysis and capture any

key risk into the Corporate Risk Management framework

The BCM framework responds to the

strategic risk SR5 – ‘Event causing disruption or destruction of

critical business functions and/or production and delivery of council

services’.

Risk Management at NCC

The role of Manager Business

Excellence & Transformation has been vacant for many months and as a result

the proactive approach to progressing risk management practises in Council have

faltered. While individuals have still continued to review and update the risk

register the committee has not met during the period over which this position

has been vacant.

Jane Klingender has been

appointed to the role of Manager, Business Excellence &

Transformation. A new position of Risk Advisor has been approved

and the role has not yet been filled, with the first round of advertising being

unsuccessful. A review of the job description and grade has been

undertaken in preparation for re-advertising. With the appointment of the Risk

Advisor there will be a significant uplift in the organisation’s

capability and focus on risk management.

2.4 Significance and Engagement

There are no external

consultation requirements for this report.

2.5 Implications

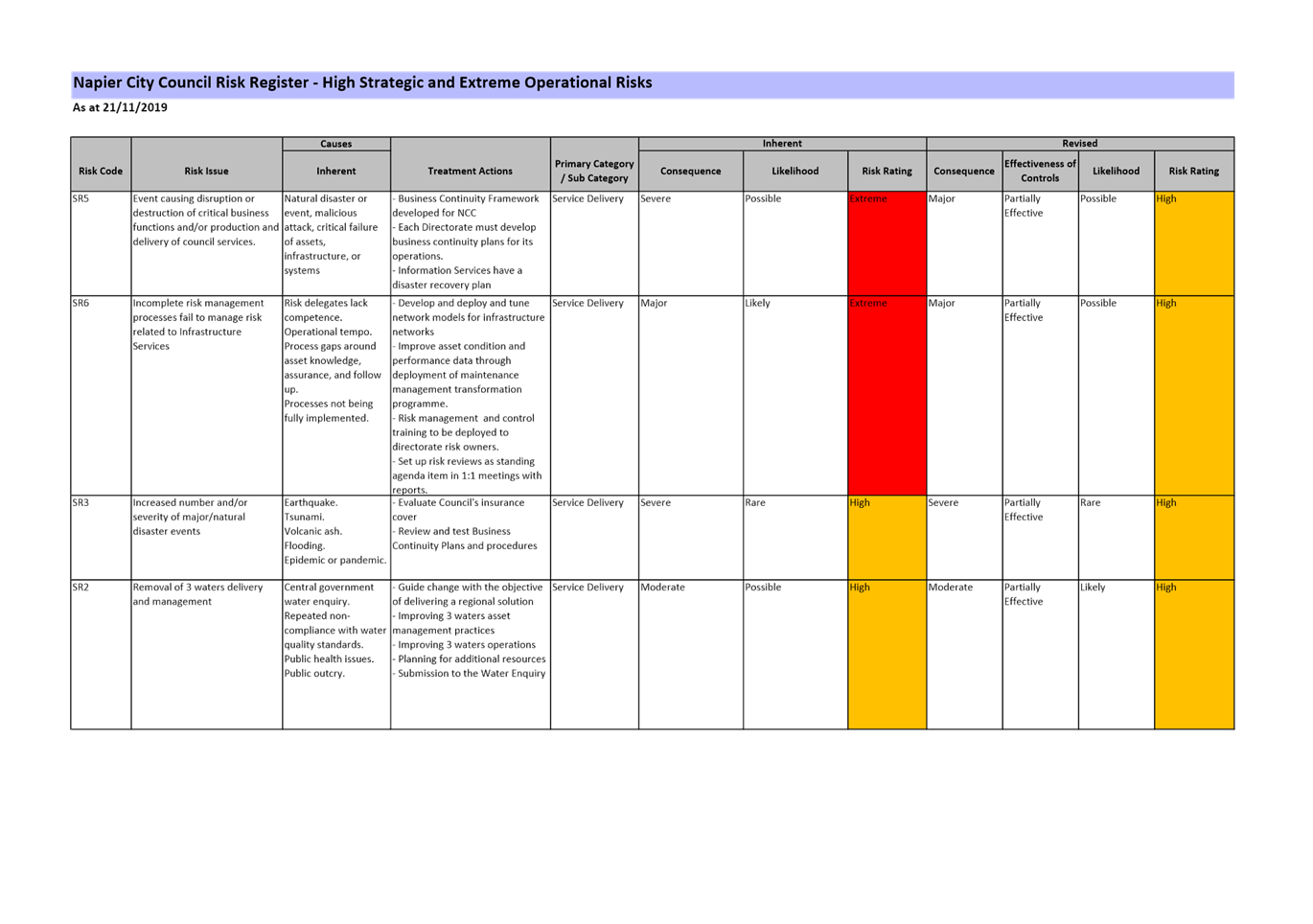

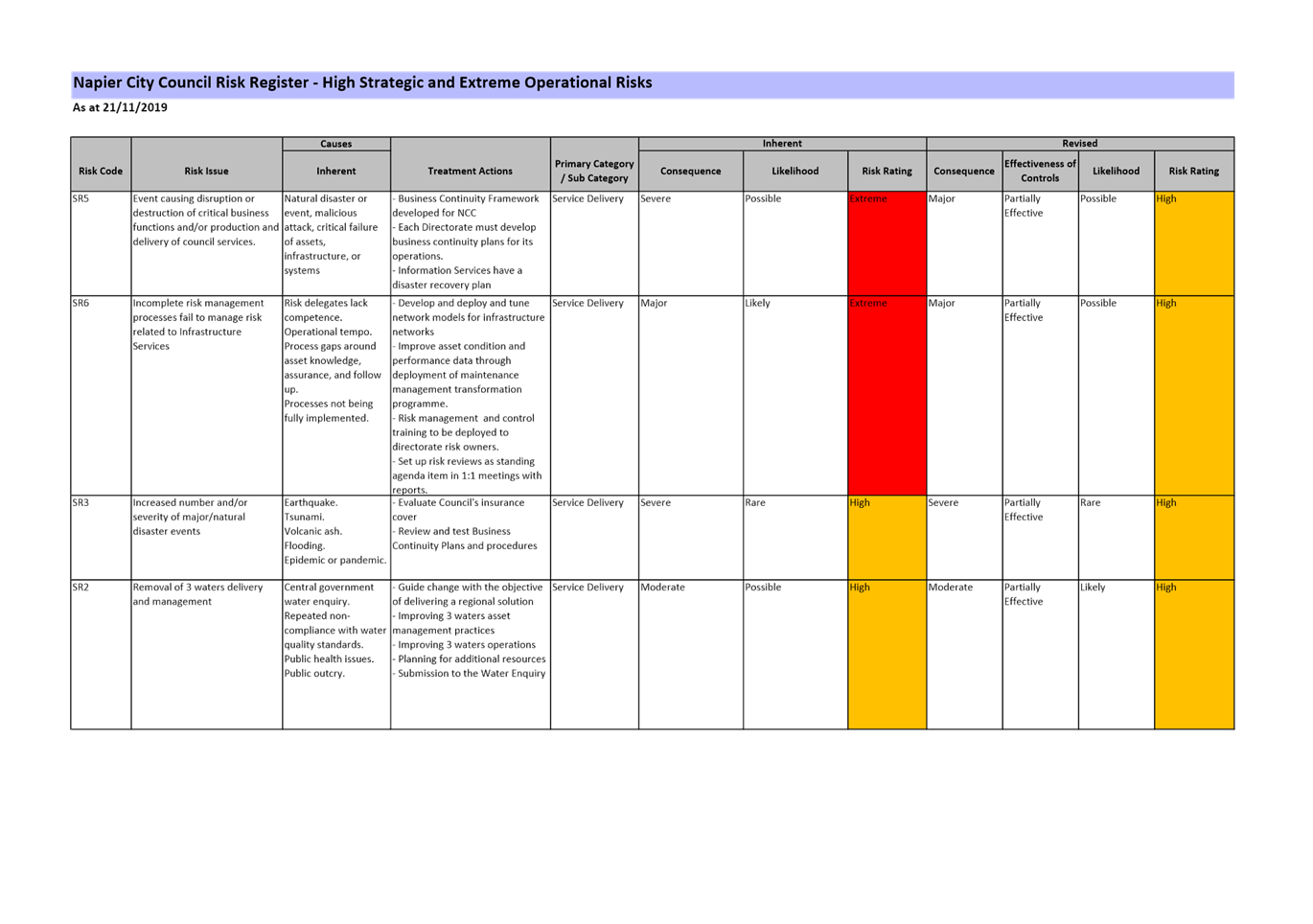

Risk Register

There are currently 5 strategic

and 149 operational risks in the risk register. (Project risks have been

excluded from reporting). Two new operational risks have been added to

the registers since the last meeting of the Committee.

There are five risks to report to

the Committee as the highest rated risks; one is an operational risk rated

Extreme (OR164) and four are strategic risks rated High (SR2, SR3, SR5 and

SR6).

These risks are reported in the

attached spreadsheet. (Attachment A).

All five risks have treatment

actions to further manage the causes or consequences of each risk.

Extreme Risks

There are no risks in the

registers that have a current rating (revised risk rating) of extreme.

Risk OR164 Bluff Hill –

fall from cliff top was previously reported as extreme however a review of the

risk has determined that the risk is high – not extreme. There is

an old existing fence in place to prevent an accidental fall. A new,

replacement fence is being constructed to ensure the level of protection is

maintained.

High Risks

The four high risks in the

strategic register are:

· SR2 Removal

of three waters delivery and management

· SR3

Increased number and/or severity of major/natural disaster events

· SR5 Event

causing disruption or destruction of critical business functions and/or

production and delivery of council services.

· SR 6 Risk

management practices

These risks were previously

reported to you on 11 September and they have not changed. The risks are

outside the control of NCC. The risks treatments listed against these

risks are ongoing.

Other Topical Current, New and

Emerging Risks

In addition to the risks reported

as a matter of course we have identified some current topical risks of relevance

to the organisation. These all impact on the organisation’s ability to

deliver high quality services to the community. The risks identified

include:-

· Legal action

such as the pool litigation and leaky building claims. These are

impacting on both the management resource (time that is not spent delivering

other projects etc.) and the Councils finances (cost).

· The election

and changes in Council. It takes time for new councillors to come up to

speed and this can impact on the organisations decision making. We have 5

new Councillors who are currently being inducted into the organisation.

· Provincial

Growth Fund requests may not be successful

· Drinking

Water – OR26 “Contamination of Water Supply resulting in death and

or widespread illness”

o OR26 has an inherent risk

rating of extreme with a revised (current) risk rating of high as a result of

many actions and controls that all go into the make up of the Water Safety Plan

(WSP). The only fully effective control is

chlorination of source water resulting in the provision of residual

disinfection throughout the network. All other actions and controls do not reduce the extreme

risk rating.

2.6 Options

N/A

2.7 Development of Preferred Option

N/A

2.8 Attachments

a Schedule of

High Strategic and Extreme Operational Risks as at 21 November 2019 ⇩

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

Item 2

Attachments a

|

Audit and Risk

Committee - 05 December 2019 - Open Agenda Item

3

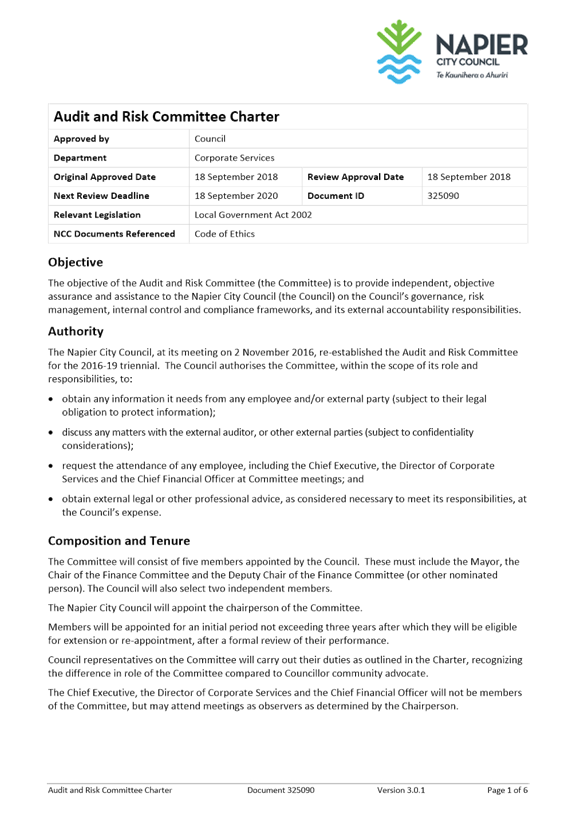

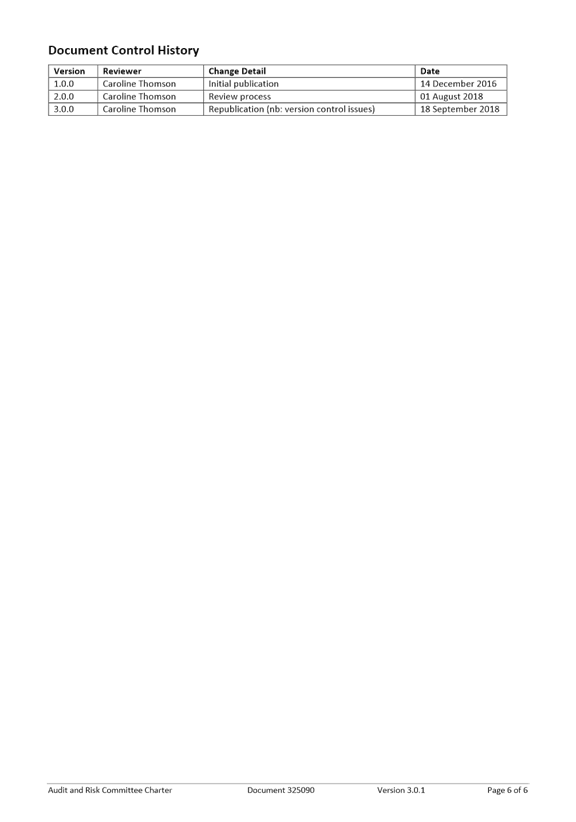

3. Audit and Risk Committee

Charter

|

Type of Report:

|

Procedural

|

|

Legal Reference:

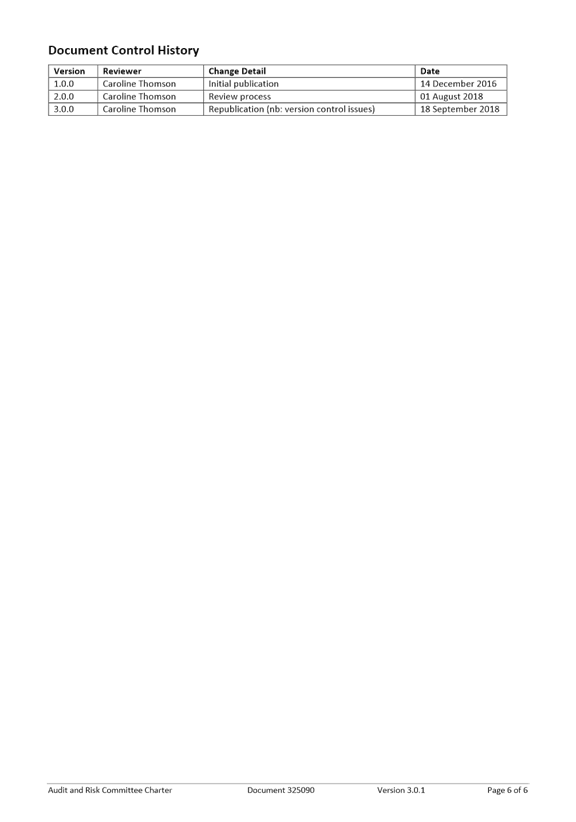

|

N/A

|

|

Document ID:

|

873943

|

|

Reporting Officer/s & Unit:

|

Adele Henderson, Director Corporate Services

|

3.1 Purpose of Report

The purpose of this report is to

advise the incoming committee of the committee charter and of the

recommendation for the charter to be reviewed over the next 12 months.

|

Officer’s Recommendation

The Audit

and Risk Committee:

a. Note

and discuss the current Audit and Risk Committee Charter and make any

recommended changes

|

|

Chairperson’s Recommendation

That the Committee resolve that the

officer’s recommendation be adopted.

|

3.2 Background Summary

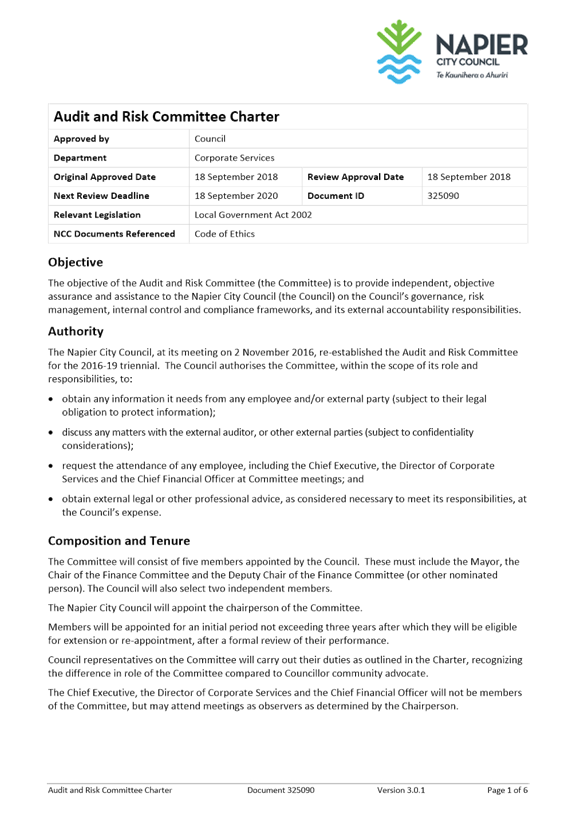

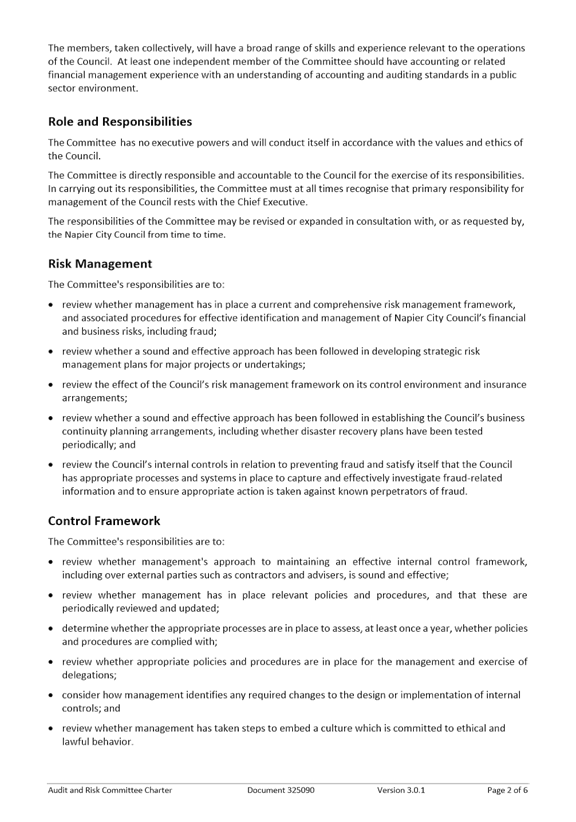

The objective of the Audit and

Risk Committee is to provide independent, objective assurance and assistance to

the Napier City Council on the Councils governance, risk management, internal

control and compliance frameworks, and its external accountability responsibilities.

The new Council confirmed its

committee structure and the inclusion of the Audit and Risk Committee on 19th

November 2019.

The Audit and Risk Charter

outlines the key role and responsibilities of the Committee and is reviewed

every second year to ensure that Committee’s focus areas remain relevant

in the changing environment of Council activities.

The attached Charter was

adopted by the Council on 18 September 2018.

3.3 Issues

The charter sets out the

committee’s role and responsibilities. This is required to be

reviewed at least every 2 years. With the start of a new term of Council

and of a new term of the Audit and Risk Committee it will be a good time for

the committee to spend time becoming familiar with the charter and reviewing

the content to ensure it makes the committee’s role and responsibilities

clear to members.

Any recommendations can be made

and provided to the committee for adoption at the end planned meeting.

3.4 Significance and Engagement

N/A

3.5 Implications

Financial

N/A

Social & Policy

N/A

Risk

N/A

3.6 Options

The options available to Council

are as follows:

a. Receive and note the content of

the current Audit and Risk Committee Charter and continue to operate until the

suggested review date of 18th September 2020

b. Identify and recommend charges

to the content of the Audit and Risk Committee Charter and bring changes back

to the next meeting of Audit and Risk Committee

c. Instruct Officers to bring the

charter back to a future meeting of the committee for discussion and review.

3.7 Development of Preferred Option

The recommendation is that the

Committee notes the content of the current charter and make any changes that

fit the new requirements of the incoming Councillors and committee

3.8 Attachments

a Audit and

Risk Committee Charter 2018 ⇩

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

Item 3

Attachments a

|

Audit and Risk Committee - 05

December 2019 - Open Agenda Item

4

4. Proposed Audit and Risk

Committee 2020 meeting calendar

|

Type of Report:

|

Operational

|

|

Legal Reference:

|

N/A

|

|

Document ID:

|

871747

|

|

Reporting Officer/s & Unit:

|

Caroline Thomson, Chief Financial Officer

|

4.1 Purpose of Report

To consider the proposed timetable of

meetings for the Audit and Risk Committee in 2020, as detailed below.

|

Officer’s Recommendation

The Audit

and Risk Committee:

a. Receive

the proposed timetable of meetings for the Audit and Risk Committee for 2020.

|

|

Chairperson’s Recommendation

That the Committee resolve that the

officer’s recommendation be adopted.

|

4.2 Background Summary

The following table sets out the

meetings held during 2019 together with the proposed schedule for meetings for

2020:

|

Proposed

Audit and Risk Committee meetings timetable 2020

|

|

2019

|

Content

|

2020

|

Content

|

|

28 March 2019

|

Draft Annual Plan, risk management, insurance

arrangements, BCP update, H&S, investment and debt report, external audit

arrangements, freeholding framework

|

20 March 2020

|

Insurance arrangements, Draft Annual Plan 20/21, external

audit arrangements

|

|

20 June 2019

|

Risk management, H&S, investment and debt report,

internal audit programme, legislative compliance, legal update, Annual Plan

|

12 June 2020

|

General

|

|

13 September 2019

|

Risk management, H&S, investment and debt report,

audit management report, Draft Annual Report, legal update, review of A&R

committee, Cloud vendor security, IT firewall penetration test, relocation of

offsite archives

|

18 September 2020

|

Draft Annual Report 19/20

|

|

5 December 2019

|

Risk management, H&S, investment and debt report,

fraud gap analysis, audit management report, A&R committee meeting

calendar, sensitive expenditure

|

11 December 2020

|

General

|

4.3 Issues

No Issues

4.4 Significance and Engagement

N/A

4.5 Implications

Financial

N/A

Social & Policy

N/A

Risk

N/A

4.6 Attachments

Nil

Audit and Risk

Committee - 05 December 2019 - Open Agenda Item

5

5. Financial Delegation

|

Type of Report:

|

Legal and Operational

|

|

Legal Reference:

|

Local Government Act 2002

|

|

Document ID:

|

869923

|

|

Reporting Officer/s & Unit:

|

Adele Henderson, Director Corporate Services

|

5.1 Purpose of Report

To review and approve the Chief

Executive’s financial and non-financial delegation

|

Officer’s Recommendation

The Audit

and Risk Committee:

i. Approve

an increase of the financial delegation to the Chief Executive from $500k to

$1m

ii. Approve

the Delegation to the Chief Executive document dated 5 December 2019

|

|

Chairperson’s Recommendation

That the Committee resolve that the

officer’s recommendation be adopted.

|

5.2 Background Summary

The delegations to the Chief

Executive were made 16 December 2015 and were last modified in 2015.

A full review of all legislation

that effects local government was undertaken in 2016, and were provided for

Council approval at that time.

In terms of section 42 of the

Local Government Act 2002, the Chief Executive is responsible for:

· implementing

the decisions of the Council;

· providing

advice to the Council and its community board;

· ensuring

that all responsibilities, duties and powers delegated to the Chief Executive

or to any person employed by the Chief Executive, or imposed or conferred by

any Act, regulation or bylaw are properly performed or exercised;

· managing

the activities of the Council effectively and efficiently;

· maintaining

systems to enable effective planning and accurate reporting of the financial and

service performance of the Council;

· providing

leadership for the staff of the Council;

· employing

staff on behalf of the Council (including negotiating their terms of

employment).

Clause 32 of Schedule 7 of the

Local Government Act 2002 (the “Act”), authorises the Council, for

the purposes of efficiency and effectiveness, to delegate to the Chief

Executive, and, subject to any conditions, limitations, or prohibitions imposed

by the Council, gives the Chief Executive the authority to subdelegate to council

officers.

The Chief Executive is

accountable to the Council, council committees, and subcommittees for the

actions of all staff and contractors. Individual staff are accountable to the

Chief Executive and are not directly accountable to the Council, council

committees, subcommittees or individual councillors.

The Local Government Act

prohibits the delegation of the following:

· the

power to make a rate; or

· the

power to make a bylaw; or

· the

power to borrow money, or purchase or dispose of assets, other than in

accordance with the long-term council community plan; or

· the

power to adopt a long-term council community plan, annual plan, or annual

report; or

· the

power to appoint a chief executive; or

· the

power to adopt policies required to be adopted and consulted on under this Act

in association with the long-term council community plan or developed for the

purpose of the local governance statement;

The Council specifically

delegates authority to the Chief Executive the power to sub-delegate to other

officers any or all of the powers or authorities delegated to him or her.

All sub-delegations must be given in writing by the Chief Executive.

The delegation to the Chief

Executive includes a delegation of the power to warrant enforcement

officers. The Council has determined that there are no circumstances in

which the Council wishes to:

a) limit or restrict the

exercise of the power; or

b) impose conditions on the

exercise of the power; or

c) prohibit, in specified

circumstances, the exercise of the power;

on the basis that the Chief

Executive will continue to implement auditable processes for the investigation

of the background of officers prior to the granting of a warrant.

5.3 Issues

The present financial delegation

to the Chief Executive were made in 2015. Given the size and scale of the

capital programme this setting may be considered too low. Each Council

has the discretion to set the financial delegation that it feels is

appropriate.

Council is facing a significant

capital programme over the coming years, and may wish to consider increasing

the financial delegation to the Chief Executive to ensure that contracts can be

awarded in a timely manner. It is acknowledged that an increased

delegation does not remove the responsibilities of the Chief Executive to spend

within the agreed parameters of the Long Term Plan.

“The

Council encourages the Chief Executive to report to Council is any matter is

considered difficult, is of particular political importance or sensitivity,

where there is special community interest in it, or where the matter relates to

a subject area where the council policy is unclear.”

At

present an increasing number of contracts must be negotiated and then ratified

by the Tenders Subcommittee. These contracts typically come about as the

result of a formal tendering process with set evaluation criteria, and then

some post tender negotiations with the preferred tenderer about price (and in

some cases scope). That tendering process leaves very little opportunity

for the Tender Subcommittee to add value other than at a general oversight.

One

of the issues that is presently causing concern is the current level of

delegated authority to the Chief Executive reduces the flexibility to respond

to the difficult contracting environment. In addition, the construction

industry costs have increased considerably over recent years. It is estimated,

based on the Local Government Cost Index (LGCI) figures produced by BERL in

2018, that capital expenditure costs have increased by 8.4% since 2015.

It

is recommended that the financial delegation of the Chief Executive be

increased to $1m, which allows the Tender Subcommittee to retain oversight of

the upper level of contracts.

5.4 Significance and Engagement

This decision raises no issues in

terms of the Councils Significance and Engagement Policy

5.5 Implications

Financial

N/A

Social & Policy

A new document has been created

to provide Council with better visibility over the delegations to the Chief

Executive as attached.

Risk

That Council would like more

rather than less oversight on awarding of contracts and therefore increasing

the workload of the Tenders subcommittee.

There

would be a small increase in the level of risk for the Council as a result of

the lesser level of oversight, even though all contract would still covered by

the change would be for already budgeted expenditure and undergo the check and

balances already in place at officer level. To a degree change in risk profile

would be off-set by an improvement in the flexibility and negotiation position.

5.6 Options

The options available to Council are as follows:

Financial Delegation

a. Set the financial delegation

threshold to $1,000,000 as recommended;

b. Determine a different new

threshold; or

c. Retain the status quo $500,000

Non-financial

Delegations

d. Approve non-financial

delegations to the Chief Executive as attached

e. Change the non-financial delegations

to the Chief Executive as attached

5.7 Development of Preferred Option

Financial Delegation

Option a – increase the

financial delegation to $1,000,000

This will reduce the number of

contracts that will need consideration by the Tenders Subcommittee. Costs

of construction have increased significantly since the financial delegation to

the CE was originally made. For contracts below the threshold it will

significantly reduce the time between negotiation and commitment, and hence

improves the Councils negotiation position.

Non-Financial delegation

Option d – approved as

attached, as no risk has been identified with delegations of this nature.

As noted above, there are some things that cannot be delegated by Council

5.8 Attachments

a Delegations

to the Chief Executive ⇩

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

Item

5

Attachments

a

|

Delegations to

Chief Executive

Dated 5 December 2019

Index

Preamble. 3

Council Responsibility and Accountability. 3

Chief Executive’s Role. 3

Delegation to the Chief Executive. 4

Appointment of Enforcement Officers. 6

Purpose

The Council is an elected unit of local government that exists in

perpetual succession unless that status is altered by statute. It acts by

resolution and through its Chief Executive.

The delegations in this document formalise the powers and authority

delegated by the Napier City Council to its Chief Executive.

Council

Responsibility and Accountability

The Council has overall responsibility and accountability for the

proper direction and control of the Council’s activities in pursuit of

community outcomes. This responsibility includes:

· Formulating

the City Council strategic direction in conjunction with the community –

particularly through the Long Term Council Plan (LTP);

· Setting

policy frameworks for the community and the organisation;

· Determining

the services and activities to be undertaken and setting the budget for the

organisation;

· Striking

the rates;

· Managing

principal risks;

· Upholding

the law and administering various laws and regulations;

· Monitoring

the delivery of the LTP and Annual Plan;

· Ensuring

the integrity of management control systems;

· Safeguarding

the public interest;

· Ensuring

effective succession of elected members;

· Reporting

to ratepayers.

A key to the efficient running of any council is that there is a

clear division between the role of elected members and that of management. The

Local Government Act 2002 sets out a series of governance policies that support

the principles of local government. The Council has adopted a Local Governance

Statement. That statement clarifies the governance and the management

responsibilities, the governance role and expected conduct of elected members,

and describes the effective, open and transparent processes used by Council.

The delegations of powers and authority to committees or to the

Chief Executive is an essential part of having effective and efficient

governance and management systems in place.

While many of the Council’s functions may be delegated, the

overall responsibility for maintaining effective systems of internal control

ultimately rests with the Council. Internal control includes the policies,

systems and procedures established to provide measurable assurance that

specific objectives will be achieved.

No delegation relieves the Council, an elected member, or officer of

the liability or legal responsibility to perform or ensure performance of any

function or duty.

Chief

Executive’s Role

The Chief Executive is appointed by the Council in accordance with

section 42 of the Local Government Act 2002. The Chief Executive is responsible

for implementing and managing the Council's policies and objectives within the

budgetary constraints established by the Council.

In terms of section 42 the Chief Executive is responsible for:

· implementing

the decisions of the Council;

· providing

advice to the Council and its community board;

· ensuring

that all responsibilities, duties and powers delegated to the Chief Executive

or to any person employed by the Chief Executive, or imposed or conferred by

any Act, regulation or bylaw are properly performed or exercised;

· managing

the activities of the Council effectively and efficiently;

· maintaining

systems to enable effective planning and accurate reporting of the financial

and service performance of the Council;

· providing

leadership for the staff of the Council;

· employing

staff on behalf of the Council (including negotiating their terms of

employment).

Clause 32 of Schedule 7 of the Local Government Act 2002 (the

“Act”), authorises the Council, for the purposes of efficiency and

effectiveness, to delegate to the Chief Executive, and, subject to any

conditions, limitations, or prohibitions imposed by the Council, gives the

Chief Executive the authority to subdelegate to council officers.

The Chief Executive is accountable to the Council, council

committees, and subcommittees for the actions of all staff and contractors.

Individual staff are accountable to the Chief Executive and are not directly

accountable to the Council, council committees, subcommittees or individual

councillors.

Delegation

to the Chief Executive

Pursuant to the provisions of clause 32 of Schedule 7 of the Local

Government Act 2002, Napier City Council delegates to the Chief Executive of

the Napier City Council all powers and authority to act on any matter in

respect of which the Council is empowered or directed by law to exercise

or undertake, except those powers or authorities in respect of which

delegation is prohibited by the Act, by any other statute or regulation, or

expressly excluded from this delegation. This delegation does not preclude the

Chief Executive from referring any such matter to the Council, or a committee

of the Council for a decision.

The Council encourages the Chief Executive to report to Council if

any matter is considered difficult, is of particular political importance or

sensitivity, where there is special community interest in it, or where the

matter relates to a subject area where council policy is unclear.

The Act prohibits the delegation of the following:

· the

power to make a rate; or

· the

power to make a bylaw; or

· the

power to borrow money, or purchase or dispose of assets, other than in

accordance with the long-term council community plan; or

· the

power to adopt a long-term council community plan, annual plan, or annual

report; or

· the

power to appoint a chief executive; or

· the

power to adopt policies required to be adopted and consulted on under this Act

in association with the long-term council community plan or developed for the

purpose of the local governance statement;

In addition the Council has not delegated the following powers or

authorities to the Chief Executive:

· the

power to compulsorily acquire land under the Public Works Act 1981;

· the

power to set strategic policy direction;

· the

power to enter into contracts for the supply of goods and services to a value

exceeding $500,000 (proposed Council 5 December 2019);

· the

power to enter into unconditional contracts for the sale or purchase of land or

an interest in land;

· the

power to enter into unconditional leases whether as landlord or tenant for a

term of 2 years or more, (with the exception of leases of clubrooms and other

buildings on Council parks and reserves in accordance with the Council’s

established policy);

· the

hearing of notified resources consents, designations and Heritage Order

applications;

· any

matter not permitted to be delegated by any other Act (for example the approval

of a policy statement or plan under the Resource Management Act 1991 or the granting

of special exemptions under s.6 of the Fencing of Swimming Pools Act 1987);

· any

matter that can only be given effect by a Council resolution.

For the purposes of this delegation “unconditional”

means “without a condition requiring an approval to be given by

resolution of the Council, or Committee of the Council with authority to give

that approval”.

The Council specifically delegates authority to the Chief Executive

the power to subdelegate to other officers any or all of the powers or

authorities delegated to him or her. All subdelegations must be given by

the Chief Executive in writing.

In addition to the delegations made above, in relation to matters

arising at the end of term of the Council, from the day of the declaration of

the results of the triennial general election until the first meeting of the

Council following the triennial general election, authority to make decisions

on behalf of the Council, in respect of urgent matters arising during this

time:

a) in consultation

with the Director Infrastructure or Director Corporate Services in respect of

Tenders and Contracts with delegated authority to award contracts up to $500k

in value;

b) in consultation

with the Group Manager: Planning and Regulatory Services in respect of Liquor

Licensing and Regulatory matters;

c) in consultation

with the incoming Mayor, as may be appropriate, in respect of other matters;

with any decision made outside of the normal delegations to the

Chief Executive to be reported to the first ordinary meeting of the incoming

Council or to a meeting of the appropriate Standing Committee of the Council.

That the Council delegate to the Chief Executive the authority to

enter into agreements for the taking of land or easements where the

compensation payable for the land or the interest in land, in each case does

not exceed $100,000 (plus GST) exclusive of disbursements.

Appointment

of Enforcement Officers

The delegation to the Chief Executive includes a delegation of the

power to warrant enforcement officers. The Council has determined that there

are no circumstances in which the Council wishes to:

a) limit or restrict

the exercise of the power; or

b) impose conditions

on the exercise of the power; or

c) prohibit, in

specified circumstances, the exercise of the power;

on the basis that the Chief Executive will continue to implement

auditable processes for the investigation of the background of officers prior

to the granting of a warrant.

Audit and Risk Committee - 05

December 2019 - Open Agenda Item

6

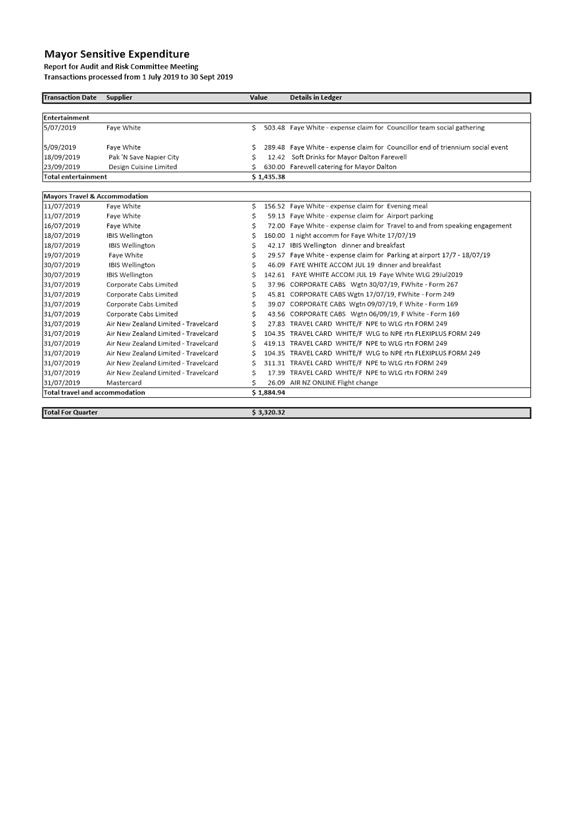

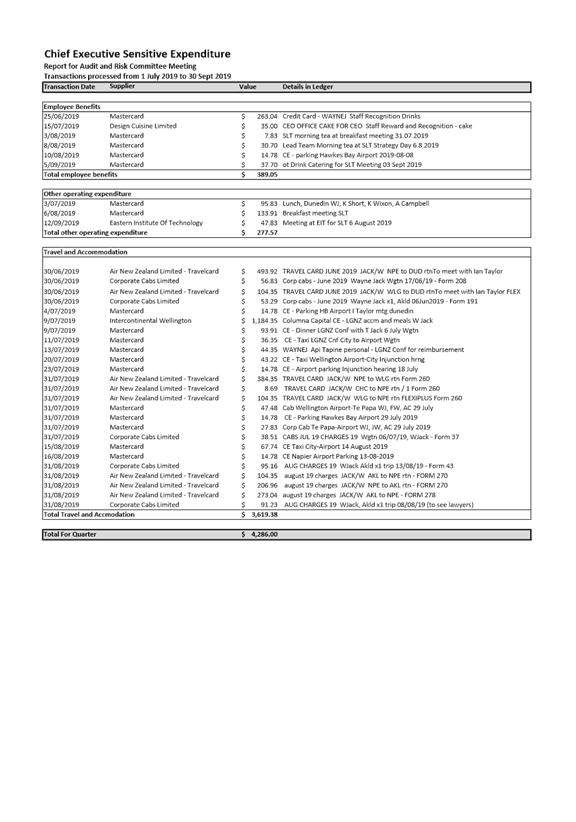

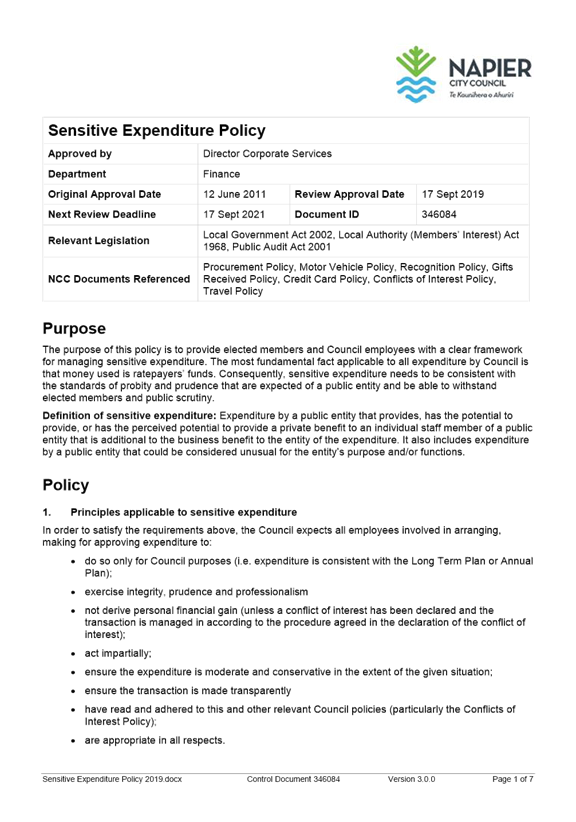

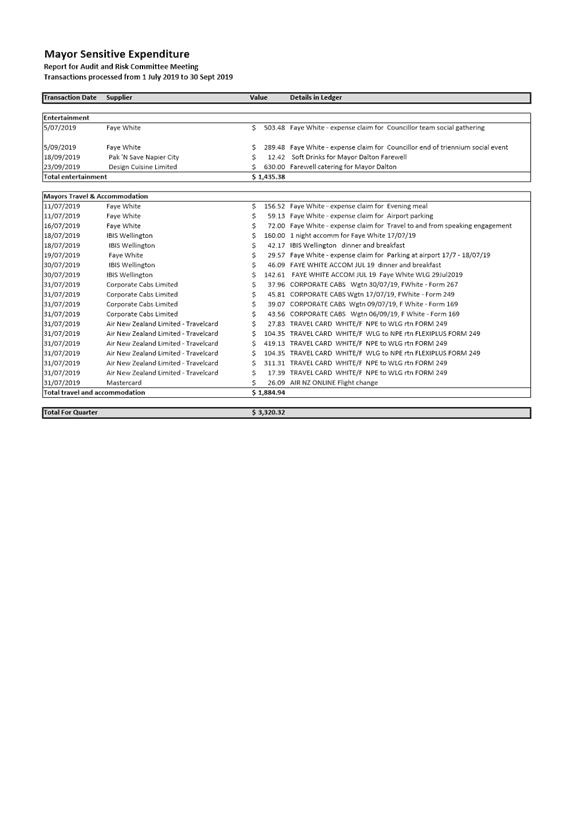

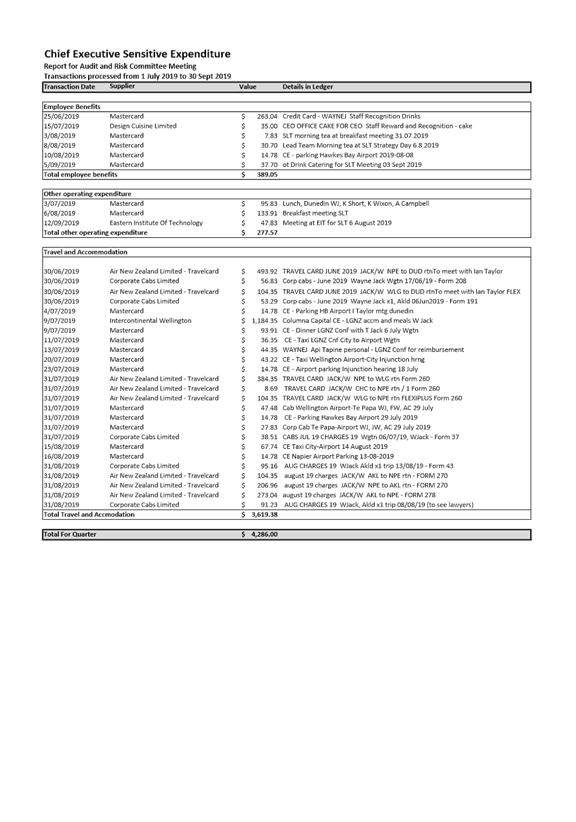

6. Sensitive Expenditure:

Mayor and Chief Executive

|

Type of Report:

|

Operational and Procedural

|

|

Legal Reference:

|

N/A

|

|

Document ID:

|

871750

|

|

Reporting Officer/s & Unit:

|

Caroline Thomson, Chief Financial Officer

|

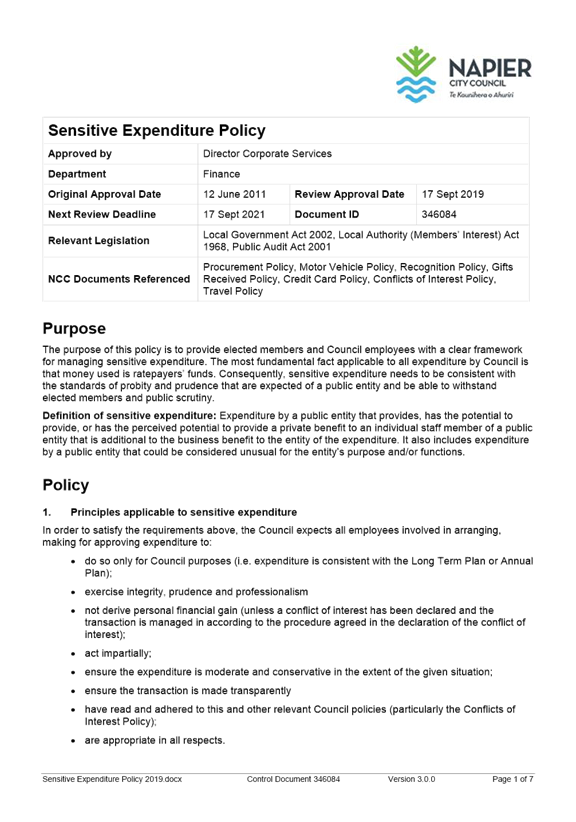

6.1 Purpose of Report

To provide the information required

for the Committee to review Sensitive Expenditure of the Mayor and Chief

Executive for compliance with Council’s Sensitive Expenditure Policy.

|

Officer’s Recommendation

The Audit

and Risk Committee:

a. Receive

the report of Sensitive Expenditure for the Mayor and Chief Executive and

review for compliance with the Sensitive Expenditure Policy.

|

|

Chairperson’s Recommendation

That the Committee resolve that the

officer’s recommendation be adopted.

|

6.2 Background Summary

The Sensitive Expenditure Policy

approved by the Senior Leadership Team on 17 September 2019 requires a report

of all sensitive expenditure by the Chief Executive and by the Mayor to Audit

and Risk Committee meetings (clauses 6.3 and 6.4). The policy also states that

the expenditure items will be reviewed by the Chairperson or the Deputy

Chairperson of the Audit and Risk Committee for compliance with this policy.

6.3 Issues

No Issues

6.4 Significance and Engagement

N/A

6.5 Implications

Financial

N/A

Social & Policy

N/A

Risk

N/A

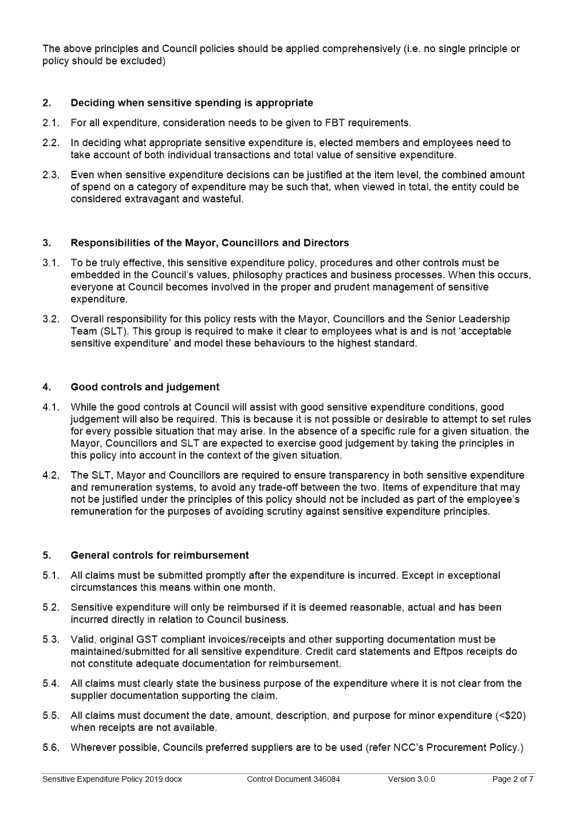

6.6 Attachments

a Sensitive

expenditure items Q1 - Mayor ⇩

b Sensitive

expenditure items Q1 - Chief Executive ⇩

c NCC Sensitive

Expenditure policy ⇩

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

Item 6

Attachments a

|

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

Item 6

Attachments b

|

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

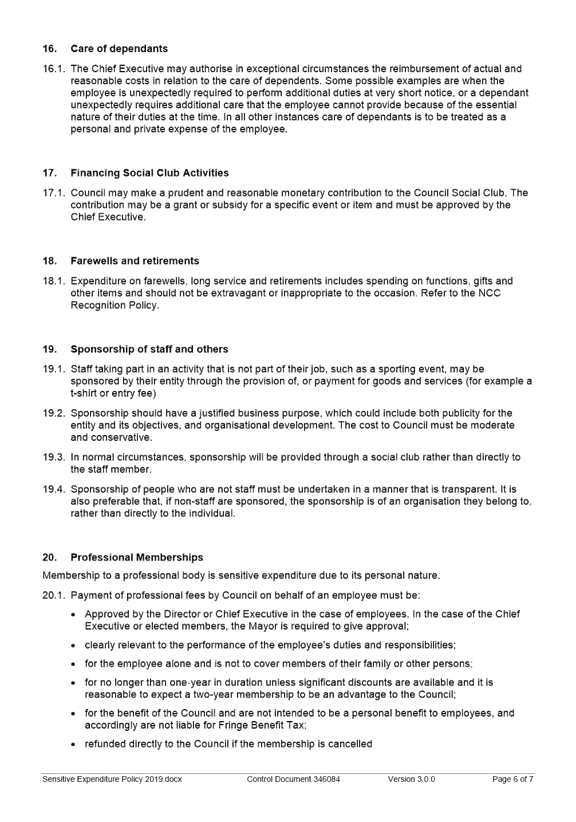

Item 6

Attachments c

|

Audit and Risk Committee - 05

December 2019 - Open Agenda Item

7

7. External Accountability:

Audit New Zealand Management Report

|

Type of Report:

|

Information

|

|

Legal Reference:

|

Local Government Act 2002

|

|

Document ID:

|

871746

|

|

Reporting Officer/s & Unit:

|

Caroline Thomson, Chief Financial Officer

|

7.1 Purpose of Report

To consider the Audit NZ management

report to the Council on the audit of Napier City Council for the year ended 30

June 2019 (to be tabled at the meeting).

|

Officer’s Recommendation

The Audit

and Risk Committee:

a. Receive

the Audit NZ management report to the Council on the audit of Napier City

Council for the year ended 30 June 2019.

|

|

Chairperson’s Recommendation

That the Committee resolve that the

officer’s recommendation be adopted.

|

7.2 Background Summary

Audit NZ has completed the audit

of Council’s accounts for the year ended 30 June 2019. The findings from

the audit are set out in the audit management report attached.

Audit NZ issued Council with an

unmodified audit opinion and an unmodified audit report on the Council’s

summary annual report for 2018/19. This means that Audit NZ were satisfied that

the financial statements and financial performance information present fairly

the Council’s activity for the year and its financial position.

7.3 Issues

The financial statements are free

from material misstatements.

The audit management report

contains detailed findings and recommendations for areas of improvement

together with management response. Audit NZ has agreed to remove section 4.2

relating to the trial balance from the final report.

The final audit management report

will be tabled at the meeting.

7.4 Significance and Engagement

N/A

7.5 Implications

Financial

N/A

Social & Policy

N/A

Risk

N/A

7.6 Attachments

a Draft Audit

NZ management report for the year ended 30 June 2019 ⇩

|

Audit and Risk Committee - 5 December 2019 - Attachments

|

Item 7

Attachments a

|

Report to

the Council on the audit of

Napier

City Council

For the year ended 30 June

2019

1.

Contents

|

Key messages. 3

1 Recommendations. 5

2 Our audit report. 7

3 Matters raised in

the Audit Plan. 9

4 Items noted during the

audit. 15

5 Public sector audit. 19

6 Changes to the

Government Rules of Sourcing. 20

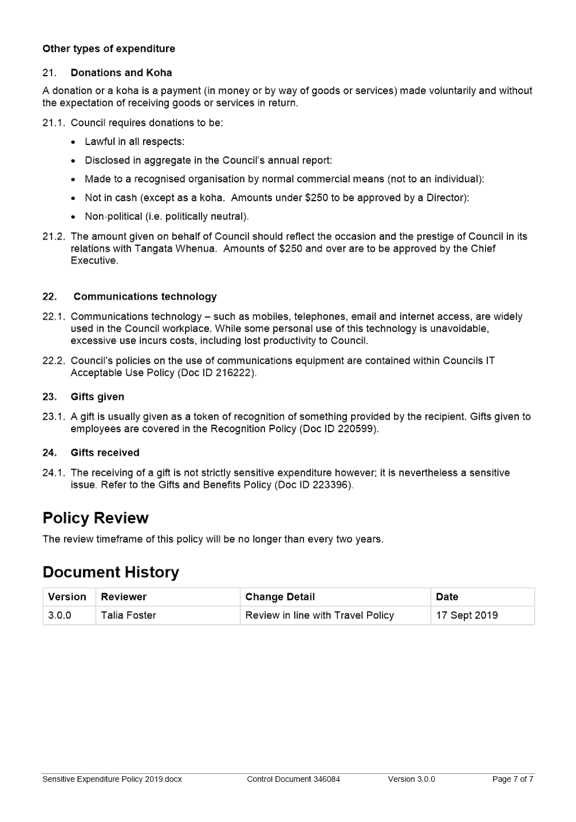

7 Helping you to

understand your risks: procurement and contract management. 21

8 Useful publications. 26

Appendix 1: Status

of previous recommendations. 29

Appendix 2: Corrected

misstatements. 38

Appendix 3:

Disclosures. 40

|

2.

Key messages

3.

We

have completed the audit for the year ended 30 June 2019. This report sets

out our findings from the audit and draws attention to areas where the City Council is doing well and

where we have made recommendations for improvement.

Audit opinion

4.

We

issued an unmodified audit opinion dated 26 September 2019. We also issued an

unmodified audit report on the City Council’s summary annual report on

24 October 2019.

Matters identified

during the audit

The following

significant issues were considered during the audit.

· Weathertightness

claim

– We are satisfied with the disclosure of a weather tightness claim as a

contingent liability, rather than a provision, on the basis that there is no

reliable estimate of the likely cost.

· Revalued assets – We were

satisfied with the robustness of the valuations undertaken this year by the

City Council. The classes of assets revalued were the roading assets and the

land and buildings assets.

· Assets that are

revalued but were not revalued this year – We reviewed, and are satisfied with,

the robustness of management’s assessments as to why there is no material

difference between the fair value and the carrying value of these assets.

· Mandatory performance

measures

– We are satisfied that the reporting of mandatory measures, as required

by the Non-Financial Performance Rules 2013 (the rules), fairly represented the

City Council’s performance and complied with the intentions of the rules.

We were also satisfied with the explanations and commentary that were included

in the Annual Report in relation to measures that had not been achieved.

· Deferred tax

liability

– As in

its prior years’ financial statements, the City Council has not accounted

for deferred tax liabilities in relation to its revalued port assets on the

basis that the inner harbour assets are highly unlikely to be sold. However

this is

not an acceptable argument under the relevant accounting standard, PBE IAS 12 Income

Taxes. The accounting standard requires all deferred tax liabilities to be

recognised. We also note that the unrecognised deferred tax liability is close

to our materiality thresholds (i.e. a possible impact on our audit opinion in

future years).

5.

We

are pleased to note that there has been an improvement in the delivery of the

draft Annual Report and the supporting work papers in the current year. There

is still some room for improvement as there were issues (detail and timing of

delivery) with the information provided.

There are six new

recommendations raised in the management report (see section 4) but it is

pleasing to note that the City Council continues to work on clearing previous

recommendations.

Thank you

6.

We

would like to thank the Council, management and staff for their help and

assistance throughout the audit.

7.

8.

9.

Stephen

Lucy

10.

Appointed

Auditor

11.

1 Recommendations

Our recommendations

for improvement and their priority are based on our assessment of how far short

current practice is from a standard that is appropriate for the size, nature,

and complexity of your business. We use the following priority ratings for our

recommended improvements.

Our recommendations

for improvement and their priority are based on our assessment of how far short

current practice is from a standard that is appropriate for the size, nature,

and complexity of your business. We use the following priority ratings for our

recommended improvements.

|

Priority

|

Explanation

|

|

12.

Urgent

|

13.

Needs

to be addressed urgently

14.

These

recommendations relate to a significant deficiency that exposes the City

Council to significant risk or for any other reason need to be addressed

without delay.

|

|

15.

Necessary

|

16.

Address

at the earliest reasonable opportunity, generally within six

months

17.

These

recommendations relate to deficiencies that need to be addressed to meet

expected standards of best practice. These include any control weakness that

could undermine the system of internal control.

|

|

18.

Beneficial

|

19.

Address,

generally within six to 12 months

20.

These

recommendations relate to areas where the City Council is falling short of

best practice. In our view it is beneficial for management to address these,

provided the benefits outweigh the costs.

|

1.1 New

recommendations

The following table summarises our

recommendations and their priority.

|

Recommendation

|

Reference

|

Priority

|

|

Rate Assessment Notice compliance with legislation

A formal review should be completed on the rates assessment

notice to ensure all legislative requirements have been met.

|

4.1

|

Necessary

|

|

Financial statements should be prepared directly from the trial

balance

The financial statements should be prepared directly from the

trial balance (i.e. adjustments should be made to the general ledger prior to

the financial statements being produced).

|

4.2

|

Necessary

|

|

Revaluations

The City Council should ensure that all assets in a class of

assets are revalued at the same time and that all valuation reports are

examined for accuracy.

|

4.3

|

Necessary

|

|

International travel approval

All international travel should be pre-approved by the Chief

Executive with information on what the benefit and purpose to Council is,

ensuring all expenditure incurred for travel is Council expenditure.

|

4.4

|

Necessary

|

|

Approval of the Mayor’s expenditure

Documentation setting out the Mayor’s expenditure provided

to the Audit and Risk committee should be retained.

|

4.5

|

Necessary

|

|

Need for a QA over performance measure report

The City Council should complete a monthly review of all the

service requests relating to wastewater and water supply, to ensure the

correct attendance and completed times are recorded.

|

4.6

|

Necessary

|

1.2 Status

of previous recommendations

Set out below is a summary of the action

taken against previous recommendations. Appendix 2 sets out the status of

previous recommendations in detail.

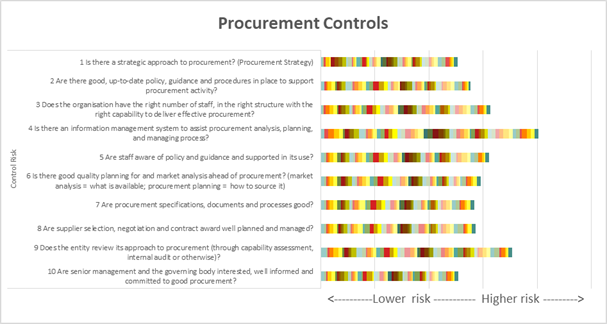

|

Priority

|

Priority

|

|

Urgent

|

Necessary

|

Beneficial

|

Total

|

|

Open

|

-

|

7

|

5

|

12

|

|

Implemented or closed

|

-

|

2

|

-

|

2

|

|

Issues raised in 2019 interim management letter that we will

follow-up as part of our 2019/20 audit

|

|

4

|

2

|

6

|

|

Total

|

-

|

13

|

7

|

20

|

2 Our

audit report

2.1 We

issued an unmodified audit report

We issued an

unmodified audit report on 26 September 2019. This means we were satisfied that

the financial statements and the non-financial performance information in the

activity groups present fairly the City Council’s activity for the year

and its financial position at the end of the year.

We issued an

unmodified audit report on 26 September 2019. This means we were satisfied that

the financial statements and the non-financial performance information in the

activity groups present fairly the City Council’s activity for the year

and its financial position at the end of the year.

We also issued an unmodified audit report on

the City Council’s summary annual report on 24 October 2019. This

means that we were satisfied that the summary of the annual report

fairly represents the information regarding the major matters dealt with in the

annual report.

2.2 Uncorrected

misstatements

The financial statements are free from

material misstatements, including omissions. During the audit, we have

discussed with management any misstatements that we found, other than those

which were clearly trivial. The misstatements that have not been corrected are

listed below along with management’s reasons for not adjusting these

misstatements. We are satisfied that these misstatements are individually and

collectively immaterial.

|

|

Assets

|

Liabilities

|

Equity

|

Financial performance

|

|

Dr (Cr)

|

Dr (Cr)

|

Dr (Cr)

|

Dr (Cr)

|

|

Tax on revaluations

Tax expense

Deferred tax liability

|

|

(1,152)

|

|

1,854

(702)

|

|

Total

|

0

|

(1,152)

|

0

|

1,152

|

Explanation of

uncorrected misstatements:

To

recognise the income tax/deferred tax relating to the port assets.

Management explanation for not correcting the

misstatement:

It

is highly unlikely that the Inner Harbour assets will ever be sold by Council.

Consequently, there will be no asset or liability in the future.

Audit New Zealand comment on management

explanation

The

basis upon which the City Council is not accounting for deferred tax liability

is not an acceptable argument under the relevant accounting standard, PBE IAS

12 Income Taxes. The accounting standard requires all deferred tax

liabilities to be recognised. We also note that the deferred tax liability is

close to our materiality thresholds (i.e. a possible impact on our audit

opinion in future years).

2.3 Corrected

misstatements

We also identified misstatements that were

corrected by management. These corrected misstatements had the net effect of

increasing expenditure by $430,174 and to decrease the associated asset by the

same amount compared to the draft financial statements. The corrected

misstatements are listed in Appendix 2.

2.4 Quality

and timeliness of information provided for audit

Management needs to

provide information for audit relating to the annual report of the City

Council. This includes the draft annual report with supporting working papers.

We provided a listing of information we required to management. This included

the dates we required the information to be provided to us.

Management needs to

provide information for audit relating to the annual report of the City

Council. This includes the draft annual report with supporting working papers.

We provided a listing of information we required to management. This included

the dates we required the information to be provided to us.

We are pleased to note that there has been an

improvement in the delivery of the draft Annual Report and the supporting work

papers in the current year. The staff were generally prompt and responses to

audit queries were of good quality. There is still some room for improvement as

there were issues (detail and timing of delivery) with the information

provided, e.g. fixed assets revaluations and service requests KPIs.

3 Matters

raised in the Audit Plan

21.

In our Audit Plan of

8 April 2019, we identified the following matters as the main audit risks and

issues:

In our Audit Plan of

8 April 2019, we identified the following matters as the main audit risks and

issues:

22.

|

Audit risk/issue

|

Outcome

|

|

Weathertightness

|

|

In its 2017/18 financial statements, the City Council included

disclosure on the weather-tightness claims in its contingent liability note

and appropriate provision for these claims within the financial statements.

The City Council is involved in litigation for weather-tightness

issues on an ongoing basis. We are of the view that a liability should be

recognised in the City Council’s financial statements where the

estimated figure for the potential liability is known.

We understand one of the litigation claims has been settled

during the year.

|

We are satisfied with the disclosure of a weather tightness

claim as a contingent liability, rather than a provision, on the basis that

there is no reliable estimate of the likely cost.

The Council has advised us, including a specific representation

in the year end representation letter, that the reasons for the uncertainty

include:

· The plaintiff is still quantifying the claim at this

point in time which is unusual for these cases.

· There is significant uncertainty in determining the

costs of these cases. Council’s experience in settling a recent weather

tightness claim was that the final settlement considerably exceeded its best

estimate as at 30 June 2018.

Therefore the City Council has recognised a contingent liability

based on the amount of the known claim at this time.

We reviewed the documentation to support Council’s

position and also discussed the claim with Council’s external legal

representatives.

|

|

Fair value of property, plant and equipment

|

|

Infrastructural assets and other revalued assets need to be

revalued with sufficient regularity to ensure that the carrying amount does

not differ materially from fair value. The relevant accounting standard is

PBE IPSAS 17, Property, Plant and Equipment.

The City Council revalues its assets on a three yearly cycle

with the exception of roading and library collection which is done annually.

The last full revaluation for the City Council was 30 June 2017. As such, the

only assets that City Council is due to revalue as at 30 June 2018 are the

roading assets and library collection.

In a non-revaluation year the City Council must consider whether

there has been any significant movement in the fair value of the assets that

are not being revalued.

In addition, the value of work in progress (WIP) on projects

that span an extended period of time needs to be assessed for impairment

regularly over the period of each project.

We expect that the City Council will have done a comprehensive

analysis to determine whether there is a significant variance between the

fair value as at 30 June 2019 and the carrying value that would trigger the

need for the City Council to revalue or impair its assets.

|

Revalued assets – land and buildings, and roading

We were satisfied with the robustness of the valuations

undertaken this year by the City Council.

For land and buildings ($550 million) and the roading assets

($247 million) we:

· Reviewed how the City Council ensured completeness over

the asset data;

· Reviewed the City Council’s explanations of

variances between the latest and prior years’ valuations for

reasonableness;

· Obtained a confirmation from the Independent valuers

(Opus and Telfer Young);

· Confirmed our understanding of the valuation

methodology and key assumptions. We assessed these for compliance with

PBE IPSAS 17 and evaluated their reasonableness based on our

experience and knowledge of other roading, and land and building valuations;

· Determined how the age and condition of the assets had

been determined, and how this had been reflected in the determination of the

remaining useful life of the assets and the valuation calculation for those

assets;

· Determined how unit rates for replacement costs have

been determined for roading assets. We confirmed the reasonableness of a

sample of unit costs by reference to recent capital works undertaken by the

City Council; and

· Reviewed how changes in the value of roading, and land

and buildings are accounted for and disclosed in the financial statements.

The roading valuation report noted some areas for the City

Council to continue to improve its records however these were not material to

the value of the assets and the revaluation amounts were appropriately

included into the financial statements.

Assets that are revalued but were not revalued this year

We were satisfied with management’s assessment that a full

revaluation was not required to be undertaken for the asset classes that

were not revalued this year.

We reviewed the robustness of management’s assessments as to

why there is no material difference between the fair value and the carrying

value of these assets, with a focus on the significant assets that were not

revalued (3 waters). The City Council obtained advice from a 3rd party (AECOM) for

the 3 waters assets. We sighted a report from AECOM who advised that, based on the

Capital Goods Price Indices published by Statistics New Zealand, they

assessed the indicative associated movement of 3 waters facilities

infrastructure assets over the period since the last valuation as

approximately 4.65% (being 1.6% for this year and 3.05% for the previous

year).

|

|

Risk of management override of internal controls

|

|

There is an inherent risk in every organisation of fraud

resulting from management override of internal controls.

Management are in a unique position to perpetrate fraud because

of their ability to manipulate accounting records and prepare fraudulent financial

statements by overriding controls that otherwise appear to be operating

effectively.

Auditing standards require us to treat this as a risk on every

audit.

|

To address the risk of material misstatement due to fraud to an

acceptable level we completed the following audit work:

· Tested the appropriateness of journal entries recorded

in the general ledger and other adjustments made in the preparation of the

financial statements.

· Reviewed accounting estimates (e.g. weather tightness

provision) for biases and evaluated whether the circumstances producing the

bias, if any, represent a risk of material misstatement due to fraud.

· Maintained awareness of any significant transactions

that were outside the normal course of business, or that otherwise appear to

be unusual given our understanding of the City Council and its environment,

and other information obtained during the audit.

From our testing we did not identify any issues that indicated

management override.

|

|

Systems for mandatory performance measures

|

|

The measures set out in the Non-financial Performance Measures

Rules 2013 (the Rules) were reported on for the first time in the 2016 Annual

Report. The Rules came into force under s261B of the Local Government Act

2002, and mandated a total of 19 measures across water supply, wastewater,

storm water drainage, flood protection, and roading and footpath activities.

We again assessed the systems in place to measure performance,

and reviewed the reporting in the Annual Report, against the measures during

our 2017/18 audit. We noted in this review that there had been improvements

in this area when compared to the 2016/17 audit.

We found that improvements could still be made in relation to

the reporting against mandatory measures for complaints and median response

times.

|

We continue to recommend improvements in this area. We:

· followed up on the City Council’s progress in

implementing the recommendations we made in last year’s management

report; and

· performed testing on the reported median response times

to ensure appropriate reporting in the Annual Report.

We found that some of the records included in the system were

not complete. We found as we followed these through that the supporting job

sheets had the required data but that this had either not been recorded in

the system at all or had not been recorded accurately.

We also reviewed any required additional commentary where

necessary to ensure the City Council is reporting fairly on its performance

during the year.

|

|

Capital projects

|

|

The City Council continues to undertake an intensive capital

programme.

Council has recognised the risk with the level of projects being

undertaken and is taking positive actions to mitigate these. A project

manager has been contracted to co-ordinate and oversee the capital programme.

A process to regularly report on the progress of the capital projects has

also been implemented.

|

The level of carry forwards from this year to next year has

increased by $10.5 million over the prior year to $15.2 million.

We have no significant concerns over the carry-forwards as there

were some major projects that were delayed such as the National Aquarium

expansion project and the Aquatic Centre Expansion project. The Aquarium

delay is due to final designs still being a work in progress and the need for

the City Council to secure external funding for the project. The Aquatic

Centre delay is due to the current legal case around the project being taken

by a number of residents against the City Council about whether there was

adequate/appropriate consultation in making the decision to proceed with the

project.

The major projects included in the carry forward work do not

affect the levels of service.

|

|

Investment property revaluation

|

|

Investment properties need to be revalued annually.

The relevant accounting standard is PBE IPSAS 16, Investment

Properties.

|

We assessed the revaluation as being fair value and that it had

been appropriately included into the financial statements.

We reviewed the valuation and assessed whether the underlying

assumptions and data were consistent with the City Council’s management

and knowledge of the assets.

|

|

Deferred tax liability

|

|

In its prior years’ financial statements, the City Council

has not accounted for deferred tax liabilities in relation to its revalued

port assets on the basis that the inner harbour assets are highly unlikely to

be sold. This was noted in Council's Letter of Representation as an

uncorrected misstatement of $1.278 million in 2017/18.

The basis upon which the Council is not accounting for deferred

tax liability is not an acceptable argument under the relevant accounting

standard, PBE IAS 12 Income Taxes. The standard requires all deferred

tax liabilities to be recognised. We note that the deferred tax liability

calculations are getting closer to our materiality thresholds (i.e. a

possible impact on our audit opinion).

|

We continue to recommend that the City Council comply with

Generally Accepted Accounting Practice.

As noted in section 2.2, this remains an outstanding issue in

the current year with the deferred tax liability being understated by $1.152

million.

|