|

Prosperous Napier Committee - 27 February 2020 - Attachments

|

Item 2 Attachments a |

Prosperous Napier Committee

Open Agenda

|

Meeting Date: |

Thursday 27 February 2020 |

|

Time: |

Following People and Places Napier Committee |

|

Venue: |

Council Chambers |

|

Committee Members |

Mayor Wise, Councillor Taylor (In the Chair), Deputy Mayor Brosnan, Councillors Boag, Browne, Chrystal, Crown, Mawson, McGrath, Price, Simpson, Tapine and Wright |

|

Officer Responsible |

Director Corporate Services |

|

Administration |

Governance Team |

|

|

Next Prosperous Napier Committee Meeting Thursday 9 April 2020 |

Prosperous Napier Committee - 27 February 2020 - Open Agenda

ORDER OF BUSINESS

Apologies

Nil

Conflicts of interest

Public forum

Nil

Announcements by the Mayor

Announcements by the Chairperson including notification of minor matters not on the agenda

Note: re minor matters only - refer LGOIMA s46A(7A) and Standing Orders s9.13

A meeting may discuss an item that is not on the agenda only if it is a minor matter relating to the general business of the meeting and the Chairperson explains at the beginning of the public part of the meeting that the item will be discussed. However, the meeting may not make a resolution, decision or recommendation about the item, except to refer it to a subsequent meeting for further discussion.

Announcements by the management

Confirmation of minutes

Nil

Agenda items

1 Reserve Funding Changes............................................................................................. 3

2 Hawke's Bay Airport Ltd Half Year Report to 31 December 2019.................................... 8

3 Digital Property File Fee Amendment............................................................................ 18

4 Policy - Council Organisation Appointments and Remuneration.................................... 29

Minor matters not on the agenda – discussion (if any)

Public excluded ............................................................................................................. 37

Prosperous Napier Committee - 27 February 2020 - Open Agenda Item 1

1. Reserve Funding Changes

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

872505 |

|

Reporting Officer/s & Unit: |

Adele Henderson, Director Corporate Services |

1.1 Purpose of Report

To approve changes to Financial Reserves and reserve funding.

Note: this report was initially taken to the Council meeting held on 19 November 2019 where it was laid on the table.

|

The Prosperous Napier Committee: a. Approve the transfer of rates funds of $7,410,078, previously transferred into the Financial Contributions Reserve, back into the Subdivision and Urban Growth Fund. b. Transfer the General Reserve No 1 remaining reserve balance of $20,681 as at 30 June 2019 to the Capital Reserve Account. c. Approve a change in funding, for the following existing projects to now be funded from the Subdivision and Urban Growth Fund i. District Plan Review ($1.2m total) ii. Asset Management Transformation Project ($225,000 2019/20 and $1.5m in total) iii. Te Awa Development Investigation ($255,500 2019/20) d. Approve a change in funding, the following existing projects to now be funded from the Solid Waste Disposal Income Account. i. Smoothing impact of Kerbside recycling in 2019/20 and 2020/21 ($1.3m)

|

|

That the Council resolve that the officer’s recommendation be adopted. |

1.2 Background Summary

As defined in the Local Government Act 2002, a reserve fund means money set aside by a local authority for a specific purpose, in accordance with clause 31 of Schedule 10 of the Local Government Act 2002.

Councils Reserve Funds are classified into three categories

· Council Created Reserves – created by Council for specific purposes

· Restricted Reserves – where there are legal obligations which restrict the use of the funds

· Bequest and Trust Funds – amounts received from bequests, donations or funds held on behalf of a community organisation

1.3 Issues

Reserve Funds

Officers have been working to review the history and use of various Council reserve funds. Part of this review has identified that funds should be moved between funds to more accurately reflect the nature and purpose for which funds are held in reserves.

General Reserve No 1

This was created to fund costs associated to former NZ Rail Land in the city where loans were raised to fund associated infrastructure to support development. As at 30 June 2019 there were sufficient funds in the reserve to repay the outstanding loans so additional loan principal of $442,094 was repaid as at 30 June 2019. Following the repayment of the debt the remaining balance of this reserve of $20,681 can be transferred to the Capital Reserve.

Financial Contributions Reserve Fund

LGA Section 106 enables Napier City Council to require development or financial contributions from developers to help fund the cost of new or expanded infrastructure and services, which are required to meet the additional demand created by growth.

Financial Contributions are applicable to lots and units for residential purposes and they are also applicable to construction and/or development of lots and units for commercial and/or industrial purposes.

The Financial and Development Contribution charges are adjusted annually on 1 July in accordance with the provisions of Sections 106(2B) and 106(2C) of the LGA, based on the Statistics NZ Producers’ Price Index outputs for construction (PPI).

Council is required to have a policy on Development Contributions and/or Financial Contributions as a component of its Funding and Financial Policies. Section 106 of the LGA details the specific matters to be covered in any Development Contributions or Financial Contributions Policy.

The current policy states that Council considers, at this stage, that it will rely on the financial contributions specified in the City of Napier District Plan prepared under the Resource Management Act 1991 (RMA) mainly for residential development, as this has been subject to considerable community consultation and is well accepted by the community. Residential activity for the purposes of this policy means the development of land and buildings (including accessory buildings such as garages, carports and storage sheds) primarily for the use of a household (whether any person is subject to care, supervision or not).

The policy states that Council requires Development Contributions under Section 198 of the Act for Commercial and Industrial activities throughout the City. Council is also able to charge Financial Contributions for Commercial and Industrial Activities using the provisions in the District Plan instead of development contributions under S198.

Commercial activity for the purposes of this policy means development of land and buildings primarily to be used for the display, offering, provision, sale or hire of goods, equipment or service and includes retailing, travellers’ accommodation, day care centres, off-licence premises, wholesale liquor outlets, offices, shops, medical clinics/hospitals, churches, residential care facilities, educational facilities and retirement complexes but does not include activities specifically excluded under the LGA. Industrial activity for the purposes of this policy means development of land and buildings primarily to be used for manufacturing, assembling, testing, fabricating, processing, packing or associated storage of goods and the servicing and repair of goods and vehicles and includes service stations, transport depots warehouses, factories, network utility operations and unsealed yards.

This Financial and Development Contribution policy sets out the development and financial contributions payable, specifies how and when they are to be calculated and paid, and summarises the methodology and rationale used in calculating the level of contributions.

Any Development Contributions charged under this policy are distinct from and in addition to the provisions in the District Plan that provide Council with the discretion to require financial contributions under the RMA 1991.

Funding Transfer recommendation

Over the years Council had a practice of making payments into the Financial Contributions Reserve. These were made out of rates transferred into the Subdivision & Urban Growth Fund.

The total amounts of rates transferred into the Financial Contributions Account were $7,408,013. As these funds were collected for a rates contribution, Council is able to determine the use of rates funds.

To ensure we have a clear separation between council funds from rates, and the actual financial contributions received on development, we recommend that the rates funds of $7,408,013 are transferred back into the Subdivision and Urban Growth Fund where future decisions can be made on the use of these funds at Councils discretion.

Subdivision and Urban Growth Fund

Prior to the 2018/28 LTP Council had a practice of transferring rates funds into this reserve each year representing new rates collected as a result of subdivisions. These funds were then used to provide an offset against rates as well as funding the costs of servicing growth related debt. Some funds were also periodically transferred into the Financial Contributions Reserve.

In the 2018/28 LTP the practice of flowing funds through this reserve was discontinued with all rates reflected in the consolidated view. This left a remaining balance of $2.6m in this reserve. With the rates funds, previously transferred into the financial contributions reserve, to be transferred back to this reserve this can now be the source of funding for projects linked to growth. This will bring the total Subdivision and Urban Growth Fund reserve once approved changes have been made to $10m

The approved reserve funded costs for projects linked to growth, such as the District Plan Review ($1.2m), Asset Management Transformation Project ($225,000 in 2019/20, with a total cost of $1.5m) and Te Awa Development Investigation ($255,500) can then be funded from the Subdivision and Urban Growth Fund.

Solid Waste Disposal Income Account

Council has a substantial reserve which has been built up from the NCC share of distributions from the Joint Landfill facility. This fund provides a source of funds to meet Council’s share of capital expenditure at the landfill. A review has identified that the current balance of $6.7m is more than is needed for Landfill related capital at this stage. This fund was identified as the source of funding for the new recycling bins. This reserve fund can also be used to assist with funding the introduction of the new “wheelie bin” refuse collection service.

In addition, previously Council has approved the allocation of reserve funds to assist with smoothing the impact of the new Kerbside recycling service. This required $520k in 2018/19, $700k in 2020/21 and $600k in 2021/22. The 2018/19 allocation was funded from the Capital Reserve however this reserve does not have sufficient funds to cover the 2019/20 and 2020/21 funding allocations. These costs can be funded from the Solid waste Disposal income account as there will not be sufficient funds in the capital reserve to cover these reserve allocations. In addition it is recommended that the purchase of new bins required for the new waste contract are funded from this reserve.

Changes to Source of Funding for projects

The following, reserve funded projects, projects can now, more appropriately be funded from the Subdivision and Urban Growth Fund:-

· District Plan Review

· Asset Management Transformation Project

· Te Awa Development Investigation

The following projects can now, more appropriately, be funded from the Solid Waste Disposal income Account:-

· Funds for smoothing cost of Kerbside Recycling Service

1.4 Significance and Engagement

N/A

1.5 Implications

Financial

N/A

Social & Policy

The above changes to the reserve balance does not impact on the Financial and Development Contribution Policy itself

Risk

N/A

1.6 Options

The options available to Council are as follows:

A – Approve the following changes/movements to Reserve funds

a. Approve the transfer of rates funds of $7,410,078, previously transferred into the Financial Contributions Reserve, back into the Subdivision and Urban Growth Fund.

b. Approve to transfer the General Reserve No 1 remaining reserve balance of $20,681 as at 30 June 2019 to the Capital Reserve Account.

c. Approve a change in funding, for the following existing projects to now be funded from the Subdivision and Urban Growth Reserve

a. District Plan Review ($1.2m total)

b. Asset Management Transformation Project ($225,000 2019/20 and $1.5m in total)

c. Te Awa Development Investigation ($255,500 2019/20)

d. Approve a change in funding, the following existing projects to now be funded from the Solid Waste Disposal Income Account.

a. Smoothing impact of Kerbside recycling in 2019/20 and 2020/21 ($1.3m)

B – Amend proposed changes/movements to Reserve Funds

C – Not approve changes to Reserve Funds

1.7 Development of Preferred Option

A – Approve the following changes/movements to Reserve funds

Prosperous Napier Committee - 27 February 2020 - Open Agenda Item 2

2. Hawke's Bay Airport Ltd Half Year Report to 31 December 2019

|

Type of Report: |

Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

895314 |

|

Reporting Officer/s & Unit: |

Caroline Thomson, Chief Financial Officer |

2.1 Purpose of Report

To receive the half year report to shareholders from Hawke’s Bay Airport Limited to 31 December 2019.

|

The Prosperous Napier Committee: a. Receive the Hawke’s Bay Airport Limited half year report to shareholders, to December 2019.

|

|

That the Council resolve that the officer’s recommendation be adopted. |

2.2 Background Summary

Section 66 of the Local Government Act 2002 requires that a Council-controlled organisation must report to Council each half year. However, Section 65 requires regular monitoring of performance of a Council Controlled Organisation.

The Hawke’s Bay Airport Limited is a Council-controlled organisation. It is a company incorporated under the Companies Act and is owned by the Crown, Hastings District Council and Napier City Council. Napier City Council has a 26% shareholding.

The Company produces separate annual accounts. No payments are made by Napier City Council to the Company and there is no financial provision included in Council budgets. The Napier City Council share in the Company is included in its annual financial statements as an investment, valued using the equity method of accounting.

In accordance with Part 5, Section 65 of the Local Government Act 2002, Napier City Council has a responsibility to regularly undertake performance monitoring of the Hawke’s Bay Airport Limited. The half yearly report to shareholders to 31 December 2019 has been received from Hawke’s Bay Airport Limited for Council’s information.

2.3 Issues

The voluntary administration of the head contractor on the HBAL terminal expansion project and subsequent withdrawl of Jetstar services may necessitate a request for dividend relief. It is HBAL’s intention to keep shareholders fully informed in this regard.

2.4 Significance and Engagement

N/A

2.5 Implications

Financial

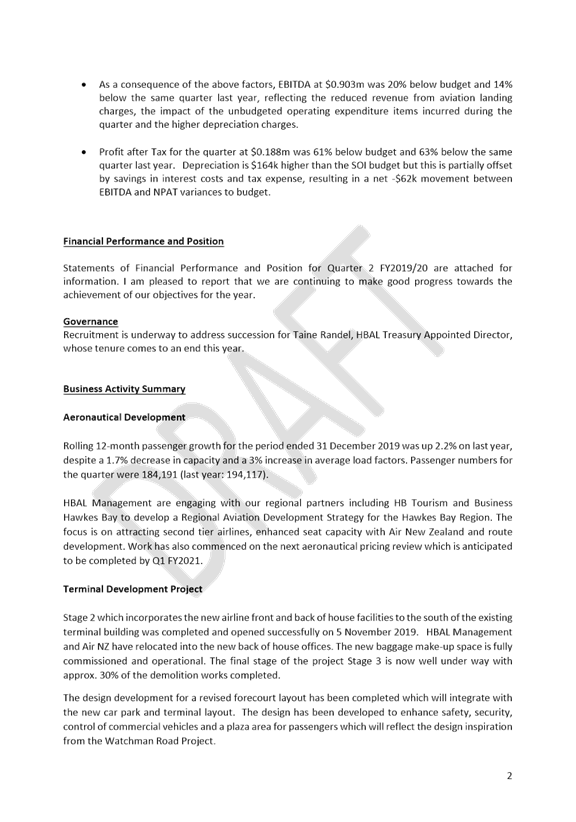

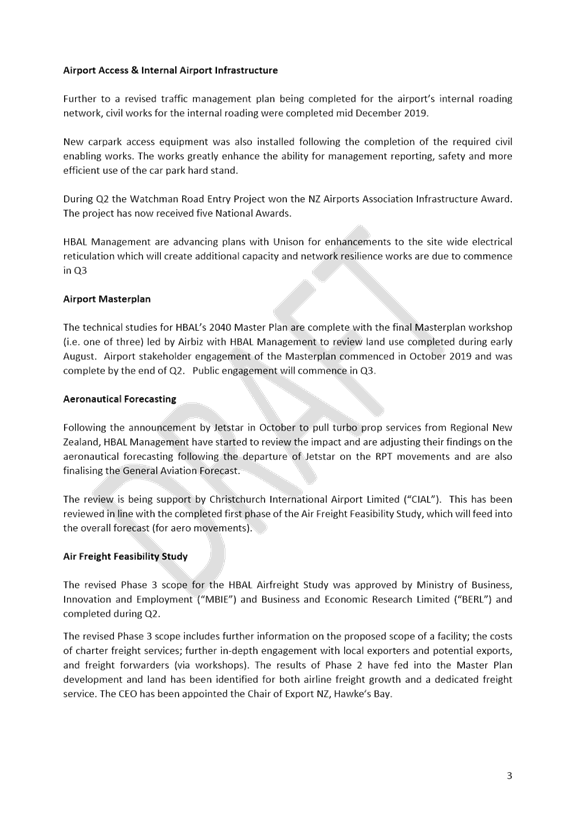

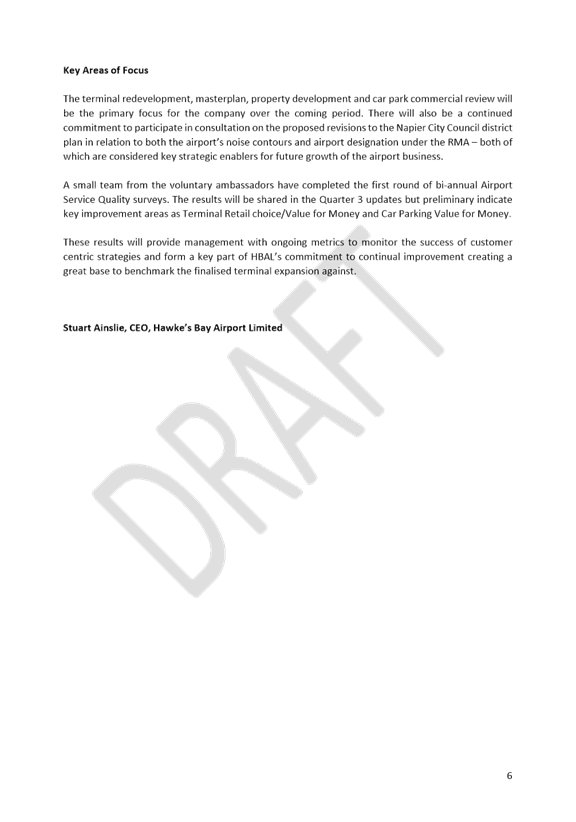

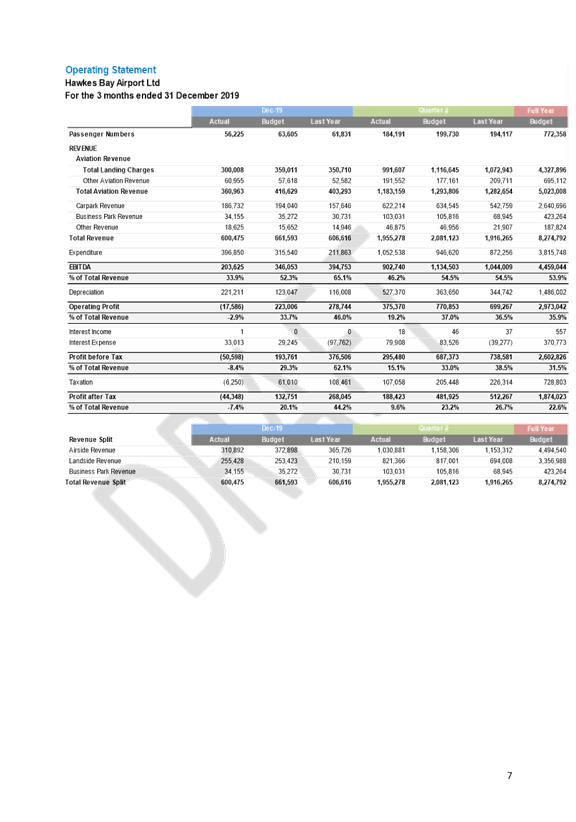

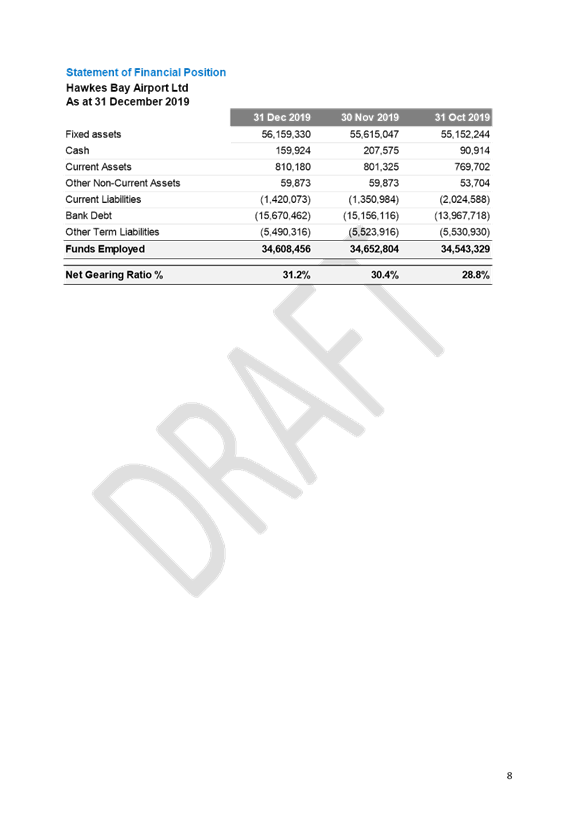

HBAL has delivered a net profit after tax (NPAT) result of $188k (9.6%) for the second quarter of the 2020 financial year. The result is lower than the Statement of Intent (SOI) and the same quarter last year which delivered a net profit return of 26.7%. This was expected given the impact on airline and passenger related revenue due to the withdrawal of JetStar services and the reduction in airline capacity noted prior to this. The result was further impacted by the timing of some expenditure and higher than budgeted depreciation. The report to shareholders includes the financial report for the three months ended 31 December 2019 in attachment A.

Social & Policy

N/A

Risk

N/A

a HBAL report to shareholders to December 2019 ⇩

3. Digital Property File Fee Amendment

|

Type of Report: |

Operational and Procedural |

|

Legal Reference: |

N/A |

|

Document ID: |

902624 |

|

Reporting Officer/s & Unit: |

Rachael Horton, Manager Regulatory Solutions |

3.1 Purpose of Report

To review the fee for a digital property file contained in the Schedule of Fees and Charges for 2019/20 with a view to amending the fee and offering an additional service option.

|

The Prosperous Napier Committee: a. Resolve to amend the fees for digital property files to the following:

Full digital property file $40 Building File only $20

i. A reduced fee of $15 will be charged if a customer subsequently requests a full digital property file on a property after previously only requesting a Building File.

|

|

That the Council resolve that the officer’s recommendation be adopted. |

3.2 Background Summary

Council are required to review fees and charges annually and formally approve any changes. The Schedule of Fees and Charges for 2019/20 was adopted by Council on 4 June 2019 for commencement from 1 July 2019. The fee for the provision of a digital property file was set at $95.

Property Files

Council maintain a public file of all properties within Napier. There are around 28,000 property files currently held, some dating back to pre-1931. Property files contain information relating to the land and buildings of the property, including but not limited to:

· consents

· plans

· information regarding hazards

· infrastructure services

Access to the property files are sought by homeowners and businesses for a range of reasons, such as purchase and sale, development and improvements, fire installation, and surveying.

Property File Digitisation Project

In 2017 a project was commenced to digitise all property files, which were currently held in paper form. Up until this project commenced, the public could access these files free of charge by coming into the council office and photocopying the paper file. However, this type of access was high risk to Council where damage or removal of all or part of the file was possible.

To fund the digitisation project and to ensure fairness across all users of the service, a flat fee of $95 was set based on the administrative time required to review, digitise and provide the digital information to the user. It is estimated to take, on average, just over 1.5 hours per property file, however large commercial property files, containing hundreds of documents take significantly longer. With allowances for council’s time, supervision and general overheads, council has set the fee at $95 including GST.

The digitisation project is a transformational initiative for council to meet the growing need for online services and digital information. The project aligns with central government initiatives including Better Property Services project (integrating central and local government property and building), and Better Public Services Result Area 10 (New Zealanders can complete their transactions with government easily in a digital environment) Most territorial authorities have either completed or are in the process of digitising their paper files.

3.3 Issues

From 1 July 2019, access to property files has only been through the provision of a digital file. On receipt of a request and payment of the $95 fee, the paper file is reviewed, scanned, and sent to the user in digital format.

Feedback

Council has received informal feedback about the introduction of the fee. Some customers were pleased to have an online digital service. Commercial customers are able to pass on the cost to their customers or absorb the cost into the current fees. Other customers, however, felt that the free paper-based service should continue or that the digital service should be free of charge. Others believed the $95 fee was too high.

We also received feedback that it was unreasonable for council to charge a flat fee of $95 when the customer only wanted access to a small part of the file, such as the building plan. For example: a commercial fire installer only wants to view the building plan and does not require the entire property file.

Survey - type of service

To understand our customer needs, we surveyed all users of the service since 1 July 2019 – a total of 395 customers. We received 104 responses.

A summary of the survey is provided below. The survey results are attached.

Survey respondents were asked to indicate how likely or unlikely they are to use each of the following options:

· Full digital property file – residential/rural/commercial/industrial

o 69% of 103 respondents for this option indicated they are very likely to use this service

· Building File only (just Building Permits/Consents and building file notes – no Planning information or Resource Consents)

o 34% of 96 respondents for this option indicated they are very likely to use this service

· Building Consent Plans and Building Permits (Building Plans only, i.e. no scheme plans, subdivision plans etc)

o 39% of 98 respondents for this option indicated they are very likely to use this service

· Drainage Plan only

o 21% of 93 respondents for this option indicated they are very likely to use this service

Fee amount

· There are 25 councils who charge for a full digital property file, with fees ranging from $10 to $95. The average of these fees is $38.84. We are proposing our fee be set at $40.

· There are only a few councils who offer an alternative service, such as Building File only, and these services varied in type and could not be considered the same service. We could not establish an average, but consider $20 to be an appropriate fee. Noting that some Building Files can be extremely large, in excess of 100 pages.

Proposed fee and charges

Taking into account the survey results, we propose offering the following two services:

1. Full digital property file $40

2. Building File only $20

a. A reduced fee of $15 will be charged for a subsequent request of a full digital property file after requesting a Building File

We propose these two options for the following reasons:

· The most popular option from the survey was the Full Digital Property file.

· The next options chosen were the Building File only and Building Consent Plans and Building Permits. As the Building File contains all of the information of the other options, it was considered the next best service to offer customers. The more information customers have, the better informed they will be about the property they have an interest in.

3.4 Significance and Engagement

As this is a minor single line change to Fees and Charges for 2018/19 adopted in March. Council is able to make a decision on this matter without further consultation.

3.5 Implications

Financial

The fee was first set at $95 to fund the digitisation project over the expected life of the project. Reducing the fee as proposed will mean that the charges will need to apply for longer to recover the costs of the project.

How long these fees will need to be charged for will be worked through in a separate funding decision as part of the 2020 Annual Plan process.

Social & Policy

N/A

Risk

N/A

a Digital Property File Survey Results ⇩

Prosperous Napier Committee - 27 February 2020 - Open Agenda Item 4

4. Policy - Council Organisation Appointments and Remuneration

|

Type of Report: |

Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

902626 |

|

Reporting Officer/s & Unit: |

Devorah Nícuarta-Smith, Team Leader Governance |

4.1 Purpose of Report

To present the Council Organisation Appointments and Remuneration Policy for adoption.

|

The Prosperous Napier Committee: a. Adopt the Council Organisation Appointments and Remuneration Policy

|

|

That the Council resolve that the officer’s recommendation be adopted. |

4.2 Background Summary

Council regularly reviews its policies. Where a policy is external (public facing) the policy is brought to Council for visibility and adoption.

The main change to the attached Policy is its name, from “Remuneration of Authority and Council Policy”, for increased clarity on the subject of the Policy.

Other updates include only increased consistency in considerations and formatting between parts one and two. The Policy has been reviewed in line with that of Hastings District Council, and it has been confirmed that the two align. This is useful for consistency where an individual may be appointed to a joint Council Organisation, Council Controlled Organisation or Council Controlled Trading Organisation.

4.3 Issues

No Issues

4.4 Significance and Engagement

This matter does not trigger Council’s Significance and Engagement Policy or other engagement requirements.

4.5 Implications

Financial

The policy outlines considerations that should be taken in to account when appointing Council Organisation Directors or Trustees. However the policy itself does not have direct financial implications at this time.

Social & Policy

N/A

Risk

N/A

4.6 Options

The options available to Council are as follows:

a. To adopt the Council Organisation Appointments and Remuneration Policy

b. To request officers to consider amendments to the Policy to be brought back to a future meeting

4.7 Development of Preferred Option

To adopt the Council Organisation Appointments and Remuneration Policy.

a Council Organisation Appointments and Remuneration Policy ⇩

Prosperous Napier Committee - 27 February 2020 - Open Agenda

That the public be excluded from the following parts of the proceedings of this meeting, namely:

AGENDA ITEMS

1. Request for Remission for Special Circumstances

2. Recommendations for Appointment to the Napier District Licensing Committee

The general subject of each matter to be considered while the public was excluded, the reasons for passing this resolution in relation to each matter, and the specific grounds under Section 48(1) of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution were as follows:

|

General subject of each matter to be considered. |

Reason for passing this resolution in relation to each matter. |

Ground(s) under section 48(1) to the passing of this resolution. |

|

1. Request for Remission for Special Circumstances |

7(2)(b)(ii) Protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information |

48(1)A That

the public conduct of the whole or the relevant part of the proceedings of

the meeting would be likely to result in the disclosure of information for

which good reason for withholding would exist: |

|

2. Recommendations for Appointment to the Napier District Licensing Committee |

7(2)(a) Protect the privacy of natural persons, including that of a deceased person |

48(1)A That

the public conduct of the whole or the relevant part of the proceedings of

the meeting would be likely to result in the disclosure of information for

which good reason for withholding would exist: |