Extraordinary Meeting of Council - 30 April 2020 - Open Agenda Item 1

1. Annual Plan Proposed Rate Increase Options

|

Type of Report: |

Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

920951 |

|

Reporting Officer/s & Unit: |

Adele Henderson, Director Corporate Services |

1.1 Purpose of Report

The purpose of this report is to provide Council with details of the financial impacts of Covid19 on the 20/21 budget, provide Council with planning assumptions to guide budgeting for 20/21, and present a shortlist of options to fund the operating deficit. The report also seeks Council approval for the proposed rates increase and to prepare the 2020/21 draft Annual Plan and consultation document on the basis of the decisions made at this meeting.

|

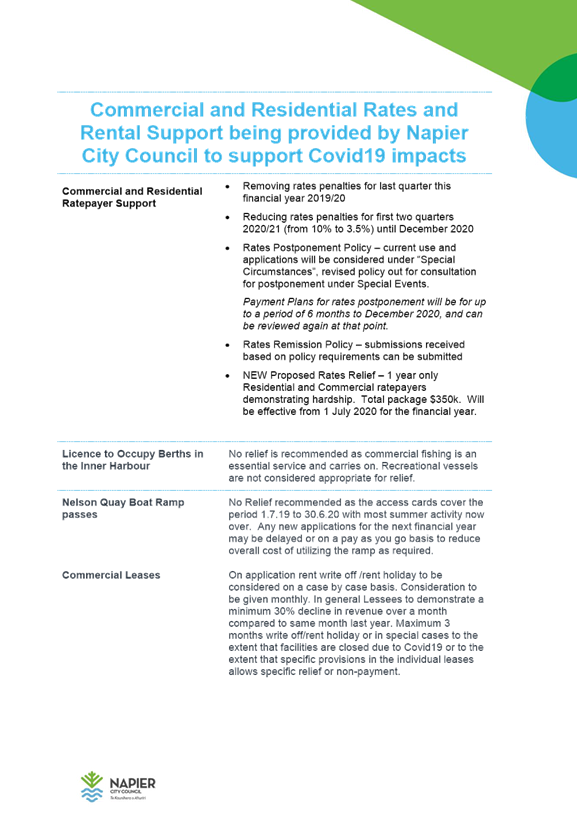

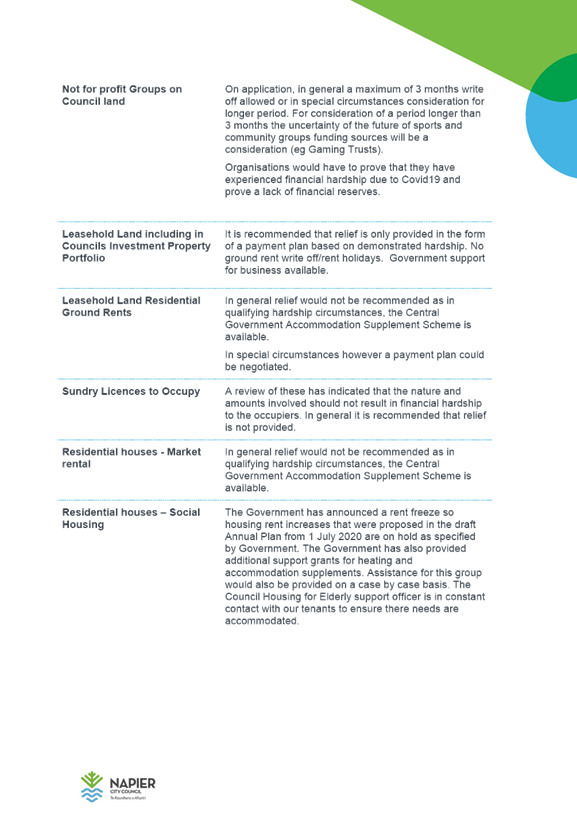

That Council: a. Receive the information and note the analysis of options; assumptions; and the risks as outlined in this report. b. Note that Covid19 has had a material impact on households and businesses and Council has developed a range of actions to support those facing hardship in the community, and the Recovery Project will continue to develop how it might respond. A separate report has been prepared for Council on Council on Rates and Rental Relief. c. Note that a number of briefing sessions/workshops have been held with elected members and seek Councillor input and direction setting in relation to preparing the final material required for the revised Annual Plan and consultation document for the community. d. Note the revised timeline that was provided to Council on 23 April, will see the adoption of the Annual Plan later than the statutory deadline due to the additional changes required for the revised plan and impact on the timeline for consulting and hearings. The revised adoption date is currently set for 27 August. e. Note that Covid19 has had a material impact on Council’s budget for the current year (2019/20), and is likely to put Council into a net operating rates deficit when the final position is known in August (currently estimated at $3m). f. Agree that the 2020/21 Annual Plan and consultation document be prepared for consideration by the Council, based on Option C, which recommends i. A 4.80% average rates, ii. Funding of a planned operating gap of $6.74 million to be allocated from Council reserves, ($4 million from the Parking Reserve, and $2.74 million from the Suburban and Urban Growth Fund.). Council will consult on the use of these funds as part of the Annual Plan 20/21 iii. Note that under section 80 of the Local Government Act 2002 Council could consider internal borrowing for any rates or debtors relief applications received prior to community consultation and adoption of the 20/21 Annual Plan. If community consultation confirms that it is appropriate to use the parking and urban/suburban growth funds to fund the operating gap of $6.74m the internal loan would be repaid from these reserves. iv. Note Council officers have identified operational savings of $3.7 million in the development of the revised Covid19 Annual Plan 20/21 |

|

That the Council resolve that the officer’s recommendation be adopted. |

1.2 Background Summary

The annual plan 20/21 covers the period from 1 July 2020 to 30 June 2021, and is the third year of the Long Term Plan 2018-28. The initial draft annual plan was prepared for consultation and was considered by Council at its meeting March 2020.

As outlined to Council, in the report to the Extraordinary Council meeting on 23 April, with the Covid19 pandemic situation rapidly having a significant impact on New Zealand and in turn on Council operations, the draft plan is not recommended to proceed and a new Annual Plan must be developed that reflects the challenges ahead.

The approach and assumptions to guide the development of the revised Annual plan are outlined in this report for Council’s agreement.

This report also sits alongside the Rates and Relief package (a separate report to Council) that can be immediately enacted and will cross this financial year 2019/20 and next financial year 2020/21.

1.3 Issues

The fast-changing events since the pandemic impacted on New Zealand, its borders, and being in lockdown has meant it has been difficult to prepare our Annual Plan for 2020/21 with any certainty. It is in effect, an emergency budget rather than a normal Annual Plan.

Council is committed to a programme and budget that supports the city to recover, but many of those details are based on several factors, including how long the Covid-19 pandemic lockdown lasts, what role Central government play in recovery, and the impact on the economy and on residents and businesses.

While it will be important to build a budget that recognises the current financial challenges that household and business face, it is also important to note that substantial support packages are available via government, banks and local government.

It is important to note that any costs that are deferred, or funded through different funding mechanisms, shift this year’s rates burden to future years and rates will be steeper in those years as a consequence.

The broad basis for setting the 2020/21 budget is finding the right balance between supporting those in need now and stimulating the local economy, while not over burdening ratepayers in the future.

1.4 Significance and Engagement

Council will be consulting on the Annual Plan 2020/21, and will work within the requirements of the government settings for Alert Levels 2, 3 and 4.

Council will seek feedback on the use of Reserve Funding for the identified one-year only operating cost shortfall due to Covid19 with the community as part of the Annual Plan consultation 20/21.

1.5 Implications

Financial

The original Annual Plan 20/21 proposed an increase of 6.5%, due to increases relating waste, recycling and water related projects.

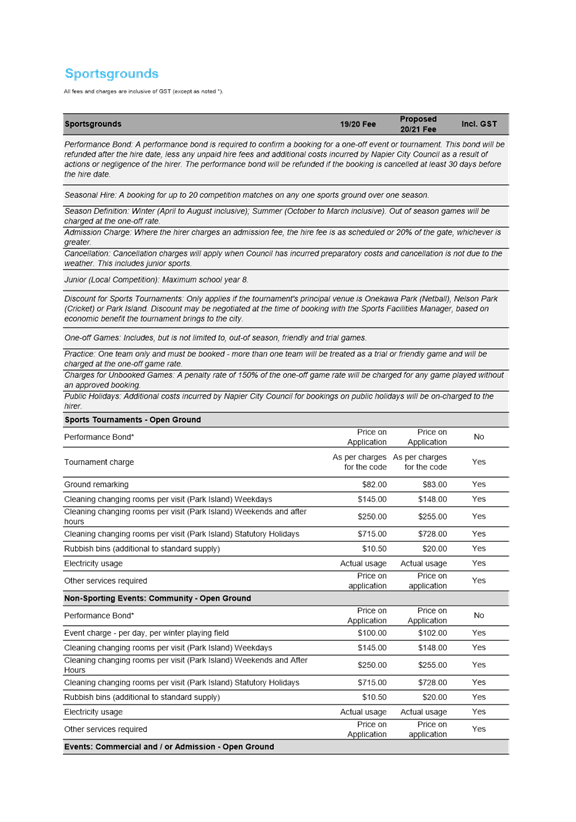

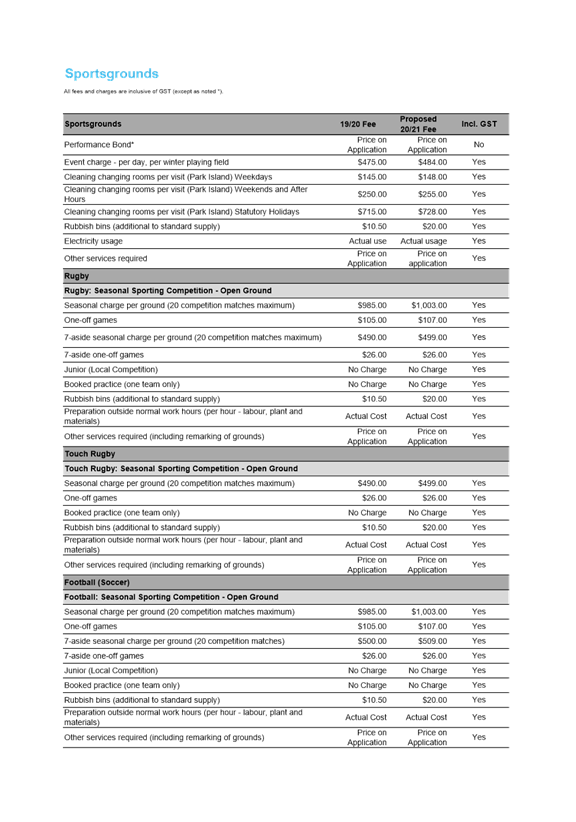

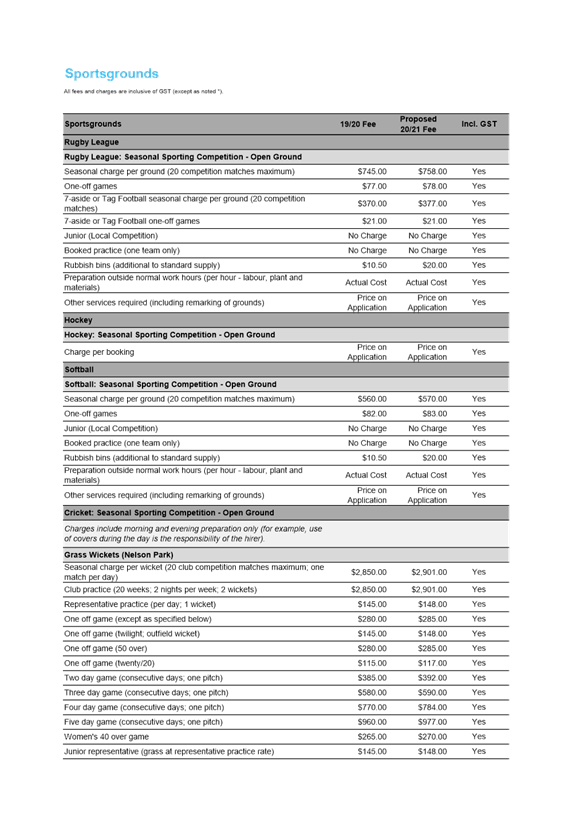

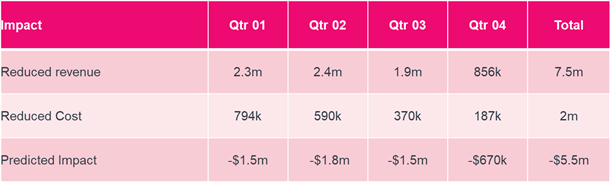

Council officers assessed the financial impact from Covid19 had, including the significant reduction in income from tourism, sportsgrounds, halls, and regulatory services, the loss of income and the inability to match the offset with operating cost reductions has shown that Council will have an operating shortfall for 20/21 of $5.5m or 9.5% of rates (See Table A).

This translates to a 16% rates requirement for 2020/21 before financial measures and mitigations are utilised to bring this down to an affordable and practical level for the community during this unprecedented time.

Currently only 51% of Napier City Council income is obtained from rates income. A shortfall in other income areas, requires Council to consider how it might fund the requirement in the short term, as well as start to put its mind to what the impacts will be in the longer term (through the Long Term Plan).

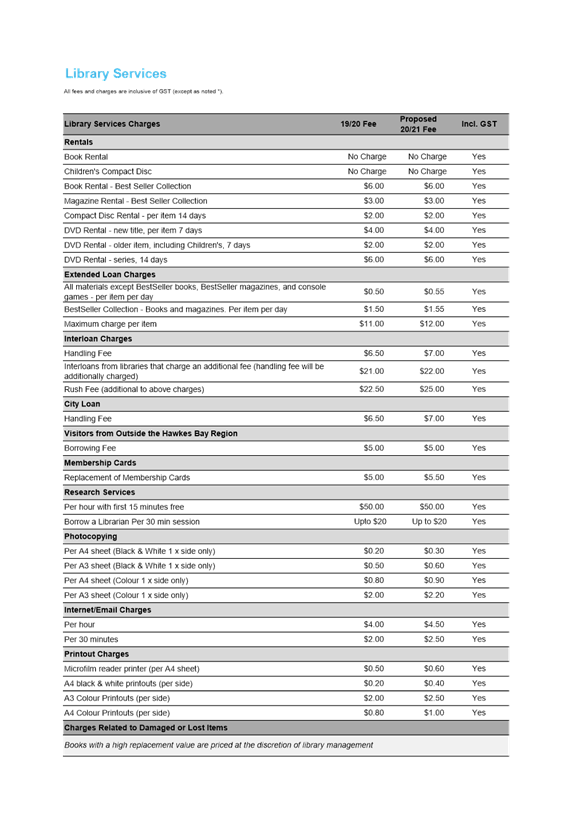

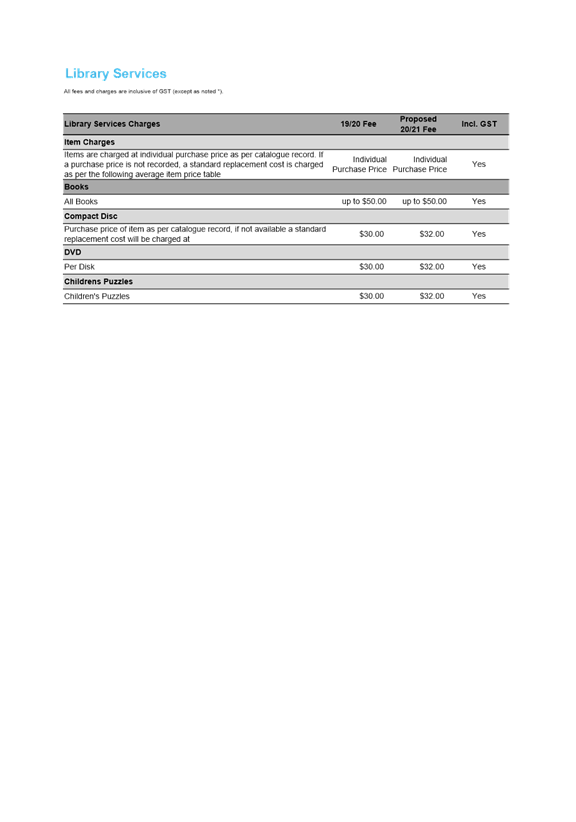

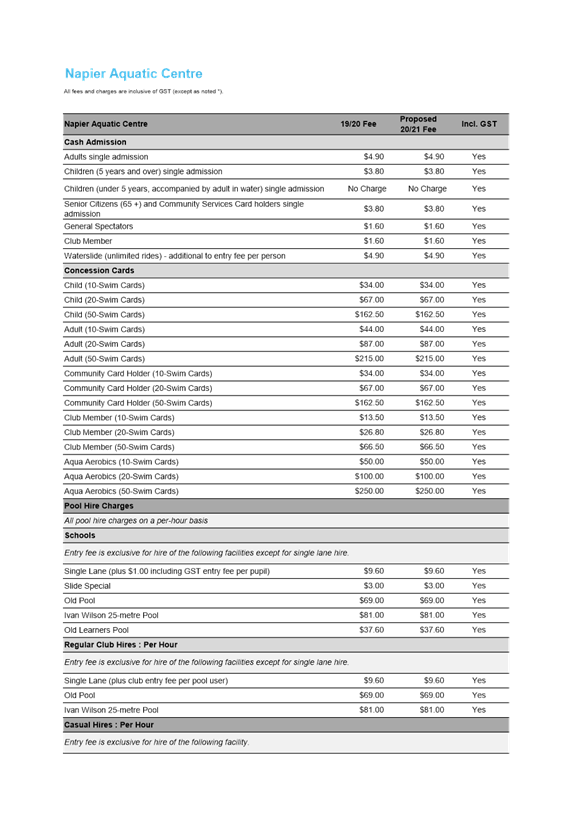

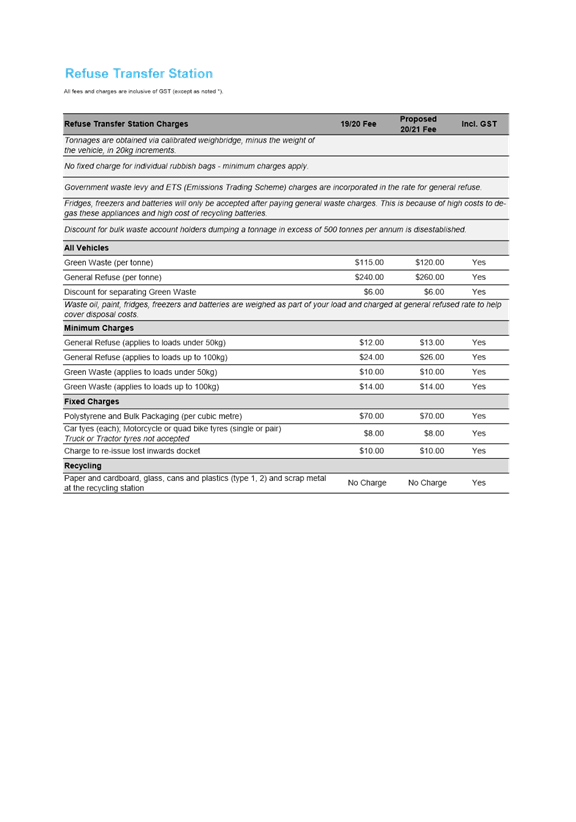

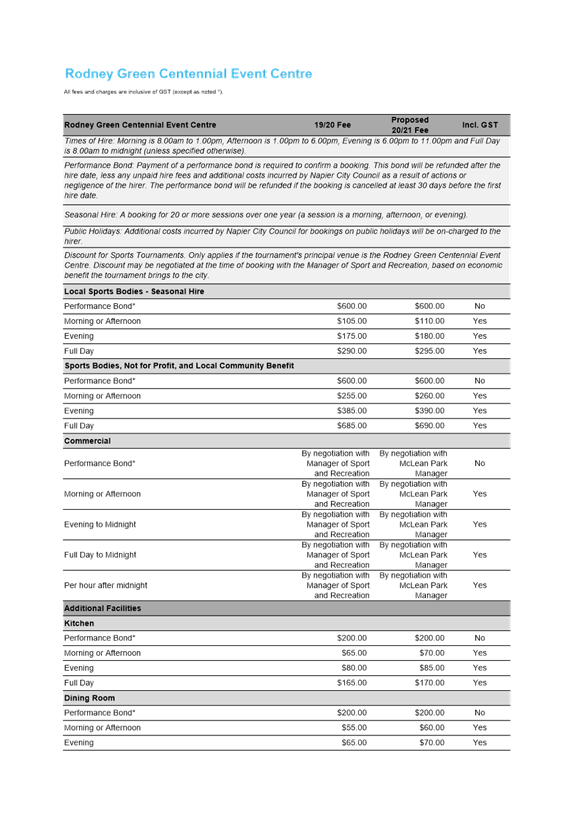

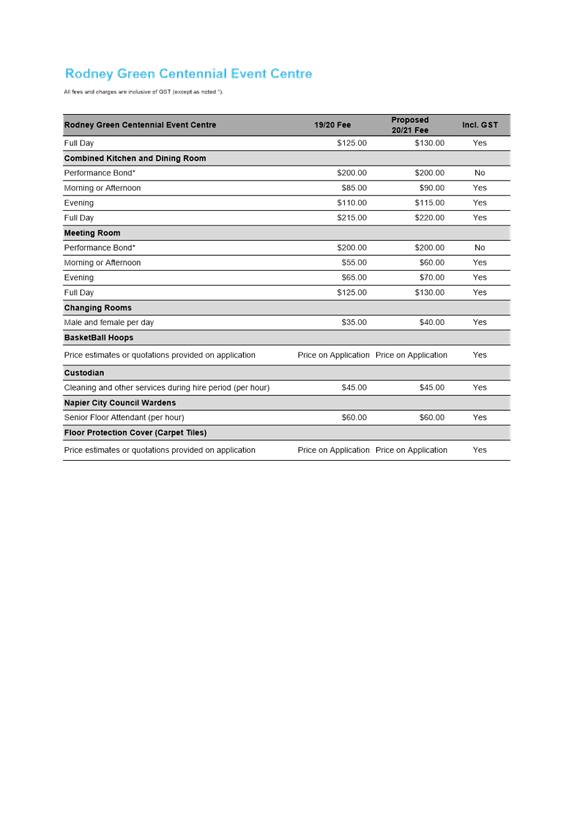

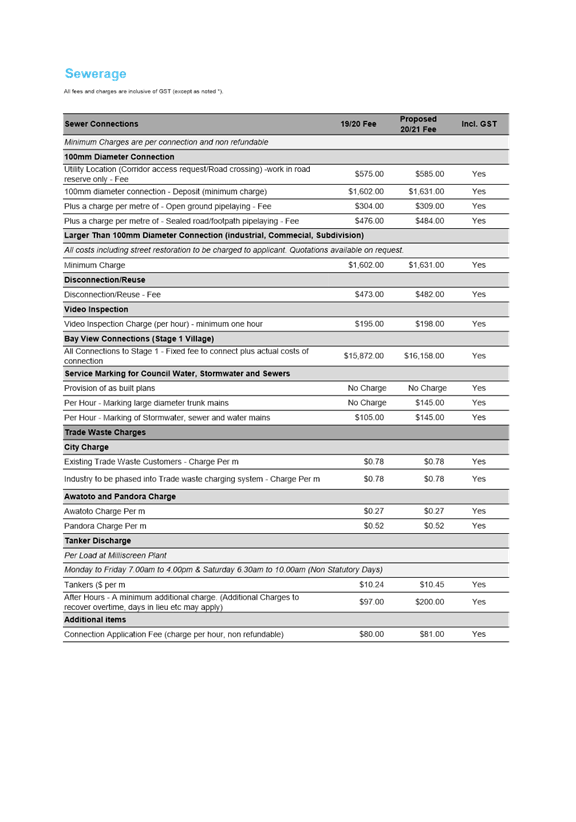

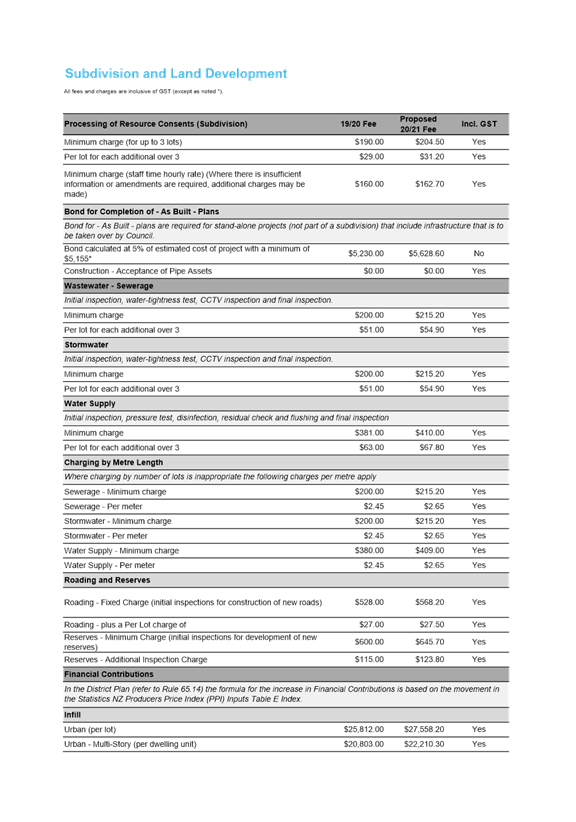

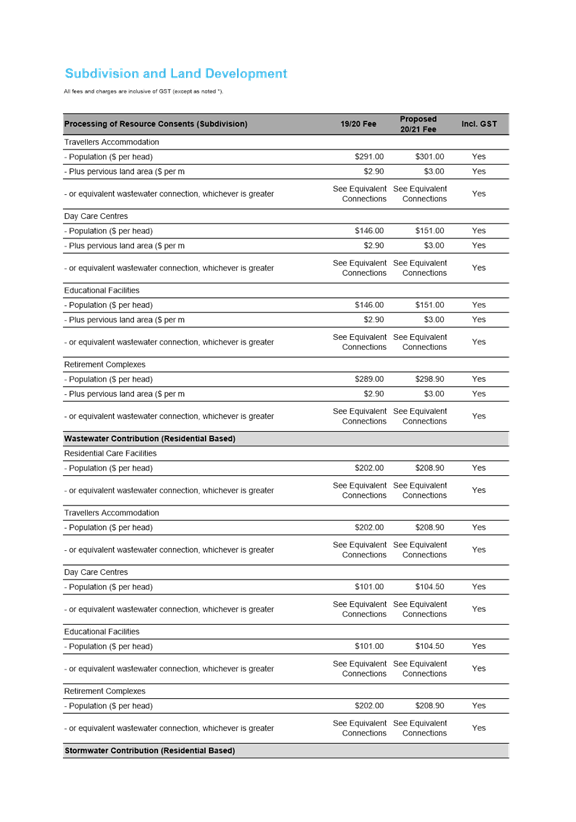

Table A: Financial Impacts by Quarter as a result of Covid19 on 20/21

The table below summarises the impacts to revenue and expenditure for 2020/21 by Quarter as a result of Covid19. This information aligns with the assumptions provided in Table E in this report.

The purpose of this report is to provide details of the financial impacts on 20/21 together with a shortlist of options to fund the operating deficit. The shortlisted options are:

|

Option A – revised Covid19 Annual Plan – 4.80% rates increase – gap funded by debt

|

This option recognises the hardship faced by the community at this time, and includes operational savings of $3.7m. It proposes to debt fund the operational shortfall of $6.74m through loans over 10 years (prudent timeframe), which will impact 21/22 rates increase by 1.35%. This option recommends any operating surplus that might be achieved in future years is utilised to offset any remaining loan be prioritised for this purpose. There continues to be major projects and ongoing pressures on rates for 2021/22, so if debt funding is used to fund the gap, this may put further increases on rates in coming years where there continues to be ongoing cost pressures to manage. Officers do not recommend this option.

|

|

Option B – revised Covid19 Annual Plan – 0% rates increase – gap funded by reserves and debt

|

At the request of Councillors and interest within the wider community, officers have reviewed the option of a zero rates increase without reducing service levels. To achieve a 0% rates increase, in addition to all the other savings, and use of reserves, Council would need to fund an additional $2.88m from either loans or reserves. The options to fund the additional gap created by a 0% rates increase:

a. Fund the Covid19 funding gap with reserves to get to 4.8% ($6.7m) and

b. Fund difference of $2.88m from loans, which would increase 21/22 rates (and the following 10 years) by 0.58%, (noting this would be a significant burden to the following years rates) or

c. b. Fund $2.88m from reserves as per Option C, however, this would leave the reserves with insufficient funding to meet anticipated future needs (eg parking buildings, and Council’s commitment to development). This would result in those projects requiring loan-funding as a consequence of spending the reserve. d. The most significant impact of moving to this option, is that the following years rates (2021/22) would need to rise by $2.88m to meet the baseline budget, which would result in a 4.8% increase, plus the loan cost of 0.58%. The full impact is a 5.36% increase for 2021/22, not including any capital project loan costs, or any other cost increase associated with that year. This does not include any other costs delayed and impacts from other decisions to reach the recommended increase of 4.8%.

This decision would not be considered financially prudent, and therefore not be consistent with Council’s Revenue and Financing Policy or Section 101 (Financial Management), and Section 100 (Balance Budget) of the Local Government Act. At a practical level it also passes a significant rates impost onto future ratepayers, which is not considered prudent or sustainable.

If service reductions were to be considered by Council to achieve further cost savings this could translate directly to a reduction in rates. Approximately $600k savings would deliver a 1% reduction in rates. If there was a desire to reduce the rates increase to 0% this would require a service level reduction of $2.88m to achieve this. The Department of Internal Affairs and the Office of the Auditor General advice is that any significant service level reduction would require a Long Term Plan Amendment.

Officers do not recommend this option.

|

|

Option C – PREFERRED – revised Covid19 – 4.80% rates increase - gap funded by reserves

|

This option recognises the hardship faced by the community at this time, financial prudence by utilising Council reserves (Parking reserve $4m, and Suburban and Urban Growth Fund $2.74m), including operational savings of $3.7m.

This option provides a pragmatic balance between managing the pressures on current ratepayers and ensuring the Council remains financially sustainable into the future, whereby the actions of today do not impact unfairly on ratepayers in the future. The reserve funding proposed is for a specific purpose, in funding the one-off shortfall in operating revenue anticipated in 2020/21. While this does not meet the S100 (i) balanced budget provision of the Local Government Act, it can be resolved that it is financially prudent due to the one-off nature.

Council operate two types of reserves, Council Created Reserves and Council Restricted Reserves. The purpose of Council Created Reserves is set out and adopted by Council, however, with a Council resolution, a change can be made to how these funds are utilised. Council Restricted Reserves tend to have a legal restriction on how the funds can be received and spent.

For the purposes of funding a one year only gap anticipated as a result of Covid19, there are two reserves that could have a change to the use, and made available to fund the anticipated shortfall for 2020/21. This is the Parking Account Reserve ($5m) and the Subdivision & Urban Growth Fund ($2.6m). The recommendation would mean that both funds will have a $5m balance, allowing their short to medium requirements to be met without financial consequences to the community

It is recommended that the proposal to utilise the parking reserve and urban/suburban growth funds to partially offset the rates increase is included as part of the Annual Plan 20/21 consultation.

|

Summary of the Options:

|

Potential 202/21 Annual Plan |

Option A |

Option B |

Option C |

|

Rates increase 20/21 |

4.8% - debt |

0% rates increase – debt/reserves |

4.8% - reserves |

|

No reduction in service levels |

√ |

√ |

√ |

|

Debt fund shortfall in revenue reducing the impact on ratepayers 20/21 |

√ |

√ |

X |

|

Unlikely to require an LTP amendment |

X |

X |

X |

|

Require amendment to Revenue and Finance Policy |

X |

X |

X |

|

Likely to meet the financial prudence test |

√ |

X |

√ |

|

Meets balanced budget requirement |

X-√* |

X-√ |

X-√ |

|

Recommended by officers |

X |

X |

√ |

· X-√ - balanced budget i.e. income would be met by expenditure, however, debt funding is not considered sustainable and should only be considered a short term option

Other financial options considered and discounted by Council through workshops

Council considered two other options, but these options were not considered appropriate to be taken further. These included:

· Consideration continuing original Annual Plan increase of 6.5%, and funding the Covid19 impacts through the use of reserves. This was discounted as an option due to the hardship being faced by the community at this time and Council recognising that they should aim to bring the cost down as far as reasonably practicable through reducing rates in addition to the rates and recovery package.

· Recognising the full impact of Covid19 to Council that was anticipated across the full year, based on the assumptions noted in this paper in Table E. This option required a 16% average rates increase, and was quickly discounted as a viable option, given the issues being faced by the community, hardship and the pressure to keep rates as low as possible at this time.

Depreciation

Council officers considered whether not funding depreciation for a year was an option. Reducing depreciation funding at a time when the city has an expectation of increased funding of infrastructure, is not necessarily recommended. Removing depreciation in the short term would result in further costs being required to be put onto future year’s ratepayers. Napier has a strong history of funding depreciation prudently including revaluations. It notes that the revaluation process undertaken in 2019, resulted in an increase of 4% to cover the additional depreciation requirements associated with the revaluation. Council prudently cut costs to ensure that this did not further increase this year’s rates requirement. If not offset, Council would have been seeking an original budget increase of 10.5% (6.5% baseline increase + 4% revaluation depreciation costs). Not funding depreciation is also inconsistent with Council’s Revenue and Financing Policy and the balanced budget requirement in Section 100 of the Local Government Act. The policy could be amended through undertaking consultation and would likely require audit sign-off but not require a Long Term Plan amendment.

If Council chose not to fund this increase it would need to substantiate why it thought it was prudent not to do so. Not funding the increased depreciation by 10% would increase rates in future years by 0.65% for every year for the next 10 years.

For this reason, Council officers do not recommend this as an option.

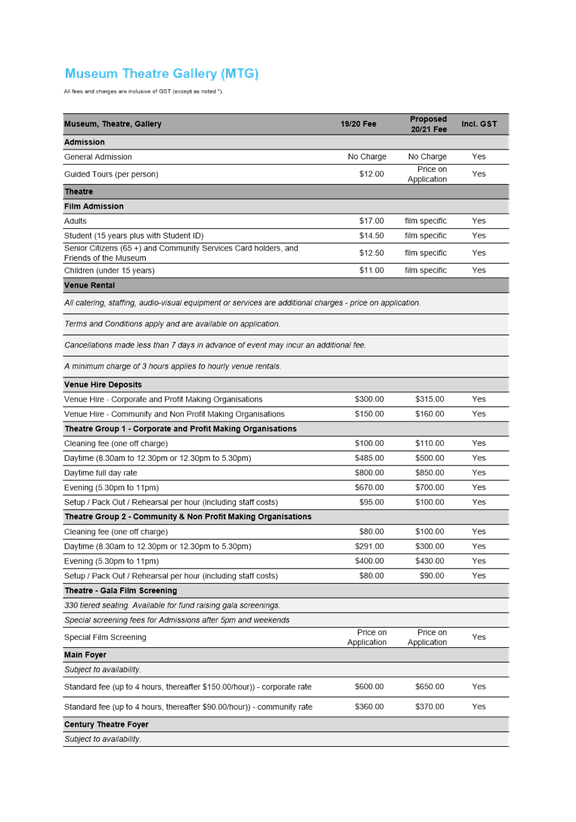

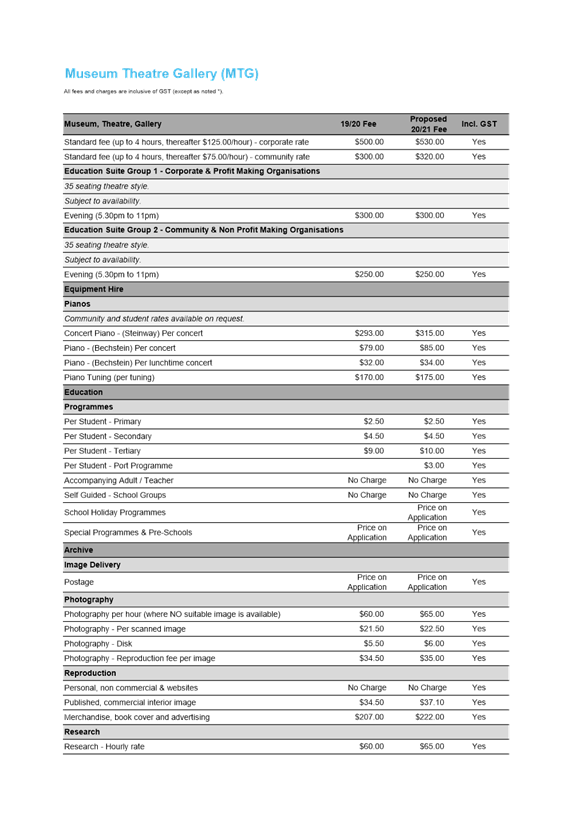

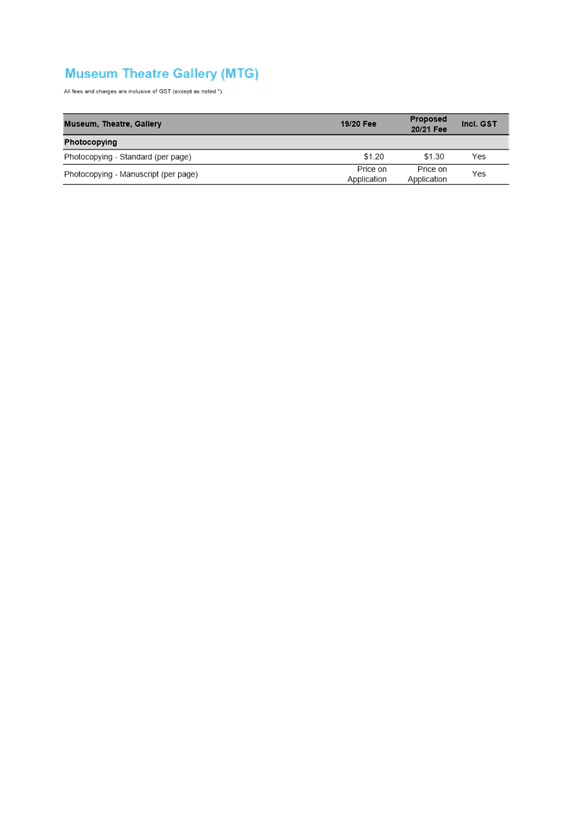

Revenue

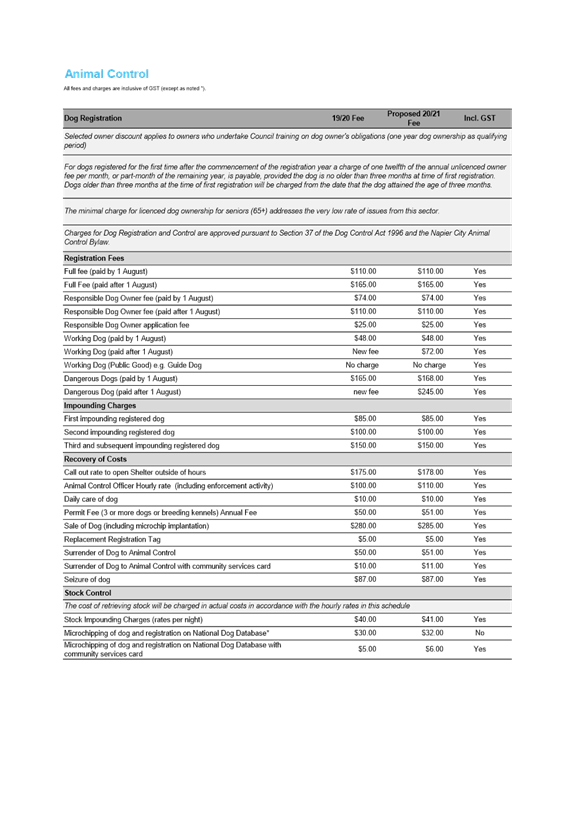

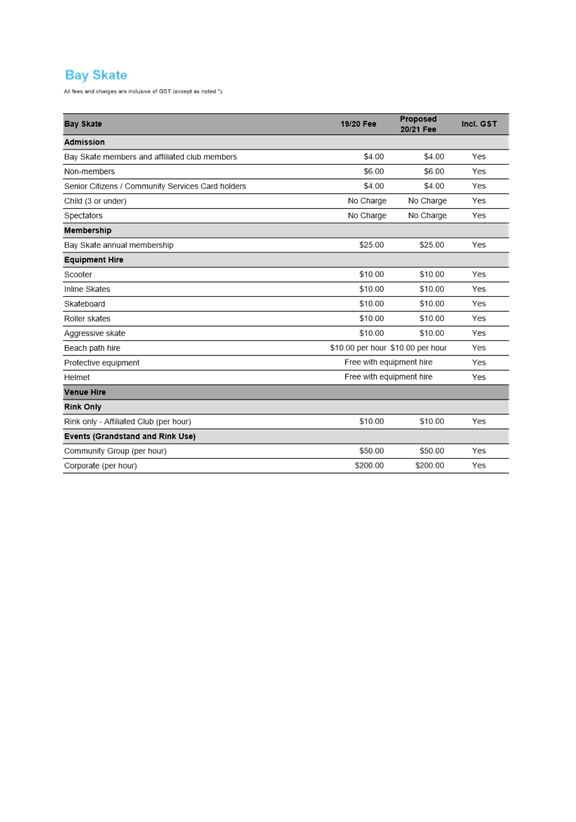

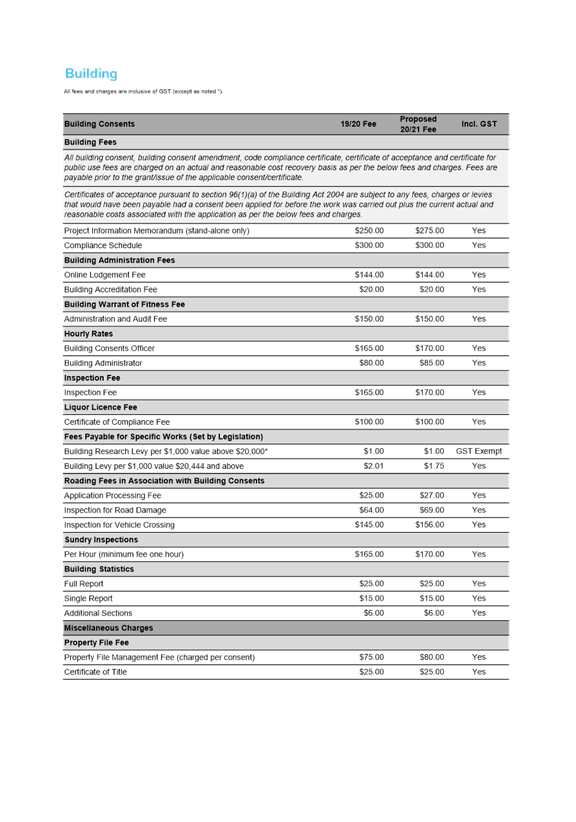

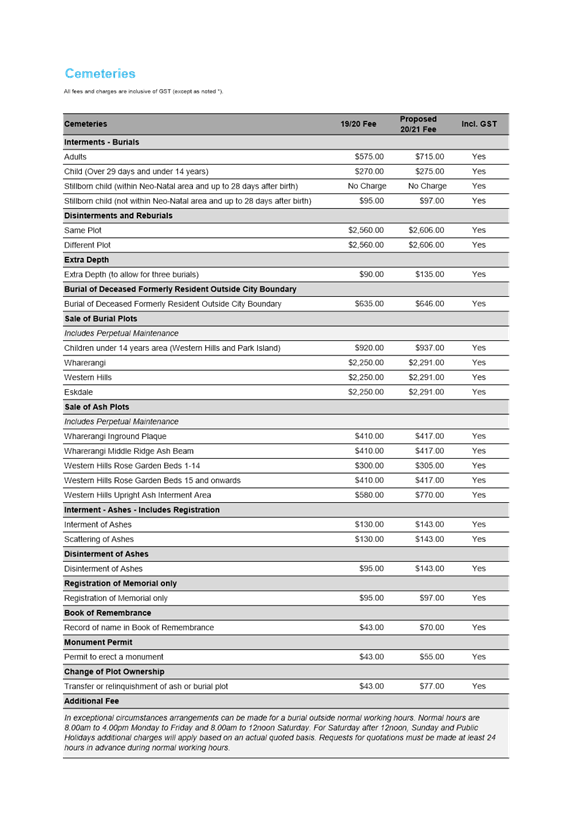

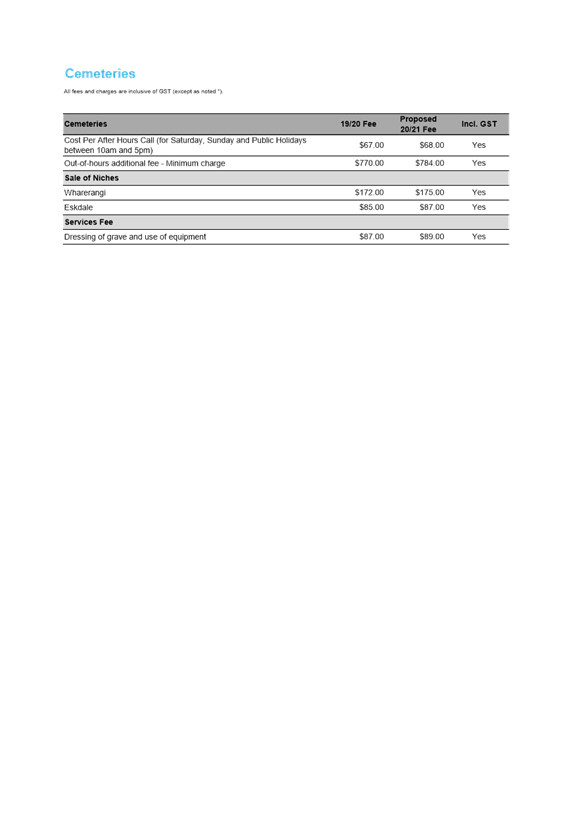

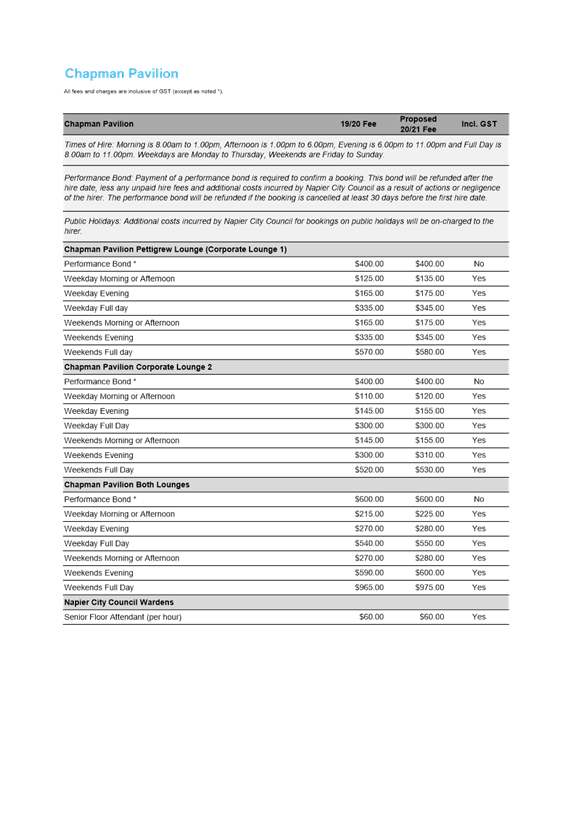

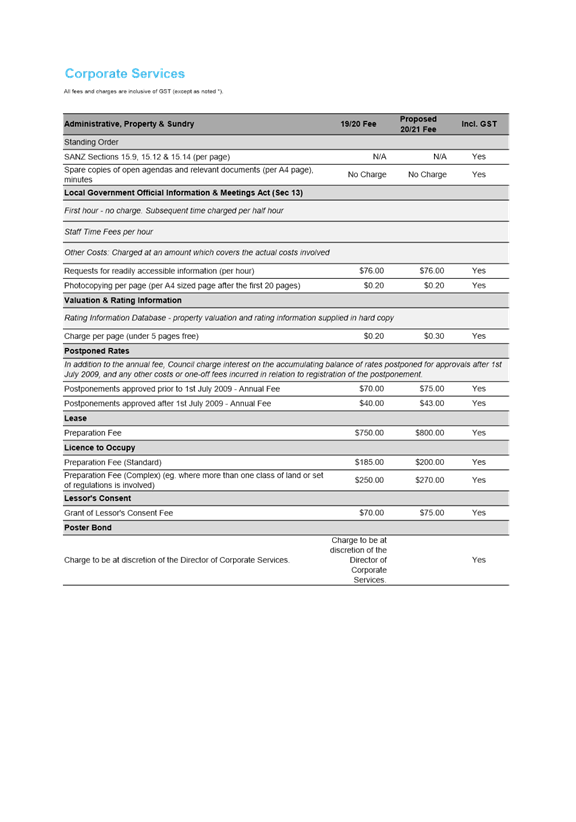

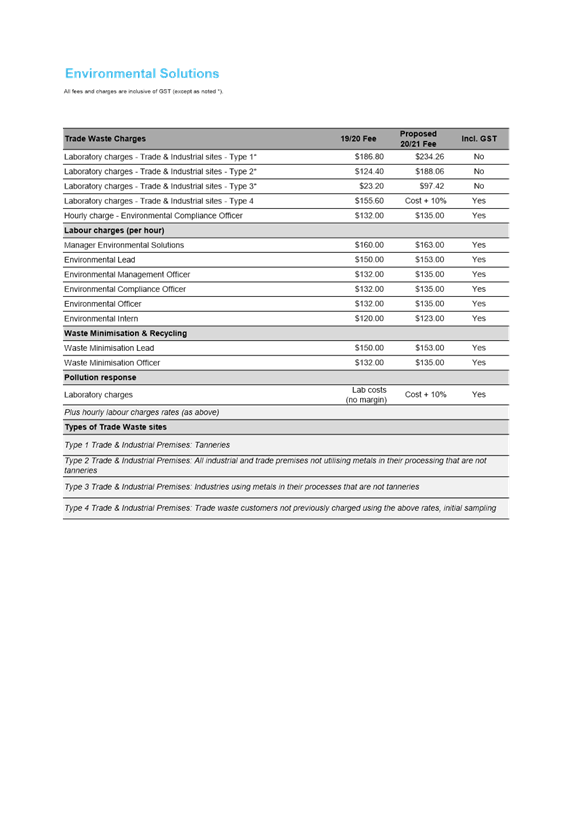

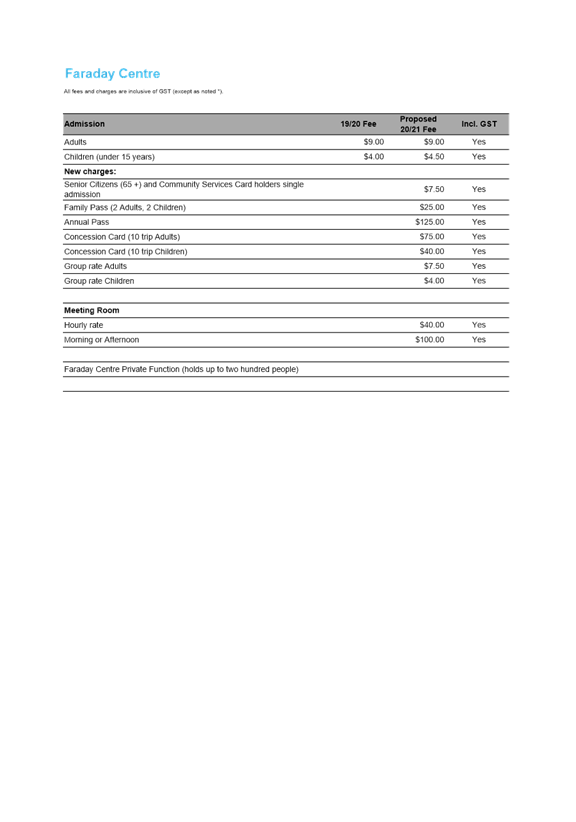

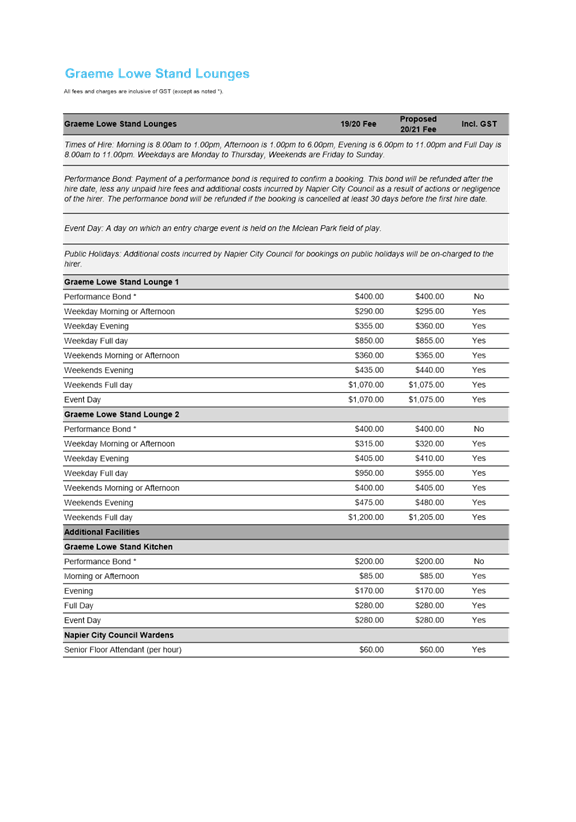

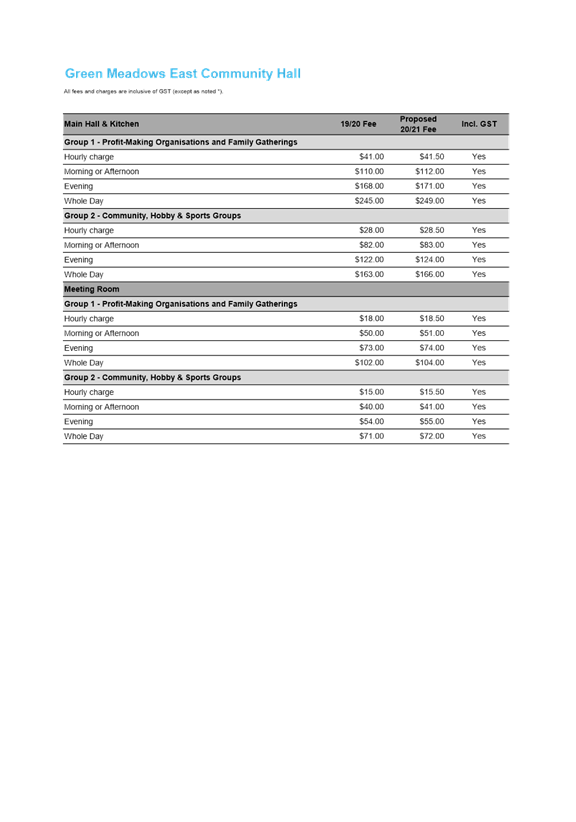

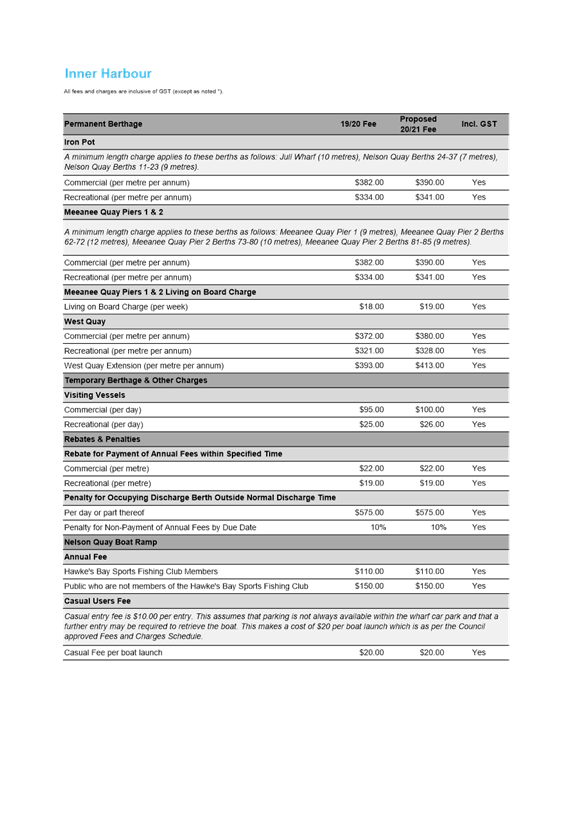

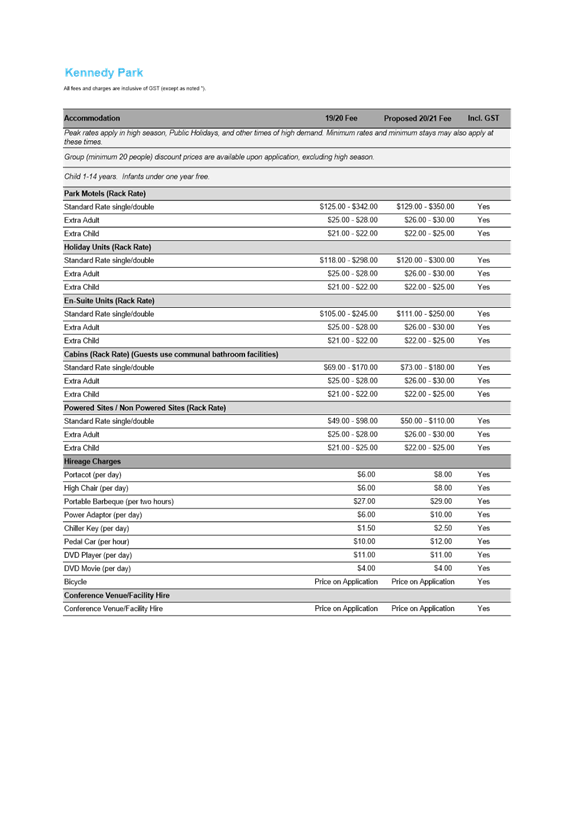

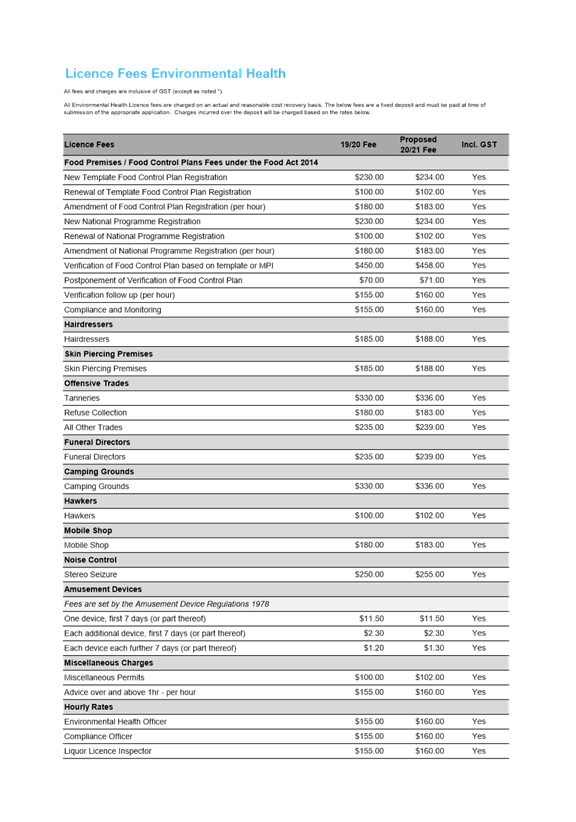

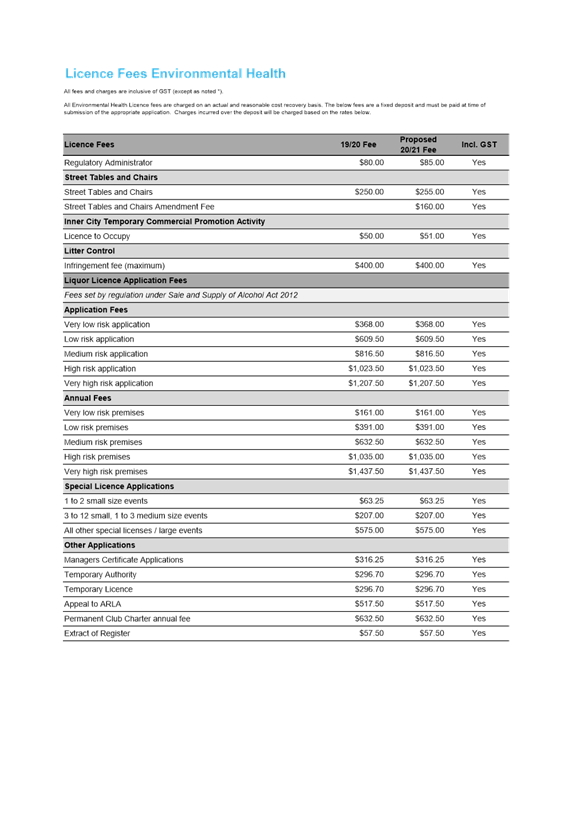

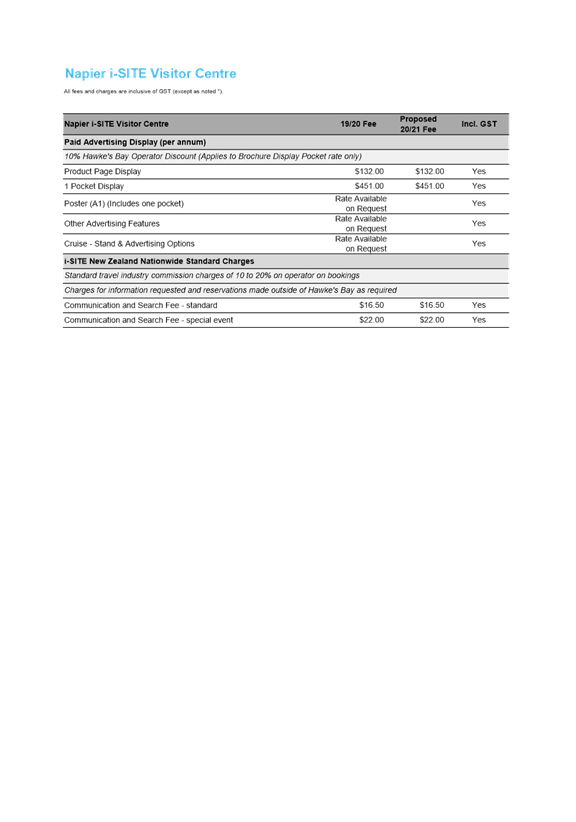

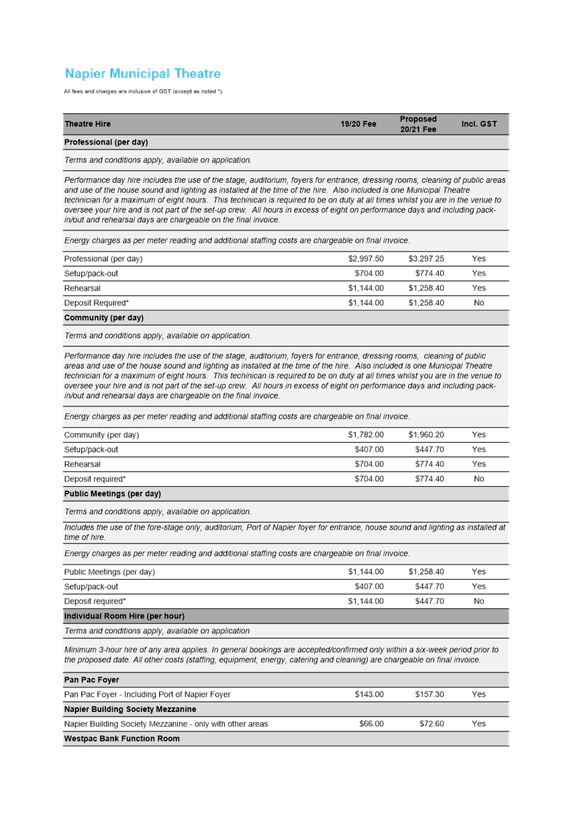

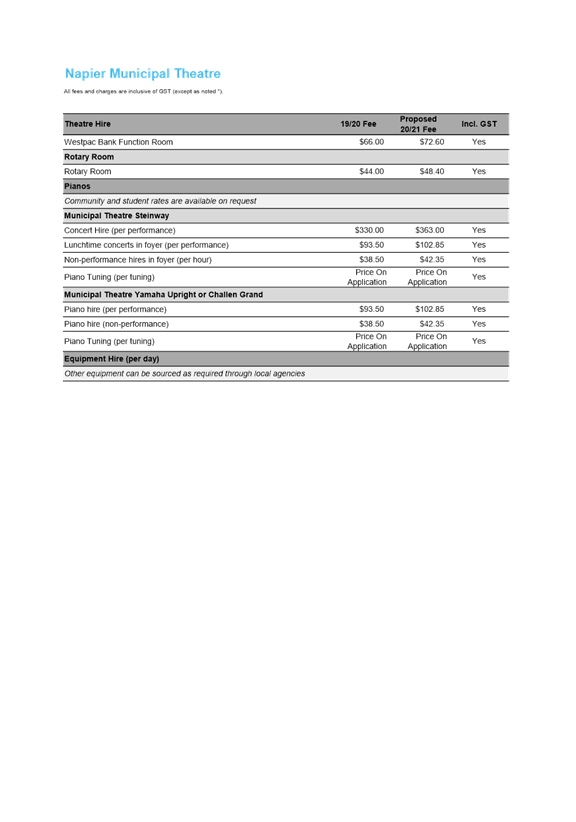

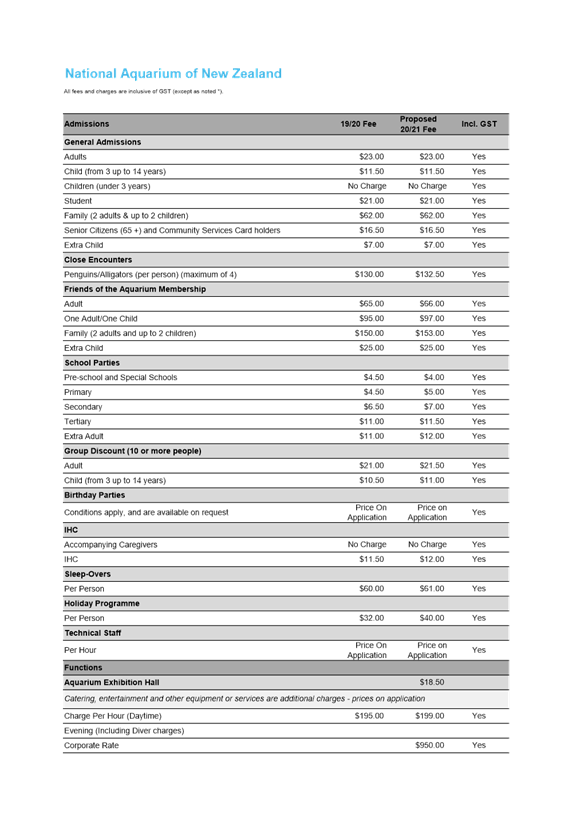

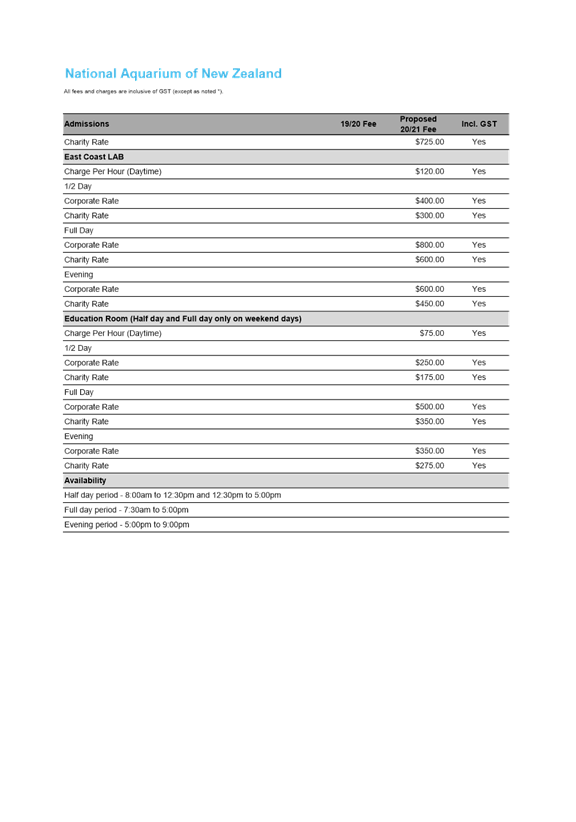

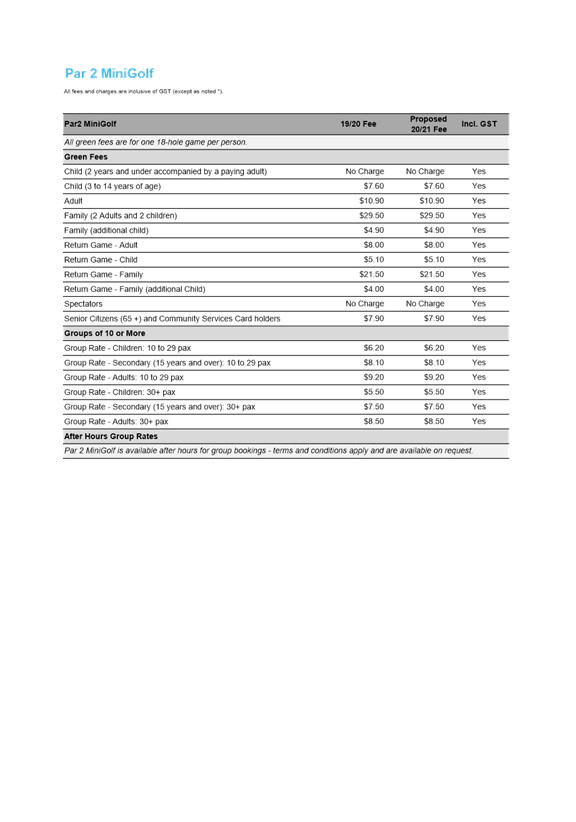

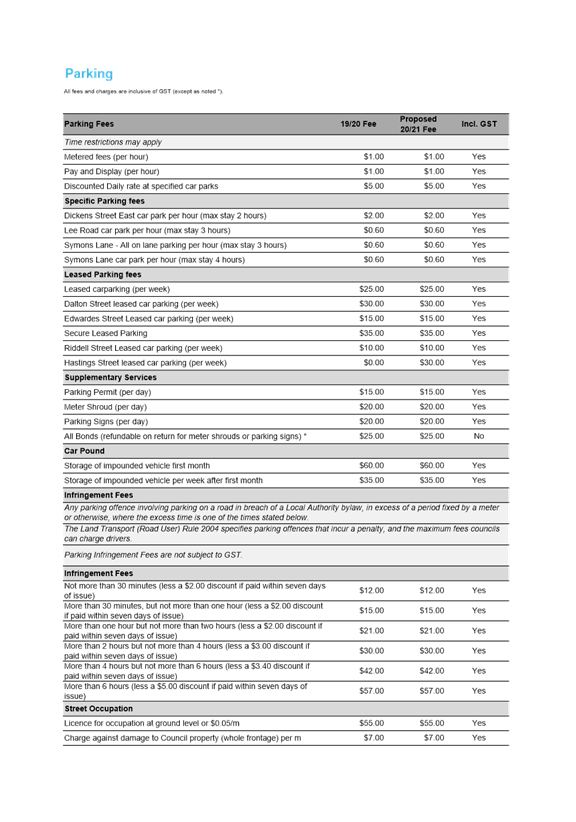

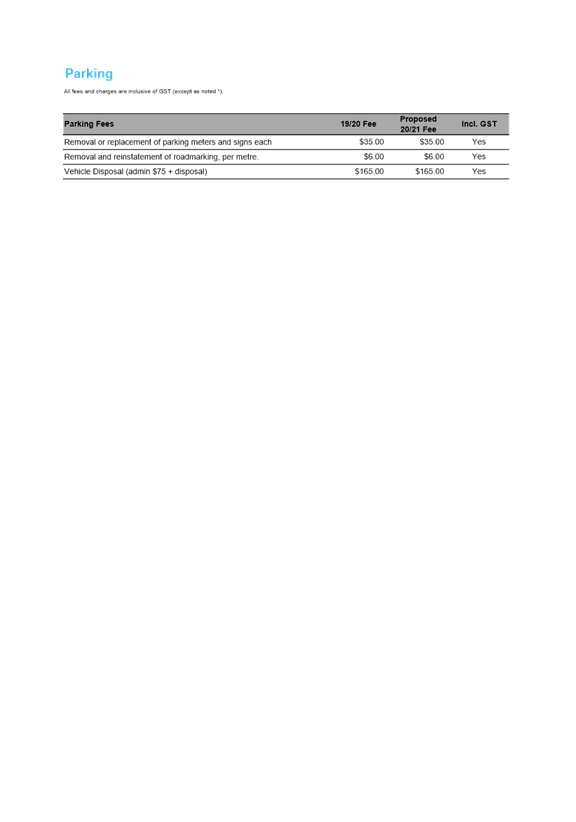

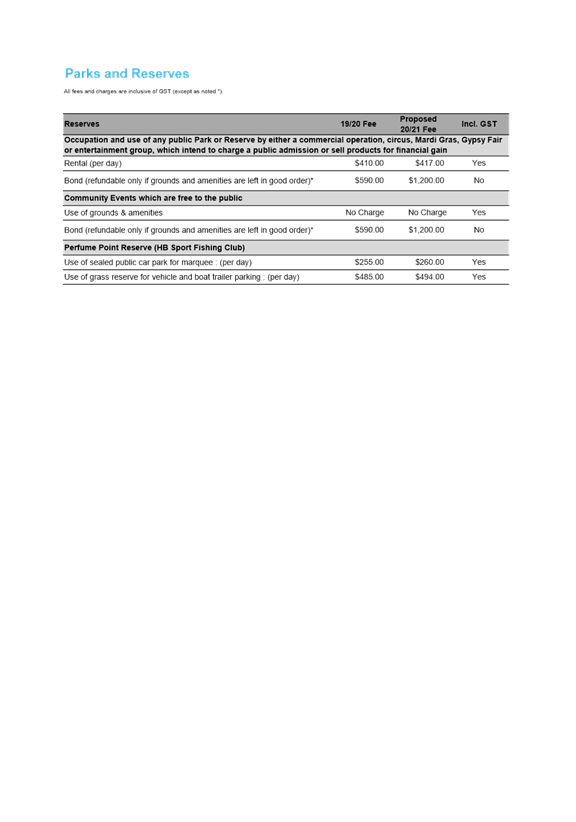

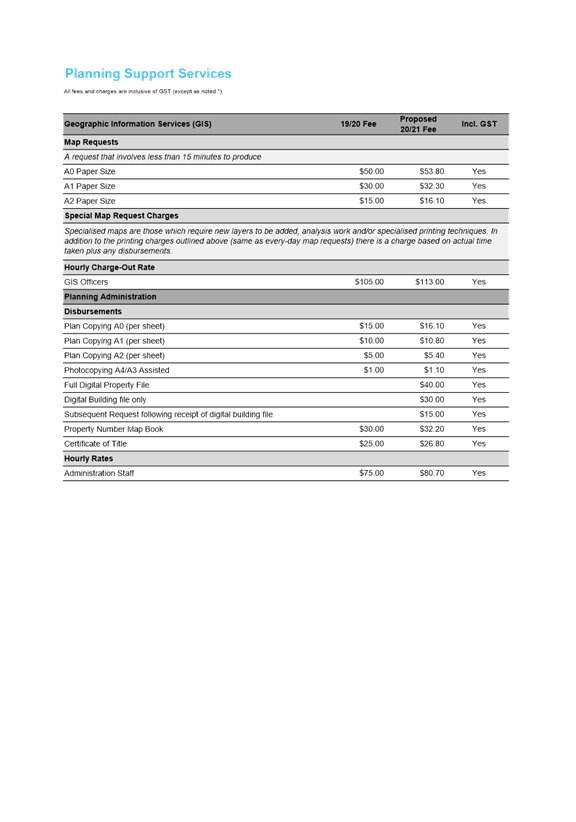

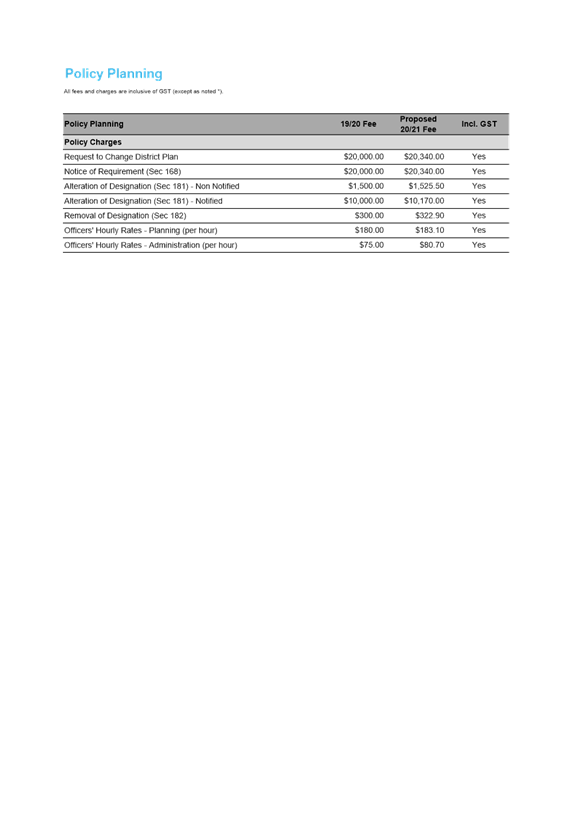

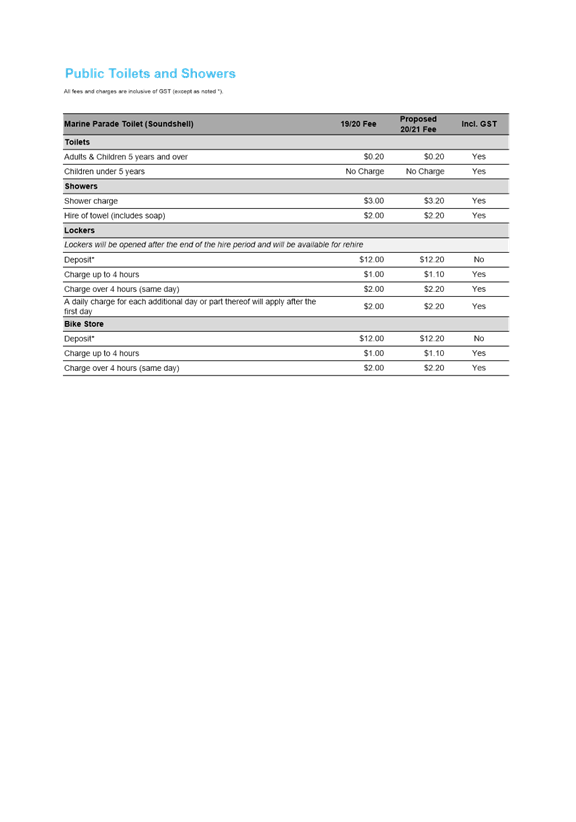

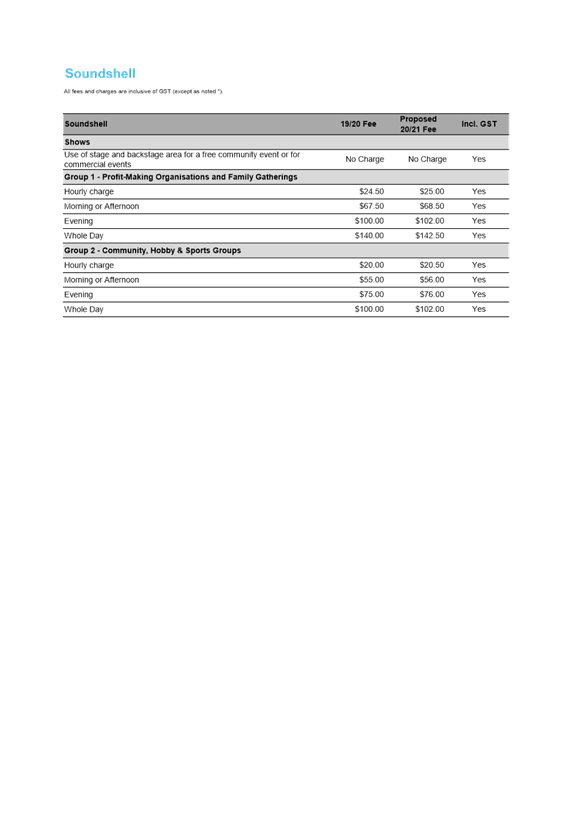

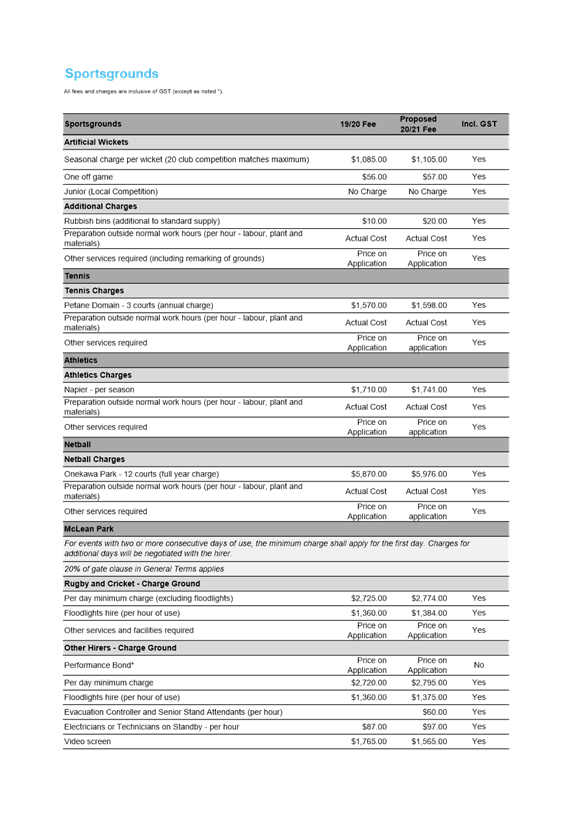

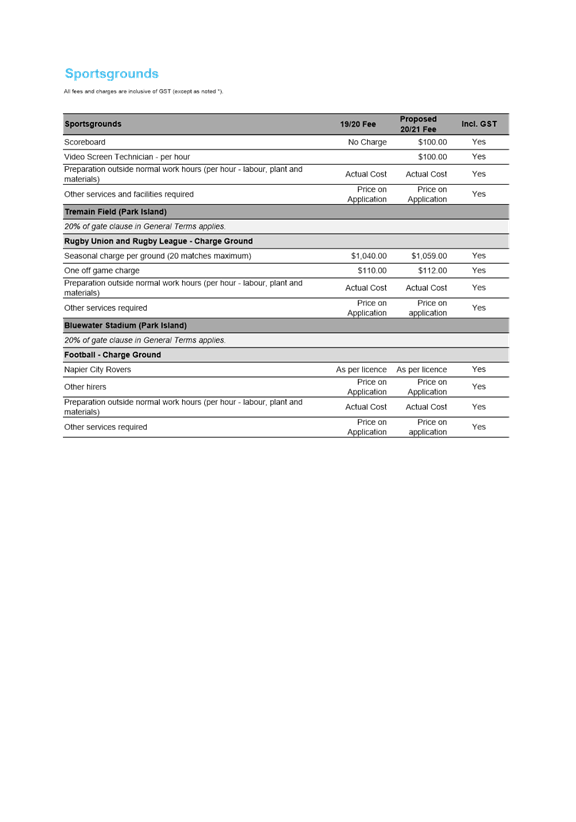

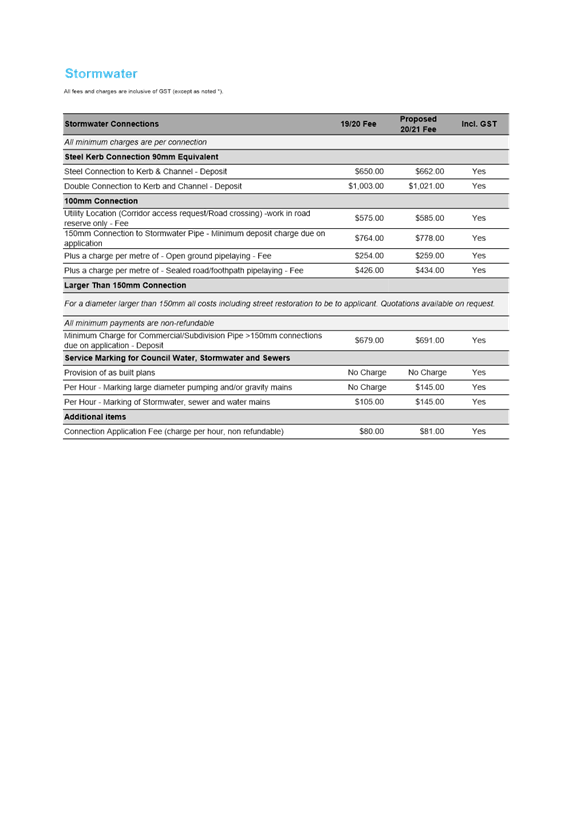

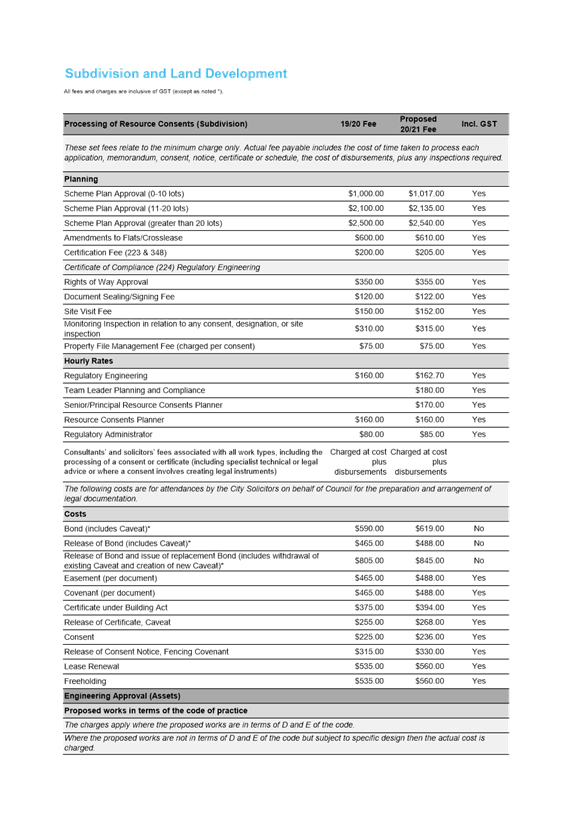

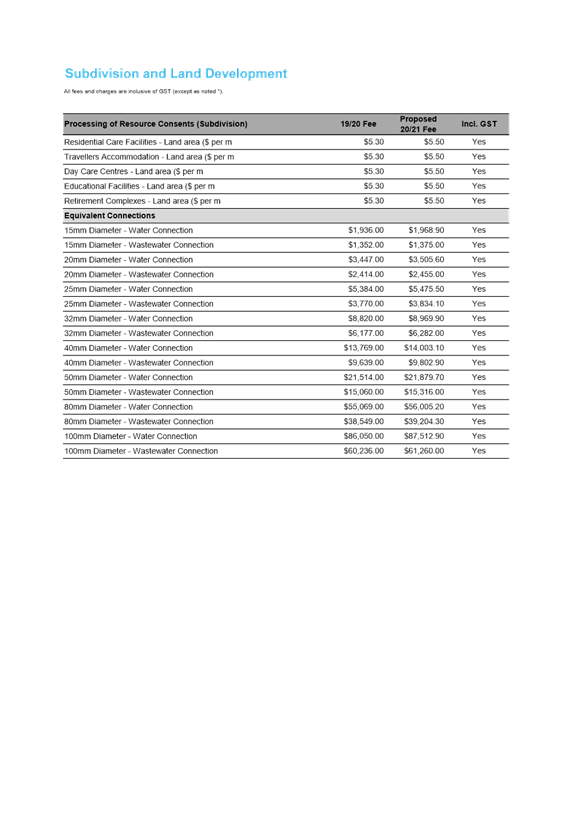

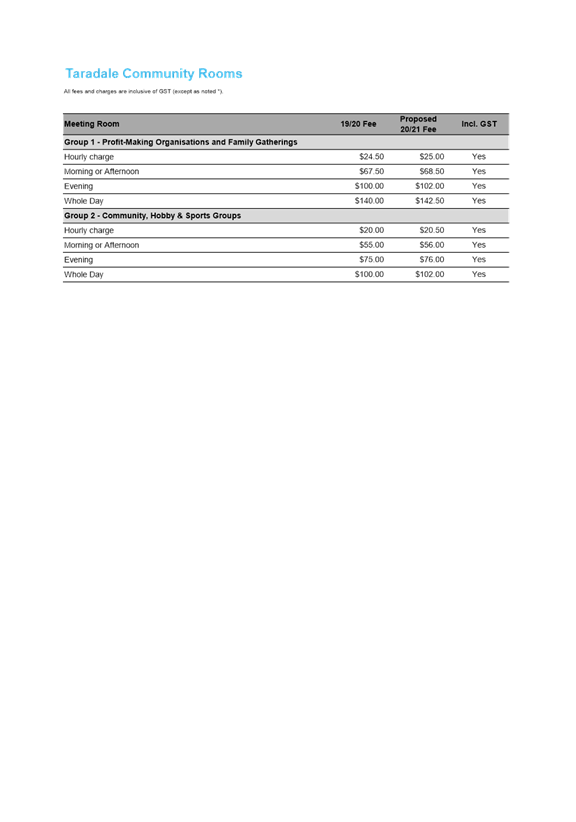

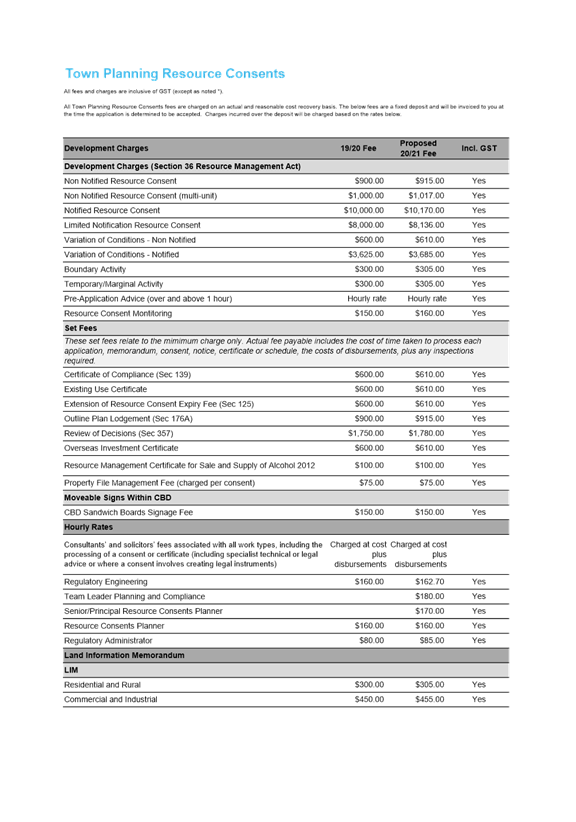

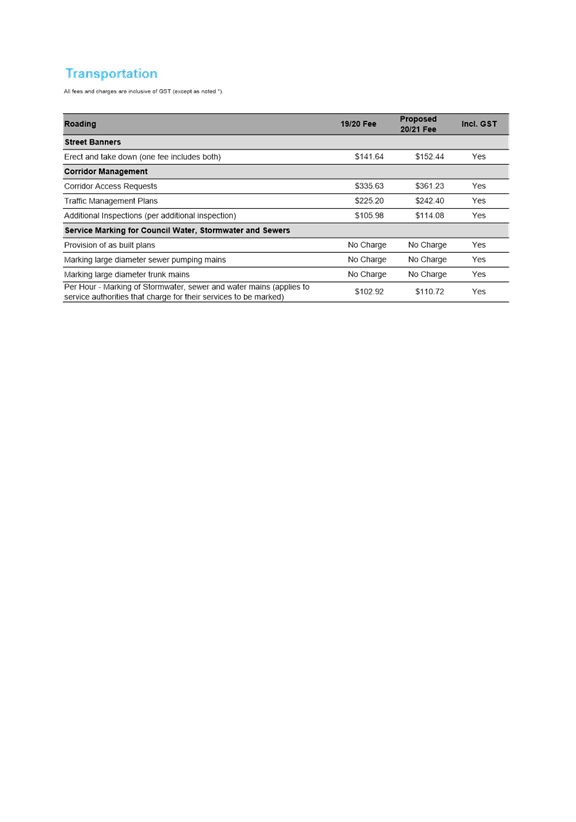

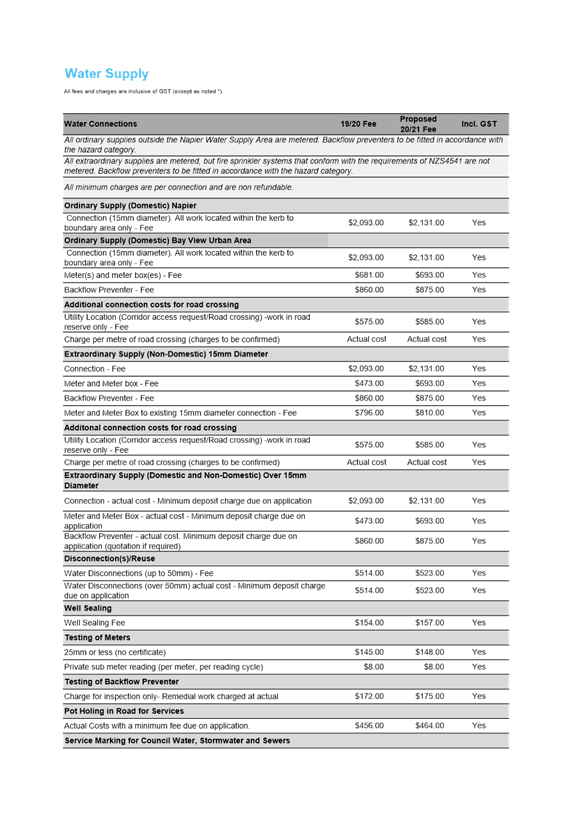

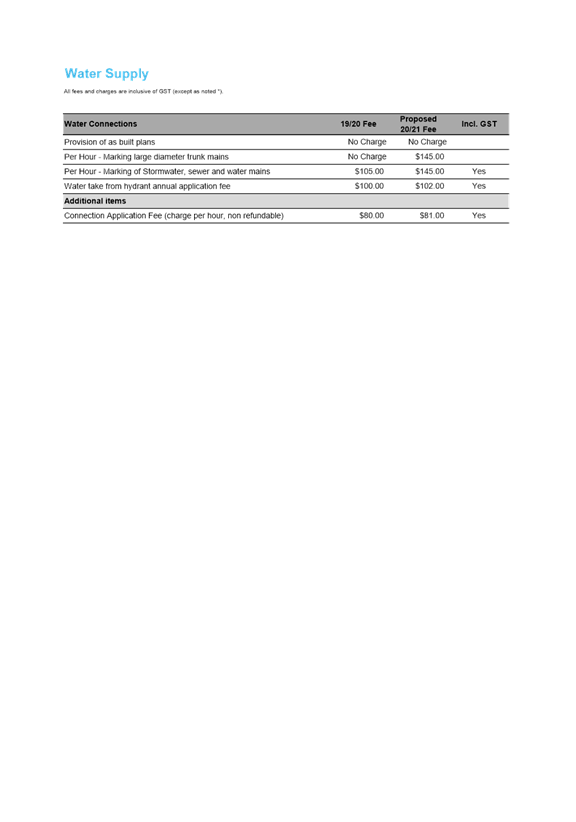

It is noted that revenue is being forecast down by $5.3m for the remainder of the 2019/20 year and $7.5m for 2020/21. Fees and charges increases that were originally proposed and adopted by Council were related to increases that were intended to achieve better compliance with the Revenue and Financing Policy, offsetting the impact the forecasted cost increases would have on rates. Council officers recommend continuing with the proposed fees and charges increases for all areas other than Council’s Tourism related activities including Aquarium, Conference Centre, Kennedy Park, Par 2, and The Municipal Theatre, Bay Skate and I-Site. This ensures that no further burden is put onto rates to offset the shortfall in revenue and its non-compliance to Policy.

The dividend the Council originally expected to receive from its shareholding in Hawke’s Bay Airport is at risk. The dividend was originally expected to offset the Council rates requirement in 2020/21 and would have resulted in a 0.86% rates offset, however we have factored in this income risk in the revised Annual Plan.

Operating expenditure

There are some minor cost reductions that have occurred directly as a result of the Covid19 shutdown. These include reduction in energy costs and some operating expenses in our facilities, however Council continues to incur the majority of its operating costs that maintain services in the city.

Council is responsible for coordinating, supporting and hosting events in the community. To date only a council support event, the Big Easy has been cancelled as a result of Covid19, with delays being signalled to other events. Council are set to review the planned expenditure on events for 2020/21, and will continue to focus on this as a basis for bringing people to Napier, who will in turn spend in our local economy and to generate economic outcomes. Grants that Council provides to support community arts, cultural organisations will still be required to sustain these organisations. Where some grants will be available, they may be repurposed to the welfare, and wellbeing response for the Community. This will help pay for a range of initiatives being developed as part of the Recovery Plan.

Capital expenditure

Prior to Covid19, the Council was forecasting approximately $53m of capital expenditure (excluding vested assets) that was originally planned for 2019/20. This forecast will need to be reviewed as a result of the lockdown and the ability of services to continue operating and the ability to deliver project requirements during that time. There is already a significant capital programme planned for 20/21 of $70m. Officers will be recommending Council carry forward any unspent budget from the current year, and once supply chain, and demand for infrastructure services are better known, then reforecasting of the capital plan can be updated via the Revised Annual Plan 20/21. Any change in timing associated with loan-funded projects will impact the following year’s rates.

The government recognises its role in the response to the national crisis and have sought interest in government funding for shovel ready projects. Napier have submitted applications to the Government infrastructure funds for shovel-ready projects, and regionally its three waters capital programme. If successful, both would have a positive impact on future year’s rates requirements.

Cost cutting and levels of service

Council could attempt to make further cuts to operating expenditure budgets; but given the budget already includes significant savings ($3.7m) and unbudgeted risks, this would inevitably need to result in significant service level reductions. Level of service cuts are only recommended to be undertaken when a full and clear understanding on the medium to long term impacts of Covid19 have been fully understood. As we head into the Recovery phase, and more information is available, then Council will be better informed on any required next steps.

This information is key, as determining what services to cut is likely to be extremely challenging in the current environment – amidst an expectation that Council should be upping support to its community and investing in infrastructure to aide recovery, rather than reducing it. Adding to this is the likelihood that dependant on what the service is, cuts to services levels often take quite some time to initiate, and to achieve this would be the likely extend to include potential contract settlements and even potential redundancy costs – meaning the savings may not be evident immediately. Again, noting that we do not have enough information to determine the longer term implications from Covid19, a considered approach is recommended before significant change are potentially made. In the event that Council may wish to consider this now by changing significantly the levels of service, they are advised that this process would trigger an LTP amendment which would delay further the timeline. This delay may then adversely impact the ability to get on with urgent works planned for the year 2020/21 such as the outfall and the water clarity projects of community importance and regulatory driven.

If service reductions were to be considered by Council to achieve further cost savings this could translate directly to a reduction in rates. Approximately $600k savings would deliver a 1% reduction in rates. If there was a desire to reduce the rates increase to 0%, this would require a service level reduction of $2.88m to achieve this. The Department of Internal Affairs and the Office of the Auditor General advice is that any service level reduction would require a Long Term Plan Amendment.

Financial Consideration and impacts on future years

The table below summarises the impact based on a range of average rates increase of 4.8% for a year, month and per week. Our average residential rates for 2019/20 is approximately $2,239, so this will mean a rates increase of approximately $107 per year or $2.06 per week.

Table B: Average increase per year/month/week for 4.8% increase

|

Increase |

Average Rates 2019/20 |

Rates 2020/21 |

|

Increase per year |

Increase per month |

Increase per week |

|

4.8% |

1,500 |

1,572 |

|

72 |

6 |

1.38 |

|

4.8% |

2,000 |

2,096 |

|

96 |

8 |

1.85 |

|

4.8% |

2,500 |

2,620 |

|

120 |

10 |

2.31 |

|

4.8% |

3,000 |

3,144 |

|

144 |

12 |

2.77 |

|

4.8% |

3,500 |

3,668 |

|

168 |

14 |

3.23 |

|

4.8% |

4,000 |

4,192 |

|

192 |

16 |

3.69 |

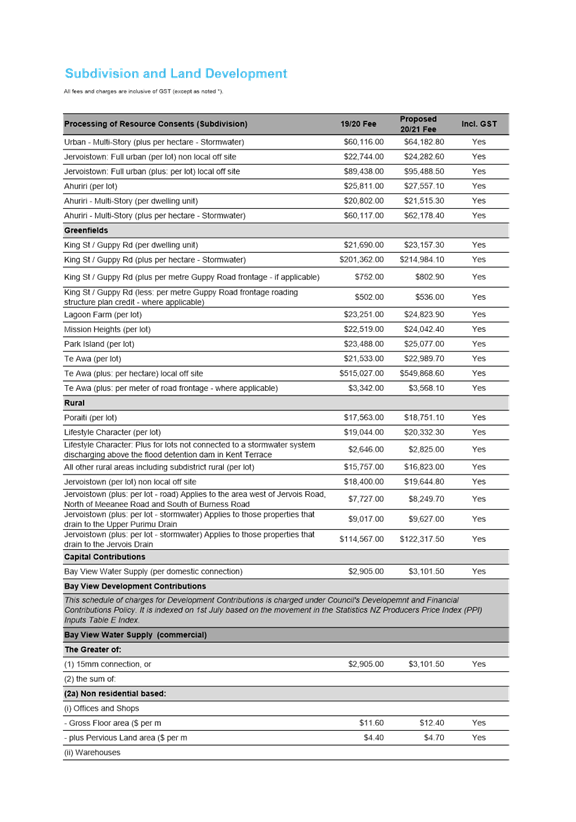

The table below summarises the components considered in the development of the rates increase for 2020/21:

Table D: Reconciliation of Rates increase requirements

|

Rates increase |

Comment |

|

|

Original Annual Plan rates increase |

6.50% |

Key cost drivers for original Annual Plan rates increase: Refuse 1.3%, Recycling 0.5%, Insurance 0.7% and Loan servicing 1.0% |

|

Review of Covid19 impacts to business activities |

9.50% |

Forecast loss of tourism revenue streams and lack of ability to respond without ceasing or reducing levels of service which requires consultation (savings included before increase) |

|

Subtotal |

16.00% |

Total based on two lines above. |

|

RELIEF PACKAGE – Rates relief and penalties and postponement |

1.60% |

Rates relief $350k, Rates penalties $88k, Postponement $525k |

|

Reserve funding of Tourism/Penalties/Rates postponement/Airport income/Rates relief |

(10.91%) |

$6.74m ($2.74m Suburban and Urban Growth Fund + $4m Parking Reserve)** |

|

Additional Cost savings through operational savings |

(2.75%) |

One year only cost savings to offset rates |

|

Loss of Dividend Income |

0.86% |

|

|

Proposed average rates increase 20/21 |

4.80% |

Social & Policy

Council are required to meet its obligations under the Local Government Act 2002, its Significance and Engagement Policy, and Revenue and Finance Policy, Liability Management, Investment Policy, Rates Postponement, Rates Remissions in relation to the preparation of the Annual Plan.

Risk

There is a high level of risk associated with uncertainty in relation to the development of the Annual Plan 20/21. There has been widespread job losses in New Zealand with some forecasts signalling unemployment levels between 13- 26% being noted in some Government modelling. We do not know how and what industries will be come through the pandemic without some potential change or risk to the way current business operates.

Supply chains dependent on overseas products will have been impacted to some degree, and we are yet to understand what this means to our capital programme.

There is strong interest from the Government to provide funding to reinvigorate the economy by spending, however, this may also result negatively with higher demand for services in certain industries and the consequential increase in prices.

At the time of writing this report, we are uncertain on how long our various Alert levels will remain in place, and the consequential impact that this will have on the activities of Council. Essential services of Council will continue to operate through the lockdown.

The financial risk for the funding gap of $6.74m is considered high with the level of uncertainty that we have for our activities (assumptions outlined in table below). In the event that the funding gap at the end of the financial year was worse than anticipated, Council would need to review options for any additional requirements at that time, including the need to seek loan funding. In contrast, if the funding gap was better than anticipated, less reserve funding would be required, resulting in funding being available for alternative projects. To mitigate this risk, there will be a strong focus on the financial performance of the organisation during the year and more regular reporting to Council will be undertaken to ensure that tight financial controls are in place to manage this.

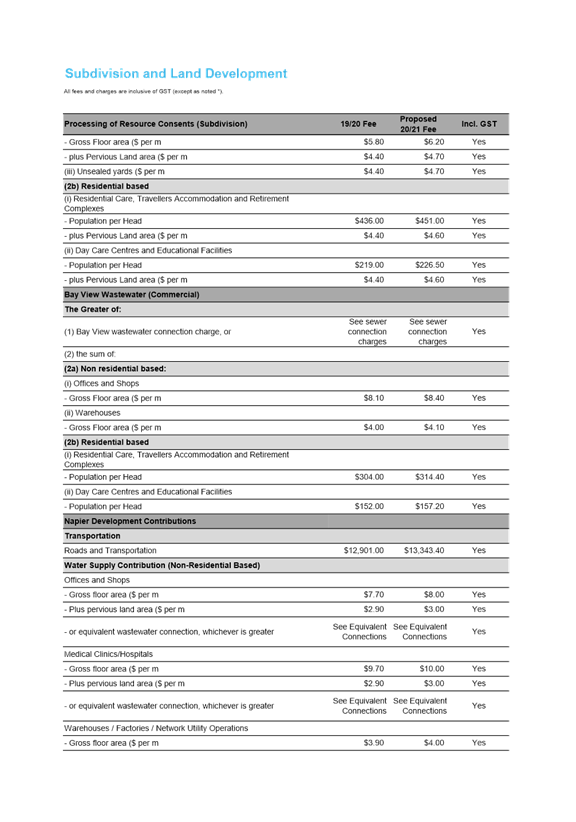

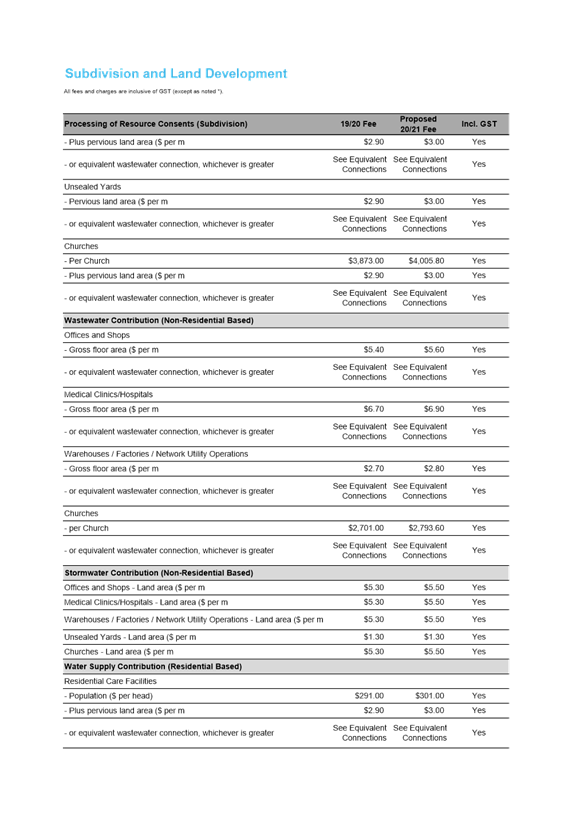

Below is a table of the assumptions used for the revised Covid19 Annual Plan. There is risk associated with each of the assumptions and these will impact on our ability to deliver the Annual Plan as a result.

Table E: Revised Covid19 Annual Plan Budget assumptions

|

CC |

Percentage Normal Business |

Qtr 01 |

Qtr 02 |

Qtr 03 |

Qtr 04 |

Description - Reasoning |

|

180 |

Sportsgrounds |

0% |

60% |

100% |

100% |

The winter season of 2020 will generate low if any revenue. This will follow on by a slow uptake in spring Q2 from which the seasons will follow as normal. |

|

185 |

McLean Park |

0% |

20% |

40% |

60% |

The impact on Mc Lean Park is substantial with the community avoiding crowded spaces, followed by travel restrictions imposed for both local and international events. Expect no action in Q1 2020/21 followed by a slow recovery of 20% per quarter. The corporate box sales will also lag behind following a similar trend. The anticipation is that McLean Park will reach 30% of its predicted revenue in FY 2020/21. |

|

240 |

Bay Skate |

75% |

85% |

100% |

100% |

We anticipate that Bay Skate will pick up rather rapidly with sales reaching 100% of the predicted quarterly revenue by Q3. The delayed uptake in Q1 and Q2 will be largely driven by self-imposed social distancing. |

|

380 |

Libraries |

0% |

20% |

50% |

80% |

The library will pick up slowly in Q1 and Q2 and slowly recover to the norm to the end of the year. As books are physically handled by the reader there will be a rationale that they will be avoided for a longer time. |

|

400 |

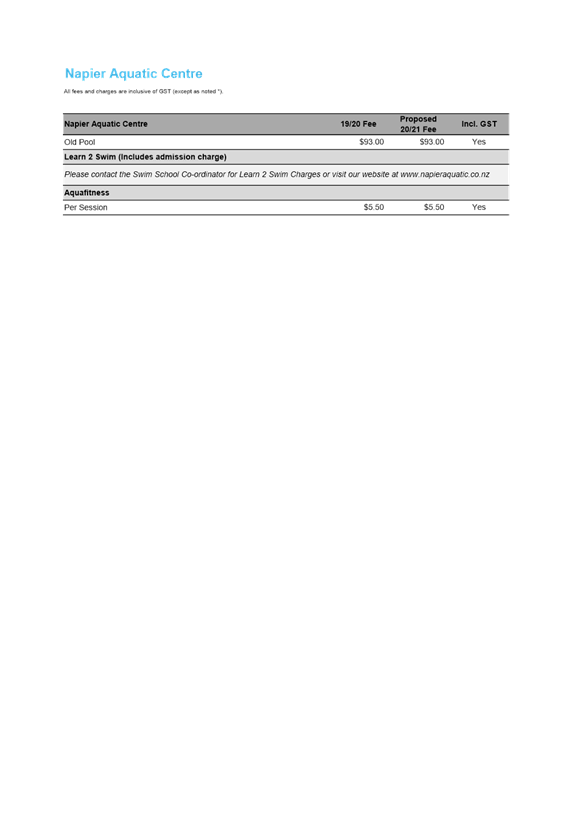

Napier Aquatic Centre |

65% |

75% |

100% |

100% |

The Aquatic centre will pick up roughly where budgeted with a delay in Q1 and Q2 due to level 3 requirements around social distancing. |

|

450 |

Building Consents |

85% |

90% |

95% |

90% |

Building consents will have a slow start due to the financial restrictions imposed by the lack of income during self-isolation period. The anticipation however is that this will pick up by Q3 as local builders, draughtsmen & building inspectors are reporting that there are a large number of projects in progress to be completed after lockdown. Building work may begin to taper off from Q4 as pre-Covid19 projects are completed & a lull emerges in the building market. |

|

465 |

National Aquarium of NZ |

65% |

75% |

80% |

85% |

The Aquarium will follow a similar trend of recovery with the exception that we anticipate that we will lose 10% of our revenue generated by overseas visitors. |

|

466 |

Par 2 MiniGolf |

20% |

65% |

80% |

90% |

We anticipate there will be a slow recovery as people will gain confidence in relaxing social distancing and gathering in public spaces. |

|

468 |

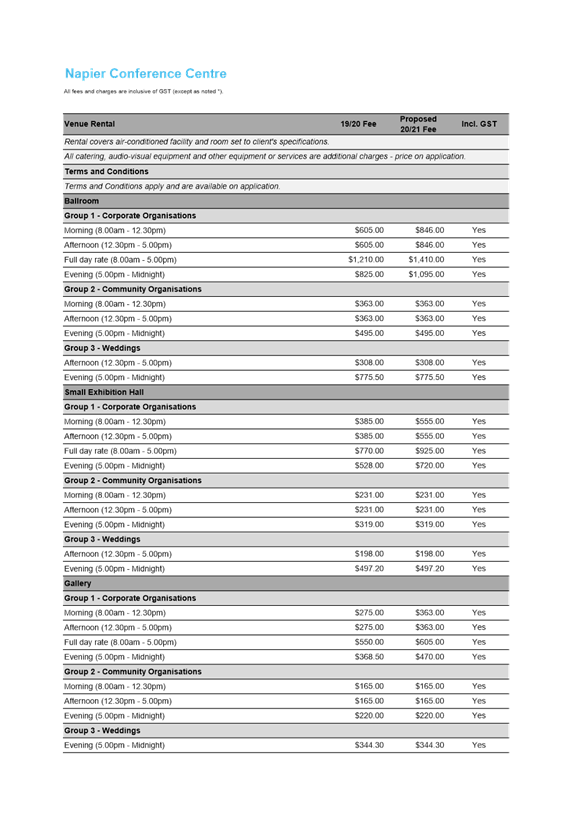

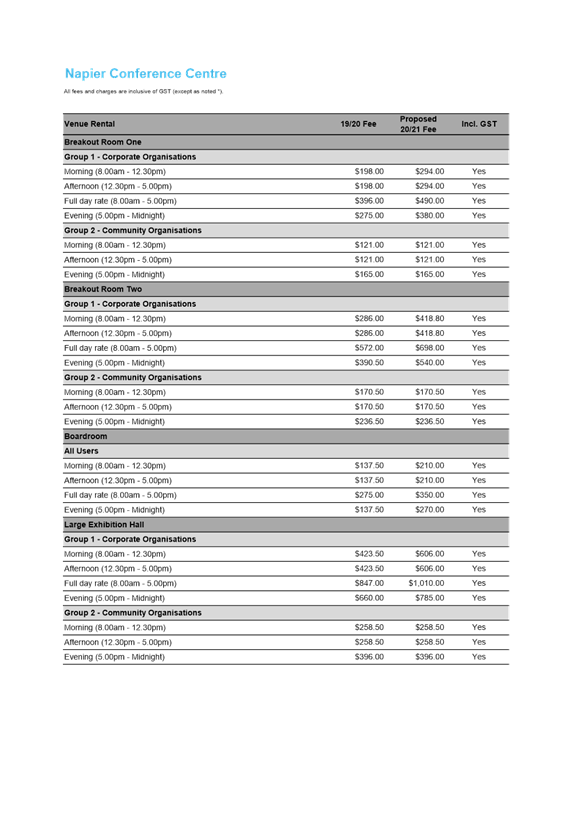

Napier Conference Centre |

10% |

40% |

70% |

85% |

The Napier Conference Centre will be hit hard until local travel is reinstated. This is anticipated to take up to 6-12 months after which activities will start returning to normal. |

|

470 |

Napier Municipal Theatre |

10% |

40% |

50% |

60% |

With the lack of international traveling acts, the restrictions on local and international travel we do not anticipate that the theatre will fully recover until late in Q3 of 2020/21. |

|

472 |

Napier i-SITE Visitor Centre |

50% |

20% |

30% |

40% |

In the past 20-30% of the i-SITE’s business came from the domestic tourist and/or locals sectors, we are anticipating that there will be solid business from these sectors |

|

478 |

Kennedy Park |

2% |

10% |

40% |

60% |

Around 87% of Kennedy Park’s customers are domestic so it is hopeful once the domestic market opens up again the business will gain traction back to normal operations in 18 months. |

|

529 |

MTG Hawke's Bay |

10% |

20% |

25% |

25% |

With MTG's main revenue driven out of tourism we expect that the revenue will not exceed 20% of the expected forecasts. |

|

560 |

Property Holdings |

95% |

95% |

100% |

100% |

Property holdings will probably be impacted in Q1 and Q2 due to entities not being able to pay their rent. The limit of this impact is due to the Government grants and subsidies. |

|

582 |

Housing - Rental |

80% |

100% |

100% |

100% |

Housing rentals will possibly incur some bad debt as the tenants attempt to recover after the lock down. With social welfare lending a hand we anticipate that this will not last past Q1. |

1.6 Options

The options available to Council are as follows:

a. Option A – revised Covid19 Annual Plan – 4.80% rates increase – gap funded by debt

b. Option B – revised Covid19 Annual Plan – 0% rates increase – gap funded reserves and debt

c. Option C – PREFERRED – revised Covid19 – 4.80% rates increase - gap funded by reserves

d. Council can amend any recommendation

1.7 Development of Preferred Option

Option C – PREFERRED – revised Covid 19 – 4.80% - $6.74m proposed funding gap from Council reserves

This option recognises the hardship faced by the community at this time, financial prudence by utilising Council reserves (Parking reserve $4m, and Suburban and Urban Growth Fund $2.74m), and operational savings of $3.7m.

This option provides a pragmatic balance between managing the pressures on current ratepayers and ensuring the Council remains financially sustainable into the future, whereby the actions of today do not impact unfairly on ratepayers in the future. The borrowing proposed is for a specific purpose, in funding the one-off shortfall in operating revenue anticipated in 2020/21. While this does not meet the section 100 (i) balanced budget provision of the Local Government Act, it can be resolved that it is financially prudent due to the one off nature.