|

Extraordinary Meeting of Council - 21 May 2020 - Attachments

|

Item 1 Attachments a |

Extraordinary Meeting of Council

Open Agenda

|

Meeting Date: |

Thursday 21 May 2020 |

|

Time: |

10.00am |

|

Venue: |

Zoom livestreamed via Facebook |

|

Council Members |

Mayor Wise, Deputy Mayor Brosnan, Councillors Boag, Browne, Chrystal, Crown, Mawson, McGrath, Price, Simpson, Tapine, Taylor, Wright |

|

Officer Responsible |

Interim Chief Executive |

|

Administrator |

Governance Team |

|

|

Next Ordinary Council Meeting Thursday 4 June 2020 |

Extraordinary Meeting of Council - 21 May 2020 - Open Agenda

ORDER OF BUSINESS

Apologies

Nil

Conflicts of interest

Public forum

Nil

Announcements by the Mayor including notification of minor matters not on the agenda

Note: re minor matters only - refer LGOIMA s46A(7A) and Standing Orders s9.13

A meeting may discuss an item that is not on the agenda only if it is a minor matter relating to the general business of the meeting and the Chairperson explains at the beginning of the public part of the meeting that the item will be discussed. However, the meeting may not make a resolution, decision or recommendation about the item, except to refer it to a subsequent meeting for further discussion.

Announcements by the management

Agenda items

1 Napier Conference Centre Renaming............................................................................. 3

2 Park Island Northern Sports Hub - Taradale Bridge Club.............................................. 15

3 Parks, Reserves and Sportsgrounds Water Conservation Strategy............................... 20

4 Rates Postponement Policy Review.............................................................................. 22

5 Rates Remission Policy Review.................................................................................... 31

6 Investment Policy Review............................................................................................. 40

7 Liability Management Policy Review............................................................................. 48

8 Statement of Proposal to join the Local Government Funding Agency.......................... 56

Minor matters discussion (if any)

Public excluded ............................................................................................................. 60

Extraordinary Meeting of Council - 21 May 2020 - Open Agenda Item 1

1. Napier Conference Centre Renaming

|

Type of Report: |

Operational |

|

Legal Reference: |

N/A |

|

Document ID: |

919760 |

|

Reporting Officer/s & Unit: |

Steve Gregory, Manager Business & Tourism |

1.1 Purpose of Report

To provide Council with background information on the history of the name and branding of the current Napier Conference Centre and to propose a name change that will respect and complement the Napier War Memorial Centre.

|

That Council: a. Approve the business activity name change from Napier Conference Centre to ‘Napier Conferences and Events’. b. Note the War Memorial working group is working to make a recommendation to Council on the memorial elements reinstatement design expected this calendar year. c. Note a management policy for the Napier War Memorial Centre will be developed to protect the site’s heritage, recognising the commemorative elements and community use of the facility post adoption of the design mentioned in point b.

|

In 1995, Napier City Council undertook a project review in consultation with the Napier Community around its intention to redevelop the then War Memorial Hall. A feasibility study had identified that the development of a conference centre catering for events up to 300 people, would provide significant benefits to the Napier City economy. The War Memorial Hall was seen as the ideal location for a multi-use public amenity conference centre. The Hall was in a deteriorating state, was underutilised and unsuitable for contemporary needs, with inherent design problems and requiring a significant investment to restore it. Upon consulting with the community, Council made the decision in 1993 to proceed with the development of the War Memorial Hall into a conference centre. The Hall then became known as the ‘War Memorial Centre’ until 2000 when it was again rebranded to ‘Napier War Memorial Conference Centre’.

At a meeting on 29 June 2016, Council resolved to rename the Napier War Memorial Conference Centre to Napier Conference Centre, with the tag line of Conferences / Events / Functions. It was considered that having the words ‘war memorial’ in the name of a conferencing and events business creates marketing issues, especially for international clients who confuse the facility with a Leagues Club or Returned Services Association (RSA) clubrooms. With knowledge of the war memorial being removed from the building and relocated to Memorial Square as part of the 2016/17 redevelopment, it was deemed an appropriate time to remove the use of ‘war memorial’ in the name.

At a Council meeting of 3 April 2018, a paper titled ‘Renaming Napier Conference Centre’ provided Council with background information as to how the current branding came about, and outlined the risks and financial impacts of any further changes to the branding. At this meeting, the Council resolved the following:

a. Reinstates the words ‘War Memorial’ to the currently named Napier Conference Centre, the name becoming ‘Napier War Memorial Centre’.

b. Resolve the building branding, including signage, forms part of the War Memorial design concepts being brought to Council in June 2018.

c. That the Napier Conference Centre is recognised and marketed as a key business activity within the Napier War Memorial Centre.

d. That Napier City Council develop a policy for the ongoing management of the War Memorial Centre to protect the site’s heritage, recognising the commemorative elements and community use of the facility.

The Marketing Manager reports that at a follow-up discussion with the previous Mayor and eight councillors on 24 April 2018 seeking clarification on the resolution, she was told;

“the Napier Conference Centre is the tenant, and Napier War Memorial Centre is the landlord”

“Napier Conference Centre branding or marketing doesn’t need to change”

“We see a plinth, a flagstone or using the circular wall as placement for the words Napier War Memorial Centre”.

It was confirmed that a plinth in the forecourt area could be affected or damaged during construction of the new war memorial and should be delayed until the design is confirmed. It was also agreed that the curved area of the extension facing the Floral clock, be suitably sign written with ‘Napier War Memorial Centre’.

The venue is now known as the Napier War Memorial Centre and until the venue signage is confirmed (as per resolution b. above), the building has signage on the exterior of the ballroom (curved part of the venue).

An architect has been contracted and is working with the newly formed War Memorial Reference Group comprised of Councillors, RSA, military and history representatives and community representatives. The building signage will be resolved during this period of concept design and planning and it is appropriate to use the Reference Group to advise on the venue signage once the memorial design concept has been agreed.

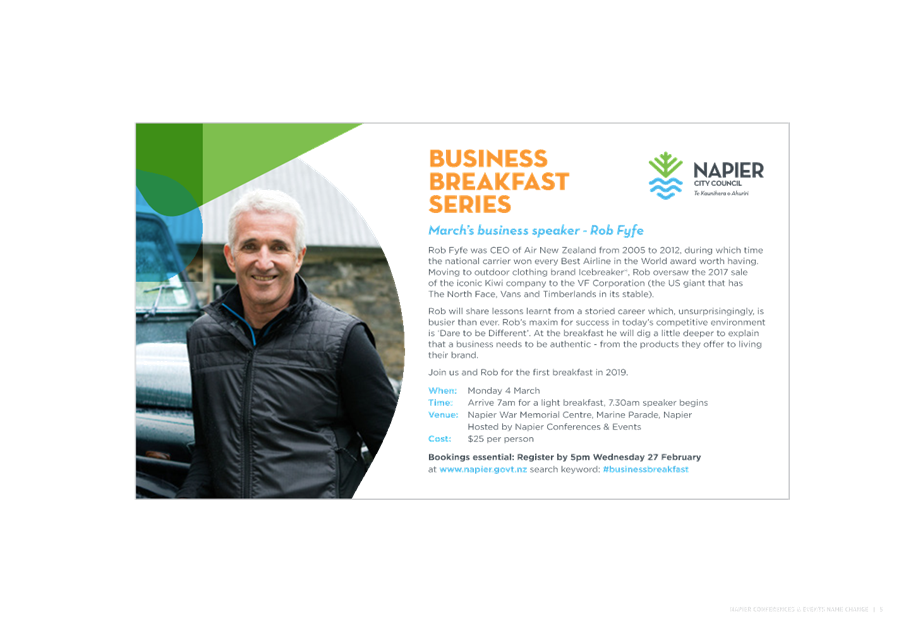

The business activity continues to be marketed as “Napier Conference Centre” which does present confusion to our community and clients with both names being associated to facilities or ‘centres’. It is therefore recommended that the business activity be renamed to better differentiate between the War Memorial building and the business activity that operates from within the War Memorial.

Please note two separate papers will come to Council in the coming weeks on the Napier War Memorial Centre design and War Memorial Centre policy as per previous resolutions.

13 Issues

At the Council meeting of 19 November 2019, Mayor Kirsten Wise announced that the Napier Conference Centre marketing brand was to be removed from the venue by 20 December 2019. The removal of the external signage from the Large Exhibition hall, was one of the reasons for the confusion between two names referencing ‘centre’, a.) Napier Conference Centre and b.) Napier War Memorial Centre.

At a staff meeting on 16 December 2019 involving Mayor Kirsten Wise, Deputy Mayor Annette Bronson and Councillor Sally Crown and Council officers, it was agreed that Officers would conduct a renaming exercise to minimise any confusion between the building name, Napier War Memorial Centre, and the business operating inside the building, the Napier Conference Centre.

It recommended that the Napier Conference Centre is renamed to ‘Napier Conferences and Events’ and remove the tag line ‘Conferences / Events / Functions’ since this is communicated in the new business name itself. This is a logical alternative, as by removing the word ‘centre’, the new name draws attention to what the business actually delivers; Conferences and Events.

The building is the Napier War Memorial Centre and this will be communicated as the location and address on all Napier Conferences and Events marketing collateral. The renaming exercise has been a straight forward project worked on between the Napier Conference Centre and Communications and Marketing team. It has been a cost effective and efficient approach that has been considered, which can be implemented with relative speed before the conference and events busy periods begins.

It was not considered necessary to engage in a complete rebrand exercise as the current logo is well recognised and has a growing reputation in the industry. It was developed in 2011 and has been used since this time (nine years). A full rebrand would take considerable investment, which is currently not budgeted for in 2019/20 or 2020/21 financial year budgets.

The Napier Conference Centre is actively promoted nationally, and more recently in the Australasian market, targeting international conferences and trade shows. Because of this tactful promotion into the conference and trade markets, combined with the growing reputation of the Napier Conference Centre, ‘brand’ bookings are growing.

There is genuine revenue growth in the Napier Conference Centre business with significant increases for the last three financial years. It is acknowledged that due to the COVID-19 pandemic, growth will be slower, particularly for the international market, than pre COVID-19.

|

Revenue: Retail and Product Sales |

||

|

2019/20 |

$2,305,826 Forecast *as at YTD February 2020 (Forecast calculated pre COVID-19 pandemic) |

21% revenue increase forecasted up from 2018/19 |

|

2018/19 |

$1,904,189 |

25% revenue increase up from 2017/18 |

|

2017/18 |

$1,521,199 |

First full year of operation after redevelopment |

A business goal in the near future for the Napier Conference Centre is that business will be able to fund itself. This will add further favourable economic benefit to the city of Napier and was a key assumption in the original business case supporting the development.

The most recent economic impact assessment the Napier Conference Centre has on the Hawke’s Bay region was done by Economic Solutions Limited in September 2017 and this indicated that the business’s total economic impact value was $13.38 million. It is presumed this value has increased over the last two years.

For the remainder of 2019/20 the Napier Conference Centre has 84 confirmed bookings with a total forecasted value $1,412,182. At the time this paper was written, the business has 51 confirmed bookings for 2020/21.

The Hawke’s Bay Opera House opened in February this year and will be competing with both the Napier Conference Centre and the Napier Municipal Theatre for a share of these markets when they come back online. Weakening our strong brand ahead of this may adversely impact our market share and therefore revenue.

The word ‘conference’ has been a part of the business name for 20 years. To remove this will cause confusion for conference organisers and delegates. Conferences typically are booked many months and more likely years in advance, with invitations for registrations going out to potential delegates well in advance of bookings. Therefore, the process of any potential name needs to be carefully planned and then communicated to avoid confusion and reputation damage. The name change to ‘Napier Conferences and Events’ plays to the business’s strengths and has an element of familiarity to the industry and our clients preserving our reputation within the industry.

The Napier Conferences and Events business activity will continue to coordinate bookings for functions out of the Napier War Memorial Centre and other Council venues such as Century Theatre, Municipal Theatre, Rodney Green Centennial Events Centre and the East Coast Lab. Links to these venue websites will also be promoted on the Napier Conferences and Events website.

1.4 Significance and Engagement

N/A

1.5 Implications

Financial

The cost of renaming the Napier Conference Centre business activity will come from the existing Napier Conference Centre marketing budget.

COVID-19 financial revenue impact on Napier Conference Centre

2019/20 February YTD Actuals

|

Napier Conference Centre - Cumulative Revenue YTD February |

February |

|

I2G - Retail and Product Sales - Budget 2019-2020 |

1,331,838 |

|

I2G - Retail and Product Sales - Actuals 2019-2020 |

1,441,275 |

|

I2G - Retail and Product Sales - Actuals 2018-2019 |

1,226,563 |

|

I2G - Retail and Product Sales - Actuals 2017-2018 |

1,073,533 |

· +$109,437 2019/20 Budget

· +$214,712 2018/2019 Actuals

2019/20 Forecast

|

Napier Conference Centre: 2019/20 Revenue Forecast |

468 NConC |

|

I2G - Retail and Product Sales - Budget 2019-2020 |

$2,029,110 |

|

I2G - Retail and Product Sales - Forecast Actuals 2019-2020 |

$1,529,649 |

|

Profit / Loss |

-$499,461 |

2020/21 Revenue Forecast

|

Napier Conference Centre |

Q1 |

Q2 |

Q3 |

Q4 |

|

% revenue generation compared to 2019/20 |

10% |

40% |

70% |

85% |

· This roughly translates to revenue being 60% ($1,200,000) down compared to 2019/20 budget.

Social & Policy

N/A

Risk

Officers have purposely preferred a renaming rather than rebranding exercise, simply due to the time and financial constraints a rebranding exercise would have on the business.

It is critical that the business is able to continue to use its existing branding and grow its brand in the competitive conference, trade and events market nationally and further abroad within Australasia. The business is now establishing itself with a growing positive reputation, which is reflected in growing bookings and revenue generation.

The team is operating an efficient commercial model and sales and marketing tactics are already locking in future bookings in conference cycles in future years. With a now growing number of established loyal customers, any drastic brand positioning changes could be detrimental to the business. The business has credible market share for the immediate and wider region and we need to continue establishing and growing this further. It cannot be emphasised enough that the conference, trade, events and function markets are fiercely competitive and we must remain visible, viable and continue building on what is now an established competitive reputation.

1.6 Options

The options available to Council are as follows:

a. To rename the Napier Conference Centre business activity to ‘Napier Conferences and Events’, while using the existing logo and brand identity.

b. Status quo and continue operating under current business name ‘Napier Conference Centre’.

1.7 Development of Preferred Option

The preferred option is to rename the business to ‘Napier Conferences and Events’. To continue using the existing logo and branding to avoid confusion for users and the community having two ‘centres’ on site. A number of forward bookings, months and years out, have been secured under our current branding, and client expectation will be that event attendees, many from out of town, will be able to easily locate the business without any confusion.

a Marketing Collateral & Signage Concepts - Napier Conferences and Events ⇩

2. Park Island Northern Sports Hub - Taradale Bridge Club

|

Type of Report: |

Procedural |

|

Legal Reference: |

N/A |

|

Document ID: |

913748 |

|

Reporting Officer/s & Unit: |

Debra Stewart, Team Leader Parks, Reserves, Sportsgrounds |

2.1 Purpose of Report

To seek approval in principal for the Taradale Bridge Club locate at the Park Island Northern Sports Hub subject to detailed feasibility and design including consideration of co-location with Napier Pirates and the Napier Bridge Club.

|

That Council: a. Approve in principal the Taradale Bridge Club locating at the Park Island Northern Sports Hub. This approval is given subject to the Taradale Bridge Club in conjunction with Council Officers working through stakeholder engagement, detailed design and confirming the club has sufficient funds to meet the full cost of the development. |

The Taradale Bridge Club have up until recently been located at the Taradale Club but their lease has not been renewed. The Bridge Club are now sharing the Napier Bridge Clubs premises at Whitmore Park. Whilst this is suitable short term the Taradale Bridge Club are of the view that this is not an appropriate long term solution.

The Taradale Bridge Club have prepared a business case Attachment A – Taradale Bridge Club Business Case, and presented to the Councils Public Forum seeking Councils support for the proposal to establish a home in Park Island as part of the Northern Sports Hub.

The Bridge Club have a membership of 224 mainly in the 60+ age group and who mostly live in the Taradale area. They require space for 24 card tables with kitchen and toilet facilities and parking for up to 40 cars. The membership of the Clubs at Napier, Taradale, Havelock North and Hastings has seen recent growth in members with a membership across the four clubs up about 4% in the last two years.

The Taradale Bridge Club have reviewed a number of alternative sites however, all of these have proved to be unavailable or unsuitable (refer Appendix 1 of Attachment A).

After a comprehensive review of all sites the Taradale Bridge Clubs preference is establish their home at Park Island in the Northern Sports Hub. This activity is considered to be adequately provided for in the Northern Sports Hub and the Park Island Masterplan includes the following in relation to this - page 43 “Enable planning and design of the Northern Sports Hub in conjunction with Pirates Rugby and Sports Club and any other partner sports organisations”. Whilst the Taradale Bridge Club are not specifically considered in the Park Island Masterplan they are considered to be “other partner sports organisations”.

Figure 1 - Orange box in the centre of this page is the site allocated to Napier Pirates and “other partner sports organisations”

2.3 Issues

Council have recently been approached by the Napier Bridge Club who currently have their home at Whitmore Park who are looking at opportunities to further support the development of bridge in the Napier. Council Officers are of the view that all matters relating to bridge in Napier should be considered when looking at the rehoming of the Taradale Bridge Club. A letter from the Napier Bridge Club is Attached – Attachment B.

There is currently no design work undertaken for the Northern Sports Hub and while preliminary discussions have been held with Napier Pirates around their requirements for the site no final decisions have been made by the club in relation to relocating to the Northern Sports Hub.

The Taradale Bridge Club have indicated that they have $500,000 available for the development of their new facility. It is important to note that the location identified is essentially undeveloped land and therefore no provision for servicing that site has been made. No costings have been undertaken at this stage and detailed cost estimates for the facility would need to include servicing the site, all infrastructure (water, wastewater, stormwater power and telecommunications) including ground works and car-parking. Costs would also include design and project management and any necessary consenting including Development Contributions for any service connections. Prior to this work being completed there would also need to be some engagement with other stakeholders including Napier Pirates Rugby and Sports Club and the Napier Bridge Club to ensure that an appropriate design solution for the site was achieved with the right level of future proofing for other potential user groups.

2.4 Significance and Engagement

This matter does not trigger the Significance and Engagement Policy. The future of the Park Island has already been consulted on via the Park Island Master Plan and Plan Change 11.

2.5 Implications

Financial

The Taradale Bridge Club have $500,000 available for this project. The project has not yet been fully scoped and must be fully costed prior to any final approvals being given.

Council does not currently have funding set aside for the development of the Northern Sports Hub in the 20/21 financial year.

Social & Policy

n/a

Risk

n/a

2.6 Options

The options available to Council are as follows:

a. Council not approve the application by the Taradale Bridge to locate at the Park Island Northern Sports Hub.

b. Council approve in principle the application by the Taradale Bridge Club to establish their home within the Park Island Northern Sports Hub.

2.7 Development of Preferred Option

Option A

The Taradale Bridge Club could, with the agreement of the Napier Bridge Club, continue to use the Whitmore Park facility however both bridge clubs have identified that this facility is no longer the best fit for the communities they serve.

Option B

The Taradale Bridge Club have undertaken a full assessment of sites that may be suitable for their activity. Their preferred location is the Park Island Northern Sports Hub which is set aside for Napier Pirates and “other partner sports organisations”.

Whilst in principle the Park Island Northern Sports Hub is considered to be a suitable location for the Taradale Bridge Club there has been not design work undertaken for this site and this work, associated stakeholder engagement, and costing must be undertaken prior to any final approval being given and an appropriate lease/licence to occupy being entered into.

a Taradale Bridge Club Business Case (Under Separate Cover) ⇨

b Napier Bridge Club Letter ⇩

3. Parks, Reserves and Sportsgrounds Water Conservation Strategy

|

Type of Report: |

Information |

|

Legal Reference: |

N/A |

|

Document ID: |

912628 |

|

Reporting Officer/s & Unit: |

Debra Stewart, Team Leader Parks, Reserves, Sportsgrounds |

3.1 Purpose of Report

To advise Council of the Parks, Reserves and Sportsgrounds Water Conservation Plan for endorsement prior to its presentation in a paper at the World Urban Parks International Congress Event, Green Pavlova in Rotorua, May 2020 (now postponed to May 2021 in light of Covid-19).

|

That Council: a. Approve the Parks, Reserves and Sportsgrounds Water Conservation Plan for presentation at the World Urban Parks International Congress Event, Green Pavlova in Rotorua, May 2020 (now postponed to May 2021 in light of Covid-19).

|

The Water Conservation Plan for Parks Reserves and Sportsgrounds has been prepared as requirement of Napier City Councils’ Water Conservation Strategy, which was required as part the Hawke’s Bay Regional Council Consent to take water for the city. The city’s Water Conservation Strategy included a specific requirement for a review of watering efficiency of parks, reserves and sportsgrounds.

Parks, Reserves and Sportsgrounds are known to have a high levels of water consumption with specific sites known to be consuming a significant amount of water. It has also been acknowledged that there is lots that we do not know about our current levels of water consumption.

Napier City Council is the first Council in New Zealand to prepare a Water Conservation Plan of this nature and this plan is considered to be the first step towards a better understanding of parks water consumption and identifying some areas where some improvements could be made.

The majority of the parks, reserves and sportsgrounds are watered from the city’s town supply via a combination of automated and manual watering systems.

As part of the process of preparing the Water Conservation Plan figures from Water Meter accounts were reviewed, where available, to determine water usage. This was deemed to be the most reliable information although it should be noted that not all sites are metered.

At the time the report was prepared, there were three parks and reserves sites that were in the city’s top 10 water users Centennial Gardens, Anderson Park and the Botanical Gardens.

However, it should be noted that since the implementation of water restrictions there has been a significant decline in water use in parks, reserves and sportsgrounds.

In addition a number of the recommendations in the Parks, Reserves and Sportsgrounds Water Conservation Plan have been partly of fully implemented. These include –

· The sealing of Centennial Pond

· Improved communications particularly around water use

· Minor repairs and leaks fixed ongoing

· Reduced watering in the Botanical Gardens

· Programme for installation of water meters

· Reviewing irrigation options for new projects including Park Island Number 1 Field

3.3 Issues

The Parks, Reserves and Sportsgrounds Water Conservation Plan was to be presented to a World Urban Parks International Congress Event, Green Pavlova in Rotorua, May 2020. However due to Covid-19 this event has been postponed until May 2021. It is not clear at this stage whether this paper will still be relevant and form part of the 2021 event programme.

3.4 Significance and Engagement

n/a

3.5 Implications

Financial

n/a

Social & Policy

n/a

Risk

n/a

3.6 Options

n/a

3.7 Development of Preferred Option

n/a

Extraordinary Meeting of Council - 21 May 2020 - Open Agenda Item 4

4. Rates Postponement Policy Review

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government (Rating) Act 2002 |

|

Document ID: |

921868 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager |

4.1 Purpose of Report

To review and update the policy to include better definition around financial hardship resulting from Significant Extraordinary Circumstances. Some minor clarification of Criteria wording.

|

That Council: a. Approve the proposed amendments to the Rates Postponement Policy to include Significant Extraordinary Circumstances. |

The COVID-19 pandemic and a subsequent response planning has highlighted the need to better define rates postponements for Significant Extraordinary Circumstances.

4.3 Issues

In its current form, the Rates Postponement Policy is structured to review postponements on a very small (individual) scale. Significant time (including that of Prosperous Napier Committee) and resources are required to process each application. The proposed amendment allows the Council to apply broad postponements in situations where Significant Extraordinary Circumstances are identified.

The proposed amendment is as follows:

Postponement for Significant Extraordinary Circumstances

Objective

To provide a rates postponement to ratepayers experiencing financial hardship directly resulting from Significant Extraordinary Circumstances that affects their ability to pay rates.

For the purpose of this policy the following definitions will apply:

· Significant Extraordinary Circumstances: as defined by Council resolution. Significant Extraordinary Circumstances may be natural or economic in nature, and will identify the type and location of properties affected.

· Financial Hardship: for the purpose of this provision is defined as the inability of a person, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered necessary according to New Zealand standards. In the case of a ratepayer who is not a natural person, it is the inability, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered essential to the functioning of that entity according to New Zealand standards.

· Small Business: a business operated by a small business person, small partnership or close company as defined in section YA 1 of the Income Tax Act 2007.

Conditions and Criteria

This part of the policy will only apply to Rating Units used for residential purposes or by Small Businesses.

Once Significant Extraordinary Circumstances have been identified by Council, the criteria and application process (including an application form, if applicable), will be made available. Council may set a timeframe for the event. Council may review the criteria and/or timeframe of Significant Extraordinary Circumstances through subsequent resolutions.

Council resolution will include:

a. that the resolution applies under the Rates Postponement Policy; and

b. the Significant Extraordinary Circumstances triggering the policy (e.g. including, but not limited to, flood, pandemic, earthquake); and

c. how the Significant Extraordinary Circumstances are expected to impact the community (e.g. hardship); and

d. the types or location of properties effected by the Significant Extraordinary Circumstances; and

e. timeframe for postponement in relation to the Significant Extraordinary Circumstances.

No application for postponement can be made under this policy unless Significant Extraordinary Circumstances have been identified by Council.

Any requests for rates postponement for Rating Units with a land value greater than $1.5m will be decided upon at the discretion of Council and requests for rate postponement for Rating Units with a land value less than $1.5m will be delegated to Council officers.

The ratepayer must demonstrate, to the Council’s satisfaction, that paying the rates would result in Financial Hardship.

The applicant must demonstrate to Council’s satisfaction that the ratepayer has taken all necessary steps to claim any central government benefits or allowances the ratepayer is properly entitled to receive that would assist the ratepayer to meet their financial commitments. Evidence such as official correspondence must be provided with the application.

Council will consider applications where the same ratepayer is liable for rates for multiple Rating Units. In such instances, Council will look at the collective impact to the ratepayer.

Only the person/s entered as the ratepayer (in the case of a close company every director must sign the application form), or their authorised agent, may make an application for rates postponement for Significant Extraordinary Circumstances that resulted in Financial Hardship. However, where the ratepayer is not the owner of the Rating Unit, the owner must also provide written approval of the application.

The ratepayer must be the current ratepayer for the Rating Unit at the time Significant Extraordinary Circumstances are identified by Council.

Where the Council decides to postpone rates the ratepayer must make acceptable arrangements for payment of rates, for example by setting up a system for regular payments. Such arrangements will be based on the circumstances of each case.

Council may charge a fee on postponed rates for the period between the due date and the date they are paid. This fee is designed to cover Council’s administrative and financial costs. The fees will be set as part of the Council resolution identifying Significant Extraordinary Circumstances.

Postponed rates will remain postponed until the earlier of:

a. The ratepayer/s ceases to be the owner or occupier of the Rating Unit; or

b. A date specified by Council in the Council resolution identifying Significant Extraordinary Circumstances.

Further minor amendments include:

· Removal of the provision “At the end of five years any postponed rates will be written off if the rating unit has not been subdivided.” From Postponement for Farmland. This will encourage development in areas identified for growth.

· Delegation to approve rates postponements for Postponement for Farmland and Postponement for Elderly extended to Chief Financial Officer and Investment & Funding Manager.

· Additional legislative and Council document references have been included in the policy.

· Applications under Postponement for Special Circumstances can now be made by the “…ratepayer or their authorised agent…” instead of solely by the “applicant”.

4.4 Significance and Engagement

There has been no external consultation on the proposed changes.

The proposed amendments are similar to those already in place, or proposed, for other Councils.

Significance of the proposed amendments are high as they could potentially impact proportion of residents or ratepayers.

4.5 Implications

Financial

N/A

Social & Policy

The proposed amendment will allow Napier City Council to be more responsive, by way of financial relief, to any events that have a material negative impact on the wider city.

Risk

Taking the Postponement Policy in its current form, the Council is not well placed to provide timely relief via postponement, and may be overwhelmed due to administrative burden should another extraordinary or emergency event occur.

4.6 Options

The options available to Council are as follows:

a. Adopt all of the proposed changes.

b. Adopt selected proposed changes.

c. Adopt none of the proposed changes.

4.7 Development of Preferred Option

The proposed changes to the Rates Postponement Policy to provide better definition around financial hardship resulting from Significant Extraordinary Circumstances.

a Rates Postponement Policy ⇩

|

Extraordinary Meeting of Council - 21 May 2020 - Attachments

|

Item 4 Attachments a |

|

Rates Postponement Policy |

|||

|

Approved By |

Pending Approval by Council |

||

|

Department |

Finance |

||

|

Original Approval Date |

29 June 2018 |

Review Approval Date |

Pending |

|

Next Review Deadline |

June 2023 |

Document ID |

346038 |

|

Relevant Legislation |

Local Government (Rating) Act 2002 Local Government Act 2002 Income Tax Act 2007 |

||

|

NCC Documents Referenced |

Published in the Long Term Plan 2018-2028 which was reviewed between March/April 2018 and adopted on 29-06-18 Reviewed and amended in response to COVID-19 Rating – Delegations under Local Government (Rating) Act 2002 |

||

Purpose

To enable Council to postpone the requirement to pay all or part of the rates on a Rating Unit under Section 87 of the Local Government (Rating) Act 2002 where a rates postponement policy has been adopted and the conditions and criteria in the policy are met.

Policy

Postponement for Farmland

Objective

To support the District Plan by encouraging owners of farmland around urban areas to refrain from subdividing their land for residential purposes.

Conditions and Criteria

To initially qualify, or continue qualifying, for postponement of rates under this policy the Rating Unit must be classified, or continue to be classified, as farmland for differential purposes (ratepayers wishing to ascertain their classification are welcome to inspect the Council’s rating information database at the Council office).

Rates postponement will continue to apply on those properties that were subject at 30 June 2003 to postponement under Section 22 of the Rating Valuations Act 1998. Other rural ratepayers wishing to take advantage of this part of the policy must make application in writing, addressed to the Director Corporate Services. The application for postponement must be made to the Council prior to the commencement of the rating year. Applications received during a rating year will be applicable from the commencement of the following rating year. Applications will not be backdated.

For properties currently subject to rates postponement and for new applications approved, Council will postpone the difference between rates payable on the equivalent Rates Postponement Value advised by its Valuation Service Provider and rates payable on the Rateable Value of the land each year.

The Council may charge an annual fee on postponed rates for the period between the due date and the date they are paid. This fee is designed to cover the Council’s administrative and financial costs and may vary from year to year. The amount of the fee is included in Council’s Schedule of Fees and Charges.

If the Rating Unit is subdivided then postponed rates and any accumulated fees will be payable. The ratepayer will be required to sign an agreement acknowledging this. Postponed rates will be registered as a charge against the land (i.e. in the event that the property is sold the Council has first call against any of the proceeds of that sale). Again, the ratepayer will be required to sign an agreement acknowledging this.

Authority to approve applications will be delegated by Council to the Director of Corporate Services, Chief Financial Officer and Investment and Funding Manager.

Postponement for the Elderly

Objective

The objective of this part of the policy is to assist elderly ratepayers with a fixed level of income to meet rates particularly, but not exclusively, resulting from increasing levels of rates.

Definition

Elderly Ratepayers as those who are old enough to qualify to receive NZ Superannuation.

For the purpose of this provision, Financial Hardship is defined as the inability of a person, to reasonably meet the cost of goods, services and financial obligations that are considered necessary according to New Zealand standards.

Conditions and Criteria

Postponement will only apply to Elderly Ratepayers on a fixed income.

Only Rating Units used solely for residential purposes will be eligible for consideration for rates postponement under this policy.

Only the person entered as the ratepayer, or their authorised agent, may make an application for rates postponement for Financial Hardship. The ratepayer must be the occupant and current owner of, and have owned for not less than five years, the Rating Unit which is the subject of the application. The person entered on the Council’s rating information database as the ‘ratepayer’ must not own any other Rating Units or investment properties (whether in the district or elsewhere).

The ratepayer (or authorised agent) must make an application to Council on the prescribed form (copies can be obtained from the Council Office).

The Council will consider, on a case by case basis, all applications received that meet the criteria outlined under this section. The following factors will be considered – age, income source and level, annual rates payable, period of postponement, equity in the property owned, and the amount of rates postponed.

Authority to approve applications will be delegated by Council to the Director of Corporate Services, Chief Financial Officer and Investment and Funding Manager.

Applicants seeking rates postponement will be encouraged to seek independent advice before formally accepting any offer for postponement made by the Council.

As a general rule postponement will not apply to the first $500 per annum of the rate account after any rates rebate has been deducted.

Where the Council decides to postpone rates the ratepayer must first make acceptable arrangements (e.g. by setting up a system to meet agreed minimum regular payments) for payments required under the terms of the postponement approval for the current rating year, and future payment years..

Postponement will only apply on properties on which houses have been insured. Annual proof may be required that insurance has been maintained.

Where rates postponement is approved for a property with an outstanding mortgage, the mortgagee will be advised by Council that rates postponement has been granted by the Council.

Any postponed rates will be postponed until:

The death of the ratepayer(s); or

· Until the ratepayer(s) ceases to be either the owner or occupier of the Rating Unit; or

· Until a date specified by the Council.

The Council will charge an annual postponement fee. The annual postponement fee will cover Council’s administrative costs including finance costs. The finance cost will be charged at the average return on investments rate for Council for that year.

All postponement fees payable (including finance costs) will be added to the amount of postponed rates annually and be paid at the time postponed rates are paid.

The policy will apply from the beginning of the rating year in which the application is made although the Council may consider backdating past the rating year in which the application is made depending on the circumstances.

The postponed rates, inclusive of any accumulated postponement fees, or any part thereof may be paid at any time. The applicant may elect to postpone the payment of a lesser sum than that which they would be entitled to have postponed pursuant to this policy.

Postponed rates will be registered as a statutory land charge on the Rating Unit title. This means that the Council will have first call on the proceeds of any revenue from the sale or lease of the Rating Unit. In addition to the annual fee and interest, Council will charge any other costs or one-off fees incurred in relation to registration of the postponement as part of the postponement.

This policy will not affect any rates postponement provisions approved prior to 1 July 2009, which will continue to apply in accordance with the conditions related to each case.

This policy does not apply to non-elderly ratepayers experiencing financial hardship.

Council will assist in the referral of any other ratepayer on a fixed income facing long term financial hardship to the appropriate agency.

Postponement for Significant Extraordinary Circumstances

Objective

To provide a rates postponement to ratepayers experiencing financial hardship directly resulting from Significant Extraordinary Circumstances that affects their ability to pay rates.

For the purpose of this policy the following definitions will apply:

· Significant Extraordinary Circumstances: as defined by Council resolution. Significant Extraordinary Circumstances may be natural or economic in nature, and will identify the type and location of properties affected.

· Financial Hardship: for the purpose of this provision is defined as the inability of a person, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered necessary according to New Zealand standards. In the case of a ratepayer who is not a natural person, it is the inability, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered essential to the functioning of that entity according to New Zealand standards.

· Small Business: a business operated by a small business person, small partnership or close company as defined in section YA 1 of the Income Tax Act 2007.

Conditions and Criteria

This part of the policy will only apply to Rating Units used for residential purposes or by Small Businesses.

Once Significant Extraordinary Circumstances have been identified by Council, the criteria and application process (including an application form, if applicable), will be made available. Council may set a timeframe for the event. Council may review the criteria and/or timeframe of Significant Extraordinary Circumstances through subsequent resolutions.

Council resolution will include:

a. that the resolution applies under the Rates Postponement Policy; and

b. the Significant Extraordinary Circumstances triggering the policy (e.g. including, but not limited to, flood, pandemic, earthquake); and

c. how the Significant Extraordinary Circumstances are expected to impact the community (e.g. hardship); and

d. the types or location of properties effected by the Significant Extraordinary Circumstances; and

e. timeframe for postponement in relation to the Significant Extraordinary Circumstances.

No application for postponement can be made under this policy unless Significant Extraordinary Circumstances have been identified by Council.

Any requests for rates postponement for Rating Units with a land value greater than $1.5m will be decided upon at the discretion of Council and requests for rate postponement for Rating Units with a land value less than $1.5m will be delegated to Council officers.

The ratepayer must demonstrate, to the Council’s satisfaction, that paying the rates would result in Financial Hardship.

The applicant must demonstrate to Council’s satisfaction that the ratepayer has taken all necessary steps to claim any central government benefits or allowances the ratepayer is properly entitled to receive that would assist the ratepayer to meet their financial commitments. Evidence such as official correspondence must be provided with the application.

Council will consider applications where the same ratepayer is liable for rates for multiple Rating Units. In such instances, Council will look at the collective impact to the ratepayer.

Only the person/s entered as the ratepayer (in the case of a close company every director must sign the application form), or their authorised agent, may make an application for rates postponement for Significant Extraordinary Circumstances that resulted in Financial Hardship. However, where the ratepayer is not the owner of the Rating Unit, the owner must also provide written approval of the application.

The ratepayer must be the current ratepayer for the Rating Unit at the time Significant Extraordinary Circumstances are identified by Council.

Where the Council decides to postpone rates the ratepayer must make acceptable arrangements for payment of rates, for example by setting up a system for regular payments. Such arrangements will be based on the circumstances of each case.

Council may charge a fee on postponed rates for the period between the due date and the date they are paid. This fee is designed to cover Council’s administrative and financial costs. The fees will be set as part of the Council resolution identifying Significant Extraordinary Circumstances.

Postponed rates will remain postponed until the earlier of:

a. The ratepayer/s ceases to be the owner or occupier of the Rating Unit; or

b. A date specified by Council in the Council resolution identifying Significant Extraordinary Circumstances.

Postponement for Special Circumstances

Objective

To enable Council to provide rates postponement for special and unforeseen circumstances, where it considers relief by way of rates postponement is justified in the circumstances.

Conditions and Criteria

Application for rates postponement must be made in writing by the ratepayer or their authorised agent.

Each circumstance will be considered by Council on a case by case basis. Where necessary, Council consideration and decision will be made in the Public Excluded part of a Council meeting.

The terms and conditions of postponement including any application of an annual fee will be decided by Council on a case by case basis.

The applicant will be advised in writing of the outcome of the application.

Policy Review

This policy will be reviewed at least once every three years.

Document History

|

Version |

Reviewer |

Change Detail |

Date |

|

2.0.0 |

Caroline Thomson |

Updated and approved by Council |

29 June 2018 |

|

3.0.0 |

|

Updated and approved by Council |

|

5. Rates Remission Policy Review

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government (Rating) Act 2002 |

|

Document ID: |

925181 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager |

5.1 Purpose of Report

To review and update the policy to include definition around financial hardship resulting from Significant Extraordinary Circumstances. Some minor clarification of Criteria wording.

|

That Council: a. Approve the proposed amendments to the Rates Remission Policy to include Significant Extraordinary Circumstances.

|

The COVID-19 pandemic and a subsequent response planning has highlighted the need to better define rates remissions for Significant Extraordinary Circumstances.

5.3 Issues

In its current form, the Rates Remission Policy is structured to review remissions on a very small (individual) scale. Significant time (including that of Prosperous Napier Committee) and resources are required to process each application. The proposed amendment allows the Council to be proactive, and apply broad remissions in situations where Significant Extraordinary Circumstances are identified.

The proposed amendment is as follows:

Remission of Rates in Response to Significant Extraordinary Circumstances being identified by Council.

Objective

To enable Council to provide rates remission to assist ratepayers in response to Significant Extraordinary Circumstances impacting Napier’s ratepayers.

Definitions

Financial Hardship: for the purpose of this provision is defined as the inability of a person, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered necessary according to New Zealand standards. In the case of a ratepayer who is not a natural person, it is the inability, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered essential to the functioning of that entity according to New Zealand standards.

Conditions and Criteria

For this policy to apply Council must first have identified that there have been Significant Extraordinary Circumstances affecting the ratepayers of Napier, that Council wishes to respond to.

Once Significant Extraordinary Circumstances have been identified by Council, the criteria and application process (including an application form, if applicable), will be made available.

For a Rating Unit to receive a remission under this policy it needs to be an “Affected Rating Unit” based on an assessment performed by officers, following guidance provided through a resolution of Council.

Council resolution will include:

1. That the resolution applies under the Rates Remission Policy; and

2. Identification of the Significant Extraordinary Circumstances triggering the policy (including both natural and man-made events); and

3. How the Significant Extraordinary Circumstances are expected to impact the community (e.g. financial hardship); and

4. The type of Rating Unit the remission will apply to; and

5. Whether individual applications are required or a broad based remission will be applied to all affected Rating Units or large groups of affected Rating Units; and

6. What rates instalment/s the remission will apply to; and

7. Whether the remission amount is either a fixed amount, percentage, and/or maximum amount to be remitted for each qualifying Rating Unit.

Explanation

The specific response and criteria will be set out by Council resolution linking the response to specific Significant Extraordinary Circumstances. The criteria may apply a remission broadly to all Rating Units or to specific groups or to Rating Units that meet specific criteria such as proven Financial Hardship, a percentage of income lost or some other criteria as determined by council and incorporated in a council resolution.

Council will indicate a budget to cover the value of remissions to be granted under this policy in any specific financial year.

The types of remission that may be applied under this policy include:

· The remission of a fixed amount per Rating Unit either across the board or targeted to specific groups such as:

§ A fixed amount per residential Rating Unit

§ A fixed amount per commercial Rating Unit

Further minor amendments include:

Provision for the remission of penalties through identification of Significant Extraordinary Circumstances.

Applications under Remission for Special Circumstances can now be made by the “…ratepayer or their authorised agent...” instead of solely by the “ratepayer”.

5.4 Significance and Engagement

There has been no external consultation on the proposed changes.

The proposed amendments are similar to those already in place, or proposed, for other Councils.

Significance of the proposed amendments are high as they could potentially impact proportion of residents or ratepayers.

5.5 Implications

Financial

N/A

Social & Policy

The proposed amendment will allow Napier City Council to be more responsive, by way of financial relief, to any events that have a material negative impact on the wider city.

Risk

Taking the Rates Remission Policy in its current form, the Council is not well placed to provide timely relief via remission, and may be overwhelmed due to administrative burden should further Significant Extraordinary Circumstances occur.

5.6 Options

The options available to Council are as follows:

a. Adopt all of the proposed changes.

b. Adopt selected proposed changes.

c. Adopt none of the proposed changes.

5.7 Development of Preferred Option

The proposed changes to the Rates Remission Policy to provide better definition around financial hardship resulting from Significant Extraordinary Circumstances.

a Rates Remission Policy ⇩

|

Extraordinary Meeting of Council - 21 May 2020 - Attachments

|

Item 5 Attachments a |

|

Rates Remission Policy |

|||

|

Approved by |

Pending Approval by Council |

||

|

Department |

Finance |

||

|

Original Approval Date |

30 June 2019 |

Review Approval Date |

June 2020 |

|

Next Review Deadline |

June 2023 |

Document ID |

|

|

Relevant Legislation |

Local Government Act 2002, Local Government (Rating) Act 2002 |

||

|

NCC Documents Referenced |

Published in the Long Term Plan 2018-2028 which was reviewed between March/Apr 2018 and adopted on 29-06-18 Reviewed and amended as part of 2019/20 Annual Plan Reviewed and amended as part of 2020/21 Annual Plan |

||

Purpose

To enable Council to remit all or part of the rates on a rating unit under Section 85 of the Local Government (Rating) Act 2002 where a Rates Remission Policy has been adopted and the conditions and criteria in the policy are met.

Policy

1. Remission of Penalties

Objective

The objective of this part of the Rates Remission Policy is to enable Council to act fairly and reasonably in its consideration of rates which have not been received by the Council by the penalty date due to circumstances outside the ratepayer’s control.

Conditions and Criteria

Penalties incurred will be automatically remitted where Council has made an error which results in a penalty being applied.

Remission of one penalty will be considered in any one rating year where payment has been late due to significant family disruption. This will apply in the case of death, illness, or accident of a family member, at about the times rates are due.

Remission of the penalty will be considered if the ratepayer forgets to make payment, claims a rates invoice was not received, is able to provide evidence that their payment has gone astray in the post, or the late payment has otherwise resulted from matters outside their control. Each application will be considered on its merits and remission will be granted where it is considered just and equitable to do so

Remission of a penalty will be considered where sale has taken place very close to due date, resulting in confusion over liability, and the notice of sale has been promptly filed, or where the solicitor who acted in the sale for the owner acted promptly but made a mistake (e.g. inadvertently provided the wrong name and address) and the owner cannot be contacted. Each case shall be treated on its merits.

Penalties will also be remitted based on the application, by officers, of Council criteria established after Council has identified that Significant Extraordinary Circumstances have occurred that warrants further leniency in relation to the enforcement of penalties that would otherwise have been payable. The criteria to be applied will be set out in a council resolution that will be linked to the specific Significant Extraordinary Circumstances that have been identified by Council.

Penalties will also be remitted where Council’s Chief Financial Officer considers a remission of the penalty, on the most recent instalment, is appropriate as part of an arrangement to collect outstanding rates from a ratepayer.

2. Remission for Residential Land in Commercial or Industrial Areas

Objective

To ensure that owners of rating units situated in commercial or industrial areas are not unduly penalised by the zoning decisions of this Council and previous local authorities.

Conditions and Criteria

To qualify for remission under this part of the policy the rating unit must:

· Be situated within an area of land that has been zoned for commercial or industrial use. Ratepayers can determine where their property has been zoned by inspecting the City of Napier District Plan, copies of which are available from the Council office.

· Be listed as a ‘residential’ property for differential rating purposes. Ratepayers wishing to ascertain whether their property is treated as a residential property may inspect the Council’s rating information database at the Council office.

Rates will be automatically remitted annually for those properties which had Special Rateable Values applied under Section 24 of the Rating Valuations Act 1998 up to 30 June 2003, and for which evidence from Council’s Valuation Service Provider indicates that, with effect from the 2002 revaluation of Napier City, the land value has been penalised by its zoning. The amount remitted will be the difference between the rates calculated on the equivalent special rateable value provided by the Valuation Service Provider and the rates payable on the Rateable Value.

Other ratepayers wishing to claim remission under this part of the policy must make an application in writing addressed to the Chief Financial Officer.

The application for rates remission must be made to the Council prior to the commencement of the rating year. Applications received during a rating year will be applicable from the commencement of the following rating year. Applications will not be backdated.

Where an application is approved, the Council will direct its Valuation Service Provider to inspect the rating unit and prepare a valuation that will treat the rating unit as if it were a comparable rating unit elsewhere in the district. The ratepayer may be asked to contribute to the cost of this valuation. Ratepayers should note that the Valuation Service Provider’s decision is final as there are no statutory right of objection or appeal for values done in this way.

3. Remission for Land Subject to Special Preservation Conditions

Objective

To preserve and encourage the protection of land and improvements which are the subject of special preservation conditions.

Conditions and Criteria

Rates remission under this Section of the policy relates to land that is subject to:

· A heritage covenant under the Historic Places Act 1993; or

· A heritage order under the Resource Management Act 1991; or

· An open space covenant under the Queen Elizabeth the Second National Trust Act 1977; or

· A protected private land agreement or conservation covenant under the Reserves Act 1977; or

· Any other covenant or agreement entered into by the owner of the land with a public body for the preservation of existing features of land, or of buildings, where the conditions of the covenant or agreement are registered against the title to the land and are binding on subsequent owners of land.

Ratepayers who own Rating Units meeting this criteria may qualify for remission under this part of the policy.

Rates will automatically be remitted annually for those properties which had Special Rateable Values applied under Section 27 of the Rating Valuations Act up to 30 June 2003, and which meet the above criteria. The amount remitted will be the difference between the rates calculated on the equivalent special rateable value provided by the Valuation Service Provider and the rates payable on the Rateable Value.

Other ratepayers wishing to claim remission under this part of the policy must apply in writing to the Council office, and must provide supporting documentary evidence of the special preservation conditions, e.g. copy of the Covenant, Order or other legal mechanism.

The application for rates remission must be made to the Council prior to the commencement of the rating year. Applications received during a rating year will be applicable from the commencement of the following rating year.

Applications for remission under this part of the policy will be approved by the Council. The Council may specify certain conditions before remission will be granted. Applicants will be required to agree in writing to these conditions and to pay any remitted rates if the conditions are violated.

Where an application is approved, the Council will direct its Valuation Service Provider to inspect the Rating Unit and provide a special valuation. The ratepayer may be asked to contribute to the cost of this valuation. Ratepayers should note that the Valuation Service Provider’s decision is final as there is no statutory right of objection or appeal for values done in this way.

The equivalent special rateable value will be determined by the Valuation Service Provider on the assumption that:

· The actual use to which the land is being put at the date of valuation will be continued; and

· Any improvements on the land will be continued and maintained or replaced in order to enable the land to continue to be so used.

It will be assessed taking into account any restriction on the use that may be made of the land imposed by the mandatory preservation of any existing tenements, hereditaments, trees, buildings, other improvements, and features.

4. Remission of Uniform Annual General Charges (UAGC) and Targeted Rates of a Fixed Amount on Rating Units Owned by the Same Owner

Objective

To provide for relief from UAGC and Targeted Rates of a fixed amount per Rating Unit or Separately Used or Inhabited Parts of a Rating Unit, where two or more Rating Units are owned by the same person or persons, and are:

· part of a subdivision plan which has been deposited for separate lots, or separate legal titles exist; or

· but the Rating Units may not necessarily be used jointly as a single unit, and each Rating Unit does not benefit separately from the services related to the UAGC and Targeted Rates.

Conditions and Criteria

Remission of UAGC and Targeted Rates of a fixed amount applies in the following situations:

· Unsold subdivided land, where as a result of the High Court decision of 20 November 2000 ‘Neil Construction and others vs. North Shore City Council and others’, each separate lot or title is treated as a separate Rating Unit, and such land is implied to be not used as a single unit.

All remissions under this part of the policy will be approved by the Chief Financial Officer.

5. Remission for Water Rates (by meter)

Objective

To provide ratepayers with a measure of relief by way of partial rates remission where, as a result of the existence of a water leak on the Rating Unit which they occupy the payment of fuller rates is inequitable, or where officers are convinced that there are errors in the data relating to water usage.

Conditions and Criteria

· The existence of a significant leak on the occupied Rating Unit has been established and there is evidence that steps have been taken to repair the leak as soon as possible after the detection, or officers have reviewed the usage data and are convinced that the usage readings are so abnormal as to require adjustment.

· The Council or its delegated officer(s) as determined from time to time and set out in the Council’s delegations register shall determine the extent of any remission based on the merits of each situation.

6. Remission to smooth the effects of change in rates on individual or groups of properties

Objective

To enable Council to provide rates remission where, as a result of a change in Council policy or other change that results in a significant increase in rates, Council decides it is equitable to smooth or temporarily reduce the impacts of the change by reducing the amount payable.

Conditions and Criteria

· Remission of part of the value based rates to enable the impact of a change in rates to be phased in over a period of no more than 3 years.

To continue with any existing rates adjustment where, due to change in process, policy or legislation Council considers it equitable to do so subject to a maximum limit of 3 years to a remission made under this clause in the policy.

7. Remission for Special Circumstances

Objective

To enable Council to provide rates remission for special and unforeseen circumstances, where it considers relief by way of rates remission is justified in the circumstances.

Conditions and Criteria

Applications for rates remission must be made in writing by the ratepayer or their authorised agent.

Each circumstance will be considered by Council on a case by case basis. Where necessary, Council consideration and decision will be made in the Public Excluded part of a Council meeting.

The terms and conditions of remission will be decided by Council on a case by case basis. The applicant will be advised in writing of the outcome of the application.

8. Remission of Rates in Response to Significant Extraordinary Circumstances being identified by Council.

Objective

To enable Council to provide rates remission to assist ratepayers in response to Significant Extraordinary Circumstances impacting Napier’s ratepayers.

Definitions

Financial Hardship: for the purpose of this provision is defined as the inability of a person, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered necessary according to New Zealand standards. In the case of a ratepayer who is not a natural person, it is the inability, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered essential to the functioning of that entity according to New Zealand standards.

Conditions and Criteria

For this policy to apply Council must first have identified that there have been Significant Extraordinary Circumstances affecting the ratepayers of Napier, that Council wishes to respond to.

Once Significant Extraordinary Circumstances have been identified by Council, the criteria and application process (including an application form, if applicable), will be made available.

For a Rating Unit to receive a remission under this policy it needs to be an “Affected Rating Unit” based on an assessment performed by officers, following guidance provided through a resolution of Council.

Council resolution will include:

1. That the resolution applies under the Rates Remission Policy; and

2. Identification of the Significant Extraordinary Circumstances triggering the policy (including both natural and man-made events); and

3. How the Significant Extraordinary Circumstances are expected to impact the community (e.g. financial hardship); and

4. The type of Rating Unit the remission will apply to; and

5. Whether individual applications are required or a broad based remission will be applied to all affected Rating Units or large groups of affected Rating Units; and

6. What rates instalment/s the remission will apply to; and

7. Whether the remission amount is either a fixed amount, percentage, and/or maximum amount to be remitted for each qualifying Rating Unit.

Explanation

The specific response and criteria will be set out by Council resolution linking the response to specific Significant Extraordinary Circumstances. The criteria may apply a remission broadly to all Rating Units or to specific groups or to Rating Units that meet specific criteria such as proven Financial Hardship, a percentage of income lost or some other criteria as determined by council and incorporated in a council resolution.

Council will indicate a budget to cover the value of remissions to be granted under this policy in any specific financial year.

The types of remission that may be applied under this policy include:

· The remission of a fixed amount per Rating Unit either across the board or targeted to specific groups such as:

o A fixed amount per residential Rating Unit

o A fixed amount per commercial Rating Unit

Policy Review

This policy will be reviewed at least once every three years.

Document History

|

Version |

Reviewer |

Change Detail |

Date |

|

2.0.0 |

Caroline Thomson |

Updated and approved by Council with LTP |

29 June 2018 |

|

3.0.0 |

Caroline Thomson |

Updated in conjunction with 2019-20 Annual Plan |

4 June 2019 |

|

4.0.0 |

|

Updated in conjunction with 2020-21 Annual Plan |

|

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

921741 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager |

6.1 Purpose of Report

Triennial review of Investment Policy including any proposed amendments.

|

That Council: a. Adopt the current Investment Policy without amendment. |

The Investment Policy must be reviewed at least once every three years. The last review was conducted in June 2018. The current review has been prompted as part of a wider project to assess the viability of Council becoming a member of the Local Government Funding Agency (LGFA).

6.3 Issues

The Investment Policy has been reviewed to ensure that it contains provisions for Napier City Council to hold bonds, commercial paper and shares issued by the LGFA – this is a condition of membership.

Provisions to hold investments issued by the LGFA were made in prior Investment Policy reviews. No further amendments are required as part of this review.

6.4 Significance and Engagement

N/A

6.5 Implications

Financial

Napier City Council may need to borrow in the 2020/21 financial year to meet anticipated costs. If provisions aren’t included to hold LGFA investments, then other channels will need to be explored to source funding.

Social & Policy

N/A

Risk

N/A

6.6 Options

The options available to Council are as follows:

a. Adopt the Investment Policy in its current form.

b. Reject the Investment Policy in its current form.

6.7 Development of Preferred Option

N/A

a Investment Policy ⇩

|

Extraordinary Meeting of Council - 21 May 2020 - Attachments

|

Item 6 Attachments a |

|

Investment Policy |

|||

|

Approved by |

Council |

||

|

Department |

Finance |

||

|

Original Approval Date |

30 June 2015 |

Review Approval Date |

29 June 2018 |

|

Next Review Deadline |

30 June 2021 |

Document ID |

346412 |

|

Relevant Legislation |

Section 102(1) of the Local Government Act 2002 |

||

|

NCC Documents Referenced |

NCC Long Term Plan 2015-2025, wording below was reviewed between March and May 2018, and published in the Long Term Plan 2018-2028 |

||

Purpose

The Investment Policy is adopted under Section 102(1) of the Local Government Act 2002 and must state the local authority’s policies in respect of investments.

Policy

Council generally holds investments for strategic reasons where there is some community, social, physical or economic benefit accruing from the investment activity. Generating a commercial return on strategic investments is considered a secondary objective. Investments and associated risks are monitored and managed, and regularly reported to Council in accordance with the relevant sections of the Council’s Treasury Management Manual.

In its investment activities Council is guided by the Trustee Act of 1956. When acting as a trustee or investing money on behalf of others, the Trustee Act highlights that trustees have a duty to invest prudently and that they shall exercise care, diligence and skill that a prudent person of business would exercise in managing the affairs of others.

Council is a risk-averse entity and does not wish to incur additional risk from its treasury activities. Its broad objectives in relation to treasury activity are to manage all of Council’s investments within its strategic, financial and commercial objectives and optimise returns within these objectives, manage the overall cash position of Council’s operations to meet known and reasonable unforeseen funding requirements, and invest surplus cash and the financial investment portfolio in liquid securities and strongly credit-rated counterparties.

Staff seek to develop and maintain professional relationships with Council’s bankers, financial market participants and other stakeholders.

Acquisitions of New Investments

With the exception of treasury investments, new investments are acquired if an opportunity arises and approval is given by the appropriate Council committee, based on advice and recommendations from Council officers. Before approving any new investments, Council gives due consideration to the contribution the investment will make in fulfilling Council’s strategic objectives, and the financial risks of owning the investment.

The authority to acquire treasury investments is delegated to the Director Corporate Services.

Mix of Investments

Council maintains investments in the following mix of investments:

Equity Investments

Equity Investments are held for various strategic, economic development and financial objectives, as outlined in the Long Term Plan (LTP.) Council Equity Investments include interests in the Hawke's Bay Airport Authority and Omarunui Landfill Operation, and may include other Council Controlled Organisations (CCOs). Council may also make advances to CCOs.

Council seeks to achieve an acceptable rate of return on all its equity investments, consistent with the nature of the investment and Council’s stated philosophy on investments.

Council reviews the performance of these investments on a regular basis to ensure strategic and economic objectives are being achieved. Any disposition of these investments requires Council approval. Dividends received and proceeds from the disposition of equity investments are used to repay debt, to invest in new assets or investments or any other purpose that is considered appropriate by Council.

New Zealand Local Government Funding Agency Limited (LGFA)

Council may invest in shares and other financial instruments of the LGFA, and may borrow to fund that investment.

Council’s objective in making any such investment will be to:

· Obtain a return on the investment.

· Ensure that the LGFA has sufficient capital to remain viable, meaning that it continues as a source of investment and/or debt funding for the Council.

Council may invest in LGFA bonds and commercial paper as part of its financial investment portfolio.

As a borrower, Council’s investment is recognised through shares and borrower notes. As an investor in LGFA shares and as a Guarantor, Council subscribes for uncalled capital in the LGFA.

Property Investments