Extraordinary Meeting of Council

Open Agenda

|

Meeting Date:

|

Wednesday 12 August 2020

Thursday 13 August 2020

|

|

Time:

|

9.00am

|

|

Venue:

|

Large Exhibition Hall

War Memorial Centre

Marine Parade

Napier

|

|

Council Members

|

Mayor Wise, Deputy Mayor Brosnan, Councillors Boag,

Browne, Chrystal, Crown, Mawson, McGrath, Price, Simpson, Tapine, Taylor,

Wright

|

|

Officer Responsible

|

Interim Chief Executive

|

|

Administrator

|

Governance Team

|

|

|

Next Ordinary Council Meeting

Thursday 27 August 2020

|

Extraordinary

Meeting of Council - 12 August 2020 - Open Agenda

ORDER OF BUSINESS

Apologies

Nil

Conflicts of interest

Agenda items

1 Submissions

on the Rates Remmission Policy and Rates Postponement Policy, and Proposal to

join the Local Government Funding Agency.................................................................................. 3

2 Submissions

on the Annual Plan 2020/21 Consultation Document.... 53

Extraordinary

Meeting of Council - 12 August 2020 - Open Agenda Item

1

Agenda Items

1. Submissions

on the Rates Remmission Policy and Rates Postponement Policy, and Proposal to

join the Local Government Funding Agency

|

Type of Report:

|

Legal and Operational

|

|

Legal Reference:

|

Local Government Act 2002

|

|

Document ID:

|

949321

|

|

Reporting Officer/s & Unit:

|

Garry Hrustinsky, Investment and Funding Manager

|

1.1 Purpose of Report

To present the submissions received

on consultation documents relating to the Rates Remission Policy, Rates

Postponement Policy, and proposal to join the Local Government Funding Agency.

|

Officer’s

Recommendation

That

Council:

a. Adopt

the amended Rates Remission Policy.

b. Adopt

the amended Rates Postponement Policy.

c. Adopt

the proposal for Napier City Council to join the Local Government Funding

Agency as an unrated guaranteeing local authority.

|

1.2 Background

Summary

On the 11th of June

Council adopted the amended Rates Remission Policy, amended Rates Postponement

Policy and Statement of Proposal to join the Local Government Funding Agency

(LGFA) to be consulted on with Napier residents.

As outlined at the 11th

of June Council meeting, any change to the Rates Remission Policy and Rates

Postponement Policy, and the proposal to join the LGFA require Council to

follow the principles of consultation as outlined in section 82 of the Local

Government Act 2002. Any consultation to these policies and proposal is

separate to, but can be undertaken in conjunction with, consultation on the

Annual Plan.

In parallel with the consultation

on the Annual Plan, officers consulted on the proposed Rates Remission Policy,

Rates Postponement Policy, and proposal to join the LGFA. Consultation was

conducted between the 18th of June and 16th of July.

Individual submissions are

provided in the attachments to this report.

Rates Remission Policy –

Community Feedback

Summary of feedback

Council received 5 submissions.

Submitters were asked whether they agreed with the proposed changes to the Rates

Remission policy. Submitters were provided with an opportunity to write a

comment. Of the 5 submitters,

· 80% -

agreed with proposed changes to the policy (one comment submitted)

· 0% -

disagreed with proposed changes to the policy.

· 20% - did

not answer the question (one comment submitted).

One respondent who agreed with

the amendment commented on the importance of fairness and common sense –

namely that there should be “…no financial disadvantages to other

ratepayers…”

One respondent who did not answer

the question was seeking information on the Government Rates Rebate Scheme.

Management information and

comment

Regarding fairness and common

sense, the amendments are intended to provide broader community support. It is

believed that support provided to those sections of the community that may be

disadvantaged by significant extraordinary events will ultimately benefit the

whole community.

A reply was made to the

respondent seeking information on the Government Rates Rebate Scheme on the 7th

of July. Information on the scheme was emailed to the respondent, followed by

an application form being mailed out.

Officer recommendation

That Council adopt the proposed

amendments to the Rates Remission Policy.

Rates Postponement Policy

– Community Feedback

Summary of feedback

Council received 7 submissions.

Submitters were asked whether they agreed with the proposed changes to the Rates

Postponement policy. Submitters were provided with an opportunity to write a

comment. Of the 7 submitters,

· 100% -

agreed with proposed changes to the policy (three comments submitted)

· 0% -

disagreed with proposed changes to the policy.

One respondent stated that they agreed

with the proposed policy.

One respondent was not clear with

their feedback and commented “I would have liked more information on how

many more officers and their level of seniority in the Council.”

One respondent challenged the

yearly increases in rates for older persons. In addition to challenging the

value for money from rates, it was questioned why rates keep increasing for the

same service.

Management information and

comment

Regarding information on officers

and their level of seniority in Council, it is uncertain as to the nature of

the question. If the respondent is enquiring about the officers involved in

managing any potential responses, this is an existing team of 5 officers within

the Rates Department. Applications for rates postponement are managed by this

department in the normal course of business. Other responsible officers are

specifically identified within the Postponement Policy.

Older persons having trouble

meeting their rates obligations may apply for a rates postponement for the

elderly. Information on the postponement can be found here https://www.napier.govt.nz/services/properties-and-rates/rates/postponement-and-remission/

In addition to ongoing operating

costs (which increase for the Council every year), there are a number of

capital works projects that require funding. Details on these projects can be

found here https://www.napier.govt.nz/napier/projects/

or refer to a detailed breakdown provided within the 2018-28 Long Term Plan.

With regards to relative

affordability of Napier City Council rates, according to the Ratepayers’

Report 2019 (www.ratepayersreport.nz),

Auckland ranked #1 ($3,387 average) as the most expensive rates in NZ. Napier

ranked #46 (Hastings ranked #36, $2,247 average) at $2,147 average of the 66

councils assessed. Southland District #64 was the cheapest recorded at $1,737

(the last two had no data supplied).

Officer recommendation

That Council adopt the proposed

amendments to the Rates Postponement Policy.

Proposal to join the Local

Government Funding Agency – Community Feedback

Summary of feedback

Council received 8 submissions.

Submitters were asked whether they agreed with the proposal to join the Local

Government Funding Agency as an unrated guaranteeing local authority.

Submitters were provided with an opportunity to write a comment. Of the 8

submitters,

· 100% -

agreed with proposal to join the Local Government Funding Agency (three

comments submitted)

· 0% -

disagreed with the proposal to join the Local Government Funding Agency.

Of the three responses received,

two generally agreed with joining. One respondent agreed with joining, but

questioned whether it may not be more astute to join as a shareholder given the

current economic environment and low interest rates – an annual dividend

could be expected by Napier City Council for the benefit of ratepayers.

Management information and

comment

The positive responses,

particularly about speeding up development of infrastructure and improvements

have been noted.

Regarding membership options,

Council has not excluded becoming a shareholder of the LGFA in the future. Whilst

any dividend from the LGFA would be shared with the community through a slight

reduction in rates, in this instance, shares would be purchased through

increased borrowing (geared investment). Given the uncertainty arising from

COVID-19, no guarantee of being paid a dividend in any given year, and the

drive by Council to reduce operating costs as much as possible, public

affordability was a greater consideration than potential return for the 2020/21

financial year.

Officer recommendation

That Council proceed with

application for membership of the Local Government Funding Agency as an unrated

guaranteeing local authority.

1.3 Issues

No issues.

1.4 Significance and Engagement

Policy amendments and application

to join the LGFA impact all ratepayers. Advertising with links to www.sayitnapier.nz was conducted prior to,

and during, the consultation period. Bodies with a special interest in LGFA

membership (NZCFI, LGFA, NZ Bankers Association and Westpac Bank) were

contacted directly.

1.5 Implications

Financial

Membership of the LGFA provides

Council with an avenue to meet forecast borrowing needs.

Social & Policy

Proposed policy amendments allow

Council to more effectively respond to significant extraordinary circumstances

and better serve the community in times of need.

Risk

N/A.

1.6 Options

The options available to Council

are as follows:

a. Approve the policies and proceed

with applying to join the Local Government Funding Agency as an unrated

guaranteeing local authority.

b. Amend the application to join

the Local Government Funding Agency based on public submissions.

1.7 Development of Preferred Option

Option A – approve the policies

and proceed with applying to join the Local Government Funding Agency as an

unrated guaranteeing local authority. There was no opposition to proposed

amendments or membership.

1.8 Attachments

a Rates

Remission Policy ⇩

b Rates

Postponement Policy ⇩

c Proposal to

join the LGFA ⇩

d Rates

Remission Policy Public Submissions ⇩

e Rates

Postponement Policy Public Submissions ⇩

f LGFA

Proposal Public Submissions ⇩

|

Extraordinary Meeting of

Council - 12 August 2020 - Attachments

|

Item 1

Attachments a

|

|

Rates

Remission Policy

|

|

Approved

by

|

Pending

Approval by Council

|

|

Department

|

Finance

|

|

Original

Approval Date

|

30

June 2019

|

Review

Approval Date

|

Pending

|

|

Next

Review Deadline

|

Pending

|

Document

ID

|

|

|

Relevant

Legislation

|

Local

Government Act 2002, Local Government (Rating) Act 2002

|

|

NCC

Documents Referenced

|

Published

in the Long Term Plan 2018-2028 which was reviewed between March/Apr 2018 and

adopted on 29-06-18

Reviewed

and amended as part of 2019/20 Annual Plan

Reviewed

and amended as part of 2020/21 Annual Plan

|

Purpose

To enable Council to remit all or part of

the rates on a rating unit under Section 85 of the Local Government (Rating)

Act 2002 where a Rates Remission Policy has been adopted and the conditions and

criteria in the policy are met.

Policy

1. Remission of Penalties

Objective

The objective of this part of the Rates

Remission Policy is to enable Council to act fairly and reasonably in its

consideration of rates which have not been received by the Council by the

penalty date due to circumstances outside the ratepayer’s control.

Conditions and Criteria

Penalties incurred will be automatically

remitted where Council has made an error which results in a penalty being

applied.

Remission of one penalty will be

considered in any one rating year where payment has been late due to

significant family disruption. This will apply in the case of death, illness,

or accident of a family member, at about the times rates are due.

Remission of the penalty will be

considered if the ratepayer forgets to make payment, claims a rates invoice was

not received, is able to provide evidence that their payment has gone astray in

the post, or the late payment has otherwise resulted from matters outside their

control. Each application will be considered on its merits and remission will

be granted where it is considered just and equitable to do so

Remission of a penalty will be considered

where sale has taken place very close to due date, resulting in confusion over

liability, and the notice of sale has been promptly filed, or where the

solicitor who acted in the sale for the owner acted promptly but made a mistake

(e.g. inadvertently provided the wrong name and address) and the owner cannot

be contacted. Each case shall be treated on its merits.

Penalties will also be remitted based on

the application, by officers, of Council criteria established after Council has

identified that Significant Extraordinary Circumstances have occurred that

warrants further leniency in relation to the enforcement of penalties that

would otherwise have been payable. The criteria to be applied will be set out

in a council resolution that will be linked to the specific Significant

Extraordinary Circumstances that have been identified by Council.

Penalties will also be remitted where

Council’s Chief Financial Officer considers a remission of the penalty,

on the most recent instalment, is appropriate as part of an arrangement to

collect outstanding rates from a ratepayer.

2. Remission for Residential Land in

Commercial or Industrial Areas

Objective

To ensure that owners of rating

units situated in commercial or industrial areas are not unduly penalised by

the zoning decisions of this Council and previous local authorities.

Conditions and Criteria

To qualify for remission under

this part of the policy the rating unit must:

· Be situated within an area of land that has

been zoned for commercial or industrial use. Ratepayers can determine where

their property has been zoned by inspecting the City of Napier District Plan,

copies of which are available from the Council office.

· Be listed as a ‘residential’

property for differential rating purposes. Ratepayers wishing to ascertain

whether their property is treated as a residential property may inspect the

Council’s rating information database at the Council office.

Rates will be automatically

remitted annually for those properties which had Special Rateable Values

applied under Section 24 of the Rating Valuations Act 1998 up to 30 June 2003,

and for which evidence from Council’s Valuation Service Provider

indicates that, with effect from the 2002 revaluation of Napier City, the land

value has been penalised by its zoning. The amount remitted will be the

difference between the rates calculated on the equivalent special rateable

value provided by the Valuation Service Provider and the rates payable on the

Rateable Value.

Other ratepayers wishing to

claim remission under this part of the policy must make an application in

writing addressed to the Chief Financial Officer.

The application for rates

remission must be made to the Council prior to the commencement of the rating

year. Applications received during a rating year will be applicable from the

commencement of the following rating year. Applications will not be backdated.

Where an application is

approved, the Council will direct its Valuation Service Provider to inspect the

rating unit and prepare a valuation that will treat the rating unit as if it

were a comparable rating unit elsewhere in the district. The ratepayer may be

asked to contribute to the cost of this valuation. Ratepayers should note that

the Valuation Service Provider’s decision is final as there are no

statutory right of objection or appeal for values done in this way.

3. Remission for Land Subject to Special Preservation Conditions

Objective

To preserve and encourage the

protection of land and improvements which are the subject of special

preservation conditions.

Conditions and Criteria

Rates remission under this Section of the

policy relates to land that is subject to:

· A heritage covenant under the Historic

Places Act 1993; or

· A heritage order under the Resource

Management Act 1991; or

· An open space covenant under the Queen

Elizabeth the Second National Trust Act 1977; or

· A protected private land agreement or

conservation covenant under the Reserves Act 1977; or

· Any other covenant or agreement entered

into by the owner of the land with a public body for the preservation of

existing features of land, or of buildings, where the conditions of the

covenant or agreement are registered against the title to the land and are

binding on subsequent owners of land.

Ratepayers who own Rating Units meeting

this criteria may qualify for remission under this part of the policy.

Rates will automatically be remitted

annually for those properties which had Special Rateable Values applied under

Section 27 of the Rating Valuations Act up to 30 June 2003, and which meet the

above criteria. The amount remitted will be the difference between the rates

calculated on the equivalent special rateable value provided by the Valuation

Service Provider and the rates payable on the Rateable Value.

Other ratepayers wishing to claim

remission under this part of the policy must apply in writing to the Council

office, and must provide supporting documentary evidence of the special

preservation conditions, e.g. copy of the Covenant, Order or other legal mechanism.

The application for rates remission must

be made to the Council prior to the commencement of the rating year.

Applications received during a rating year will be applicable from the

commencement of the following rating year.

Applications for remission under this part

of the policy will be approved by the Council. The Council may specify certain

conditions before remission will be granted. Applicants will be required to

agree in writing to these conditions and to pay any remitted rates if the

conditions are violated.

Where an application is approved, the

Council will direct its Valuation Service Provider to inspect the Rating Unit

and provide a special valuation. The ratepayer may be asked to contribute to

the cost of this valuation. Ratepayers should note that the Valuation Service

Provider’s decision is final as there is no statutory right of objection

or appeal for values done in this way.

The equivalent special rateable value will

be determined by the Valuation Service Provider on the assumption that:

· The actual use to which the land is being

put at the date of valuation will be continued; and

· Any improvements on the land will be

continued and maintained or replaced in order to enable the land to continue to

be so used.

It will be assessed taking into account

any restriction on the use that may be made of the land imposed by the

mandatory preservation of any existing tenements, hereditaments, trees,

buildings, other improvements, and features.

4. Remission of Uniform Annual General Charges (UAGC) and Targeted Rates of

a Fixed Amount on Rating Units Owned by the Same Owner

Objective

To provide for relief from UAGC and

Targeted Rates of a fixed amount per Rating Unit or Separately Used or

Inhabited Parts of a Rating Unit, where two or more Rating Units are owned by

the same person or persons, and are:

· part of a subdivision plan which has been

deposited for separate lots, or separate legal titles exist; or

· but the Rating Units may not necessarily be

used jointly as a single unit, and each Rating Unit does not benefit separately

from the services related to the UAGC and Targeted Rates.

Conditions and Criteria

Remission of UAGC and Targeted Rates of a

fixed amount applies in the following situations:

· Unsold subdivided land, where as a result

of the High Court decision of 20 November 2000 ‘Neil Construction and

others vs. North Shore City Council and others’, each separate lot or

title is treated as a separate Rating Unit, and such land is implied to be not

used as a single unit.

All remissions under this part of the

policy will be approved by the Chief Financial Officer.

5. Remission for Water Rates (by meter)

Objective

To provide ratepayers with a measure of

relief by way of partial rates remission where, as a result of the existence of

a water leak on the Rating Unit which they occupy the payment of fuller rates

is inequitable, or where officers are convinced that there are errors in the

data relating to water usage.

Conditions

and Criteria

· The existence of a significant leak on the occupied

Rating Unit has been established and there is evidence that steps have been

taken to repair the leak as soon as possible after the detection, or officers

have reviewed the usage data and are convinced that the usage readings are so

abnormal as to require adjustment.

· The Council or its delegated officer(s) as determined

from time to time and set out in the Council’s delegations register shall

determine the extent of any remission based on the merits of each situation.

6. Remission to smooth the effects of change in rates on individual or

groups of properties

Objective

To enable Council to provide rates

remission where, as a result of a change in Council policy or other change that

results in a significant increase in rates, Council decides it is equitable to

smooth or temporarily reduce the impacts of the change by reducing the amount

payable.

Conditions and Criteria

· Remission of part of the value based rates to enable

the impact of a change in rates to be phased in over a period of no more than 3

years.

To continue with any existing rates

adjustment where, due to change in process, policy or legislation Council

considers it equitable to do so subject to a maximum limit of 3 years to a

remission made under this clause in the policy.

7. Remission for Special Circumstances

Objective

To enable Council to provide rates

remission for special and unforeseen circumstances, where it considers relief

by way of rates remission is justified in the circumstances.

Conditions and Criteria

Applications for rates remission must be

made in writing by the ratepayer or their authorised agent.

Each circumstance will be considered by

Council on a case by case basis. Where necessary, Council consideration and

decision will be made in the Public Excluded part of a Council meeting.

The terms and conditions of remission will

be decided by Council on a case by case basis. The applicant will be advised in

writing of the outcome of the application.

8. Remission of Rates in Response to Significant Extraordinary Circumstances

being identified by Council.

Objective

To enable Council to provide rates

remission to assist ratepayers in response to Significant Extraordinary

Circumstances impacting Napier’s ratepayers.

Definitions

Financial Hardship: for the purpose of

this provision is defined as the inability of a person, after seeking recourse

from Government benefits or applicable relief packages, to reasonably meet the

cost of goods, services and financial obligations that are considered necessary

according to New Zealand standards. In the case of a ratepayer who is not a

natural person, it is the inability, after seeking recourse from Government

benefits or applicable relief packages, to reasonably meet the cost of goods,

services and financial obligations that are considered essential to the functioning

of that entity according to New Zealand standards.

Conditions and Criteria

For this policy to apply Council must

first have identified that there have been Significant Extraordinary

Circumstances affecting the ratepayers of Napier, that Council wishes to

respond to.

Once Significant Extraordinary

Circumstances have been identified by Council, the criteria and application

process (including an application form, if applicable), will be made available.

For a Rating Unit to receive a remission

under this policy it needs to be an “Affected Rating Unit” based on

an assessment performed by officers, following guidance provided through a

resolution of Council.

Council resolution will include:

1. That the resolution applies under the

Rates Remission Policy; and

2. Identification of the Significant

Extraordinary Circumstances triggering the policy (including both natural and

man-made events); and

3. How the Significant Extraordinary

Circumstances are expected to impact the community (e.g. financial hardship); and

4. The type of Rating Unit the remission

will apply to; and

5. Whether individual applications are

required or a broad based remission will be applied to all affected Rating

Units or large groups of affected Rating Units; and

6. What rates instalment/s the remission

will apply to; and

7. Whether the remission amount is either a

fixed amount, percentage, and/or maximum amount to be remitted for each

qualifying Rating Unit.

Explanation

The specific response and criteria will be

set out by Council resolution linking the response to specific Significant Extraordinary Circumstances. The criteria may apply a remission broadly to all

Rating Units or to specific groups or to Rating Units that meet specific

criteria such as proven Financial Hardship, a percentage of income lost or some

other criteria as determined by council and incorporated in a council

resolution.

Council will indicate a budget to cover

the value of remissions to be granted under this policy in any specific

financial year.

The types of remission that may be applied

under this policy include:

· The remission of a fixed amount per Rating Unit either

across the board or targeted to specific groups such as:

o A fixed amount per residential Rating Unit

o A fixed amount per commercial Rating Unit

Policy Review

This policy will be reviewed at least once

every three years.

Document History

|

Version

|

Reviewer

|

Change Detail

|

Date

|

|

2.0.0

|

Caroline Thomson

|

Updated and approved by

Council with LTP

|

29 June 2018

|

|

3.0.0

|

Caroline Thomson

|

Updated in conjunction with

2019-20 Annual Plan

|

4 June 2019

|

|

4.0.0

|

|

Updated in conjunction with

2020-21 Annual Plan

|

|

|

Extraordinary Meeting of Council - 12 August 2020 - Attachments

|

Item 1

Attachments b

|

|

Rates Postponement Policy

|

|

Approved By

|

Pending Approval by Council

|

|

Department

|

Finance

|

|

Original Approval Date

|

29 June 2018

|

Review Approval Date

|

Pending

|

|

Next Review Deadline

|

Pending

|

Document ID

|

346038

|

|

Relevant Legislation

|

Local Government (Rating) Act 2002

Local Government Act 2002

Income Tax Act 2007

|

|

NCC Documents Referenced

|

Published in the Long Term Plan

2018-2028 which was reviewed between March/April 2018 and adopted on 29-06-18

Reviewed and amended in response to

COVID-19

Rating – Delegations under

Local Government (Rating) Act 2002

|

Purpose

To enable Council to postpone the requirement to pay all or part of the

rates on a Rating Unit under Section 87 of the Local Government (Rating) Act 2002

where a rates postponement policy has been adopted and the conditions and

criteria in the policy are met.

Policy

Postponement

for Farmland

Objective

To support the District Plan by encouraging owners of farmland around

urban areas to refrain from subdividing their land for residential purposes.

Conditions

and Criteria

To initially qualify, or continue qualifying, for postponement of rates

under this policy the Rating Unit must be classified, or continue to be

classified, as farmland for differential purposes (ratepayers wishing to

ascertain their classification are welcome to inspect the Council’s

rating information database at the Council office).

Rates postponement will continue to apply on those properties that were

subject at 30 June 2003 to postponement under Section 22 of the Rating

Valuations Act 1998. Other rural ratepayers wishing to take advantage of this

part of the policy must make application in writing, addressed to the Director

Corporate Services. The application for postponement must be made to the

Council prior to the commencement of the rating year. Applications received

during a rating year will be applicable from the commencement of the following

rating year. Applications will not be backdated.

For properties currently subject to rates postponement and for new

applications approved, Council will postpone the difference between rates

payable on the equivalent Rates Postponement Value advised by its Valuation

Service Provider and rates payable on the Rateable Value of the land each year.

The Council may charge an annual fee on postponed rates for the period

between the due date and the date they are paid. This fee is designed to cover

the Council’s administrative and financial costs and may vary from year

to year. The amount of the fee is included in Council’s Schedule of Fees

and Charges.

If the Rating Unit is subdivided then postponed rates and any

accumulated fees will be payable. The ratepayer will be required to sign an

agreement acknowledging this. Postponed rates will be registered as a charge

against the land (i.e. in the event that the property is sold the Council has

first call against any of the proceeds of that sale). Again, the ratepayer will

be required to sign an agreement acknowledging this.

Authority to approve applications will be delegated by Council to the

Director of Corporate Services, Chief Financial Officer and Investment and

Funding Manager.

Postponement

for Older Persons

Objective

The objective of this part of the policy is to assist ratepayers who

are Older Persons with a fixed level of income to meet rates particularly, but

not exclusively, resulting from increasing levels of rates.

Definition

Older Persons are those who are old enough to qualify to receive NZ

Superannuation.

For the purpose of this provision, Financial Hardship is defined as the

inability of a person, to reasonably meet the cost of goods, services and

financial obligations that are considered necessary according to New Zealand

standards.

Conditions

and Criteria

Postponement will only apply to Older Persons on a fixed income.

Only Rating Units used solely for residential purposes will be eligible

for consideration for rates postponement under this policy.

Only the person entered as the ratepayer, or their authorised agent,

may make an application for rates postponement for Financial Hardship. The

ratepayer must be the occupant and current owner of the Rating Unit which is

the subject of the application. The person entered on the Council’s

rating information database as the ‘ratepayer’ must not own any

other Rating Units or investment properties (whether in the district or

elsewhere).

The ratepayer (or authorised agent) must make an application to Council

on the prescribed form (copies can be obtained from the Council Office).

The Council will consider, on a case by case basis, all applications

received that meet the criteria outlined under this section. The following

factors will be considered – age, income source and level, annual rates

payable, period of postponement, equity in the property owned, and the amount

of rates postponed.

Authority to approve applications will be delegated by Council to the

Director of Corporate Services, Chief Financial Officer and Investment and

Funding Manager.

Applicants seeking rates postponement will be encouraged to seek

independent advice before formally accepting any offer for postponement made by

the Council.

As a general rule postponement will not apply to the first $500 per

annum of the rate account after any rates rebate has been deducted.

Where the Council decides to postpone rates the ratepayer must first

make acceptable arrangements (e.g. by setting up a system to meet agreed

minimum regular payments) for payments required under the terms of the

postponement approval for the current rating year, and future payment years.

Postponement will only apply on properties on which houses have been

insured. Annual proof may be required that insurance has been maintained.

Where rates postponement is approved for a property with an outstanding

mortgage, the mortgagee will be advised by Council that rates postponement has

been granted by the Council.

Any postponed rates will be postponed until:

The death of the ratepayer(s); or

· Until the

ratepayer(s) ceases to be either the owner or occupier of the Rating Unit; or

· Until a date

specified by the Council.

The Council will charge an annual postponement fee. The annual

postponement fee will cover Council’s administrative costs including

finance costs. The finance cost will be charged at the average return on

investments rate for Council for that year.

All postponement fees payable (including finance costs) will be added

to the amount of postponed rates annually and be paid at the time postponed

rates are paid.

The policy will apply from the beginning of the rating year in which

the application is made although the Council may consider backdating past the

rating year in which the application is made depending on the circumstances.

The postponed rates, inclusive of any accumulated postponement fees, or

any part thereof may be paid at any time. The applicant may elect to postpone

the payment of a lesser sum than that which they would be entitled to have

postponed pursuant to this policy.

Postponed rates will be registered as a statutory land charge on the

Rating Unit title. This means that the Council will have first call on the

proceeds of any revenue from the sale or lease of the Rating Unit. In addition

to the annual fee and interest, Council will charge any other costs or one-off

fees incurred in relation to registration of the postponement as part of the

postponement.

This policy will not affect any rates postponement provisions approved

prior to 1 July 2009, which will continue to apply in accordance with the

conditions related to each case.

This policy does not apply to non-Older Person ratepayers experiencing

financial hardship.

Council will assist in the referral of any other ratepayer on a fixed

income facing long term financial hardship to the appropriate agency.

Postponement

for Significant Extraordinary Circumstances

Objective

To provide a rates postponement to ratepayers experiencing financial

hardship directly resulting from Significant Extraordinary Circumstances that

affects their ability to pay rates.

For the purpose of this policy the following definitions will apply:

· Significant

Extraordinary Circumstances: as defined by Council resolution. Significant

Extraordinary Circumstances may be natural or economic in nature, and will

identify the type and location of properties affected.

· Financial

Hardship: for the purpose of this provision is defined as the inability of

a person, after seeking recourse from Government benefits or applicable relief

packages, to reasonably meet the cost of goods, services and financial

obligations that are considered necessary according to New Zealand standards.

In the case of a ratepayer who is not a natural person, it is the inability,

after seeking recourse from Government benefits or applicable relief packages,

to reasonably meet the cost of goods, services and financial obligations that

are considered essential to the functioning of that entity according to New

Zealand standards.

· Small

Business: a business operated by a small business person, small partnership

or close company as defined in section YA 1 of the Income Tax Act 2007.

Conditions

and Criteria

This part of the policy will only apply to Rating Units used for

residential purposes or by Small Businesses.

Once Significant Extraordinary Circumstances have been identified by

Council, the criteria and application process (including an application form,

if applicable), will be made available. Council may set a timeframe for the

event. Council may review the criteria and/or timeframe of Significant

Extraordinary Circumstances through subsequent resolutions.

Council resolution will include:

a. that

the resolution applies under the Rates Postponement Policy; and

b. the

Significant Extraordinary Circumstances triggering the policy (e.g. including,

but not limited to, flood, pandemic, earthquake); and

c. how

the Significant Extraordinary Circumstances are expected to impact the

community (e.g. hardship); and

d. the

types or location of properties effected by the Significant Extraordinary

Circumstances; and

e. timeframe

for postponement in relation to the Significant Extraordinary Circumstances.

No application for postponement can be made under this policy unless

Significant Extraordinary Circumstances have been identified by Council.

Any requests for rates postponement for Rating Units with a land value

greater than $1.5m will be decided upon at the discretion of Council and

requests for rate postponement for Rating Units with a land value less than

$1.5m will be delegated to Council officers.

The ratepayer must demonstrate, to the Council’s satisfaction

that paying the rates would result in Financial Hardship.

The applicant must demonstrate to Council’s satisfaction that the

ratepayer has taken all necessary steps to claim any central government

benefits or allowances the ratepayer is properly entitled to receive that

would assist the ratepayer to meet their financial commitments. Evidence such

as official correspondence must be provided with the application.

Council will consider applications where the same ratepayer is liable

for rates for multiple Rating Units. In such instances, Council will look at

the collective impact to the ratepayer.

Only the person/s entered as the ratepayer (in the case of a close

company every director must sign the application form), or their authorised

agent, may make an application for rates postponement for Significant

Extraordinary Circumstances that resulted in Financial Hardship. However, where

the ratepayer is not the owner of the Rating Unit, the owner must also provide

written approval of the application.

The ratepayer must be the current ratepayer for the Rating Unit at the

time Significant Extraordinary Circumstances are identified by Council.

Where the Council decides to postpone rates the ratepayer must make

acceptable arrangements for payment of rates, for example by setting up a

system for regular payments. Such arrangements will be based on the

circumstances of each case.

Council may charge a fee on postponed rates for the period between the

due date and the date they are paid. This fee is designed to cover

Council’s administrative and financial costs. The fees will be set as

part of the Council resolution identifying Significant Extraordinary

Circumstances.

Postponed rates will remain postponed until the earlier of:

a. The

ratepayer/s ceases to be the owner or occupier of the Rating Unit; or

b. A

date specified by Council in the Council resolution identifying Significant

Extraordinary Circumstances.

Postponement

for Special Circumstances

Objective

To enable Council to provide rates postponement for special and

unforeseen circumstances, where it considers relief by way of rates

postponement is justified in the circumstances.

Conditions

and Criteria

Application for rates postponement must be made in writing by the

ratepayer or their authorised agent.

Each circumstance will be considered by Council on a case by case

basis. Where necessary, Council consideration and decision will be made in the

Public Excluded part of a Council meeting.

The terms and conditions of postponement including any application of

an annual fee will be decided by Council on a case by case basis.

The applicant will be advised in writing of the outcome of the

application.

Policy

Review

This policy will be reviewed at least once every three years.

Document

History

|

Version

|

Reviewer

|

Change Detail

|

Date

|

|

2.0.0

|

Caroline Thompson

|

Updated and approved by Council

|

29 June 2018

|

|

3.0.0

|

|

Updated and approved by Council

|

|

|

Extraordinary Meeting of Council - 12 August 2020 - Attachments

|

Item 1

Attachments c

|

Statement of Proposal

To join the

Local Government Funding Agency

Key Dates

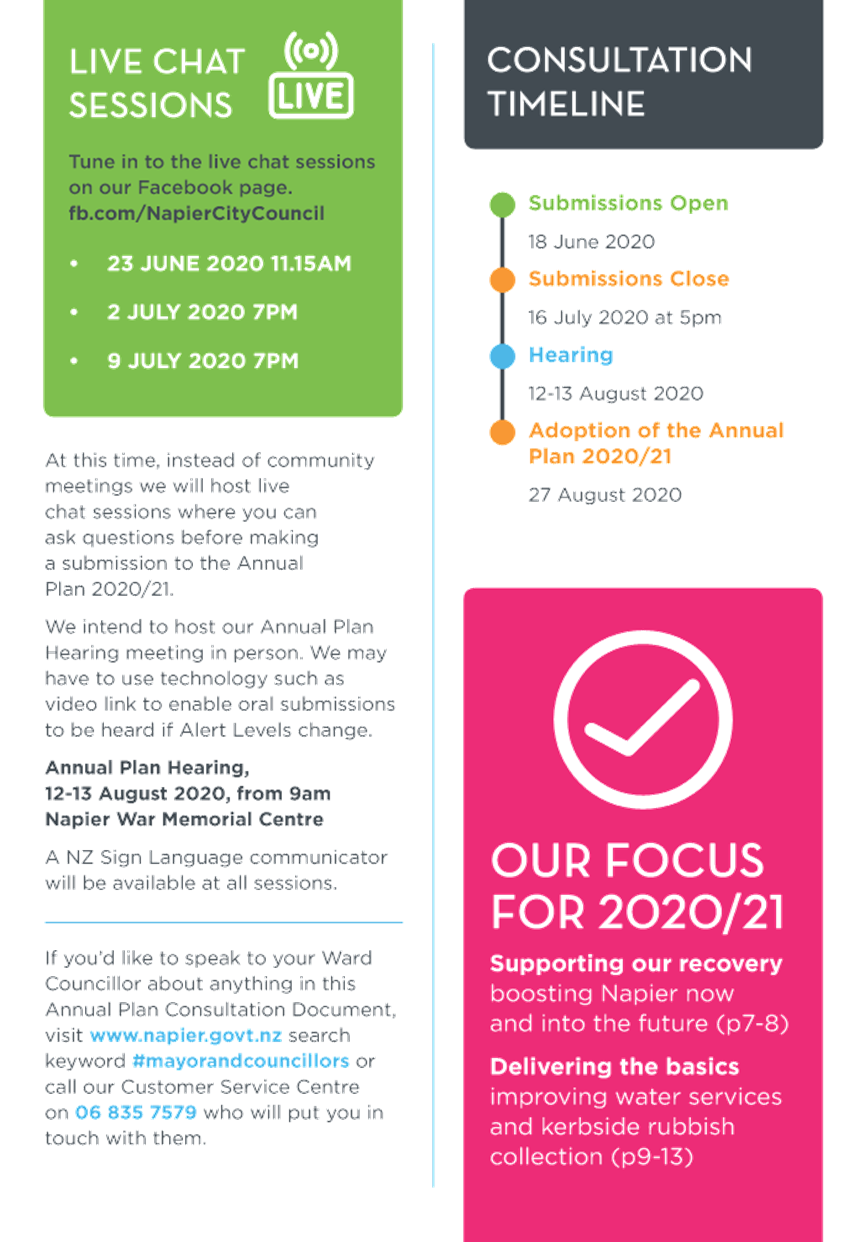

Consultation opens: 18 June 2020

Consultation closes: 15 July at 12noon

Hearings and deliberations: 12-13 August

2020, from 9AM, Napier War Memorial Centre

Adoption: 27 August 2020

Where can I get more

information?

· Visit

Council’s websites at www.napier.govt.nz and www.sayitnapier.nz

· Tune in to

the live chat sessions on our Facebook page at fb.com/NapierCityCouncil

These are scheduled for: 23 June 2020 11.15am; 2 July 2020 7pm;

9 July 2020 7pm

· If

you’d like to speak to your Ward Councillor, visit www.napier.govt.nz

search keyword #mayorandcouncillors or call our Customer Service Centre

on 06 835 7579 who will put you in touch with them.

Application to join the

Local Government Funding Agency

Introduction

Napier City Council is considering participating as an “Unrated

Guaranteeing Borrower” in the

New Zealand Local Government Funding Agency Limited (LGFA) scheme.

The LGFA scheme was set-up in 2011 by a group of local authorities and

the Crown to enable local authorities to borrow at lower interest margins than

would otherwise be available. The LGFA scheme is recognised in legislation,

which modifies the effect of some statutory provisions and allows the scheme to

provide lower cost lending than would otherwise be the case. Currently 54 of

the 78 local authorities in NZ participate in the LGFA scheme.

Under the scheme, all participating local authorities are able to

borrow from the LGFA, but different benefits apply depending on the level of

participation. Napier City Council intends to participate as an Unrated

Guaranteeing Borrower.

Being a member of the LGFA, Napier City Council has the option to

borrow, but is not bound to use the LGFA to do so.

An Information Memorandum, describing the arrangement in detail, is

attached as Appendix A, and forms part of this proposal. A number of terms that

are used in this proposal are defined in that Information Memorandum.

Statutory Considerations

Section 56 of the Local Government Act 2002 (LGA 2002) requires that a

local authority must carry out a consultation process before acquiring shares

in a Council-Controlled Organisation (CCO). The LGFA is a CCO and there are

circumstances in which, under the LGFA scheme, shares in the LGFA may be issued

to participants in the scheme.

Consequently, it is prudent for a local authority to carry out a

consultation process before joining the scheme.

Analysis of Reasonably

Practicable Options

Part C of the Information Memorandum sets out an analysis of the costs

and benefits of participating in the LGFA Scheme. A summary of those costs and

benefits and a brief rationale based on consideration of the Council’s

specific circumstances is set out below.

|

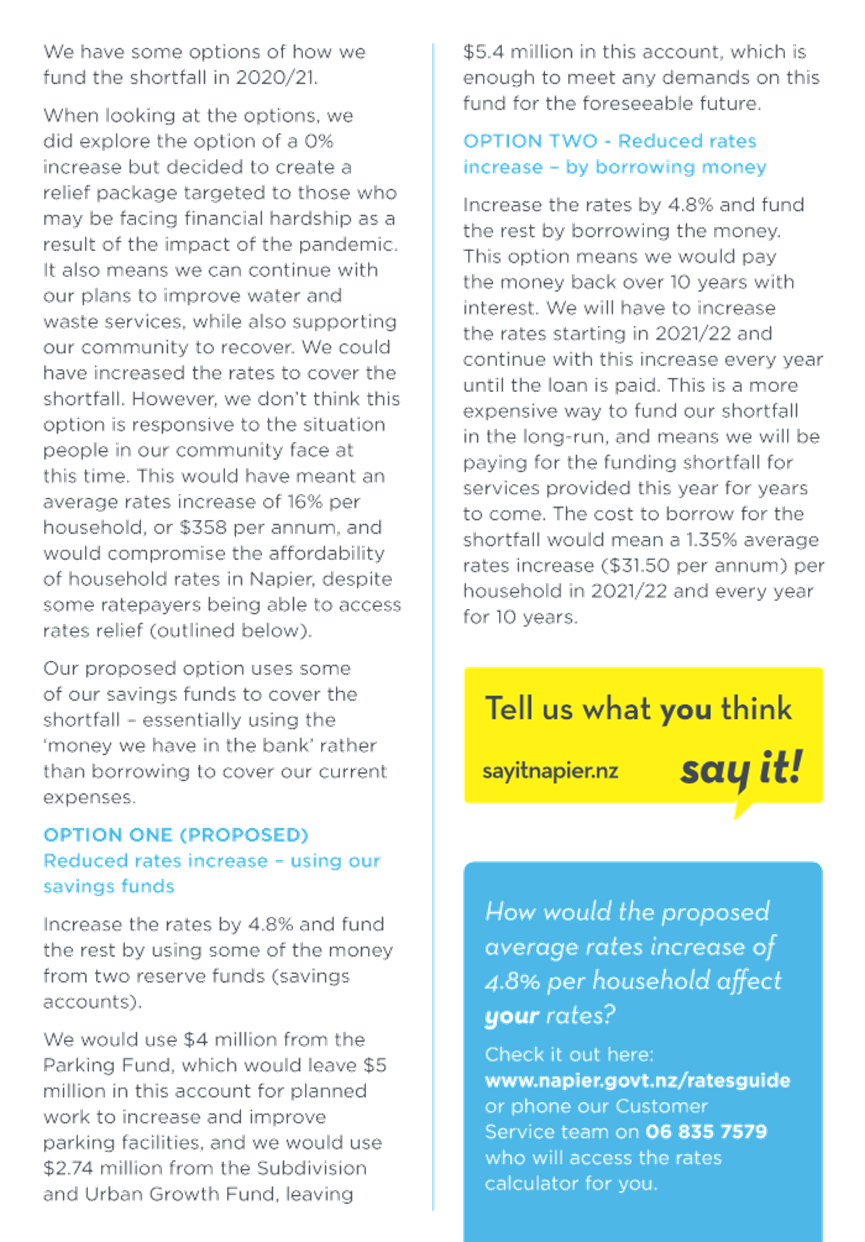

Options – LGFA

|

Additional Spend

|

Impact on Rates

|

Impact on Debt

|

|

1) No change. Not join the

LGFA. No other institutions are approached for lending.

|

$0

|

Rates will need to be increased

to fund revenue lost due to the pandemic.

|

No debt

|

|

2) Not join the LGFA.

Borrowing sourced from an approved lending institution.

|

Between $3,500 and $5,000

per $1m per annum to ensure facility is available. Approximately 1.7%pa for

any utilised facility.

|

No impact on rates

|

Debt will increase by the

amount borrowed (estimated at $33m total).

|

|

3) Join the LGFA as a

non-guaranteeing local authority. This allows NCC to borrow up to $20m

through the LGFA.

|

Associated legal fees.

Ongoing trustee fees.

|

Potential reduced rates due

to savings in facility and interest rate costs.

|

Debt will increase by the

amount borrowed (up to $20m with LGFA and any balance sourced from an

approved lending institution).

|

|

4) Join the LGFA as an

unrated guaranteeing local authority. This allows NCC to borrow more than

$20m, but with higher risk.

|

Associated legal fees.

Ongoing trustee fees.

|

Potential reduced rates due

to savings in facility and interest rate costs.

|

Debt will increase by the

amount borrowed (estimated at $33m total).

|

|

5) Join the LGFA as a

principal shareholding local authority. This allows NCC to both borrow more

than $20m and invest in LGFA shares, but with higher risk than option 4.

|

Associated legal fees.

Ongoing trustee fees.

The cost of any shares

purchased.

|

Potential reduced rates due

to savings in facility and interest rate costs.

A modest return may be

received from shares held in the LGFA. It is likely that any share purchase

would be debt-funded.

|

Debt will increase by the

amount borrowed (estimated at $33m total) plus the cost of any shares

purchased.

|

Our preferred option is Option 4 – join the LGFA as an unrated

guaranteeing local authority.

Rationale

To date Napier has been in the fortunate position

of not needing to borrow. However, ongoing demand from operational and capital

costs combined with the impact of the COVID-19 pandemic has led to Council

budgeting a $33 million shortfall over the next 12 months.

The benefits of lower interest margins are

significant.

Based on a comparison of borrowing available from

approved lending institutions, Council anticipates interest savings of

approximately $7,900 or 0.79% for every $1 million of debt[1]. At an anticipated peak debt

level of $33 million this equates to approximately $260,700 per annum.

If Council was to join as a non-Guaranteeing Local

Authority (option 3 on page 3) there would be a $20m limit in its total

borrowing capacity.

There are one-off up-front legal costs associated

with joining the LGFA of approximately $26,000 and annual ongoing trustee fees

of approximately $8,000. There are no LGFA fees (either up front or ongoing).

Council believes that the benefit of these savings outweigh the costs referred

to in the cost/benefit analysis in Part C of the Information Memorandum. There

is a low risk to Council by joining LGFA as a guarantor. This is discussed in

the Information Memorandum, Appendix, Part A paragraphs 24 to 31.

As a Guaranteeing Local Authority, Napier City

Council would be guaranteeing LGFA’s obligations to its creditors and not

the obligations of individual councils. There has never been a default by a New

Zealand local authority and there is strong oversight of the sector. The LGFA is

also well-capitalised. The lending undertaken by LGFA to local authorities is

with a security charge over rates.

Should the Council

participate in the LGFA Scheme as a Guaranteeing Local Authority?

Council is proposing to join the LGFA Scheme as a

Guaranteeing Local Authority, which

• will cost Council an estimated $26,000 in

legal fees and an estimated $8,000 per year ongoing trustee fees,

• will save Council $7,900 in interest for

every $1m of debt (potentially $260,700 per annum),

• does not restrict borrowing to $20m.

How do I have my say?

Online: sayitnapier.nz

In person:

Drop in your form to our Customer Service Centre at:

Dunvegan

House

215

Hastings Street

Napier

By post:

LGFA Application

Napier City Council

Private Bag 6010

Napier 4142

Feedback will need to get back to us by 15 July

at 12noon.

Information Memorandum

PART A – INTRODUCTION AND PURPOSE

Purpose of Information Memorandum

1. This

Information Memorandum provides a description of a funding structure for local

authorities (LGFA Scheme), which was designed to enable participating local

authorities (Participating Local Authorities) to borrow at lower interest margins than they would

otherwise pay.

2. The

purpose of this Information Memorandum is to provide information to supplement any consultation materials

prepared by local authorities consulting on whether to participate in the LGFA

Scheme.

3. This

Information Memorandum is divided into three

parts:

a) This Part A (Introduction and Purpose), which sets out the purpose

of the Information Memorandum and provides some background on the purpose of, and rationale for, the LGFA Scheme.

b) Part

B (How the LGFA Scheme Works), which sets out the characteristics of the LGFA

Scheme, and the transactions that Participating Local Authorities will be

entering into as part of their participation in the LGFA Scheme.

c) Part C (Local Authority Costs and Benefits), which sets out the costs and

benefits to individual local authorities of participating in the LGFA Scheme.

Origin of the LGFA Scheme

4. There

are a number of LGFA style schemes around the world, with the oldest in Denmark

(KommuneKredit founded in 1898). Global LGFA style schemes all utilise a

cross-guarantee structure by member councils similar to the structure of LGFA. There

has never been a call under the guarantee in any of these countries.

5. Local

Government Funding Agencies are vehicles that allow local governments to source

capital for operational purposes or capital projects. LGFAs typically operate

as a co-operative between members. The scheme allows members to source capital

more cheaply than if they sourced it alone.

6. Several

attempts to create a borrowing collective were made in the 1980s and 1990s in

New Zealand. Prompted by the Global Financial Crisis, a proposal made in 2009

received strong support. The LGFA Scheme was incorporated by a group of New Zealand local authorities

and the Crown on 1 December 2011.

At the time, Standard and Poor’s and Fitch both assigned LGFA a

preliminary domestic credit rating of AA+ (the same as the New Zealand

government).

7. The

development of the LGFA

involved:

a) undertaking a

detailed review and analysis of:

i) the then current borrowing

environment in which

New Zealand local authorities borrow; and

ii) centralised local authority debt vehicle structures

that have been developed offshore to successfully lower the cost of local authority

borrowing;

b) using

this review and analysis to develop a funding structure (the LGFA Scheme),

which was anticipated to deliver significant benefits to New Zealand local authorities;

c) confirming

with rating agencies that the proposed LGFA Scheme could achieve a high enough credit rating to deliver the

anticipated benefits;

d) obtaining formal

central government support

to facilitate establishment of the LGFA Scheme.

8. Currently there are 67 participating Council’s and at 23 April 2020 the LGFA has lent $10.8 billion to the local authority sector.

Rationale for LGFA Scheme

New Zealand Local Authority debt market

9. At the time the LGFA Scheme was developed, New Zealand

local authorities faced a number of debt related issues.

10. First, local

authorities had significant existing and forecast

debt requirements. Councils 2009-2019

long-term plans indicated that local authority

debt would double over the next five years to over $9 billion.

11. Secondly,

pricing, length of funding term and other terms and conditions varied

considerably across the sector and were less than optimal. This was due to:

a) Limited debt sources – Local authorities’ debt funding options were limited to the banks, private

placements and wholesale bonds (issuance to wholesale investors), and, to a lesser extent, retail bonds. Increasing

local authority sector funding

requirements and domestic

funding capacity constraints were likely to further negatively

impact pricing, terms and

conditions and flexibility of local

authority sector debt.

b) Fragmented

sector – There were 78 local authorities. Individually, a significant

proportion of these local authorities lacked scale – the 10 largest

accounted for ~68% of total sector borrowings.

The remaining 68 councils had 32% of sector borrowings.

c) Regulatory

restrictions – Offshore (foreign currency) capital markets were closed to

local authorities with the exception of Auckland Council and the compliance

process for local authority retail bond issuance was burdensome and generally restricted issuance to a six month

window.

Addressing the local authority debt issues

12. Each

of these issues needed to be addressed to rectify this situation. This was not

likely to happen without an intervention like the LGFA Scheme for the following reasons:

a) The

New Zealand debt markets (at least in the foreseeable future) were likely to

maintain the status quo.

b) Individually,

local authorities were not be able to attain significant scale.

c) At a sector

level it might have been possible to address the issue regarding regulation,

but regulators were likely to remain reluctant to significantly ease

restrictions on financial management across the sector without gaining

significant comfort as to the sophistication of the financial management of all

local authorities. Even if this issue was addressed by regulators, this change

alone would have been insufficient to provide a major step change.

13. The LGFA Scheme was developed because

of the homogenous nature of local

authorities; the large sector borrowing

requirements and the high credit quality / strong

security position (i.e. charge over rates) of local authorities. This created the opportunity for a centralised local authority debt vehicle to generate

significant benefits.

14. There

were numerous precedents globally of successful vehicles that pooled local

authority debt and funded themselves through issuing their own financial

instruments to investors. Such vehicles achieved success through:

a) “Credit rating

arbitrage” – Attaining

a credit rating

higher than that of the individual underlying assets (local authority borrowers) and therefore being able to borrow at lower margins.

b) “Economies of scale” –

By pooling debt the vehicles

could access a wider

range of debt sources and spread fixed operating costs,

thereby reducing the dollar cost per dollar of debt raised.

c) “Regulatory

arbitrage” – The vehicles could receive different regulatory

treatment than the underlying local authorities, improving their ability to

efficiently raise debt, e.g. through access to offshore foreign currency debt markets.

15. The

offshore precedents were typically owned by the local authorities in the

relevant jurisdiction (often with central government involvement), and that is

what was proposed here through the LGFA Scheme.

16. The

LGFA Scheme has now been successfully operating for eight years. It has exceeded the original lending and

profit targets that were forecast in 2011.

PART B – HOW THE LGFA SCHEME WORKS

Basic structure of the LGFA Scheme

17. The

basic structure of the LGFA Scheme is that a company has been established that

borrows funds and lends them on to local authorities at lower interest margins

than those local authorities would pay to other lenders.

New Zealand Local Government Funding Agency

Limited

18. The

company that lends to local authorities under the LGFA Scheme is called the New

Zealand Local Government Funding Agency Limited (LGFA). It is a limited

liability company, and its shares are held entirely by the Crown and by local authorities.

19. 20%

of the shares in the LGFA are held by the Crown and the remaining 80% by 30

individual local authorities. Thus the LGFA is a Council Controlled Trading

Organisation (CCTO).

20. The

LGFA was established solely for the purposes of the LGFA Scheme, and its

activities are limited to performing its function under the LGFA Scheme.

21. 30

local authorities (Principal Shareholding Local Authorities) hold those shares

that are not held by the Crown. The

Principal Shareholding Local Authorities contributed capital and, as

compensation for their capital contribution, receive a predetermined return on

this capital. However, the over-arching objective is that the benefits of the

LGFA Scheme are passed to local authorities as lower borrowing margins, rather

than being passed to shareholders as maximised profits.

Design to minimise default risk

22. One of the features

that is critical to the LGFA Scheme

delivering its benefit

to the sector is the achievement of a high credit rating for the LGFA. Currently

it is rated ‘AA+’ long term from Standard and Poor’s, which enables it to achieve

the credit rating arbitrage

referred to in paragraph 14(a).

Consequently there are a

number of features of the LGFA Scheme that are included to provide the protections for creditors that rating agencies

require before agreeing

to a high credit rating. These features are described in paragraphs 24 to 55

below.

23. Before

agreeing to a high credit rating, rating agencies will consider the risks of both

short term and long term default. Short term default is where a payment

obligation is not met on time. Long term default is where a payment obligation

is never met. In many cases short term

default will inevitably translate into long term default, but this is not

always the case – a short term default may be caused by a temporary

shortage of readily available cash.

Features of the LGFA Scheme designed to

reduce short term default risk

24. When a local authority borrows, the risk of short

term default, although

low, is probably significantly higher than its risk of long term default. In the long term it

can assess and collect sufficient rates revenue to cover almost any shortfall, but such revenue cannot

be collected quickly.

Consequently, there is a risk that

inadequate liability and revenue management could lead to temporary liquidity problems and short term default.

25. The

principal asset of the LGFA will be loans to participating local authorities,

so such temporary liquidity risks are effectively passed on to the LGFA.

Consequently, the rating agencies look for safeguards to ensure that liquidity

problems of a Participating Local Authority will not lead to a default by the LGFA.

26. There are two principal

safeguards that the LGFA has in place to manage short

term default (liquidity) risk:

a) It

holds cash and other liquid investments (investments which can be quickly

turned into cash). As at 23 April

2020 LGFA held $872 million of cash and liquid investments.

b) It

currently holds a $1 billion borrowing facility with central government that

allows it to borrow funds from central government if required.

27. It

is expected that these safeguards will sufficiently reduce any short term

default risk.

Features of the LGFA Scheme designed to reduce

long term default risk

28. There are a number

of safeguards that the LGFA has in place to manage long term

default risk, the most important

of which are set out below:

a) The

LGFA requires all local authorities that borrow from it to secure that borrowing with a charge over that

local authority’s rates and rates revenue (Rate Charge).

b) The LGFA

maintains a minimum capital adequacy ratio.

c) The Principal

Shareholding Local Authorities have subscribed for $20

million of uncalled capital in an equal proportions to their paid up equity contribution.

d) As

at 23 April 2020, 54 Participating Local Authorities (Guaranteeing Local Authorities) guarantee the obligations of

the LGFA.

e) Guaranteeing

Local Authorities commit to contributing additional equity to the LGFA if there

is an imminent risk that the LGFA will default.

f) The

LGFA hedges any exposure to interest rate and foreign currently fluctuations to

ensure that such fluctuations do not significantly affect its ability to meet its payment obligations.

g) The LGFA puts in place risk management policies

in relation to its

borrowing and lending designed to minimise its risk. For example, it imposes limits on the percentage of lending that is made to any one local authority to ensure that its credit

risk is suitably diversified.

h) The

LGFA ensures that its operations are run in a way that minimises operational risk.

i) Additional detail in relation to the features referred

to in paragraphs 28(a) to 28(e) is set out below.

Rates Charge

29. All

local authorities borrowing from the LGFA are required to secure that borrowing with a Rates Charge.

30. This is a powerful

form of security for the LGFA, because

it means that, if the relevant local authority defaults, a receiver appointed

by the LGFA can assess and collect sufficient rates in the relevant district

or region to recover the defaulted payments. Consequently, it significantly reduces

the risk of long term default by a local authority borrower.

31. From

a local authority’s point of view it is also advantageous, because, so

long as the local authority adheres to LGFA’s financial covenants, it is

entitled to conduct its affairs without any interference or restriction. This

contrasts with most security arrangements, which involve restrictions being

imposed on a borrower’s use of its own assets by the relevant lender.

Minimum capital

32. One

important factor in LGFA obtaining its high credit rating (AA+ from S&P and

Fitch) is the LGFA having a minimum capital adequacy ratio (a ratio that

measures the relative amounts of equity and debt-based assets that an entity

has). A strong credit rating is

important, because it provides an indication of the ability of the LGFA to

ultimately repay all of its debts.

33. The

minimum capital adequacy ratio requirement is an amount equal to at least 1.6%

of its total assets. As at December

2019 the actual ratio was 2.2%.

Sources of equity for capital adequacy purposes

34. The

equity held by the LGFA to ensure that it meets its minimum capital adequacy

ratio requirement comes from two sources. First, the Crown and the Principal

Shareholding Local Authorities contributed $25 million of initial equity as the

issue price of their initial shareholdings. Retained

earnings have seen the value of this equity rise to $79.1 million as at 30

December 2019. Secondly, each Participating Local Authority must, at the time

that it borrows from the LGFA, contribute some of that borrowing back as

equity. This source of equity is called borrower notes.

35. The

way the borrower notes works is that, whenever a Participating Local Authority

borrows, it does not receive the full amount of the borrowing in cash. Instead, a small percentage of the borrowed

amount is invested by the local authority into borrower notes. LGFA pay

interest on borrower notes. That

percentage is 1.6% of the amount borrowed.

36. Borrower

notes are repaid when the borrowing is repaid, so, in effect, the amount that

must be repaid equals the cash amount actually

advanced.

37. Borrower notes are

convertible in some circumstances into shares in the LGFA.

38. To

illustrate with an example, if a local authority borrowed $1,000,000 for five

years from the LGFA, it would receive $984,000 in cash and $16,000 of Borrower

Notes. At the end of the five years, it would repay $1,000,000, but would

simultaneously redeem its Borrower Notes of $16,000, meaning its net repayment

was equal to the $984,000 it initially received in cash.

39. A

return is paid on the Borrower Notes, However, while it is anticipated that this return will be paid, it is paid at

the discretion of the LGFA.

40. There is some additional risk to Participating Local

Authorities from this arrangement, because redemption of the Borrower Notes

will only occur if the LGFA is able to pay its other debts. For example, if at

the end of five years, the LGFA was insolvent, the local authority would have

to repay $1,000,000, but would not receive its $16,000 back for redeeming its

Borrower Notes. To date, LGFA have fully repaid all borrower notes that have matured.

Guarantee

41. Most

Participating Local Authorities entered into a guarantee when they join the

LGFA Scheme (Guarantee). Under the Guarantee the Guaranteeing Local Authorities guarantee the payment

obligations of the LGFA.

42. The

purpose of the Guarantee is to provide additional comfort to lenders (and

therefore credit rating agencies) that there will be no long term default,

though it may also be used to cover a short term default if there is a default

that cannot be covered using the protections described in paragraphs 24 to 26

above, but which will ultimately be fully covered using the rates charge

described in paragraphs 29 to 31. The Guarantee allows the LGFA to draw upon

the resource of all guaranteeing Local Authorities to avoid defaults.

LGFA Guarantee

43. The Guarantee

will only ever be called if

the LGFA defaults. Consequently, a call on the Guarantee will only occur if the numerous safeguards put in place to

prevent an LGFA default fail. This is highly unlikely to happen.

44. To provide some perspective on default, based on Standard

& Poor’s research on 39 years of global data (1981-2018), a AA+ rated

bond is expected to have a cumulative default risk of 0.32% over 5 years.

45. If

any such default did occur, and the Guaranteeing Local Authorities were called

on under the Guarantee they could potentially be called on to cover any payment

obligation of the LGFA. Such payment obligations may (without limitation) include obligations under the

following transactions:

a) A failure by the

LGFA to pay its principal lenders.

b) A failure

by the LGFA to repay drawings under the liquidity facility with central government.

c) A failure

by the LGFA to make payments under the hedging

transactions referred to in paragraph 28(f).

Guarantee risk shared

46. There

is a mechanism in the LGFA Scheme to ensure that payments made under the

Guarantee are shared between all Guaranteeing Local Authorities. The proportion

of any payments borne by a single Guaranteeing Local Authority is based on the annual rates revenue in

its district or region.

Rates Charge

47. All participating Local Authorities must provide a Rates Charge

to secure their obligations under the Guarantee.

Benefits of being a Guaranteeing Local Authority

48. Participating

Local Authorities that are not Guaranteeing Local Authorities may only borrow

up to $20,000,000 and pay a higher interest margin for their borrowing.

49. Therefore,

Guaranteeing Local Authorities have the benefit of not having this low limit on

borrowing, and paying lower funding costs.

Additional equity commitment

50. In

addition to the equity contributions made in conjunction with borrowing, all

Guaranteeing Local Authorities are required to commit to contributing equity if

required under certain circumstances. It is expected that calls on any such

commitments will be limited to situations in which there is a risk of imminent

default by the LGFA.

51. A

call for additional equity contributions will only be made if calls on the

uncalled Capital and on the Guarantee will not be sufficient to eliminate the

risk of imminent default by the LGFA. Consequently, the factors that limit the

risk in relation to the Cross

Guarantee also apply here.

52. All

participating Local Authorities are required to provide a Rates Charge to

secure their obligations to contribute additional equity.

Characteristics designed to make the LGFA

Scheme fair for all Participating Local Authorities

53. The

principal risk involved with the LGFA Scheme is that Participating Local

Authorities will default on their payment obligations. The greater this risk

is, the less attractive participation in the LGFA Scheme is for all

Participating Local Authorities.

54. The Participating Local Authorities do not create

this risk in equal amounts. There are some that carry a greater default

risk than others,

and therefore contribute

disproportionately to the overall risk in the LGFA Scheme. Those local

authorities are also the local authorities that would be likely to pay the highest

interest margins if they borrowed

outside the LGFA Scheme, and so potentially benefit the most from the LGFA Scheme.

55. To

avoid, or at least minimise,

what is effectively cross

subsidisation of the higher

risk local authorities by the lower risk local authorities, different interest margins are paid by different

local authorities when they borrow

from the LGFA, with

margins based on if a local authority has an external

credit rating and what the actual external credit rating is. For example a “AA” rated local authority will pay a slightly lower interest

margin than a “AA-“ rated local authority. An unrated local authority will pay a slightly higher

margin than a rated local authority.

Summary of transactions a Local Authority

will enter into if it joins the LGFA Scheme

56. If

a Local Authority joins the LGFA Scheme as a Guaranteeing Local Authority, it

will:

a) subscribe for

Borrower Notes (refer to paragraphs 34 to 40);

b) enter into the

Guarantee (refer to paragraphs 41 to 49);

c) commit to

providing additional equity to the LGFA under certain circumstances (see

paragraphs 50 to 52); and

d) provide a

Rates Charge to secure its obligations under the LGFA Scheme (see discussion in paragraphs 29 to 31, and 47).

PART C – LOCAL AUTHORITY COSTS AND

BENEFITS

Benefits to local authorities that borrow

through the LGFA Scheme

57. It

is anticipated that the LGFA will be able to borrow at a low enough rate for

the LGFA Scheme to be attractive because of the three key advantages the LGFA

will have over a local authority borrower described in paragraph 14. That is

– exploiting a credit rating arbitrage, economies of scale and a

regulatory arbitrage.

58. In

addition, the LGFA will provide local authorities with increase certainty of

access to funding and terms and conditions (including the potential access to

longer funding terms. LGFA currently offers borrowing terms out to 15 years.

59. The

potential savings for a local authority in terms of funding costs will depend

on the difference between the funding cost to that local authority when it

borrows from the LGFA and the funding cost to the local authority when it

borrows from alternative sources. This difference will vary between local

authorities.

60. As

at 23/04/2020 Napier City Council is expected to save approximately $7,900 per

$1 million dollars borrowed by using LGFA (versus approved borrowing

institution facilities).

61. The

funding costs each local authority pays when it borrows from the LGFA will be

affected by the following factors, some of which are specific to the local

authority:

e) the borrowing

margin of the LGFA;

f) the

operating costs of the LGFA;

g) whether a local

authority has an external credit rating

Costs to local authorities that borrow

through the LGFA Scheme

62. The

costs to Participating Local Authorities as a result of their borrowing through

the LGFA Scheme take two forms:

a) First,

there are some risks that they will have to assume to participate in the

scheme, which create contingent liabilities (i.e. costs that will only

materialise in certain circumstances).

b) Secondly, there

is a minor cost associated with the Borrower Notes.

Risks

63. The