|

Extraordinary Meeting of Council - 27 August 2020 - Attachments

|

Item 1 Attachments a |

Extraordinary Meeting of Council

Open Agenda

|

Meeting Date: |

Thursday 27 August 2020 |

|

Time: |

following ordinary meeting of Council |

|

Venue: |

Large Exhibition Hall |

|

Council Members |

Mayor Wise, Deputy Mayor Brosnan, Councillors Boag, Browne, Chrystal, Crown, Mawson, McGrath, Price, Simpson, Tapine, Taylor, Wright |

|

Officer Responsible |

Interim Chief Executive |

|

Administrator |

Governance Team |

|

|

Next Council Meeting Thursday 8 October 2020 |

Extraordinary Meeting of Council - 27 August 2020 - Open Agenda

ORDER OF BUSINESS

Apologies

Nil

Conflicts of interest

Public forum

Nil

Agenda items

1 Adoption of the Annual Plan 2020/21.............................................................................. 3

2 Resolution to set the rates for 2020/21.......................................................................... 46

Extraordinary Meeting of Council - 27 August 2020 - Open Agenda Item 1

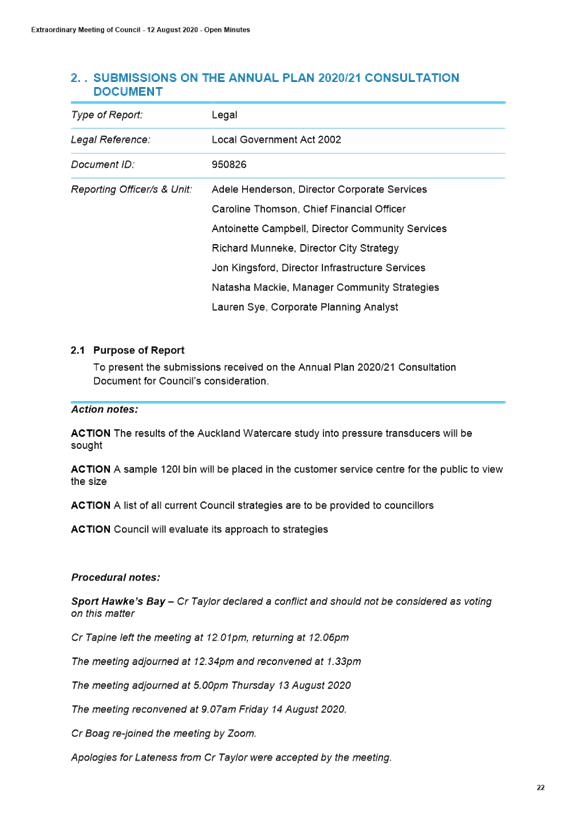

1. Adoption of the Annual Plan 2020/21

|

Type of Report: |

Legal |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

957115 |

|

Reporting Officer/s & Unit: |

Lauren Sye, Corporate Planning Analyst Caroline Thomson, Chief Financial Officer |

1.1 Purpose of Report

To adopt the 2020/21 Annual Plan in accordance with the Local Government Act 2002.

|

That Council: a. Note that the Annual Plan 2020/21 has been developed in accordance with the requirements of the Local Government Act 2002, but does not meet the requirements in section 95 (adoption by 1 July) and section 100(i) (balanced budget). b. Note the 2020/21 Annual Plan has been considered by the Audit and Risk Committee. The Committee is comfortable with the approach taken by Council in the adoption of the 2020/21 Annual Plan (minutes of Audit and Risk Committee – 12 June refer). c. Adopt the Annual Plan 2020/21 as attached in Appendix B. d. Delegate responsibility to the Chief Financial Officer to approve any final edits required to the Annual Plan and supporting information in order to finalise the documents for uploading online and physical distribution. e. Direct officers to comply with section 95 (7) of the Local Government Act 2002 and make the Annual Plan publicly available.

|

Overview

This report is an administrative matter and concludes the Council’s annual planning process by recommending that the 2020/21 Annual Plan be adopted.

Council’s Long Term Plan (“LTP”) for 2018-2028 was adopted in June 2018 after community engagement. The LTP is an intentions document, and sometimes plans change for a variety of reasons. Therefore, each year Council has to set an annual budget to ensure that plans are clearly articulated and feasible. To set those budgets, Council must consider what (if any) changes need to occur from what was projected in the LTP for the financial year in question.

Due to the Covid-19 pandemic, this year’s budget development has been undertaken twice, and the budget is in effect an emergency budget rather than a typical Annual Plan.

As outlined in previous Council reports, Council followed the following broad process for developing the Annual Plan:

· A series of workshops were held with Elected Members between November 2019 and February 2020, focussed on budget development. Elected Members were provided with cost pressures and efficiencies that could be made, and set direction to stay within the financial caps as outlined in the Financial Strategy.

· On 10 March 2020, Council then approved the underlying material, assumptions and key decisions for the development of the draft Annual Plan 2020/21 and Consultation Document, including a proposed average rates increase of 6.5% for existing ratepayers.

· Later in March, the Covid-19 pandemic hit, impacting Council revenue and creating significant uncertainty for the year ahead.

· On 23 April, Council agreed to defer the release of the Annual Plan until the most appropriate plan for the changed context of Covid-19 was developed and agreed by Council. Council noted that by deferring the release of the Plan, it would be in breach of legislative requirements.

· In April and May, Elected Members attended weekly workshops covering budget impacts; revised significant forecasting assumptions; rates (including options to reduce 2020/21 rates increase); options analysis and impact on future year’s rates and loans; proposed recovery package budget; risks; financial policies and consultation. The Audit and Risk Committee was updated fortnightly. Council set direction on a 4.8% rates increase.

· On 11 June, Council adopted the Consultation Document and supporting information, and noted that the Annual Plan does not meet the section 100(i) balanced budget requirement of the Local Government Act 2002. Council also agreed at that meeting to community consultation on Council joining the Local Government Funding Agency (LGFA), changes to the Rates Remission Policy, and Rates Postponement Policy.

· Consultation period 18 June to 16 July 2020, including three Live Chats hosted on Facebook.

· In June and July, officers further reviewed the feasibility of delivering the work programme as signalled in the draft Annual Plan. There were both internal and external capacity issues for delivering on significant initiatives. As such, changes to the 2020/21 work programme were recommended through an officers’ submission on the Annual Plan. A seminar was held on 9 July with Council to seek direction on these recommendations.

· Consideration of submissions – officers provided to Council all individual submissions and an officers’ report containing a summary of submissions, officers’ consideration of the submissions, and officers’ recommendations. Council altered some of the officers’ recommendations and added to them. For ease of reference, the minutes of the 12-14 August meeting are attached as Appendix A.

On 14 August 2020, following the consideration of feedback received and Council deliberations, Council agreed decisions to finalise the annual budget for 2020/21. The Annual Plan 2020/21 has been prepared reflecting these decisions. In particular, it includes:

· Prospective financial statements and other financial information based on year three of the LTP 2018-28 updated to reflect the budget decisions made on 14 August 2020, and

· Rating policy, reflecting decisions made on 14 August 2020.

This report recommends that the 2020/21 Annual Plan now be adopted. This is the final step in the annual planning process. The Annual Plan is not audited and does not require audit approval prior to adoption.

Following adoption, officers will finalise documentation for distribution and also undertake activity to update Napier residents, particularly submitters, of the decision.

The final overall budget position for the 2020/21 is a 4.8% average increase in rate requirements for existing ratepayers as agreed at the 14 August 2020 meeting. Before Council can resolve to set the rates for the 2020/21, Council must first adopt the Annual Plan which confirms the budget for the year. The resolution setting the rates for 2020/21 will be considered as a separate report on this agenda, following adoption of the Annual Plan 2020/21.

1.3 Issues

When preparing, consulting on and making decisions on the Annual Plan 2020/21, Council has followed a thorough process, including considering:

· significance or materiality of the differences to year three of the LTP,

· whether any formal amendment to the LTP is necessary,

· extent of Council’s resources,

· statutory decision-making practices in the Local Government Act 2002 (Part 6),

· decisions that are required for this annual budget, and

· financial management requirements.

As outlined in previous Council reports, the Annual Plan does not meet the section 100(i) balanced budget provision of the Local Government Act 2002. As required under section 80 of the Local Government Act 2002, Council has carefully considered the unbalanced budget issue, with the most financially prudent option being to reserve fund the shortfall due to the one-off nature. Council will work towards a balanced budget for the Long Term Plan 2021-31.

Council has also not meet the statutory deadline of 30 June 2020 for adopting the Annual Plan 2020/21 due to the additional time it has taken to revise budgets to reflect the impact of Covid-19. Advice provided by LGNZ, SOLGM and supported by Simpson Grierson confirms that an Annual Plan adopted after 30 June is lawful and if challenged is unlikely to be declared invalid provided the delay can be explained and the Plan is not acted on until it is adopted. Audit NZ and the Department of Internal Affairs have been advised of the late adoption date for the Annual Plan 2020/21.

Of note, Council cannot delegate the power to adopt an Annual Plan to a Committee, and this is why all Annual Plan reports have been submitted directly to Council and not through a Committee.

Relating to making a decision on a Long Term Plan or an Annual Plan, the effect of adopting an Annual Plan is to provide a formal and public statement of Council’s intentions in relation to the matters covered by the plan. A resolution to adopt a Long Term Plan or Annual Plan does not constitute a decision to act on any specific matter included within the plan (Section 96 of the Local Government Act 2002 refers).

In addition, a number of projects for which funding was approved for 2019/20, have been identified as needing to be carried forward. The final schedule of projects to be carried forward will be included in the 2020/21 revised budget and reported through the quarterly reports to Council.

1.4 Significance and Engagement

Officers assessed the changes from year three of the Long Term Plan 2018-28 and advised Council of the significant and material changes. Consultation has occurred in accordance with the Local Government Act 2002.

1.5 Implications

Financial

When considering the changes to the Annual Plan 2020/21 from the Long Term Plan 2018-28, Council officers reviewed its compliance against Council’s Financial Strategy and its Financial Prudence benchmarks.

As part of the Long Term Plan 2018-28. Council approved the Local Government Cost Index (LGCI) + 5% as its cap for rates increases. The proposed Annual Plan rates increase of 4.8% is within this level (including the kerbside waste collection level of service adopted as part of the 2019 joint Waste Management and Minimisation Plan).

It is important to note that the Balanced Budget Benchmark has not been met. The policy limit for this benchmark is set at a minimum of 100% (operating revenue to operating expenses). The financial impact of COVID-19 is expected to significantly reduce the Council’s non-rate income resulting in an unbalanced budget ratio of 95% for 2020/21.

Council will closely monitor the ongoing impacts of the COVID-19 pandemic and the 2021-31 LTP will be developed with those impacts in mind.

All other financial prudence benchmarks have been met for 2020/21.

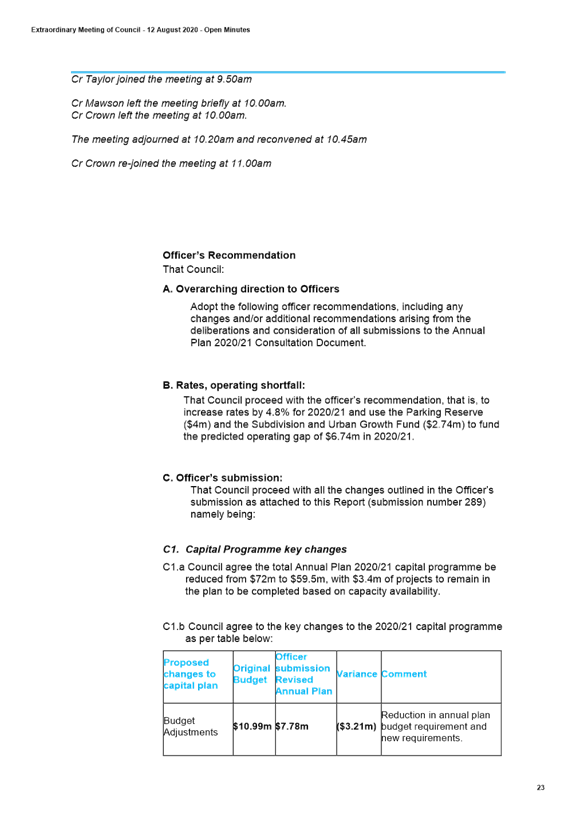

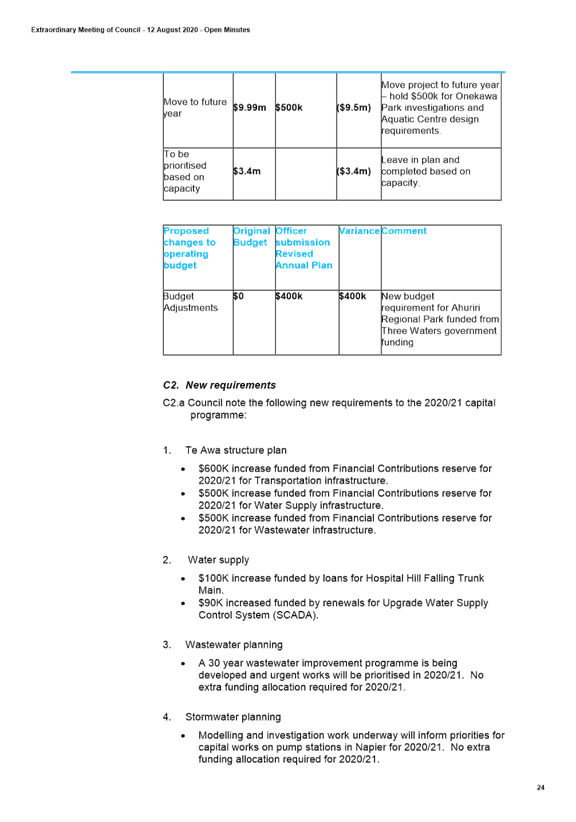

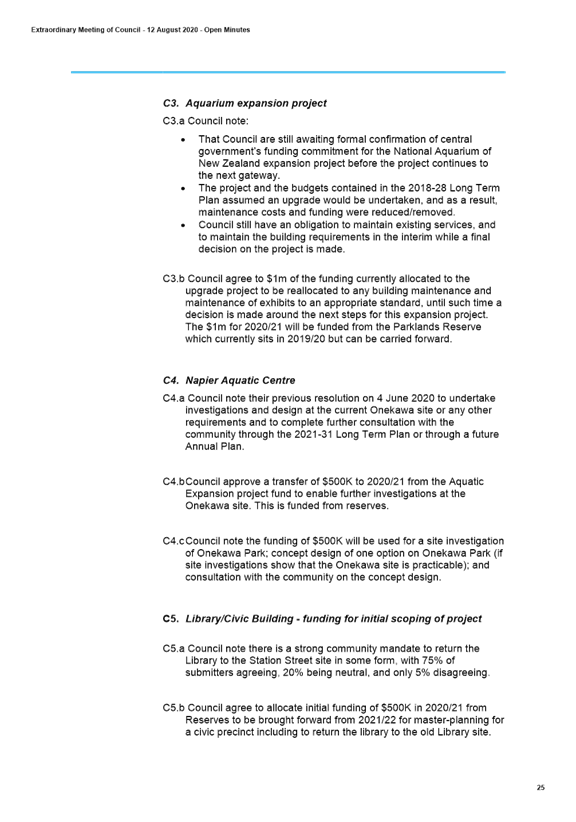

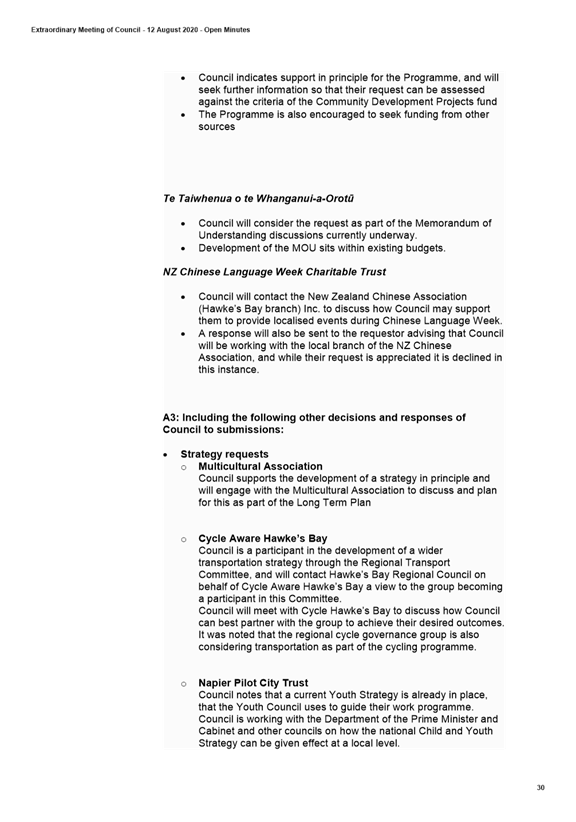

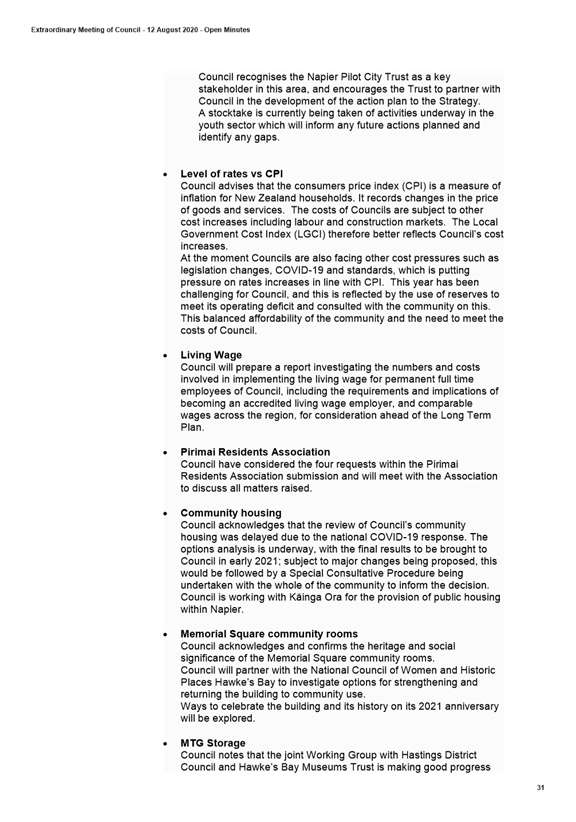

The submission process resulted in changes to the Capital Plan and additional operating budget for the Ahuriri Regional Park. Through a combination of prioritising projects, moving projects to future years, and leaving some in the capital works programme to be completed depending on capacity, the cost of planned works has reduced by $12.7m to $59.5m. These changes are summarised in the table below (further detail is contained in the Council minutes attached at Appendix A):

|

|

Draft budget |

Final Annual Plan |

Adjustment |

Comment |

|

Capital |

$21m |

$8.3m |

($12.7m) |

Projects moved out to future years and new requirements |

|

Operating |

$0 |

$400k |

$400k |

New budget requirement for Ahuriri Regional Park |

Looking ahead to 2021/22

There are financial implications in 2021/22 from bringing forward loan funded projects into 2020/21 and the inclusion of new capital work such as the Te Awa structure plan, water supply, wastewater and storm water planning. The 2021/22 budgets will be refreshed in the development of the 2021-31 Long Term Plan.

Social & Policy

The Annual Plan 2020/21 aligns with all Council policy including the Joint Waste Management and Minimisation Plan 2018-24.

Changes to the Rates Remission Policy and Rates Postponement Policy have been consulted on concurrently but separately to the Annual Plan and Council adopted the amended policies on 14 August 2020. Council also carried out concurrent consultation on the proposal for Napier City Council to join the Local Government Funding Agency as an unrated guaranteeing local authority. This proposal was agreed to and adopted by Council on 14 August 2020.

Risk

The following risks were noted as part of the development of the Annual Plan 2020/21:

- delivery of the Annual Plan could be stymied due to:

o The Capital Plan being larger than Council can achieve in the next year,

o Diversion of resources away from core delivery duties,

o Roadblocks/unplanned delays for individual projects,

o Lack of regional coordination for programmes of work,

o Shortage of technical experts to deliver,

o Resources redirected due to public health issue, judicial process, major unplanned failure, pandemic,

o Underdeveloped internal processes (risk management, governance), and

o Prioritisation of capital expenditure over operational expenditure leading to lack of investment in operational staff and improvements.

- 2020/21 budget could be insufficient to deliver all projects identified due to:

o Overly-conservative estimations of cost,

o Poorly scoped projects,

o Failure to account for cost escalation,

o Effects of Covid-19 on procurement,

o Ineffective project management, and

o Change in Council’s strategic direction.

- The ability to procure services necessary for delivery could be limited by:

o Covid-19 (including difficulties sourcing materials from overseas, and lockdown restrictions), and

o An oversaturated construction market.

- The existing wastewater outfall pipe could be damaged during the repair process due to the complexity of the repair, difficult working conditions and insufficient knowledge around the condition of the pipe in the repair locations. This could lead to further deterioration of the pipe and risk regulatory enforcement (including prosecution), reputational damage and perceived or actual environmental damage.

1.6 Options

The options available to Council are as follows:

a. Adopt the Annual Plan 2020/21, or

b. Not adopt the Annual Plan 2020/21 (which would mean that rates cannot be set).

1.7 Development of Preferred Option

Option A (adopt the Annual Plan 2020/21) is the recommended option. A robust process has been undertaken to develop the budget and Council has considered public feedback and made decisions to proceed to develop the final plan. A plan can be modified during the year within the parameters of section 96 of the Local Government Act 2002.

a Minutes - Council Meeting, 12-14 August 2020 ⇩

b Annual Plan 2020/21 (Under Separate Cover) ⇨

2. Resolution to set the rates for 2020/21

|

Type of Report: |

Legal |

|

Legal Reference: |

Local Government (Rating) Act 2002 |

|

Document ID: |

956968 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager |

2.1 Purpose of Report

To set rates for 2020/21 in accordance with the Local Government (Rating) Act 2002 and with the Funding Impact Statement.

|

That Council: a. Resolve that the Napier City Council set the following rates under the Local Government (Rating) Act 2002, on rating units in the city for the financial year commencing on 1 July 2020 and ending on 30 June 2021, and that all such rates shall be inclusive of Goods and Services Tax (GST).

(A) GENERAL RATE A general rate set under Section 13 of the Local Government (Rating) Act 2002 made on every rating unit, assessed on a differential basis on the rateable land value to apply to the Differential Groups as follows:

(B) UNIFORM ANNUAL GENERAL CHARGE A Uniform Annual General Charge of $375.00 per separately used or inhabited part of a rating unit for all rateable land set under Section 15 of the Local Government (Rating) Act 2002.

(C) WATER RATES as follows: 1. Fire Protection Rate A targeted rate for fire protection, set under Section 16 of the Local Government (Rating) Act 2002 on a differential basis and on the rateable capital value on every rating unit connected to or able to be connected and within 100 metres of either the City Water Supply System, or the Bay View Water Supply System. This rate will apply to the Differential Groups and Categories as follows:

2. City Water Rate A targeted rate for Water Supply, set on a differential basis under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit connected to or able to be connected to and within 100 metres of the City water supply system. This such rate will apply as follows:

3. Bay View Water Rate A targeted rate for Water Supply, set on a differential basis under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit connected to or able to be connected to and within 100 metres of the Bay View water supply system This rate will apply as follows:

4. Water by Meter Rate A targeted rate for water supply, set under Section 19 of the Local Government (Rating) Act 2002, on a differential basis per cubic metre of water consumed after the first 300m3 per annum, to all metered rating units as follows:

(D) REFUSE COLLECTION AND DISPOSAL RATE A targeted rate for refuse collection and disposal, set under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit, for which a weekly rubbish collection service is available, with the rate being 2 or 3 times the base rate for those units where 2 or 3 collections per week respectively is available. This rate will apply as follows:

(E) KERBSIDE RECYCLING RATE A targeted rate for Kerbside Recycling, set under Section 16 of the Local Government (Rating) Act 2002, as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit for which the Kerbside recycling collection service is available. This rate will apply as follows:

(F) SEWERAGE RATE A targeted rate for sewerage treatment and disposal, is set on a differential basis under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis. The rate is applied to each separately used or inhabited part of a rating unit connected or able to be connected and within 30 metres of the City Sewerage system (including the Bay View Sewerage Scheme). This rate will apply as follows:

(G) BAY VIEW SEWERAGE CONNECTION RATE A targeted rate for Bay View Sewerage Connection, set under Section 16 of the Local Government (Rating) Act 2002 as a fixed amount on a uniform basis, applied to each separately used or inhabited part of a rating unit connected to the Bay View Sewerage Scheme, where the lump sum payment option was not elected. The rate to apply for 2020/21 is $941.35

(H) CBD OFF STREET CARPARKING RATE A targeted rate to provide funding for additional off street carparking in the Central Business District set under Section 16 of the Local Government (Rating) Act 2002 on a differential basis on the rateable land value, to apply to rating units in the Central Business District. The rate to apply to the Differential Groups is as follows:

H) SUBURBAN OFF STREET CARPARKING RATE A targeted rate to provide funding for additional off street carparking in Suburban Shopping and commercial areas and to maintain existing offstreet parking areas in suburban shopping and commercial areas, set under Section 16 of the Local Government (Rating) Act 2002 as a rate in the dollar on Land Value as follows:

H) TARADALE OFF STREET CARPARKING RATE A targeted rate to provide funding for additional off street carparking in the Taradale Shopping and commercial area and to maintain existing offstreet parking areas in Taradale, set under Section 16 of the Local Government (Rating) Act 2002 as a rate in the dollar on Land Value as follows:

(I) CBD PROMOTION RATE A targeted rate to fund at least 70% of the cost of the promotional activities run by the Napier City Business Inc, set under Section 16 of the Local Government (Rating) Act 2002, and applied uniformly on the rateable land value of all rating units in the area defined as the Central Business District, such rate to apply to applicable properties within the Differential Groups and Differential Codes as follows:

(J) TARADALE PROMOTION RATE A targeted rate to fund the cost of the Taradale Marketing Association’s promotional activities, set under Section 16 of the Local Government (Rating) Act 2002 and applied uniformly on the rateable land value of all rating units in the Taradale Suburban Commercial area, such rate to apply to the Differential Groups and Differential Codes as follows:

(I) SWIMMING POOL SAFETY RATE A targeted rate to fund the cost of pool inspections and related costs, set under Section 16 of the Local Government (Rating) Act 2002, as a fixed amount on every rating unit where a swimming pool or small heated pool (within the meaning of the Building (Pools) Amendment Act 2016) is located, of $52 per rating unit.

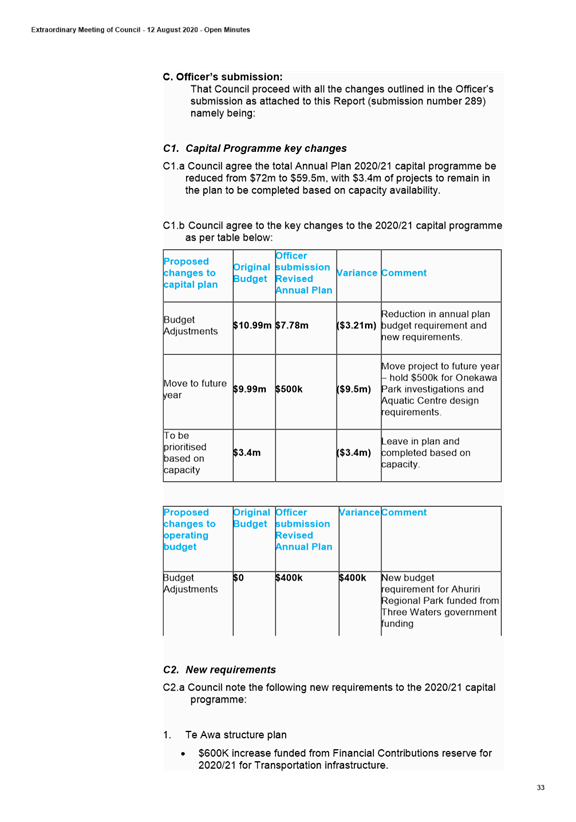

DUE DATES FOR PAYMENT AND PENALTY DATES (For Rates other than Water by Meter Rates) That rates other than water by meter charges are due and payable in four equal instalments. A 3.5% penalty will be added to any portion of rates (except for Water by Meter) assessed for instalments 1 and 2 for the 2020/21 rating year that remains unpaid after the relevant instalment date. 10% penalty will be added to any portion of rates (except for Water by Meter) assessed for instalments 3 and 4 for the 2020/21 rating year that remains unpaid after the relevant instalment date. The respective penalty dates are shown in the following table as provided for in section 57 and 58(1)(a) of the Local Government (Rating) act 2002

With the exception of instalment 4 in the 2019/20 rating year for which no penalty was applied, any portion of rates assessed in previous years (including previously applied penalties) which remains unpaid on 30 July 2020 will have a further 10% added, firstly on 31 July 2020, and if still unpaid, again on 31 January 2021.

WATER RATES Targeted rates for metered water supply will be separately invoiced from other rates invoices. Metered water supply for commercial properties is invoiced quarterly and metered water for domestic (residential) water supply is invoiced annually. A 10% penalty will be added to any part of the water rates that remain unpaid by the due date as shown in the table below as provided for in section 57 and 58(1)(a) of the Local Government (Rating) Act 2002. Metered Water Supply rates are due for payment as follows:

A penalty of 10% will be added to any portion of water supplied by meter, assessed in the current year, which remains unpaid by the relevant instalment due date, on the respective penalty date above. Any portion of water rates assessed in previous years (including previously applied penalties) which are unpaid by 30 July 2020 will have a further 10% added, firstly on 31 July 2020, and if still unpaid, again on 31 January 2021. Any water payments made will be allocated to the oldest debt.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Once the Annual Plan for the year has been adopted Council needs to pass a resolution to set the rates for the year to enable the required rates revenue to be collected to fund Council’s budgeted activities for the year.

The resolution is drafted to comply with the requirements of the Local Government (Rating) Act 2002

2.3 Issues

These resolutions are procedural in nature in that they follow the legal process to collect the revenue as proposed in the Annual Plan.

The proposed rates are as set out in the Funding Impact Statement which is included in the Annual Plan document. The rates vary slightly from those published in the draft Annual Plan however the overall effect remains at an average increase of 4.8% for existing ratepayers. Examples of the impact for different categories are provided in the Annual Plan.

2.4 Significance and Engagement

This report implements a decision of council made following consultation on the 2020/21 Annual Plan. No further action is required in relation to Council’s significance and engagement policy.

2.5 Implications

Financial

The recommendations in this report enable council to collect rates revenues of $63.853 million as outlined in the 2020/21 Annual plan.

Social & Policy

The are no social or policy implications

Risk

If council does not pass the proposed resolutions the required revenue to fund Council’s activities for 2020/21 would not be able to be collected.

2.6 Options

The options available to Council are as follows:

a. Adopt the resolutions as proposed

b. Adopt an amended resolution

c. Do not adopt the resolution

2.7 Development of Preferred Option

These resolutions are procedural in nature in that they implement a decision that is made by Council when the 2020/21 Annual Plan is adopted. The preferred decision is to adopt the resolutions as proposed without any alteration.