|

Extraordinary Meeting of Council - 15 September 2020 - Attachments

|

Item 1 Attachments a |

Extraordinary Meeting of Council

Open Agenda

|

Meeting Date: |

Tuesday 15 September 2020 |

|

Time: |

3.00pm |

|

Venue: |

Large Exhibition Hall |

|

Council Members |

Mayor Wise, Deputy Mayor Brosnan, Councillors Boag, Browne, Crown, Mawson, McGrath, Price, Simpson, Tapine, Taylor, Wright |

|

Officer Responsible |

Interim Chief Executive |

|

Administrator |

Governance Team |

|

|

Next Ordinary Council Meeting Thursday 8 October 2020 |

Extraordinary Meeting of Council - 15 September 2020 - Open Agenda Item 1

ORDER OF BUSINESS

Apologies

Councillor Chrystal

Conflicts of interest

Public forum

Nil

Announcements by the Mayor

Announcements by the management

Agenda items

1 Hawke's Bay Region 3 Waters Report............................................................................ 2

2 Three Waters Reform Programme - Funding Agreement, Delivery Plan and Proposed projects 387

3 Budgets to be carried forward to 2020/21.................................................................... 452

4 Draft Revenue and Financing Policy and underlying information................................. 463

5 Draft Rating Policy...................................................................................................... 502

6 Draft Rates Remission Policy...................................................................................... 532

7 Draft Rates Postponement Policy................................................................................ 543

8 Sportsgrounds Charges Relief Package...................................................................... 551

Agenda Items

1. Hawke's Bay Region 3 Waters Report

|

Type of Report: |

Operational |

|

Legal Reference: |

N/A |

|

Document ID: |

962595 |

|

Reporting Officer/s & Unit: |

Keith Marshall, Interim Chief Executive |

1.1 Purpose of Report

To present to Council the Morrison Low report Hawke’s Bay Three Waters, Business Case of Three Waters Service Delivery options

|

That Council: a. Note and receive the Morrison Low report Hawke’s Bay Three Waters, Business Case of Three Waters Service Delivery options, and that it will be a helpful contribution to the upcoming 3 Waters reform process. b. Note that Napier City Council has signed up to working with the Government on the 3 Waters reform process.

|

a Hawke’s Bay Three Waters, Business Case of Three Waters Service Delivery options ⇩

2. Three Waters Reform Programme - Funding Agreement, Delivery Plan and Proposed projects

|

Type of Report: |

Contractual |

|

Legal Reference: |

N/A |

|

Document ID: |

965068 |

|

Reporting Officer/s & Unit: |

Adele Henderson, Director Corporate Services Jon Kingsford, Director Infrastructure Services |

2.1 Purpose of Report

To provide delegation for the signing of the Funding Agreement and Delivery Plan associated with the Three Water Services Reform Programme including proposed projects.

|

That Council: a. Approve entering into the Funding Agreement and Delivery Plan for the first stage of the Three Waters Services Reform Programme by 30th September b. Approve the proposed projects to be undertaken as part of the Delivery Plan, noting that these are subject to approval from the Department of Internal Affairs (DIA). c. Provide delegation to the Chief Executive to make required changes to the Delivery Plan in order to finalise the agreement with DIA, noting that Council have been provided with projects that are in excess of the $12.51m available funding, and projects will be prioritised from those identified under Priority 2 and 3 list provided in this report. d. Note the Reform Programme is part of the Governments programme to reform current water service delivery, into larger scale providers, to realise significant economic, public health, environmental, and other benefits over the medium to long term, and that signing the MOU, Funding Agreement and Delivery Plan does not create any obligation upon Council with regard to future steps of this reform programme; e. Delegate signing of the Funding Agreement and Delivery Plan to the Chief Executive and Mayor

|

Over the past three years, central and local government have been considering solutions to challenges facing delivery of three waters services to communities.

This has seen the development of new legislation and the creation of Taumata Arowai, the new Water Services Regulator, to oversee and enforce a new drinking water regulatory framework, with an additional oversight role for wastewater and stormwater networks.

While addressing the regulatory issues, both central and local government acknowledge that there are broader challenges facing local government water services and infrastructure, and the communities that fund and rely on these services.

There has been underinvestment in three waters infrastructure in parts of the country and persistent affordability issues; along with the need for additional investment to meet improvements in freshwater outcomes, increase resilience to climate change and natural hazards, and enhance community wellbeing.

In July 2020, the Government announced a funding package of $761 million to provide immediate post-COVID-19 stimulus to local authorities to maintain and improve three waters (drinking water, wastewater, stormwater) infrastructure, and to support reform of local government water services delivery arrangements.

The Government has indicated that its starting intention is public multi-regional models for water service delivery to realise the benefits of scale for communities and reflect neighbouring catchments and communities of interest. There is a preference that entities will be in shared ownership of local authorities. Design of the proposed new arrangements will be informed by discussion with the local government sector.

There is a shared understanding that a partnership approach between Central and Local Government will best support the wider community interests, and ensure that any transition to new service delivery arrangements is well managed and as smooth as possible. This has led to the formation of a joint Three Waters Steering Committee to provide oversight and guidance on three waters services delivery and infrastructure reform.

At the recent Central/Local Government Forum, central and local government leadership discussed challenges facing New Zealand’s water service delivery and infrastructure, and committed to working jointly on reform.

The Joint Three Waters Steering Committee has been established to provide oversight and guidance to support progress towards reform, and to assist in engaging with local government, iwi/Māori and other water sector stakeholders on options and proposals.

The Steering Committee comprises independent chair Brian Hanna, local government mayors, chairs and chief executives, representatives of Local Government New Zealand and the Society of Local Government Managers, officials and advisors from the Department of Internal Affairs, Taumata Arowai, and the Treasury.

The Steering Committee will ensure that the perspectives, interests and expertise of both central and local government, and of communities throughout New Zealand are considered, while the challenges facing water services and infrastructure are addressed. This will include periods of engagement, in the first instance with the local government sector.

The Steering Committee is supported by a secretariat made up of advisors and officials from Local Government New Zealand, the Society of Local Government Managers, the Department of Internal Affairs, and the Treasury.

In July 2020, the Government announced funding to provide immediate post-COVID-19 stimulus to maintain and improve water networks infrastructure, and to support a three-year programme of reform of local government water services delivery arrangements.

Central and Local Government consider it is timely to apply targeted infrastructure stimulus investment to enable improvements to water service delivery, progress reform in partnership, and ensure the period of economic recovery following COVID-19 supports a transition to a productive, sustainable economy.

While the Government’s starting intention is for publicly-owned multi-regional models for water service delivery, with a preference for local authority ownership, final decisions on a service delivery model will be informed by discussion with the local government sector and the work of the Steering Committee.

Initial funding will be made available immediately to those councils that sign up to the Memorandum of Understanding (MoU) and associated Funding Agreement and Delivery Plan for the first stage of the Three Waters Services Reform Programme.

The Reform Programme is designed to support economic recovery post COVID-19 and address persistent systemic issues facing the three waters sector, through a combination of:

· stimulating investment, to assist economic recovery through job creation, and maintain investment in water infrastructure renewals and maintenance; and

· reforming current water service delivery, into larger scale providers, to realise significant economic, public health, environmental, and other benefits over the medium to long term.

The three waters reform programme can be found on the Department of Internal Affairs website.

In addition to working with the Steering Committee, there will be an ongoing programme of engagement with local government, Iwi/Māori, the wider water services sector, and communities of interest throughout the transformation programme.

Initial engagement started July/August 2020 with local government and iwi/Māori partners to discuss the Memorandum of Understanding (MoU) and associated Funding Agreement and Delivery Plan. This first engagement provides a forum for councils considering signing up to the reform programme to raise issues and work through questions ahead of signing the MoU.

Signing the Memorandum of Understanding commits councils to engage with the reform programme and share information but does not require them to continue with future stages of the reform.

From the initial workshops, ongoing work with continue with ad-hoc sessions and webinars, targeted engagement and formal information-sharing sessions with local government, iwi/Māori, water service providers and interested parties as we progress the reform programme.

Over the past three years central and local government have been considering solutions to challenges facing three waters services delivered to communities. There have been a series of hui and workshops with iwi/Māori as part of this, through the Three Waters Review and the establishment of Taumata Arowai. The progress of the proposed reform requires further engagement with iwi/Māori to more fully understand Treaty rights of interests over the course of the reform period.

A range of engagements are proposed over the next 6-12 months both directly through central government and in partnership with local government.

2.3 Issues

Signing the Memorandum of Understanding was completed in August 2020 and commits councils to engage with the reform programme and share information but does not require them to continue with future stages of the reform. Two further documents including the Funding Agreement and Delivery Plan (Attachments) are now required to be prepared and signed.

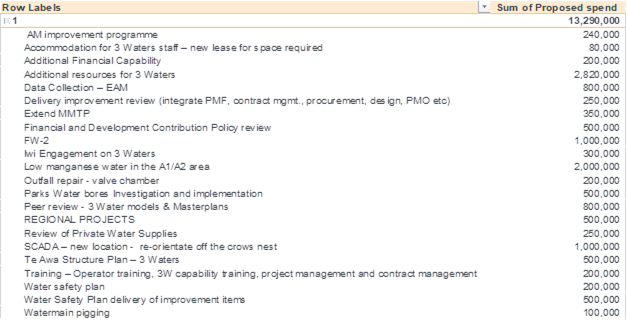

The Delivery Plan is subject to approval by DIA. Council held a workshop on 10th September and provided direction for the proposed projects to go forward to DIA. Feedback will be sought from the Maori Committee members. The projects have been given a category of Priority 1-3. In the event that the projects in Priority 1 do not get approved there are options to move to those identified as Priority 2 or 3. The Priority 1 projects currently total $13.2m which is in excess of the government funding provision. This allows some provision for discussion with DIA as required. A further $3.2m for Priority 2 and $600k for Priority 3 have been identified in the event the projects are rejected by DIA or unable to be progressed.

It is recommended that the Chief Executive is provided with delegation to finalise the agreement with DIA and move through the priorities accordingly. If those projects are not approved then the Chief Executive will work through this with DIA accordingly to finalise from other available projects that may not on the list.

Proposed projects – Priority 1

Proposed projects – Priority 2 & 3

A key part of the government’s stimulus package was job creation. It is noted that the above proposed projects will create approx. 140 jobs which are both internal fixed term roles, external consultant roles and jobs to carry out project work. Further work is still being undertaken to verify the number of jobs created before the contract is finalised.

2.4 Significance and Engagement

Funding for these projects will be received as a grant and does not trigger engagement

2.5 Implications

Financial

Funding will be provided as soon as practicable following agreement to the Memorandum and the associated Funding Agreement and Delivery Plan. The Delivery Plan will need to show that the funding is to be applied to operating or capital expenditure on three waters service delivery (with the mix to be determined by the Council) that:

• supports economic recovery through job creation; and

• maintains, increases and/or accelerates investment in core water infrastructure renewals and maintenance.

The Delivery Plan provides a summary of projects, relevant milestones, costs, location of physical works, number of people employed in works, reporting milestones and an assessment of how it supports the reform objectives set out in this Memorandum.

The Delivery Plan will be supplied to Crown Infrastructure Partners, and other organisations as agreed between the Parties, who will monitor progress of application of funding against the Delivery Plan to ensure spending has been undertaken consistent with public sector financial management requirements.

The Council will have the right to choose whether or not they wish to continue to participate in the reform programme beyond the term of the Memorandum.

Social & Policy

This Memorandum of Understanding (Memorandum) sets out the principles and objectives that the Parties agree will underpin their ongoing relationship to support the improvement in three waters service delivery for communities with the aim of realising significant public health, environmental, economic, and other benefits over the medium to long term. It describes, in general terms, the key features of the proposed reform programme and the Government funding arrangements that will support investment in three waters infrastructure as part of the COVID 19 economic recovery.

The Funding Agreement sets out the funding requirements and conditions. The Delivery Plan includes a summary of the work, costs, milestones, location of works, estimate of the number of people employed in works, and an assessment of how it supports the reform objectives.

Risk

The Council will have the right to choose whether or not they wish to continue to participate in the reform programme beyond the term of the Memorandum of Understanding.

Based on the terms outlined in the delivery plan, Council will carry any expenditure above the funding agreement by project.

2.6 Options

The options available to Council are as follows:

a. Approve the proposed projects or

b. Amend the proposed projects

2.7 Development of Preferred Option

Approve the proposed projects and sign the Funding Agreement and Delivery Plan for the Three Waters Reform Programme.

a 3 Waters Reform Programme - A3 ⇩

b 3W Reform FAQ's ⇩

c Funding Agreement - template ⇩

d Delivery Plan - template ⇩

e Funding Agreement - DRAFT ⇩

f Delivery Plan - DRAFT (TO BE TABLED) ⇩

|

Extraordinary Meeting of Council - 15 September 2020 - Attachments

|

Item 2 Attachments f |

Placeholder for Attachment 6

ITEM /20 Three Waters Reform Programme - Funding Agreement, Delivery Plan and Proposed projects

Delivery Plan - DRAFT (TO BE TABLED)

3. Budgets to be carried forward to 2020/21

|

Type of Report: |

Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

962775 |

|

Reporting Officer/s & Unit: |

Adele Henderson, Director Corporate Services Caroline Thomson, Chief Financial Officer |

3.1 Purpose of Report

To seek Council approval to carry forward budgets into 2020/21 or future years depending on the timing of the programme.

|

That Council: a. Approve total capital carry forward budgeted expenditure of $36,002,409 from 2019/20 into 2020/21 (or future years depending on the timing of the programme).

b. Approve total operational expenditure carry forward budgeted expenditure of $5,347,371 from 2019/20 into 2020/21.

|

Provision is made at the end of a financial year to carry forward project expenditure budgeted but not incurred, either fully or in part. The provision relates only to expenditure of a project nature. Requests are subject to approval by Council.

The total to carry forward from 2019/20 has increased compared to previous years due to Council completing $28.3m of the $72m budgeted in the 2019/20 Annual Plan capital programme. Delivery of the Capital Plan has been impacted by Covid19.

This report sets out the carry forward requests at activity level with further detail of the capital projects and operating budgets to be carried forward contained in attachments A and B.

3.3 Issues

No issues.

3.4 Significance and Engagement

N/A

3.5 Implications

Financial

The proposed carry forward amounts have been reviewed by Council management. It is noted that this does not impact the year end position of Council for the 2019/20 Annual Report.

The carry forward amounts are based on the final general ledger figures at 30 June 2020 and total $41,349,780 (capex: $36,002,409 and opex: $5,347,371).

The following table summarises by activity group carry forward expenditure that was budgeted but not incurred in 2019/20:

Capital Expenditure

|

Capital Activity |

Total Carry Forward Request |

|

Transportation |

2,151,597 |

|

Water Supply |

6,972,570 |

|

Stormwater |

751,755 |

|

Wastewater |

1,741,751 |

|

Other Infrastructure |

307,370 |

|

Community and Visitor Experiences |

19,994,227 |

|

Parking |

542,457 |

|

Property Assets |

1,860,195 |

|

Inner Harbour |

590,972 |

|

Support Units |

1,089,515 |

|

TOTAL |

36,002,409 |

The following table sets out the funding source for the carry forward amounts:

|

Funding Capital Expenditure |

Total Request |

|

Rates |

586,667 |

|

Loans - rates |

7,473,811 |

|

Reserves |

27,941,931 |

|

TOTAL |

36,002,409 |

Operational Expenditure

|

Operational Expenditure Activity |

Total Carry Forward Request |

|

Water Supply |

134,026 |

|

Sportsgrounds |

4,000,000 |

|

Asset Administration |

641,302 |

|

Planning Policy |

242,374 |

|

Housing - retirement |

329,679 |

|

TOTAL |

5,347,371 |

The following table sets out the funding source for the carry forward amounts:

|

Operational Expenditure Funding |

Total Request |

|

Reserves |

5,347,371 |

|

TOTAL |

5,347,371 |

Social & Policy

N/A

Risk

The volume of carry forwards are higher than we have had in previous years. Council’s normal practice is to forecast any underspend and to include any timing changes in the Annual Plan for the following year via a resolution of Council. Covid-19 provided a lot of uncertainty during the latter part of the year, and it was agreed with Council to provide all unspent budgets via the carry forward process. It is anticipated that we would revert to the existing practices next year.

There is risk that the size of the capital plan for 2020/21, combined with the large volumes of carry forwards may be challenging to deliver. The government has also created many stimulus packages to create jobs on the back of the pandemic and to stimulate the economy. This may also drive further challenges in obtaining resources and external firms to complete the work within our desired timeframes.

We are bringing on additional resources where possible to drive the capital programme that will also create jobs and benefit the community.

Many of the projects that have been carried forward are in progress. As a result, Council officers submitted to its Annual Plan and Council approved a reduction of $12.7m to the approved capital plan to ensure as much as practicable could be delivered.

Once carryforwards have been approved, Council officers will determine what year the works will be programmed. Projects may be reassessed as part of the Long Term Plan.

3.6 Options

The options available to Council are as follows:

a. Approve total carry forward expenditure of $41,349,780 from 2019/20 into 2020/21 split as follows:

i. Capital expenditure $36,002,409 from 2019/20 into 2020/21.

ii. Operational Expenditure $5,347,371 from 2019/20 into 2020/21.

b. Do not approve total carry forward total expenditure of $41,349,780

3.7 Development of Preferred Option

Approve total carry forward expenditure of $41,349,780 from 2019/20 into 2020/21 split as follows:

i. Capital expenditure $36,002,409 from 2019/20 into 2020/21.

ii. Operational Expenditure $5,347,371 from 2019/20 into 2020/21.

a Capex budget carry forward detail ⇩

b Opex carry forward detail ⇩

Extraordinary Meeting of Council - 15 September 2020 - Open Agenda Item 4

4. Draft Revenue and Financing Policy and underlying information

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

953015 |

|

Reporting Officer/s & Unit: |

Caroline Thomson, Chief Financial Officer |

4.1 Purpose of Report

To recommend the proposed amendments to the Revenue and Financing Policy for adoption by Council and subsequent consultation with the community.

|

That Council: a. Adopt the Draft Revenue and Financing Policy as attached in Appendix A b. Note that the rating implications from the Revenue and Financing Policy review will be reflected in the Statement of Proposal and Consultation Document to be presented to Council on 8 October 2020.

|

Over the last 18 months Council has undertaken a full review of its rates processes and its Funding Impact Statement (FIS) which sets out the Council’s fundamental approach to rating. Council reviewed the Revenue and Financing Policy through a series of ten workshops. The review process involved taking a first principles approach and was split into two stages.

Step 1

The first stage of the review involved Council completing a Funding Needs Analysis (FNA). This required Council to assess and document its view for each activity on the following (as required under section 101(3)(a) of the Local Government Act 2002):

· Community outcomes to which the activity primarily contributes

· Distribution of benefits – who gets the benefit whole/part of community or individuals?

· Period the benefits are expected to occur

· Extent actions or inactions contribute to need to undertake the activity (exacerbators)

· Costs and benefits of funding the activity separately from other activities

As part of the completion of this step the Council selected its preferred funding tools for both operational and capital expenditure for each activity.

The FNA is attached as an appendix to the Draft Revenue and Financing Policy (attached).

Council, at its meeting on 30 January 2020, adopted step one analysis for the Council activities.

Step 2

Under section 101(3)(b) of the Local Government Act 2002), step two requires Council to look carefully at the funding choices developed in step one and to consider the overall impact of any allocation of liability for revenue needs on the current and future social, economic, environmental, and cultural wellbeing of the community.

This process required Council to review the rating impacts from the modelling undertaken by officers and confirm the preferred rates allocation option.

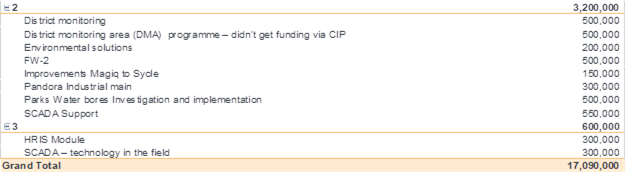

Council considered the rating models and concluded that the differentials as outlined below be proposed together with the UAGC.

New rates differentials proposed for Residential, Commercial and Rural:

Council identified that it needs to modify its rates remission policy to align with the proposed amendments to the Revenue and Financing Policy. The proposed amendments to the Rates Remission Policy are contained in a separate report to Council.

Consultation

Consultation on the Revenue and Financing Policy and supporting polices[1] will be required.

This is a formal step required to set a lawful rate, whether through a section 82 (LGA) consultation or section 83 (LGA) SCP.

The legislation lists essential information which must be included in the statement of proposal:

· analysis of the options;

· copies of any policies that will need to be changed

· the proposal; and

· the reasons for the proposal

The proposal is a primary communication document that helps the reader understand the proposal, the options council has considered, how the reader may be affected and why council prefers the proposed option. To be effective, the proposal it must be concise and to the point (while meeting the legal requirements). But it will be useful to have additional information available for those that want to dig more deeply into the matter.

In an effective rating review the proposal should be a clear statement about which rates are changing. This statement should describe how rates are allocated currently and how it is proposed to allocate them in future.

The proposal should also include a summary of the other options considered and give reasons why the council considers those options aren’t the best way forward for the community. These reasons may link back to the reasons given for the review at the start of the process. The status quo should be one of the options discussed, along with reasons why staying with it would not be appropriate.

4.3 Issues

The depreciation expense is used to determine the amount Council wishes to collect from its various funding sources (e.g. general rates, fees and charges). The depreciation policy and funding methodology will be included in the financial strategy in the 2021-31 Long Term Plan.

In order to amend the Revenue and Financing Policy and to amend the Rates Remission Policy, Council is required to consult with the community on the proposed changes to each policy.

4.4 Significance and Engagement

The introduction of the proposed changes to the Revenue and Financing Policy have been assessed as triggering high significance in Council’s Significance and Engagement Policy at the higher end of the scale, as there is a medium impact for specific groups of residents. Those who will be significantly affected by the proposed changes have been identified as follows:

· Ex-County properties identified as Commercial/Industrial

· Other Rural and Ex-County Rural over 5HA to Rural (over 5HA)

· Bay View, Other Rural and Ex-County to Residential

· Utility network assets

· Properties identified as Commercial/Industrial (for Wastewater Rate)

· Properties receiving a Postponement for Farmland

As such, separate targeted consultation will be undertaken with community-wide communications and direct, targeted engagement with those most affected.

Consultation on this policy is also a legal requirement under the Local Government Act 2002.

The proposal, and proposed amendments to the Revenue and Financing Policy and Rates Remission Policy will be available on Council’s website. Feedback will be able to be provided online via council’s website. Any feedback received on the two policies during the community consultation will also be captured.

Next steps

|

What |

When |

|

Council meeting to approve: Statement of Proposal Consultation Document |

8 October 2020 |

|

Community consultation (indicative) |

12 October 2020 – 15 November 2020 |

|

Hearings (dependent on volume of submissions) |

30 November 2020 – 18 December 2020 |

|

Adopt Revenue and Financing, Rates remission policies (indicative) |

Mid February 2021 |

4.5 Implications

Financial

Rates modelling has been conducted as part of the Revenue and Financing Policy review to ensure equality and fairness for all ratepayers.

Social & Policy

The Revenue and Financing policy will be updated at the completion of this review with effect 1 July 2021.

Risk

The Revenue and Financing Policy underpins Council’s funding so it is important to ensure that the policy is as robust as possible. The proposed changes will improve the policy and reduce any risk that Council may have had under the current policy.

The Draft Revenue and Financing policy has been legally reviewed by Simpson Grierson.

4.6 Options

The options available to Council are as follows:

a. Approve the amended Revenue and Financing Policy for public consultation

b. Make further amendments to the Revenue and Financing Policy

c. Retain the existing Revenue and Financing Policy – no change

4.7 Development of Preferred Option

The preferred option is for Council to approve the proposed amended Revenue and Financing Policy for public consultation.

a Draft Revenue and Financing Policy ⇩

Extraordinary Meeting of Council - 15 September 2020 - Open Agenda Item 5

|

Type of Report: |

Legal |

|

Legal Reference: |

Local Government (Rating) Act 2002 |

|

Document ID: |

963006 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager |

5.1 Purpose of Report

To reintroduce and update the Rating Policy.

To review and update the policy in alignment with proposed Revenue & Financing Policy, and Remission & Postponement Policy amendments.

To recommend the proposed amendments to the Rating Policy for approval by Council and subsequent consultation with the community.

|

That Council: a. Approve the reintroduction of a Rating Policy. b. Approve the proposed General Rate differentials and rates applied. c. Approve an increase in the City Water Rate from 50% to 70% for Rating Units that are not connected but within 100m of the system. d. Approve an increase in the Sewerage Rate from 50% to 70% for Rating Units that are not connected but within 30m of the system. e. Approve a note that a Wastewater Rate is being proposed to replace the Sewerage Rate. f. Approve the introduction of a Stormwater Rate. g. Note proposed amendments to rating differentials and definitions within the draft Revenue & Financing Policy. h. Note proposed amendments to remissions within the draft Rates Remission Policy. i. Note proposed amendments to postponements within the draft Rates Postponement Policy. j. Approve Council officers consulting on the Rating Policy in conjunction with the Revenue & Financing Policy. |

A significant review of the Revenue & Financing Policy is being conducted. As part of this work the Rates Remission Policy and Rates Postponement Policy are also being reviewed due to the wide-ranging impact of the Revenue & Financing Policy.

A review of the Rating Policy needs to be performed in conjunction with this wider review.

5.3 Issues

A number of Council policies refer to the Rating Policy. A policy was previously maintained, with the last example being found in the 2012/13 Ten Year Plan (refer attached). The Rating Policy was effectively made redundant by the introduction of a Funding Impact Statement into the 2015 Long Term Plan, and there is no legal requirement to maintain one.

Consultation on the Funding Impact Statement is only possible through the consultation process followed for the Annual Plan or Long Term Plan. However, changes proposed to the Revenue & Financing Policy (a foundation policy) impacts on the rating process. Further, consultation on the Long Term plan cannot effectively proceed until the Revenue & Financing Policy is adopted.

To overcome this issue, it is proposed that the Rating Policy is updated and reintroduced for public consultation. This will ensure that the community is sufficiently informed on proposed changes to rates.

In terms of process, the Rating Policy will reference the Revenue & Financing Policy, and provide the structure for future Funding Impact Statements.

To align the Rating Policy with proposed amendments to the Revenue & Financing Policy, the following amendments are proposed (please refer to the attached Draft Rating Policy and Annual Plan 2020/21 Funding Impact Statement for further details):

New differential categories and rates as follows:

|

Current |

Proposed |

|||

|

Differentials |

Differentials |

|||

|

2020/21 |

2021/22 |

|||

|

City Residential |

100% |

Residential / Other |

100% |

|

|

Commercial & Industrial |

268.09% |

Rural |

85% |

|

|

Miscellaneous |

100% |

Commercial & Industrial |

250% |

|

|

Ex-City Rural |

63.47% |

|||

|

Other Rural |

63.47% |

|||

|

Bay View |

72.80% |

|||

Proposed differential categories are defined as follows:

Residential and Other

Any property that is not defined as Commercial & Industrial, or Rural.

Commercial & Industrial

Any property that is in a commercial or industrial zone under the District Plan or used for any business activities, except properties categorised as rural, will be rated as commercial and industrial properties.

Commercial and industrial activities include, but are not restricted solely to;

· Rural and other support activities such as transport, supplies, packhouses and wineries servicing multiple clients

· Professional offices, surgeries etc.

· All retail, wholesale merchandising activities

· All forms of manufacturing and processing

· Bars, restaurants, cafes and other service activities

· Storage facilities

· Hotels, motels, B & B’s and other short-term accommodation providers

· Tourism operations

· Care facilities operated for profit

Rural

Any rating unit with an area of 5 Hectares or more that is used predominantly for land based agricultural or farming activities and the value of improvements does not exceed the value of the land.

Introduce the following targeted rates:

Stormwater Rate

The primary benficiary of stormwater assets are those properties that have a hard surface. There is a strong relationship between Capital Value and the hard surface area of a property.

This rate recovers the cost of stormwater asset management. The Stormwater Rate is based on the Capital Value of Residential and Commercial & Industrial properties within the recognised urban limit.

Rural properties, and Residential and Commercial & Industrial properties outside of the urban limit (that do not utilise the stormwater network) are exempted.

The differential categories for the water rates are:

|

Differentials |

Differential Rate within urban limits |

Differential Rate outside urban limits |

|

Residential / Other |

100% |

0% |

|

Rural |

0% |

0% |

|

Commercial & Industrial |

250% |

0% |

Amend the following targeted rates:

City Water Rate

Increase the rate for Rating Units that are not connected but within 100m of the City water supply system from 50% to 70%.

Sewerage Rate

Increase the rate for Rating Units that are not connected but within 30m of the City sewerage system from 50% to 70%.

Insert the following note: A Wastewater Rate is proposed to replace the current Sewerage Rate. A fixed rate is proposed to be applied to each water closet or urinal (pans) within a property, rather than the existing approach of charging based on the number of separately used or inhabited parts of a Rating Unit. Rating Units used primarily as a residence for one household will be treated as having one pan.

The Rating Policy will be updated to reflect the outcome of the proposal to replace the current sewerage rate with a pan charge, after consultation has been undertaken through the 2021-2031 Long Term Plan.

5.4 Significance and Engagement

There has been no external consultation on the proposed changes.

Significance of the proposed amendments are high as they impact all residents or ratepayers.

Any change to Council’s Rating Policy requires Council to follow the principles of consultation as outlined in section 82 of the Local Government Act 2002. Consultation will be performed as part of the wider Revenue & Financing Policy Review.

The proposal, and proposed amendments to the Rating Policy will be available on Council’s website. Feedback will be possible online via council’s website. Any feedback received on the policy during the community consultation will also be captured.

Next steps

|

What |

When |

|

Council meeting to approve: Statement of Proposal Consultation Document |

8 October 2020 |

|

Community consultation (indicative) |

12 October 2020 – 11 November 2020 |

|

Hearings (dependent on volume of submissions) |

30 November 2020 – 18 December 2020 |

|

Adopt Revenue and Financing, Rating Policy, Rates Remission and Rates Postponement policies (indicative) |

Early February 2021 |

5.5 Implications

Financial

Rates modelling will be conducted as part of the overall Revenue & Financing Policy review.

Social & Policy

The proposed reintroduction and amendments are intended to harmonise the Rates Remission Policy and Rates Postponement Policy with proposed amendments within the Revenue & Financing Policy. The proposed amendments will also provide a link between the Revenue & Financing Policy and the Funding Impact Statement used in Annual Plans and Long Term Plans.

The Rating Policy will be updated at the completion of this review with effect 1 July 2021.

Risk

Moderate – this policy impacts all Rating Units within the greater Napier City Council jurisdiction. Additional research and modelling will be required prior to consultation on the 2021/22 Long Term Plan to ensure that proposed rating factors are accurate and reliable.

5.6 Options

The options available to Council are as follows:

a. Approve reintroduction of a Rating Policy.

b. Approve the proposed changes.

c. Approve selected proposed changes.

d. Reject reintroduction of a Rating Policy.

e. Reject the proposed changes.

f. Reject selected proposed changes.

5.7 Development of Preferred Option

The proposed reintroduction and proposed amendments have been developed in response to an identified procedural gap between the Revenue & Financing Policy and the Funding Impact Statement.

a 2012/13 Ten Year Plan (extract) ⇩

b Annual Plan 2020/21 Funding Impact Statement ⇩

c Draft Rating Policy ⇩

|

Extraordinary Meeting of Council - 15 September 2020 - Attachments

|

Item 5 Attachments c |

|

Rating Policy |

|||

|

Approved by |

Council (Pending) |

||

|

Department |

Finance |

||

|

Original Approval Date |

|

Review Approval Date |

|

|

Next Review Deadline |

|

Document ID |

|

|

Relevant Legislation |

Local Government Act 2002, Local Government (Rating) Act 2002 |

||

|

NCC Documents Referenced |

Revenue & Financing Policy Funding Impact Statement Rates Remission Policy Rates Postponement Policy |

||

Purpose

To assist Council in setting rates as specified within the requirements of the Local Government Act 2002 (LGA) and the Local Government (Rating) Act 2002 (LGRA).

This Policy is to be read in conjunction with the Revenue and Financing Policy, Rates Remission and Postponement Policy and Funding Impact Statement.

The Council must complete the following to set a lawful rate.

· Analysis as per s.101(3) of the Local Government Act 2002

· Adopt a Revenue and Financing Policy

· Adopt a Funding Impact Statement

· Adopt an Annual or Long Term Plan

· Adopt a rates resolution consistent with the actions described above.

Note: to maintain rating consistency, unless otherwise stated, adopted amendments made during any rating year to this policy will only become effective with the adoption of the following Annual Plan or Long Term Plan.

Policy

1. General Rates

General Rates are used to fund both operating and capital expenditure. They fund the remaining costs of Council operations after all other sources of funding have been applied.

General Rates are assessed through a combination of a Uniform Annual General Charge (UAGC) and a rate in the dollar based on land value.

The amount of the UAGC is set to ensure that the total (excluding water and wastewater rates) uniform (or fixed) rates will be between 20% to 25% of total rates that are to be collected.

The General Rate is set differentially using matters as prescribed in Schedule 2 of the LGRA, and as listed in the Funding Impact Statement. The LGRA Schedule 2 allows councils to set a General Rate based on each of these matters.

General rate differentials

Rating Units assessed for the General Rate are categorised into one of three differential categories:

· Residential

· Commercial & Industrial

· Rural

Residential

Any property that is not defined as Commercial & Industrial, or Rural.

Commercial & Industrial

Any property that is in a commercial or industrial zone under the District Plan or used for any business activities, except properties categorised as rural, will be rated as commercial and industrial properties.

Commercial and industrial activities include, but are not restricted solely to:

· Rural and other support activities such as transport, supplies, packhouses and wineries servicing multiple clients

· Professional offices, surgeries etc.

· All retail, wholesale merchandising activities

· All forms of manufacturing and processing

· Bars, restaurants, cafes and other service activities

· Storage facilities

· Hotels, motels, B & B’s and other short-term accommodation providers

· Tourism operations

· Care facilities operated for profit

Rural

Any rating unit with an area of 5 Hectares or more that is used predominantly for land based agricultural or farming activities and the value of improvements does not exceed the value of the land.

Differentials

The following are the differentials to be applied based on the land value of properties in each differential category.

|

Differentials |

Group / Code |

Differential Rate |

|

Residential / Other |

1 |

100% |

|

Rural |

2 |

85% |

|

Commercial & Industrial |

3 |

250% |

The purpose of the differentials applied to the General Rate is to ensure that the amount payable by groups of ratepayers reflects Council’s assessment of the relative benefit received and share of costs those groups of ratepayers should bear based on the principles outlined in the Revenue and Financing Policy and the residential\non-residential apportionment assessment which is updated in conjunction with each city revaluation.

Notes on allocation of properties into differential categories

Rating units which have no apparent land use (or are vacant properties) will be placed in the category which best suits the zoning of the property under the district plan except where the size or characteristic of the property suggest an alternative use.

To avoid doubt where a rating unit has more than one use the relevant predominant use will be used to determine the category. The predominant use relates to the main productive activity rather than just to the land area. Where there is uncertainty the land will be categorised into the highest rated category.

Subject to the right of objection as set out in Section 29 of the Local Government (Rating) Act 2002, it shall be at the sole discretion of the Council to determine the use or predominant use of all separately rateable properties in the district.

Uniform Annual General Charge (UAGC)

Council’s Uniform Annual General Charge is set at a level that enables all Targeted Rates that are set on a uniform basis as a fixed amount, excluding those related to Water Supply and Sewage Disposal, to recover between 20% and 25% of total rates.

The charge is applied to each separately used or inhabited part of a rating unit.

2. Targeted Rates

Targeted Rates are charged to fund both operating and capital expenditure. They are charged where Council considers it desirable to separate out the funding of an activity. They are charged to rating units including those units that are separately inhabited which have access to or are deemed to benefit from the service provided. Targeted rates are a funding mechanism that may be charged for activities deemed to have either a high public or a high private good to identified properties, an area of the city or the city as a whole.

Some targeted rates are applied differentially using either land or capital values, however most targeted rates are applied on a uniform basis (same amount or rate in the dollar).

Fire Protection Rate

This rate recovers a portion of the net costs of the water supply systems before the deduction of water by meter income.

The Fire protection targeted rate is based on the Capital Value of properties connected to, or able to be connected to, the Napier City Council water supply systems.

This rate is differentially applied, in recognition that the carrying capacity of water required in the reticulation system to protect commercial and industrial properties is greater than that required for residential properties. The rate is further differentiated where a property is not connected but is within 100 metres of a water supply system. 50% of the base rate for each differentiated category applies for each property not connected but located within 100 metres of the systems.

|

Differentials |

Connected (%) |

Not connected but within 100m (%) |

|

Central Business District and Fringe Area |

400% |

200% |

|

Suburban Shopping Centres, Hotels and Motels and Industrial rating units outside of the CBD |

200% |

100% |

|

Other Rating Units connected to or able to be connected to the water supply systems |

100% |

50% |

City Water Rate

These rates recover the balance of the total net cost of the water supply systems after allowing for revenue collected from the Fire Protection Targeted Rate and the Water by Meter targeted rate.

The targeted rates are differentially applied and are a fixed amount set on a uniform basis, applied to each Separately Used or Inhabited Part of a Rating Unit connected to or able to be connected to, the Council’s City water supply system.

The differential categories for the water rates are:

· Connected – any Rating Unit that is connected to a Council system

· Service available – any Rating Unit that is not connected to a Council system but is within 100 metres of such system (charged 70% of the targeted rate for connected properties)

|

Differentials |

Connected (%) |

Not connected but within 100m (%) |

|

Rating Units connected to or able to be connected to the City water Supply Systems |

100% |

70% |

Refuse Collection and Disposal Rate

This rate recovers the cost of the kerbside refuse collection service, including an allocation of the cost of Council support services.

The Refuse Collection and Disposal targeted rate of a fixed amount is set on a uniform basis. It is applied to each separately used or inhabited part of a rating unit for which a rubbish collection service is available and is multiplied by number of times each week the service is provided. Rating units which Council officers determine are unable to practically receive the Council service and have an approved alternative service will be charged the waste service charge that excludes the approved alternative service.

Kerbside Recycling Rate

This rate recovers the net cost of the kerbside recycling collection service.

The Kerbside Recycling targeted rate of a fixed amount is set on a uniform basis. It is applied to each separately used or inhabited part of a rating unit for which the kerbside recycling collection service is available. Rating Units which Council officers determine are unable to practically receive the Council service and have an approved alternative service will be charged the waste service charge that excludes the approved alternative service.

Sewerage Rate

This rate recovers the net cost of the Wastewater Activity.

The Sewerage targeted rate is applied differentially as a fixed amount and is set on a uniform basis. It is applied to each separately used or inhabited part of a rating unit connected to, or able to be connected to, the City Sewerage System.

A differential of 70% of the rate applies to each rating unit not connected but located within 30 metres of the system.

|

Differentials |

Connected (%) |

Rate (per SUIP) |

Not connected but within 30m (%) |

Rate (per SUIP) |

|

Rating units connected to or able to be connected to the City Sewerage Systems |

100% |

$398.00 |

70% |

$278.60 |

A Wastewater Rate is proposed to replace the current Sewerage Rate. A fixed rate is proposed to be applied to each water closet or urinal (pans) within a property, rather than the existing approach of charging based on the number of separately used or inhabited parts of a Rating Unit. Rating Units used primarily as a residence for one household will be treated as having one pan.

The Rating Policy will be updated to reflect the outcome of the proposal to replace the current sewerage rate with a pan charge, after consultation has been undertaken through the 2021-2031 Long Term Plan.

Bay View Sewerage Connection Rate

The Bay View Sewerage Scheme involves reticulation and pipeline connection to the City Sewerage System. Prior to 1 November 2005, property owners could elect to connect either under a lump sum payment option, or by way of a targeted rate payable over 20 years.

The Bay View Sewerage Connection targeted rate is a fixed amount set on a uniform basis. It is applied to each separately used or inhabited part of a rating unit connected to the Bay View Sewerage Scheme, where the lump sum payment option was not elected.

The rate applies from 1 July following the date of connection for a period of 20 years, or until such time as a lump sum payment for the cost of connection is made.

The category of rateable land for setting the targeted rate is defined as the provision of a service to those properties that are connected to the sewerage system, but have not paid the lump sum connection fee.

The liability for the targeted rate is calculated as a fixed amount per separately used or inhabited part of a rating unit based on the provision of a service by the Council, including any conditions that apply to the provision of the service. The rate is used to recover loan servicing costs required to finance the cost of connection to the Bay View Sewerage Scheme for properties connecting under the targeted rate payment option.

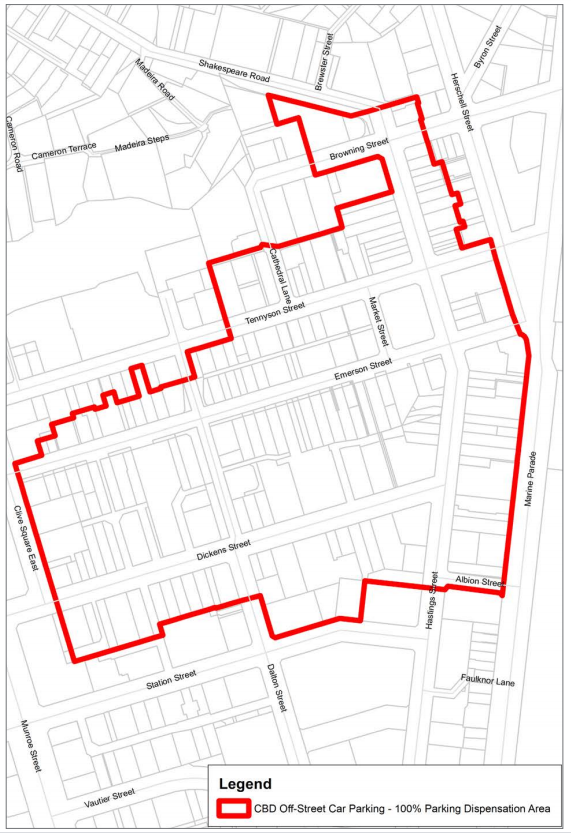

CBD Off Street Car Parking Rate

This rate is used to provide additional off street car parking in the Central Business District. Those commercial rating units in the mapped areas identified as the Central Business District Off Street Car Parking 100% and 50% Parking Dispensation areas are charged the CBD Off Street Parking targeted rate based on land value. This rate is set on a differential basis as follows:

|

Differentials |

% |

|

Properties where council provides additional parking due to the property receiving a 100% parking dispensation |

100% |

|

Properties where council provides additional parking due to the property receiving a 50% parking dispensation. |

50% |

Refer Council maps:

· CBD Off Street Car Parking – 100% Parking Dispensation Area

· CBD Off Street Car Parking – 50% Parking Dispensation Area

Taradale Off Street Car Parking Rate

This rate is used to provide additional off street car parking in the Taradale Suburban Commercial area.

Those properties in the Taradale Suburban Commercial area only are charged the Taradale Off Street Parking targeted rate based on land value and set on a uniform basis.

Suburban Off Street Car Parking Rate

This rate is used to provide additional off street car parking at each of these areas served by Council supplied off street car parking, and to maintain the existing off street car parking areas.

Those properties in suburban shopping centres and those commercial properties located in residential areas which are served by Council supplied off street car parking are charged the Suburban Shopping Centre Off Street Parking targeted rate based on land value and set on a uniform basis.

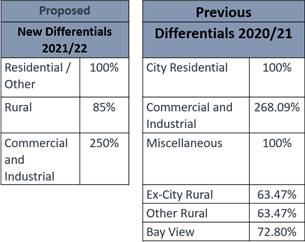

CBD Promotion Rate

This rate recovers at least 70% of the cost of the promotional activities run by Napier City Business Inc. The remainder is met from general rates to reflect the wider community benefit of promoting the CBD to realise its full economic potential.

Each commercial and industrial rating unit situated within the area as defined on Council map “CBD Promotion Rate Area” are charged the CBD Promotion targeted rate based on land value and set on a uniform basis.

Taradale Promotion Rate

This rate recovers the full cost of the Taradale Marketing Association’s promotional activities. All rating units in the Taradale Suburban Commercial area are charged the Taradale Promotion targeted rate based on land value and set on a uniform basis.

Swimming Pool Safety Rate

This rate recovers the cost of pool inspections and related costs to ensure owners meet the legal requirements of the Building Act 2004 and Building (Pools) Amendment Act 2016. A targeted rate of a fixed amount set on a uniform basis, applied to each rating unit where a residential pool or small heated pool (within the meaning of the Building (Pools) Amendment Act 2016) is subject to a 3 yearly pool inspection.

Water By Meter Charges

This rate applies to all with a water meter and is charged based on a scale of charges as shown on the schedule of indicative rates each year.

Where any rating unit is suspected to have above average water usage Council officers may require that a water meter is installed and excess usage is charged based the water by meter targeted rate.

The rate based on actual water use above the first 300m3 per annum will be charged to metered properties to which this rate applies.

Stormwater Rate

The primary benficiary of stormwater assets are those properties that have a hard surface. There is a strong relationship between Capital Value and the hard surface area of a property.

This rate recovers the cost of stormwater asset management. The Stormwater Rate is based on the Capital Value of Residential and Commercial & Industrial properties within the recognised urban limit.

Rural properties, and Residential and Commercial & Industrial properties outside of the urban limit (that do not utilise the stormwater network) are exempted.

The differential categories for Stormwater Rates are:

|

Differentials |

Differential Rate within urban limits |

Differential Rate outside urban limits |

|

Residential / Other |

100% |

0% |

|

Rural |

0% |

0% |

|

Commercial & Industrial |

250% |

0% |

Targeted Rates Note:

For the purposes of Schedule 10, clause 15(4)(e) or clause 20(4)(e) of the Local Government Act 2002, lump sum contributions will not be invited in respect of targeted rates, unless this is provided within the description of a particular targeted rate.

3. Separately Used or Inhabited Parts of a Rating Unit Definition

Definition

For the purposes of the Uniform Annual General Charge and all uniform (or fixed value) Targeted Rates with the exception of Wastewater outlined above, a separately used or inhabited part of a rating unit is defined as: Any part of a rating unit that is, or is able to be, separately used or inhabited by the owner or by any other person or body having the right to use or inhabit that part by virtue of a tenancy, lease, licence or other agreement.

This definition includes separately used parts, whether or not actually occupied at any particular time, which are provided by the owner for rental (or other forms of occupation) on an occasional or long term basis by someone other than the owner.

Examples of separately used or inhabited parts of a rating unit include:

· For residential rating units, each self-contained area is considered a separately used or inhabited part. Each situation is assessed on its merits, but factors considered in determining whether an area is self-contained would include the provision of independent facilities such as cooking / kitchen or bathroom, and its own separate entrance.

· Residential properties, where a separate area that is available to be used as an area independent to the rest of the dwelling is used for the purpose of operating a business, such as a professional practice, dedicated shop\display area or trade workshop. The business area is considered a separately used or inhabited part.

· For commercial or industrial properties, two or more different businesses operating from or making separate use of the different parts of the rating unit. Each separate business is considered a separately used or inhabited part. A degree of common area would not necessarily negate the separate parts.

· Where a single business comprises multiple buildings, or multiple floors of a single building, each building or floor of a multi-story building is deemed to constitute a separate part (SUIP).

These examples are not inclusive of all situations.

4. Maps

CBD Promotion Rate Area

CBD Off Street Parking

100% Parking Dispensation Area

50% Parking Dispensation Area

Policy Review

This policy will be reviewed at least once every three years.

Document History

|

Version |

Reviewer |

Change Detail |

Date |

|

1.0.0 |

Garry Hrustinsky |

Created |

|

6. Draft Rates Remission Policy

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

960522 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager |

6.1 Purpose of Report

To review and update the Rates Remission Policy in accordance with s.109 of the Local Government Act 2002.

To review and update the policy in alignment with proposed Remission & Postponement Policy amendments.

To recommend the proposed amendments to the Rates Remission Policy for approval by Council and subsequent consultation with the community.

|

That Council: a. Approve the inclusion of a Remission for Farmland Under 5 Hectares. b. Approve the inclusion of a Remission of Refuse Collection and/or Kerbside Recycling Targeted Rates. c. Approve the inclusion of a Remission for Residential Properties Used Solely as a Single Residence. d. Approve the removal of Remission for Land Subject to Special Preservation Conditions. e. Approve the removal of Remission of Uniform Annual General Charges (UAGC) and Targeted Rates of a Fixed Amount on Rating Units Owned by the Same Owner. f. Approve other minor changes detailed in this report g. Note proposed amendments to rating differentials and definitions within the draft Revenue & Financing Policy. h. Note proposed reintroduction and amendments to the Rating Policy. i. Approve Council officers consulting on the Rates Remission Policy in conjunction with the Revenue & Financing Policy.

|

A significant review of the Revenue & Financing Policy is being conducted. A review of the Rates Remission Policy needs to be performed in conjunction with this review due to the wide-ranging impact of the Revenue & Financing Policy.

6.3 Issues

To align the Rates Postponement Policy with proposed amendments to the Revenue & Financing Policy and Rating Policy, the following amendments are proposed (please refer to the attached Draft Rates Remission Policy for further detail):

INCLUDE

Remission for Farmland Under 5

This remission provides rates relief for farm less than 5 hectares that are used predominantly for land based agriculture or farming activities. Rating units in this category are treated as Residential for differential purposes.

Remission of Refuse Collection and/or Kerbside Recycling Targeted Rates

This amendment recognises rating units that require a less-frequent waste or recycling service through a remission.

Remission for Residential Properties Used Solely as a Single Residence

A remission is proposed where properties that are identified as having separately used or inhabited portions are used solely as a single family residence. This amendment is intended to simplify and replace Remission of Uniform Annual General Charges (UAGC) and Targeted Rates of a Fixed Amount on Rating Units Owned by the Same Owner.

REMOVE

Remission for Land Subject to Special Preservation Conditions

In practice this remission provides limited benefit to applicants. At the time of writing, only one remission was in place under this provision. Additional rates relief can be sought through Schedule 1, Parts 1 and 2 of the Local Government (Rating) Act 2002.

Remission of Uniform Annual General Charges (UAGC) and Targeted Rates of a Fixed Amount on Rating Units Owned by the Same Owner

It is recommended that this provision be replaced by Remission for Residential Properties Used Solely as a Single Residence as described above.

MINOR AMENDMENTS

Remission for Residential Land in Commercial or Industrial Areas

· Remove provisions that involve repealed legislative references (e.g. s.24 of the Rating Valuations Act 1998).

· Included the requirement for residential construction to have a building consent.

· Simplify wording.

Remission to smooth the effects of change in rates on individual or groups of properties

· “Significant increase” has been quantified as being “…25% or more over the current assessed rates for a single property.”

6.4 Significance and Engagement

There has been no external consultation on the proposed changes.

Significance of the proposed amendments are high as they could potentially impact a large proportion of residents or ratepayers.

Any change to Council’s Rates Remission Policy requires Council to follow the principles of consultation as outlined in section 82 of the Local Government Act 2002. Consultation will be performed as part of the wider Revenue & Financing Policy Review.

The proposal, and proposed amendments to the Rates Remission Policy will be available on Council’s website. Feedback will be possible online via council’s website. Any feedback received on the policy during the community consultation will also be captured.

Next steps

|

What |

When |

|

Council meeting to approve: Statement of Proposal Consultation Document |

8 October 2020 |

|

Community consultation (indicative) |

12 October 2020 – 11 November 2020 |

|

Hearings (dependent on volume of submissions) |

30 November 2020 – 18 December 2020 |

|

Adopt Revenue and Financing, Rating, Rates Remission and Rates Postponement policies (indicative) |

Early February 2021 |

6.5 Implications

Financial

Rates modelling will be conducted as part of the Revenue & Financing Policy review.

Social & Policy

The proposed amendments are intended to harmonise the Rates Remission Policy with proposed amendments within the Revenue & Financing Policy and Rating Policy.

The Rates Remission policy will be updated at the completion of this review with effect 1 July 2021.

Risk

Moderate – this is based on the large number of Commercial and Industrial properties that will be impacted by proposed changes to the Revenue & Financing Policy (namely Wastewater charges). Further fine tuning of the Rates Remission Policy will be required (post-consultation) to ensure that public feedback and the outcome of additional research is incorporated into the final draft.

6.6 Options

The options available to Council are as follows:

a. Approve the proposed changes.

b. Approve selected proposed changes.

c. Reject the proposed changes.

6.7 Development of Preferred Option

The proposed changes have been developed in response to proposed amendments to the Revenue & Financing Policy and Rating Policy.

a Draft Rates Remission Policy ⇩

b Deleted Remissions ⇩

|

Extraordinary Meeting of Council - 15 September 2020 - Attachments

|

Item 6 Attachments a |

|

Rates Remission Policy |

|||

|

Approved by |

Council |

||

|

Department |

Finance |

||

|

Original Approval Date |

30 June 2019 |

Review Approval Date |

13 August 2020 |

|

Next Review Deadline |

31 July 2023 |

Document ID |

|

|

Relevant Legislation |

Local Government Act 2002, Local Government (Rating) Act 2002 Building Act 2004 Rating Valuations Act 1998 |

||

|

NCC Documents Referenced |

Published in the Long Term Plan 2018-2028 which was reviewed between March/Apr 2018 and adopted on 29-06-18 Reviewed and amended as part of 2019/20 Annual Plan Reviewed and amended as part of 2020/21 Annual Plan |

||

Purpose

To enable Council to remit all or part of the rates on a rating unit under Section 85 of the Local Government (Rating) Act 2002 where a Rates Remission Policy has been adopted and the conditions and criteria in the policy are met.

Policy

1. Remission of Penalties

Objective

The objective of this part of the Rates Remission Policy is to enable Council to act fairly and reasonably in its consideration of rates which have not been received by the Council by the penalty date due to circumstances outside the ratepayer’s control.

Conditions and Criteria

Penalties incurred will be automatically remitted where Council has made an error which results in a penalty being applied.

Remission of one penalty will be considered in any one rating year where payment has been late due to significant family disruption. This will apply in the case of death, illness, or accident of a family member, at about the times rates are due.

Remission of the penalty will be considered if the ratepayer forgets to make payment, claims a rates invoice was not received, is able to provide evidence that their payment has gone astray in the post, or the late payment has otherwise resulted from matters outside their control. Each application will be considered on its merits and remission will be granted where it is considered just and equitable to do so

Remission of a penalty will be considered where sale has taken place very close to due date, resulting in confusion over liability, and the notice of sale has been promptly filed, or where the solicitor who acted in the sale for the owner acted promptly but made a mistake (e.g. inadvertently provided the wrong name and address) and the owner cannot be contacted. Each case shall be treated on its merits.

Penalties will also be remitted based on the application, by officers, of Council criteria established after Council has identified that Significant Extraordinary Circumstances have occurred that warrants further leniency in relation to the enforcement of penalties that would otherwise have been payable. The criteria to be applied will be set out in a council resolution that will be linked to the specific Significant Extraordinary Circumstances that have been identified by Council.

Penalties will also be remitted where Council’s Chief Financial Officer considers a remission of the penalty, on the most recent instalment, is appropriate as part of an arrangement to collect outstanding rates from a ratepayer.

2. Remission for Residential Land in Commercial or Industrial Areas

Objective

To ensure that owners of rating units situated in commercial or industrial areas are not unduly penalised by the zoning decisions of this Council and previous local authorities.

Conditions and Criteria

To qualify for remission under this part of the policy the rating unit must:

· Be situated within an area of land that has been zoned for commercial or industrial use. Ratepayers can determine where their property has been zoned by inspecting the City of Napier District Plan, copies of which are available from the Council office.

· Be listed as a ‘residential’ property for differential rating purposes. Ratepayers wishing to ascertain whether their property is treated as a residential property may inspect the Council’s rating information database at the Council office.

· Be residential construction with a Building Consent that has been granted under Section 49 of the Building Act 2004.

Ratepayers wishing to claim remission under this part of the policy must make an application in writing addressed to the Chief Financial Officer.

The application for rates remission must be made to the Council by the 30th of April prior to the commencement of the rating year. Applications received during a rating year will be applicable from the commencement of the following rating year. Applications will not be backdated.

The amount remitted will be the difference between the rates calculated on a Residential differential and a Commercial and Industrial differential.

3. Remission for Farmland Under 5 Hectares

Objective

To provide rates relief for farms where a Rating Unit is less than 5 hectares.

Conditions and Criteria

· The Rating Unit must be used predominantly for land based agriculture or farming activities.

· Remission will be revoked where a change in land use has occurred.

The amount remitted will be the difference between the rates calculated on a Residential differential and a Rural differential.

Ratepayers wishing to claim remission under this part of the policy must make an application in writing addressed to the Chief Financial Officer.

The application for rates remission must be made to Council by the 30th of April prior to the commencement of the rating year. Any remission for applications received during a rating year will be applicable from the commencement of the following rating year. Remissions will not be backdated. Declarations must be renewed every 3 years.

4. Remission of Refuse Collection and/or Kerbside Recycling Targeted Rates

Objective

To enable Council to provide rates remission where, refuse collection or kerbside recycling services are not able to be provided, or where a ratepayer receives a reduced service.

Conditions and Criteria

· Remission of part of the charge may be provided where a Council service is not provided or where Council officers have approved an alternative service.

· Remission of part of the charge be provided where a ratepayer applies for a reduced service, and a Council officer deems a reduced service to be appropriate. Under this condition, Refuse Collection may be reduced from a weekly service to a fortnightly service (or from a thrice-weekly service to a weekly service for properties within the CBD).

· Applications for remission must be made in writing by the ratepayer or their authorised agent.

· Remission may be revoked where a change in service has occurred.

5. Remission for Residential Properties Used Solely as a Single Residence

Objective

To enable Council to provide rates remission where properties that are identified as having separately used or inhabited portions are used solely as a single family residence.

Conditions and Criteria

Applications for rates remission must be made in writing by the ratepayer or their authorised agent.

A signed declaration must be provided to Council stating that the properties are used as a single family residence. The application must be made to Council by the 30th of April prior to the commencement of the rating year. Any remission for applications received during a rating year will be applicable from the commencement of the following rating year. Remissions will not be backdated. Declarations must be renewed every 3 years.

Accommodation arrangements must not be for pecuniary benefit.

6. Remission for Water Rates (by meter)

Objective

To provide ratepayers with a measure of relief by way of partial rates remission where, as a result of the existence of a water leak on the Rating Unit which they occupy the payment of fuller rates is inequitable, or where officers are convinced that there are errors in the data relating to water usage.

Conditions and Criteria

· The existence of a significant leak on the occupied Rating Unit has been established and there is evidence that steps have been taken to repair the leak as soon as possible after the detection, or officers have reviewed the usage data and are convinced that the usage readings are so abnormal as to require adjustment.

· The Council or its delegated officer(s) as determined from time to time and set out in the Council’s delegations register shall determine the extent of any remission based on the merits of each situation.

7. Remission to smooth the effects of change in rates on individual or groups of properties

Objective

To enable Council to provide rates remission where, as a result of a change in Council policy results in a significant increase in rates, Council decides it is equitable to smooth or temporarily reduce the impacts of the change by reducing the amount payable.

The Council considers a significant increase to be 25% or more over the current assessed rates for a single property.

Conditions and Criteria

· Remission of part of the value based rates to enable the impact of a change in rates to be phased in over a period of no more than 3 years.

To continue with any existing rates adjustment where, due to change in process, policy or legislation Council considers it equitable to do so subject to a maximum limit of 3 years to a remission made under this clause in the policy.

8. Remission for Special Circumstances

Objective

To enable Council to provide rates remission for special and unforeseen circumstances, where it considers relief by way of rates remission is justified in the circumstances.

Conditions and Criteria

Applications for rates remission must be made in writing by the ratepayer or their authorised agent.

Each circumstance will be considered by Council on a case by case basis. Where necessary, Council consideration and decision will be made in the Public Excluded part of a Council meeting.

The terms and conditions of remission will be decided by Council on a case by case basis. The applicant will be advised in writing of the outcome of the application.

9. Remission of Rates in Response to Significant Extraordinary Circumstances being identified by Council.

Objective

To enable Council to provide rates remission to assist ratepayers in response to Significant Extraordinary Circumstances impacting Napier’s ratepayers.

Definitions

Financial Hardship: for the purpose of this provision is defined as the inability of a person, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered necessary according to New Zealand standards. In the case of a ratepayer who is not a natural person, it is the inability, after seeking recourse from Government benefits or applicable relief packages, to reasonably meet the cost of goods, services and financial obligations that are considered essential to the functioning of that entity according to New Zealand standards.

Conditions and Criteria

For this policy to apply Council must first have identified that there have been Significant Extraordinary Circumstances affecting the ratepayers of Napier, that Council wishes to respond to.