|

Future Napier Committee - 11 February 2021 - Attachments

|

Item 1 Attachments a |

Future Napier Committee

Open Agenda

|

Meeting Date: |

Thursday 11 February 2021 |

|

Time: |

Following the Sustainable Napier Committee |

|

Venue: |

Large Exhibition Hall Napier War Memorial Centre Marine Parade Napier |

|

Committee Members |

Mayor Wise, Deputy Mayor Brosnan (In the Chair), Councillors Boag, Browne, Chrystal, Crown, Mawson, McGrath, Price, Simpson, Tapine, Taylor and Wright |

|

Officer Responsible |

Director City Strategy |

|

Administration |

Governance Team |

|

|

Next Future Napier Committee Meeting Thursday 25 March 2021 |

Future Napier Committee - 11 February 2021 - Open Agenda

ORDER OF BUSINESS

Apologies

Nil

Conflicts of interest

Public forum

Nil

Announcements by the Mayor

Announcements by the Chairperson including notification of minor matters not on the agenda

Note: re minor matters only - refer LGOIMA s46A(7A) and Standing Orders s9.13

A meeting may discuss an item that is not on the agenda only if it is a minor matter relating to the general business of the meeting and the Chairperson explains at the beginning of the public part of the meeting that the item will be discussed. However, the meeting may not make a resolution, decision or recommendation about the item, except to refer it to a subsequent meeting for further discussion.

Announcements by the management

Confirmation of minutes

Minor matters not on the agenda – discussion (if any)

That the Minutes of the Future Napier Committee meeting held on Thursday, 3 December 2020 be taken as a true and accurate record of the meeting.................................................................................... 196

Agenda items

1 Review of Local Government Investment in Business and Industry Support across the Hawke’s Bay Region. 3

2 Draft District Plan........................................................................................................ 188

3 Resource Consent Activity Update.............................................................................. 193

Public Excluded

Nil

Future Napier Committee - 11 February 2021 - Open Agenda Item 1

1. Review of Local Government Investment in Business and Industry Support across the Hawke’s Bay Region.

|

Type of Report: |

Information |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

1278534 |

|

Reporting Officer/s & Unit: |

Bill Roberts, Economic Development Manager Richard Munneke, Director City Strategy |

1.1 Purpose of Report

The Review of Local Government Investment in Business and Industry Support across the Hawke’s Bay Region report (Attachment A) summarises the findings and recommendations of a review of Hawke’s Bay Council-funded, non-statutory activities that are focussed on business, industry and sector development.

Key Findings

The Giblin Group review of Hawke’s Bay Council-funded, non-statutory activities that are focussed on business, industry and sector development (the “Review”) finds the following:

• There are no major gaps in the types of services/activities being delivered and current services/activities are based on addressing issues or leveraging opportunities that are broadly aligned with the role of local government.

• The services/activities being delivered are, however, often sub-scale (e.g. often less than 1 FTE to deliver significant programmes of work or activities). This will be limiting the potential value of business, industry and sector development investment for Hawke’s Bay. This value relates to the ability to:

o Most effectively leveraging the resources of others (e.g. Central Government funding/involvement and private sector funding/involvement). Regions need to be well organised and focused in order to maximise the opportunities available through Central Government funding support (which will continue to have a large role to play in a COVID-recovery environment), and to partner with the private sector in different ways;

o Work with speed and agility to fully understand the nature of issues, constraints and opportunities presenting for Hawke’s Bay in order to design and implement appropriate interventions where there is a clear role for government; and

o Bring mandate, mana and resources to the table to focus on areas of critical priority for Hawke’s Bay.

• The real potential value of economic development investment in Hawke’s Bay is a greater ability to meet the overarching outcome of the Matariki Strategy and Action Plan “Every whānau and every household is actively engaged in and benefiting from growing a thriving Hawke’s Bay economy”. This requires a focus on existing business (and assisting them to overcome challenges and create greater value through doing things differently and better over time); a focus on creating new platforms for growth for Hawke’s Bay (either by growing new activity in the region or by encouraging new activity to the region); and tying these things together, the investments and efforts need to support a thriving business environment (e.g. infrastructure, rules and regulations).

• The Return on Investment (RoI) from effective business, industry and sector development support can be high. For example:

o Work to support the Hawke’s Bay horticulture and viticulture sector with critical COVID-related seasonal labour issues will help to protect around $715m of regional economic activity in apples and pears alone. This sector directly supports 2,579 permanent local workers and, indirectly, a further 5,751 permanent local workers in the eco-system of services that supports the industry;

o Economic development work relating to the horticulture potential in Wairoa suggests that a proportionately minor strategic government role in different areas could help support additional expenditure to the local Wairoa economy of around $82 million over a 10year period and the employment of an additional 197 FTEs over the same period.

o Encouraging a new business to locate in Hawke’s Bay could lead to 100s of new jobs and resulting economic activity. Depending on the nature of the activity this could, in time, help to stimulate a range of value-add services (and well-paying jobs) needed to support this activity.

o For relatively small investments, effective regional branding, marketing and promotion can play a key role in attracting visitors, talent, investors and businesses to the region. Tourists in Hawke’s Bay spent over $45 million in August 2020 (the highest regional spend in the country), and while not all visitors will have been encouraged to visit by the work of Hawke’s Bay Tourism Ltd (HBTL) this still suggests an effective RoI on the $1.5m in annual funding for HBTL. Visitors to Hawke’s Bay also support local retail and hospitality and help to create vibrant city centres and regional amenities that locals enjoy and which play a critical role in wider people and talent attraction.

• There are also opportunities to better align and structure some activities and services e.g. business capability support being provided by Hastings District Council (HDC) should ideally be provided via agencies with core expertise in this area e.g. Business Hawke’s Bay (BHB)/a regional Economic Development Agency (EDA), and/or Hawke’s Bay Chamber of Commerce. This would promote regional coherence and access for business.

• Some regions and Economic Development Agencies (EDAs) have greater access to funds to support feasibility/business case development. Hawke’s Bay currently lacks a regional pool of funds that can be used to investigate economic development opportunities that are aligned with the region’s strengths/opportunities/strategy. This means that opportunities are considered in an ad hoc way and support for any investigation will depend on the degree of funding available to individual Councils at the time and the strength of any advocacy.

• Destination management and marketing is led by Hawke’s Bay Tourism Ltd (HBTL) and while there is some cross-over in activities (largely in the events space) there appears to be good coordination between Councils and HBTL.

• Business capability-related support is largely provided through the Regional Business Partner (RBP) Programme (although HDC does do a bit of this as well).

• Cluster and sector work with industry coalitions is largely led by BHB.

· There are some good examples of collaboration relating to investment attraction e.g. NZ Institute for Skills and Technology and Jetstar, but activity related to investment and talent attraction has been largely ad hoc (notwithstanding a desire to back existing strategies with funding for implementation).

· Matariki is the main focal point for regional economic development work but there is concern among stakeholders that Matariki is not delivering on its promise and that governance could be improved.

The Case for Change

The Review finds that there is a case for change. Analysis, interviews and conversations undertaken for the Review, and the survey of stakeholders conducted between 2-15 September 2020, indicate the following key issues:

· Most stakeholders and those involved in delivery and funding are looking for greater clarity over roles and functions.

· Businesses are looking for greater clarity over the activities and services available to support business activity.

· There is concern that there are unhelpful and competitive behaviours in the system and that this is constraining more effective collaboration. This is feeding a perception in the business community that the economic development system is fragmented and not particularly transparent.

· There is concern about whether Hawke’s Bay has the right capability (alongside structure/s) to support effective and efficient delivery of activities and services, leading to views that the region is not as responsiveness to community needs as it could be and punching below its weight externally.

· BHB financial sustainability is clearly an issue.

· A high proportion of stakeholders feel that funding for economic development activities and services should be increased.

· HBTL appears to be doing a successful job and is supported by its main stakeholders. Change would come with costs that could outweigh benefits (that could potentially be achieved through non-structural changes). At this point there doesn’t appear to be a strong case for change (at least institutionally).

· Funding for tourism relative to other sectors has been a theme of the feedback, with many viewing this as unbalanced. But tourism directly supports local retail and hospitality (and helps to create vibrant city centres and regional amenities that locals enjoy and play a role in people and talent attraction). This means it’s not as simple as saying one sector vs the others. Ideally, we would be supporting a range of key sectors of importance/opportunity (taking into account the appropriate role of govt).

· Business Hawke’s Bay’s financial sustainably has been highlighted as an issue in the Giblin Group report. On 17th December 2020, Business Hawke’s Bay initiated formal consultation on a proposal to wind up the organisation based on its ongoing viability to meet its commitments (over and above the Contract for Service). Decisions to be made by the Business Hawke’s Bay board are expected late January 2021. (refer Attachment B – Letter from BHB Chair to Councils). The five Hawke’s Bay Councils have reiterated their commitment to the Chairperson to work with Business Hawke’s Bay to keep the Business Hubs open and the potential assignment to one of the five councils. To support Business Hawke’s Bay’s process the councils will develop and agree a transition plan with Business Hawke’s Bay for any such eventuality.

|

The Future Napier Committee: a. Receive the Giblin Group report titled Review of Local Government Investment in Business and Industry Support across the Hawke’s Bay Region dated December 2020.

b. Notes the report is for information purposes only. No decision relating to the recommendations set out in this report are required by Council/Committee.

c. Consider the recommended options to form a new entity to lead (non-tourism) economic development activities. This new entity would focus on business development and support; innovation and industry development; skills building, attraction and retention initiatives; investment promotion and attraction; economic development strategy development; and strategy/action plan programme management.

d. Support the second stage of the review process and a more detailed investigation of the recommendations set out in the Giblin Group report Review of Local Government Investment in Business and Industry Support across the Hawke’s Bay Region dated December 2020. We note that the additional funding for the second stage is planned within the HBLASS (shared services cost centre)

e. Support engagement with Treaty Partners and other regional stakeholders on the opportunity to create an enduring economic development delivery platform that provides Hawke’s Bay with the appropriate scale and mandate to better guide and direct economic development activity to priority areas and issues.

f. Support the opportunity to embed a partnership with Māori in the new EDA model. The model would allow for discussions on the level of engagement with Māori business and, potentially, a joint resourcing approach with Hawke’s Bay Māori/iwi/hāpu fora or organisations.

g. Support the five Council’s commitment to keeping the Hawke’s Bay Business Hub open.

|

|

|

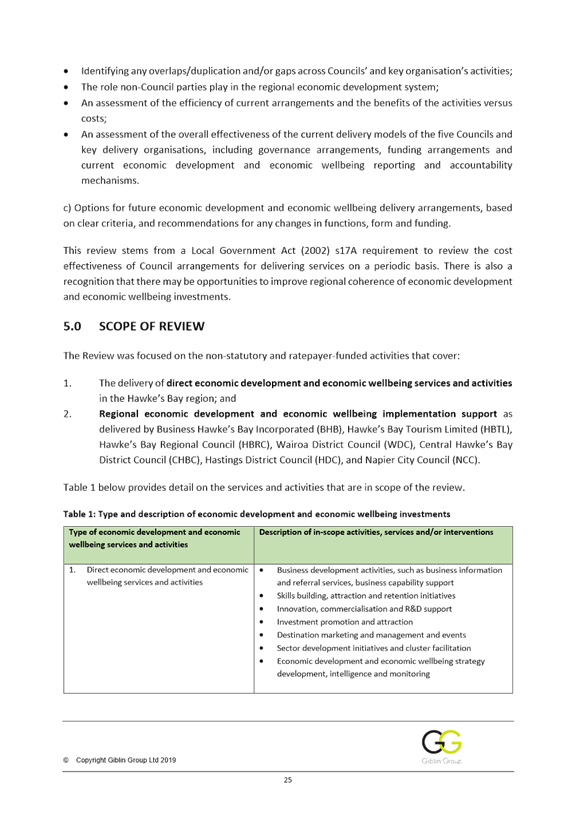

In July 2020 the five Hawke’s Bay Councils commissioned from Giblin Group a Local Government Act (2002) s17A review of Hawke’s Bay Council-funded, non-statutory activities that are focussed on business, industry and sector development. The specific activities and services that were in scope of this review were:

• Business development activities, such as business information and referral services and business capability support;

• Skills building, attraction and retention initiatives;

• Innovation, commercialisation and R&D support;

• Investment promotion and attraction;

• Destination marketing and management and events;

• Sector development initiatives and cluster facilitation;

• Economic development and economic wellbeing strategy development, intelligence and monitoring.

• Strategy/action plan programme management, coordination, communications, monitoring and reporting (i.e. largely the activities involved in supporting and implementing the Matariki Hawke's Bay Regional Development Strategy).

The Review was commissioned following a request from Business Hawke’s Bay for additional funding and subsequent desire to review the cost effectiveness of Council arrangements for delivering business, industry and sector development activities and services and to consider any opportunities to improve regional coherence of this sub-set of economic development investments.

Hawke’s Bay Councils were seeking an assessment of:

a) The role of local government in economic development and economic wellbeing in the region, based on an analysis of:

o Challenges and opportunities facing the Hawke’s Bay economy;

o Rationales for local government activities in economic development and economic wellbeing;

o The landscape in which various actors and mechanisms play a role in the regional economic development system;

o Legislative and central government expectations.

b) Economic development and economic wellbeing activities, identifying strengths, weaknesses and any relevant gaps in the activities, based on:

o The Councils’ objectives, priorities and performance targets;

o Identifying any overlaps/duplication and/or gaps across Councils’ and key organisation’s activities;

o The role non-Council parties play in the regional economic development system;

o An assessment of the efficiency of current arrangements and the benefits of the activities versus costs;

o An assessment of the overall effectiveness of the current delivery models of the five Councils and key delivery organisations, including governance arrangements, funding arrangements and current economic development and economic wellbeing reporting and accountability mechanisms.

c) Options for future economic development and economic wellbeing delivery arrangements, based on clear criteria, and recommendations for any changes in functions, form and funding.

The Giblin Group report Review of Local Government Investment in Business and Industry Support across the Hawke’s Bay Region summarises the findings and recommendations of this Review.

1.3 Issues

Current Investment in Activities and Services

In terms of the investment Hawke’s Bay ratepayers are making in business, industry and sector development the Review finds:

• In total HB Councils are investing just over $10m in business support and industry development related services and activities.

• Just under half of this is directed to the i-Sites and the Napier Convention Centre and Toi I. [Note – these have been included given their roles in regard to visitor attraction/promotion and/or events].

• Funding for Hawke’s Bay Tourism Ltd makes up 15.7% of the funding.

• Funding for Business Hawke’s Bay makes up 3.3% of funding.

• Funding for specific Council ED teams (salaries + funding for discretionary activities/projects) makes up around 13% of funding.

• At an aggregate level (nominal) funding has remained about the same over the last five years. This means in real terms funding has fallen.

• There has been some change to funding at a more detailed level e.g. HBRC used to have an Economic Development Manager; HDC has been shifting funding from the ED budget to its Strategic Projects team.

• There is a clear path dependence with current ED funding. The region has built infrastructure that requires visitor support e.g. even setting aside i-Sites, ToiToi and NCC, we have Splash Planet, Aquarium, The Faraday Centre etc, and funding has followed this need.

Effectiveness and Efficiency

In terms of effectiveness and impact the Review finds:

Councils:

· Performance measures and any related KPIs or targets are organisation specific with varying levels of detail. They are often project based. These are, for the most part, being met. The activities/services are being delivered efficiently (on the basis of FTE resources).

· There is no explicit relationship to Matariki or broader regional objectives except through general collaboration performance measures (where they exist). There is an opportunity to tighten this.

· More broadly the region does not have a clear ‘impact framework’ to articulate the ‘intervention logic’ between activities delivered and the desired outcomes for the region over the short, medium and longer-term. A framework like this could better inform distributed (individual, team/org) work programmes that contribute to regional outcomes and provide greater clarity on respective roles and responsibilities (e.g. leadership and/or close collaboration where needed).

Business Hawke’s Bay (BHB)

· BHB is meeting the KPIs set out in the Contract for Service (CfS) and has delivered outputs efficiently but it has a large work programme (relative to FTEs/funding available) that goes beyond the CfS areas of focus. This has been a strategic decision (to use reserves to create programmes where a need has been identified). Given limited FTEs this will be constraining the ability to delivery priorities as effectively as possible.

· Business Hub usage and business connection metrics continue to show growth (even including the COVID-lockdown period). The Hub is clearly filling a need for a meeting and connection space that has a look, feel, and vibe that businesses and organisations will pay to use. The Hub also plays a critical role in bringing together, under one roof, many of the key business support agencies operating in Hawke’s Bay. In an environment where there is a perception of fragmented services this is important. The Business Hub, however, runs at an overall loss and additional funding is required to support repairs and maintenance and CAPEX.

· BHB ongoing viability to meet its commitments (over and above the Contract for Service) is under currently review, with decisions to be made by the BHB board on whether to wind up the organisation late January 2021. (please refer Attachment B – Letter from BHB Chair to Councils)

Hawke’s Bay Tourism Ltd

· HBTL is meeting the KPIs set out in the funding agreement with HBRC. Central Government considers HBTL an effective RTO. It appears to be delivering outputs efficiently.

· HBTL’s members appear to be satisfied with HBTL’s contribution toward the growth of the industry and in representing the region at a national and international level. The area where members think there is an opportunity to do more is in “coordinating business opportunities for its members”. This includes education, business events and workshops focussed on the specific issues of SME tourism businesses.

1.4 Significance and Engagement

N/A

1.5 Implications

Financial

N/A

Social & Policy

N/A

Risk

N/A

1.6 Options

Section 17A of the LGA requires consideration of the following options when considering delivery improvements (note a 17A review is not limited to these options):

(a) Responsibility for governance, funding, and delivery is exercised by the local authority;

(b) Responsibility for governance and funding is exercised by the local authority, and responsibility for delivery is exercised by –

(i) a council-controlled organisation of the local authority; or

(ii) a council-controlled organisation in which the local authority is one of several shareholders; or

(iii) another local authority; or

(iv) another person or agency.

(c) Responsibility for governance and funding is delegated to a joint committee or other shared governance arrangement, and responsibility for delivery is exercised by an entity or a person listed in paragraph (b)(i) to (iv).

The Giblin Group report considers seven (7) options given the Hawke’s Bay context and the Review analysis (i.e. the range of issues, challenges and opportunities that were identified). These are:

1. The Status Quo.

2. Enhanced Status Quo v1: Improved funding for BHB.

3. Enhanced Status Quo v2: Improved funding for BHB + BHB takes on RBP contract (with HB Council support an

4. Central Govt agreement via formal procurement process).

5. Transferring business support services to a Council or across Councils.

6. Leveraging other providers: A variation of Option 4. Responsibility for (non-tourism) business and industry development and support activities/services would sit with a Council or Councils but these activities/services would be contracted to other providers in the region (e.g., industry groups, iwi organisations) to deliver.

7. Extended regional model of delivery for non-tourism economic development activities (EDA CCO): BHB would become Council Controlled Organisation (CCO). No change to HBTL.

8. Combined Regional Economic and Tourism Agency: BHB and HBTL would be folded into a new combined Regional EDA/RTO for Hawke’s Bay.

Note:

This report to Council/Committees does not seek any decisions on the recommended options set out in the Giblin Group report Review of Local Government Investment in Business and Industry Support across the Hawke’s Bay Region at this time.

When the next stage of the review process is completed and the Chief Executives have considered, a further and final report will be brought to Council to seek support and decisions to formally seek community consultation on the options and preferred recommendations. This is expected mid 2021)

Attached is a copy of the major advantages and disadvantages of each of the considered options. (Attachment C)

1.7 Development of Preferred Option

Next Steps

The Chief Executives have commissioned Giblin Group to develop the next stage of the review process to develop a detailed plan, which will be co-designed with Matariki Partners and other regional stakeholders, to:

• Further define the entity design that best meets the objectives of Matariki partners and other key stakeholders;

• Help clarify and set the transition time frame;

• Identify the key areas/components that will need to be supported and/or will undergo transition;

• Identify the key tasks in each area, including appropriate checkpoints and milestones;

• Identify relevant risks and risk levels;

• Be used to support a request to Central Government for transitional funding support.

The next stage of the review process would begin February 2021 of which the estimated cost is $40,000 (GST exclusive). This cost would be managed via the HBLASS Shared Services Cost Centre and shared by Councils in accordance with the annual budget plan on the following basis:

o Wairoa District Council (11%) $4,400

o Napier City Council (26%) $10,400

o Hastings District Council (26%) $10,400

o Central Hawke’s Bay District Council (11%) $4,400

o Hawke’s Bay Regional Council (26%) $10,400

After the next stage of the review is completed and the Chief Executives have considered, then a final report will be brought to Council to seek support and decisions to formally seek community consultation on the options and preferred recommendation. This is expected mid 2021.

The table below captures the key steps in the next stage of the review process.

The Chief Executives have commissioned Giblin Group to develop the next stage of the review process to develop a transition plan, which will be co-designed with Matariki Partners, to:

• Further define the entity design that best meets the objectives of Matariki partners and other key stakeholders;

• Help clarify and set the transition time frame;

• Identify the key areas/components that will need to be supported and/or will undergo transition;

• Identify the key tasks in each area, including appropriate checkpoints and milestones;

• Identify relevant risks and risk levels;

• Be used to support a request to Central Government for transitional funding support.

The table below captures the key steps in the proposed transition planning.

|

Key steps in transition planning |

Comment |

|

· When does it start, how long will it take, when does it finish etc? |

|

|

2. Describe the starting state |

· Where are we now? |

|

3. Describe the target state |

· Where do we want to be? |

|

4. Describe the areas that need to be supported and/or will undergo transition |

· E.g. Co-design with Matariki Partners and other stakeholders; engagement; transitional work programme; structure and legal form; governance and accountability; communication |

|

5. List the tasks in each area |

· Identify the high-level transition tasks for each area/component of the transition to a new entity. |

|

6. Identify the risks and risk levels |

· This ensures there is adequate focus on the areas that need careful attention and mitigation |

|

7. Add checkpoints and milestones |

· This helps to provide measurable targets and status checks through the process |

|

8. Implementation |

· Which will involve: o Clear ownership and resourcing of the tasks o Monitoring and reporting o A governance mechanism (either utilising an existing structure/s or creating something specific). |

The table below provides an initial view of the likely areas of focus for the next phase detailed planning.

|

Key components |

Description |

|

1. Co-design and engagement a. With Matariki Partners b. With other key stakeholders e.g. business community |

· Co-design with Matariki Partners and other key stakeholders should form the basis of the planning · The opportunity should also be taken to ensure the business community has a voice in the process · Engagement with Matariki RDS GG and/or ESG will be an important element

|

|

2. Existing ED activities/services

|

There will be elements of existing ED activities/services which will need to be supported through a transition process e.g. Business Hub

|

|

3. Structure and legal form

|

This would include the organisational structural and legal considerations in moving from the existing BHB incorporated society structure to a new structure e.g. potentially a trust (as a possible stepping stone to a CCO (if needed))

|

|

4. Governance and accountability

|

This would include issues such as planning for new Board appointments |

a Review of Local Government Investment in Business and Industry Support across the Hawke's Bay Region - Giblin Group ⇩

b Letter from Business Hawke's Bay's Board Chair - 17 December 2020 ⇩

c Advantages and Disadvantages Options Table ⇩

|

Type of Report: |

Operational and Procedural |

|

Legal Reference: |

Resource Management Act 1991 |

|

Document ID: |

1276250 |

|

Reporting Officer/s & Unit: |

Dean Moriarity, Team Leader Policy Planning |

2.1 Purpose of Report

For Council to endorse the release of the (non-statutory) Draft District Plan for the purpose of engaging with the community on its content.

|

The Future Napier Committee: a. Endorse: i. the release of the (non statutory) Draft District Plan for the purpose of engaging with the community on its content. ii. the policy framework for inclusion in the Draft District Plan to provide the opportunity for the wider public to have their say. b. Note and endorse that Council will seek written comments on the Draft District Plan with a generous period of time for submitting of no less than 6 weeks c. Note and endorse that the written comments will be considered by Council prior to confirmation of the final policy framework adopted in the Proposed District Plan in 2022. d. Note that public hearings will be held to consider submissions lodged on the Proposed Plan following its notification.

|

Officers have conducted a series of seminars with Council over the last 12 months seeking confirmation of the preferred policy approach for provisions in the Draft District Plan. In line with the agreed framework, officers have been working on the detailed content of individual chapters. The provisions are based on, and remain consistent with, the strategic direction for the Draft Plan agreed to at the start of the review process and as refined through the seminars.

The content of the majority of the Draft Plan is now at a point sufficiently advanced for Council to consider endorsing the release of a Draft Plan to seek the views and feedback from the community as an informal process prior to legal notification of a Proposed District Plan. The Draft District ePlan is available to view via the following link.

https://napier.isoplan.co.nz/draft/

2.3 Issues

Given the magnitude of the District Plan review, not all chapters are complete. A few work streams remain works in progress and will be reported through to Council prior to merging into the District Plan in advance of the formal notification of the Proposed District Plan, currently slated for early 2022. These include, Sites of Significance to Māori, Review of Structure Plans, provisions relating to greenfield growth in the hills and changes arising from the soon to be developed Napier Spatial Plan, overland flow paths, financial contributions and Notice of Requirements for Council designations.

Similarly, there are a few outstanding matters arising from stakeholder feedback which require Council confirmation of the policy approach for the Draft Plan relating to Significant Natural Areas and Heritage. It is proposed to convene a workshop with Councillors to discuss a number of these topics, update where things are at and agree on how to manage engagement and feedback on the Draft District Plan and the process for moving to a formal Proposed Plan. This workshop is scheduled for late January 2021.

2.4 Significance and Engagement

The Draft Plan provides an opportunity for any interested party to lodge comments in an informal way prior to preparing a Proposed District Plan.

The District Plan potentially impacts every person, business and property owner in Napier. A full review of the District Plan typically only occurs once every 10-15 years and provides a unique opportunity for the community to input their views into its development.

A high level communication and engagement plan is attached (Attachment A) and the detailed communication plan is being developed and will be available on our website once the plan is notified.

Mana whenua engagement has occurred since the plan inception and has followed the requirements and timeframes desired by each of the mana whenua entities.

2.5 Implications

Financial

There is currently budget set aside for the District Plan review and at this stage progress aligns with the budgetary expectations. Should additional funding be required separate application would be made to Council through the normal budgeting processes.

Social & Policy

The review is a rare opportunity for Council to ensure that the District Plan fully aligns with all of its current strategic priorities, plans and desired outcomes. Officers have endeavoured to align the regulatory provisions of the District Plan with these strategic priorities, plans and policies of Council.

Risk

The risk with this project is that should Council decide not to adopt an agreed Draft District Plan and release it for community feedback the only option for people to express their views would be to lodge submissions through the formal notification process. This may disenfranchise some members of the community and increase the complexity and acrimony of the formal process.

2.6 Options

The options available to Council are as follows:

a. Endorse the release of the Draft District Plan for the purpose of engaging with and receiving feedback from the community in an informal way.

b. Not to endorse the release of the Draft District Plan and proceed directly towards a Proposed District Plan.

2.7 Development of Preferred Option

The preferred option is for Council to adopt the Draft District Plan for the purposes of undertaking consultation and engagement with the Napier community.

a Napier District Plan Review – High Level Communication and Engagement Plan ⇩

3. Resource Consent Activity Update

|

Type of Report: |

Information |

|

Legal Reference: |

Resource Management Act 1991 |

|

Document ID: |

1278528 |

|

Reporting Officer/s & Unit: |

Luke Johnson, Team Leader Planning and Compliance |

3.1 Purpose of Report

This report provides an update on recent resource consenting activity. The report is provided for information purposes only, so that there is visibility of major projects and an opportunity for elected members to understand the process.

Applications are assessed by delegation through the Resource Management Act (RMA); it is not intended to have application outcome discussions as part of this paper.

This report only contains information, which is lodged with Council and is publicly available.

|

The Future Napier Committee: a. Note the resource consent activity update.

|

The legislated processing period for resource consents ended on 20 December 2020 and recommenced on 11 January 2021. Accordingly, the Resource Consent team has been able to utilize these non-processing days to advance active applications. Since the beginning of the year, the submission of applications has been steady.

The following is an outline of recent activity regarding applications received by Council for consenting pursuant to the RMA. This list does not detail all RMA applications under assessment or having been determined, rather provides detail around significant or noteworthy applications.

Summary Table*

|

Address |

Proposal |

Current Status |

Update |

|

2 Kenny Avenue, Ahuriri |

Two Lot into Ten Lot Subdivision and Multi Unit Development

|

Under assessment |

Additional detail provided below |

|

62 Raffles Street, Napier |

S127 Proposed variation to reduce imposed Financial Contributions |

Under assessment |

Previously reported to Future Napier Committee. No further update |

|

16 and 38 Willowbank Avenue, Meeanee |

Proposed lifestyle village |

Application suspended |

Previously reported to Future Napier Committee. |

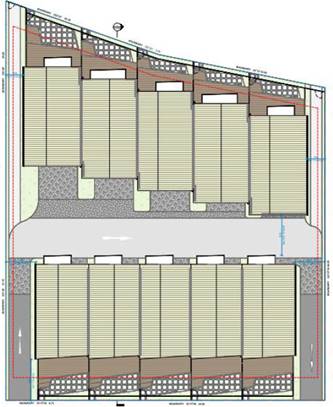

2 Kenny Avenue, Ahuriri – Two Lot into Ten Lot Subdivision and Multi Unit Development

In summary, the development proposes the construction of two terraces with each terrace comprising of 5 two storey dwellings. The site is proposed to be subdivided into ten lots, resulting in each dwelling to be situated on its own title.

Each road frontage will be addressed by one respective terrace. Access and egress for the site is proposed via Battery Road exclusively.

Figure 1. Perspective of Battery Road Frontage

Figure 2. Perspective of Kenny Avenue Frontage

The site is within the Northern Residential Zone and is subject to the Ahuriri Advocacy Heritage overlay of the Battery Road Character Area. The Advocacy Area classifies all built development within the advocacy area as a Group 3A heritage item, however as the site is vacant, there is no Group 3A classification that can be applied to the site.

.

.

Figure 3. Proposed Subdivision Layout

The proposed Lots will range in area from 164m² to 323m² with each individual proposed lot capable of providing useable open space areas. A schedule of party wall easements between terrace houses is detailed within the submitted scheme plan in addition to necessary easements for the provision of right of way vehicle access.

The relevant Council hazard overlays have been addressed through specialist reports submitted as part of the application.

Further information has been provided by the applicant with regard to stormwater capacity. This information has been referred to internal departments and is expected that the application is determined in due course.

Future Napier Committee - 11 February 2021 - Open Agenda

Future Napier Committee

Open Minutes

|

Meeting Date: |

Thursday 3 December 2020 |

|

Time: |

1.26 and adjourned at 1.27pm. Reconvened at 2.31pm-3.31pm |

|

Venue |

Large Exhibition Hall War Memorial Centre

Livestreamed via Zoom to Council’s Facebook page |

|

Present |

Mayor Wise, Deputy Mayor Brosnan (In the Chair), Councillors Boag, Browne, Chrystal, Crown, Mawson, McGrath, Price, Simpson, Tapine, Taylor and Wright |

|

In Attendance |

Interim Chief Executive Director Corporate Services (Adele Henderson), Director Community Services (Antoinette Campbell) Manager Regulatory Solutions (Rachael Horton) Manager Asset Strategy (Debra Stewart) Manager Design and Projects (James Mear) Māori Partnership Manager (Morehu Thompson) Team Leader Transportation (Robin Malley) Team Leader Planning & Compliance (Luke Johnson) Building Asset Management Lead (Andrew Clibborn) Water Strategy Manager (Cath Bayley) |

|

Administration |

Governance Team |

The meeting adjourned at 1.26pm

and reconvened at 3.35pm.

Apologies

Nil

Conflicts of interest

The Interim Chief Executive reminded Councillors that in accordance with the Local Government Act section 73 Conflict of Interest, Elected Members and Members of Local Authorities are required to advise on any potential conflict of interest in a matter that arises or was likely to arise.

The Gambling Policy to be addressed later in the meeting was to enable the community to be consulted and make submission. Where there were conflicts or perceived conflicts it could influence Council’s decision. Decisions could be challenged with perceived conflicts.

The Interim Chief Executive advised Councillors if they were in any doubt to take undue caution and declare a conflict of interest and not participate in discussion.

The following Councillors declared a Conflict of Interest in Item 1 (Review of Gambling Venues Policy)

· Councillor Graeme Taylor

· Councillor Keith Price

· Councillor Sally Crown

Public forum

Nil

Announcements by the Mayor

Nil

Announcements by the Chairperson

Nil

Announcements by the management

Nil

Confirmation of minutes

|

Councillors Crown / Chrystal That the Minutes of the meeting held on 22 October 2020 were taken as a true and accurate record of the meeting.

Carried |

Agenda Items

Having previously declared a Conflict of Interest Councillors Taylor, Price and Crown did not participate in the discussion or decision making on Item 1.

1. Review of Gambling Venues Policy

|

Type of Report: |

Procedural |

|

Legal Reference: |

Gambling Act 2003 |

|

Document ID: |

1263387 |

|

Reporting Officer/s & Unit: |

Rachael Horton, Manager Regulatory Solutions |

1.1 Purpose of Report

This report introduces the review of Council’s Gambling Venues Policy, seeks Council’s endorsement of the review process and seeks Council’s approval to release the Statement of Proposal for consultation.

|

At the Meeting Manager Regulatory Solutions spoke to the report and the Gambling Policy review that would be released in a Statement of Proposal for public consultation. She corrected a minor error in the paper on page 9 which should read ‘Future Napier Committee’ not ‘Maori Committee’. This correction will be made to the paper ahead of the second debate by Council. Under the Gambling Act 2003 and Racing Industry Act 2020 Councils are required to implement gambling policies that need to be reviewed every three years. The report was presented to the Māori Comittee and their feedback to Council was to adopt the sinking lid option for community consultation. It was proposed that Council adopt the document for consultation at the Council meeting scheduled for 17 December 2020. Discussion and clarification on the following points ensued: · Policy direction by Council during workshops held was to retain the status quo in regards to the number of venues and venues allowed. · Consultation document for the public includes “status quo” as the preferred option. · Currently the policy enables the relocation of machines if a license is held. · Where relocation was not permitted the policy could incorporate criteria whereby an exemption could be considered. · Changes to the Statement of Proposal would be marked in red and the public would be able to identify proposed changes. · To change to a sinking lid gambling policy may reduce the harm caused by problem gambling · The Statement of Proposal sets options advantages and disadvantages. · Despite the number of gaming machines declining over the years the problem gambling rate nationally has remained static. · Consultation process would enable submitters to advocate what option they prefer and better hear from the submitters prior to decision making. · Section 83 of the Local Government Act requires that a Statement of Proposal be prepared when consultation with the community is requested. · The manner and form on how Council consults with all affected parties to provide a fair opportunity for all persons to have a say is set out in Section 83 of the Local Government Act. · The Statement of Proposal for the Gambling Policy review process ticks all the boxes for Section 83. · Currently Napier has 20 venues and 298 gaming machines. · The Proposal is for Council to retain the “status quo” option. · There was support for a minor change to the paper to be made ahead of the second debate by Council to change the wording in the Statement of Proposal to “the proposed option for consultation” rather than “the preferred option for consultation” . · The Maori Committee rejected the current policy and wanted sinking lid as the preferred option. · A foreshadowed motion was noted if the Motion was not carried “that the draft policy going out for consultation is sinking lid and lowering the number of machines”. |

|

Committee's recommendation Councillors Mawson / Wright The Future Napier Committee: a. Note the information relating to the review of Council’s Gambling Venues Policy. b. Endorse the review process including approach to consultation as set out in the Significance and Engagement section. c. Approve the Statement of Proposal for public notification through the Special Consultative Procedure as prescribed in section 83 of the Local Government Act. Carried Councillors Boag and Tapine recorded their vote AGAINST the Motion |

2. Review of Location of Approved Psychoactive Products Sales Points Policy

|

Type of Report: |

Procedural |

|

Legal Reference: |

Psychoactive Substances Act 2013 |

|

Document ID: |

1263703 |

|

Reporting Officer/s & Unit: |

Rachael Horton, Manager Regulatory Solutions |

2.1 Purpose of Report

This report introduces the review of Council’s Approved Psychoactive Products Sales Points Policy, seeks Council’s endorsement of the review process and seeks Council’s approval to release the Statement of Proposal for consultation.

|

At the Meeting The Manager Regulatory Solutions, Ms Horton spoke to the report on the review to regulate Psychoactive Products Sales. Officers held two workshops to determine Council’s policy direction for consultation. The first workshop was also attended by the Chairperson of the Māori Committee. Policy direction was given to strengthen the purpose and clause relating to the distance required from sensitive communities to ensure that the exposure to the selling of approved products and their potential harm was minimised across all vulnerable and sensitive sections of our community. Discussion and feedback from the Maori Committee indicated that they would like to double the various distances from 100m to 200m · Current policy was in the Inner City Commericial zone. · Additional wording included in the Policy “vulnerable members of our community or sensitive communities congregate and includes….” · Current wording; Sales are not permitted to be within 100 metres of any existing area where childcare centres, schools, libraries or places of worship. · The Act requires not to prohibit venue for sales as prohibiting one venue in the policy would be prohibiting competition. · The Maori Committee proposed extension would be prohibiting competition. · Places of worship in the Central Business District (CBD) could not have more than 2 venues · Playgrounds good example of timeout zones where young people congregate where do you stop. Officers have broadened the policy to include areas where vulnerable or young people congregate. |

|

Committee's recommendation Councillors Mawson / Wright The Future Napier Committee recommends that Council: a. Note the information relating to the review of Council’s Approved Psychoactive Products Sales Points Policy. b. Endorse the review process including approach to consultation as set out in the Significance and Engagement section. c. Approve the Statement of Proposal for public notification through the Special Consultative Procedure as prescribed in section 83 of the Local Government Act.

Carried |

3. Resource Consent Activity Update

|

Type of Report: |

Enter Significance of Report |

|

Legal Reference: |

Enter Legal Reference |

|

Document ID: |

1260263 |

|

Reporting Officer/s & Unit: |

Luke Johnson, Team Leader Planning and Compliance |

3.1 Purpose of Report

This report provides an update on recent resource consenting activity. The report is provided for information purposes only, so that there is visibility of major projects and an opportunity for elected members to understand the process.

Applications are assessed by delegation through the Resource Management Act (RMA); it was not intended to have application outcome discussions as part of this paper. It

was noted by staff that Heritage New Zealand was a party to Resource Consent where demolition of a heritage building was proposed.

This report only contains information which was lodged with Council and is publicly available.

|

At the Meeting The Team Leader Planning and Compliance, Mr Johnson spoke to the report providing an overview of recent resource consenting activity. |

|

Committee's recommendation Councillors Crown / Tapine The Future Napier Committee: a. Note the resource consent activity update. Carried |

PUBLIC EXCLUDED ITEMS

|

Councillors Tapine / Mawson That the public be excluded from the following parts of the proceedings of this meeting, namely: 1. Land Sale Carried |

The general subject of each matter to be considered while the public was excluded, the reasons for passing this resolution in relation to each matter, and the specific grounds under Section 48(1) of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution were as follows:

|

General subject of each matter to be considered. |

Reason for passing this resolution in relation to each matter. |

Ground(s) under section 48(1) to the passing of this resolution. |

|

1. Land Sale |

7(2)(i) Enable the local authority to carry on, without prejudice or disadvantage, negotiations (including commercial and industrial negotiations) |

48(1)A That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding would exist: |

The meeting moved into Committee at 3.31pm.

|

Approved and adopted as a true and accurate record of the meeting.

Chairperson .............................................................................................................................

Date of approval ...................................................................................................................... |