|

Ordinary Meeting of Council - 8 April 2021 - Attachments

|

Item 1 Attachment a |

ordinary Meeting of Council

Open Agenda

|

Meeting Date: |

Thursday 8 April 2021 |

|

Time: |

1.00pm |

|

Venue: |

Council Chambers |

|

Council Members |

Mayor Wise, Deputy Mayor Brosnan, Councillors Boag, Browne, Chrystal, Crown, Mawson, McGrath, Price, Simpson, Tapine, Taylor and Wright |

|

Officer Responsible |

Chief Executive |

|

Administrator |

Governance Team |

Ordinary Meeting of Council - 08 April 2021 - Open Agenda

ORDER OF BUSINESS

Apologies

Nil

Conflicts of interest

Public forum

Announcements by the Mayor including notification of minor matters not on the agenda

Note: re minor matters only - refer LGOIMA s46A(7A) and Standing Orders s9.13

A meeting may discuss an item that is not on the agenda only if it is a minor matter relating to the general business of the meeting and the Chairperson explains at the beginning of the public part of the meeting that the item will be discussed. However, the meeting may not make a resolution, decision or recommendation about the item, except to refer it to a subsequent meeting for further discussion.

Announcements by the management

Agenda items

1 Consultation - Revenue & Financing Policy..................................................................... 3

2 Consultation - Rating Policy.......................................................................................... 37

3 Review - Rates Remission and Postponement on Māori Freehold Land........................ 57

4 Consultation - Rates Remission Policy.......................................................................... 60

5 Draft Financial Contributions Policy............................................................................... 71

6 Adoption of the Long Term Plan 2021-31 Consultation Document.............................. 104

7 Amendments to the 2021 Council/Committee Meeting Schedule................................ 105

Minor matters not on the agenda – discussion (if any)

Public excluded ........................................................................................................... 110

Ordinary Meeting of Council - 08 April 2021 - Open Agenda Item 1

1. Consultation - Revenue & Financing Policy

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

1298330 |

|

Reporting Officer/s & Unit: |

Adele Henderson, Director Corporate Services |

1.1 Purpose of Report

To review and update the policy by amending operational and capital funding sources for Council housing.

|

That Council: a. Note the Revenue & Financing Policy will now allow for loan funding of operating costs for approved Council activities. b. Approve the inclusion of loan funding for operational expenditure and General Rates funding for capital expenditure for Council housing activities. c. Approve the draft Revenue and Financing Policy for consultation d. Approve the consultation plan for the Revenue & Financing Policy.

|

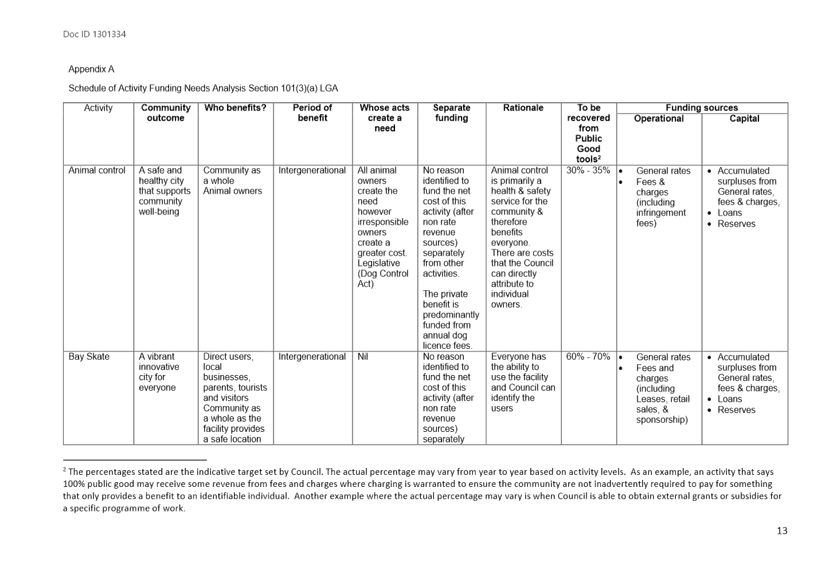

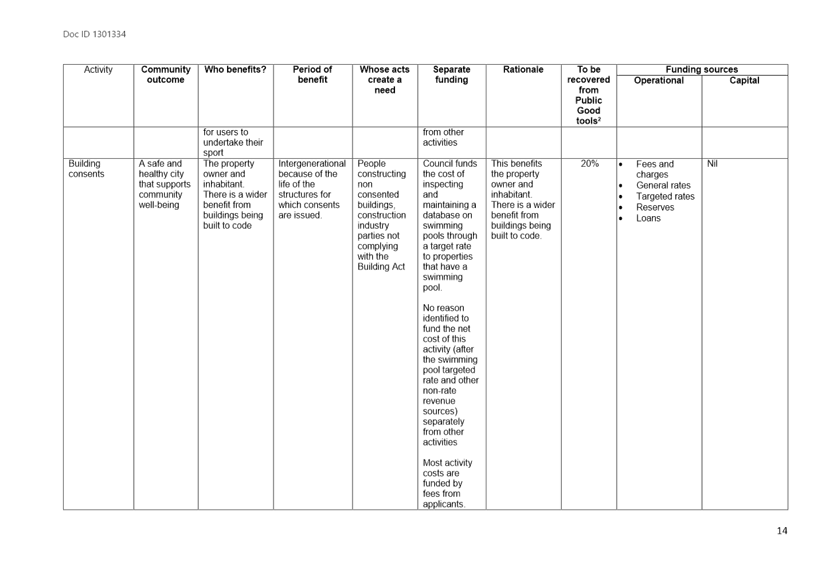

The Revenue & Financing Policy was adopted on 11 February 2021. During the development of the Long Term Plan and with rates pressures, Council requested a consideration of loan funding of operating costs. Council policy to date was firm that operating costs could not be loan funded. The update to the policy allows more flexibility on a case-by-case basis to loan fund where appropriate and approved by Council. This approach could be considered where costs may only be incurred for a number of years and are not ongoing (e.g. lease costs), where costs are transitioning from capex to opex (e.g. software as a service) and where decisions of Council on an activity have yet to be finalised (e.g. review of Council activities for the 2021-2031 Long Term Plan has identified a shortfall in funding for housing).

1.3 Issues

Council is required to fund its activities in the Long Term Plan as provided for in the Revenue and Finance Policy.

Housing

As part of the development of the Long Term Plan and costs associated with the Housing activity of Council, the revenue from rents received was not sufficient to cover the increased costs associated with Healthy Homes compliance, building upgrades and maintenance. The purpose of the Housing activity is to provide affordable housing particularly for those in retirement and on low incomes. A review of the Housing activity is currently underway that explores options for the delivery and provision of the service going forward in an affordable way. Consultation will be undertaken with the community later this year that looks at options and its ongoing sustainability.

To address the funding shortfall (approximately $2m per annum) in the short term until a decision is made, it is proposed that loans be included as an additional source of funding for operational expenditure.

It is proposed that General Rates and loans be made available as an additional source of funding for capital expenditure for the Housing activity.

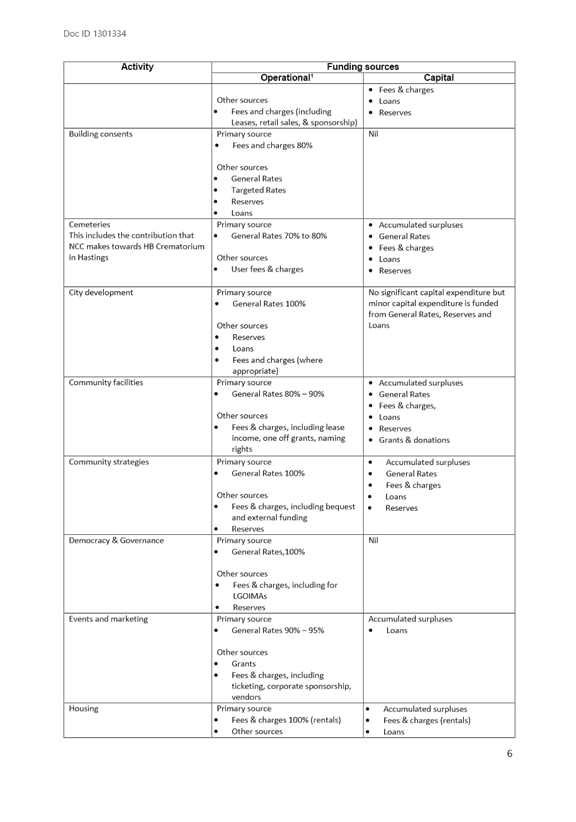

The proposed amendments are presented in italics:

|

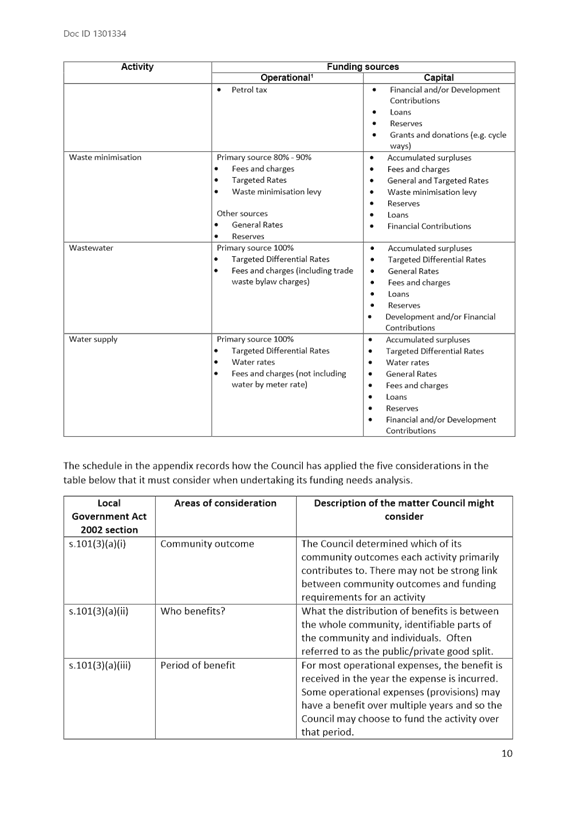

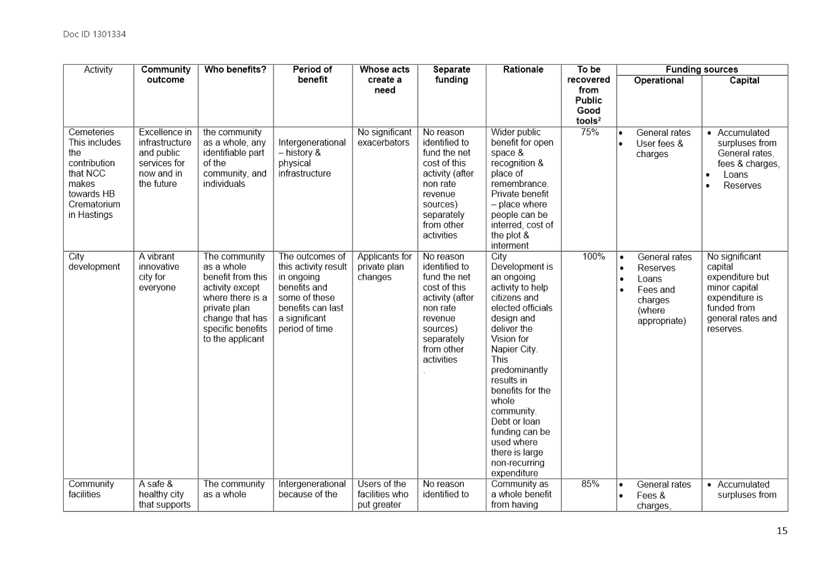

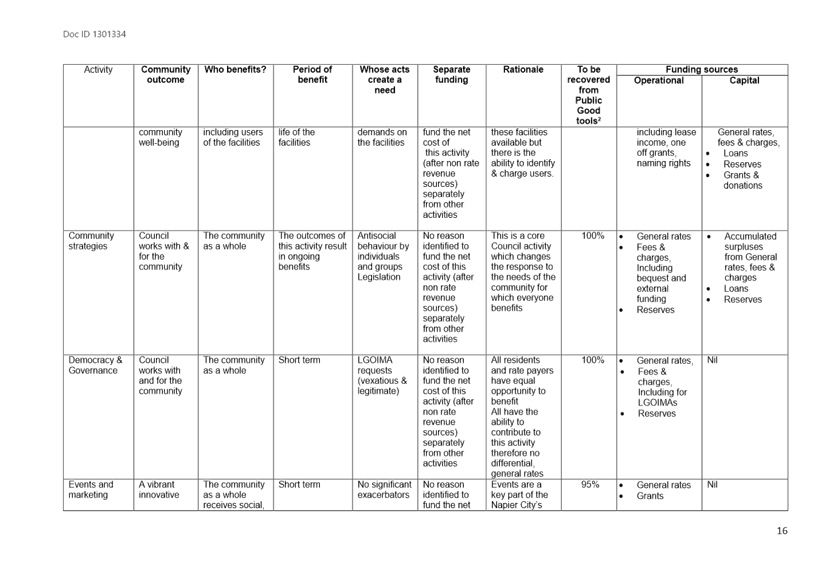

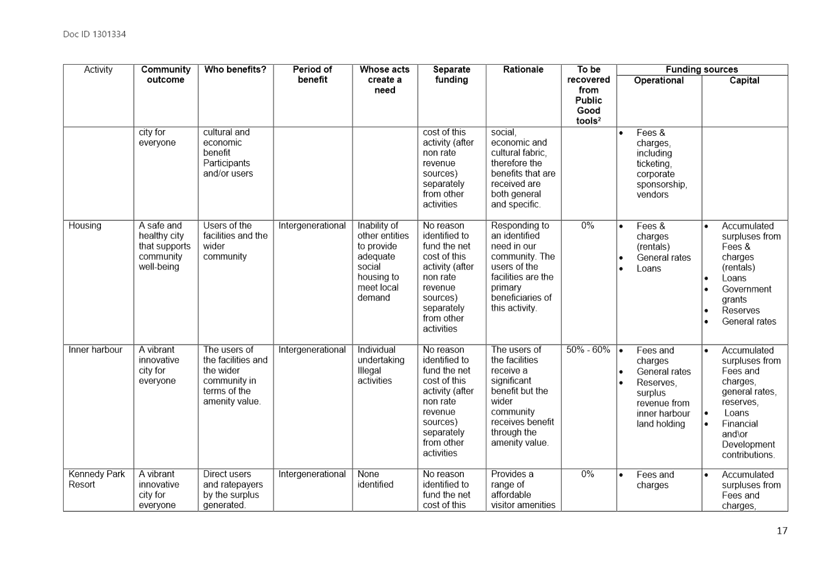

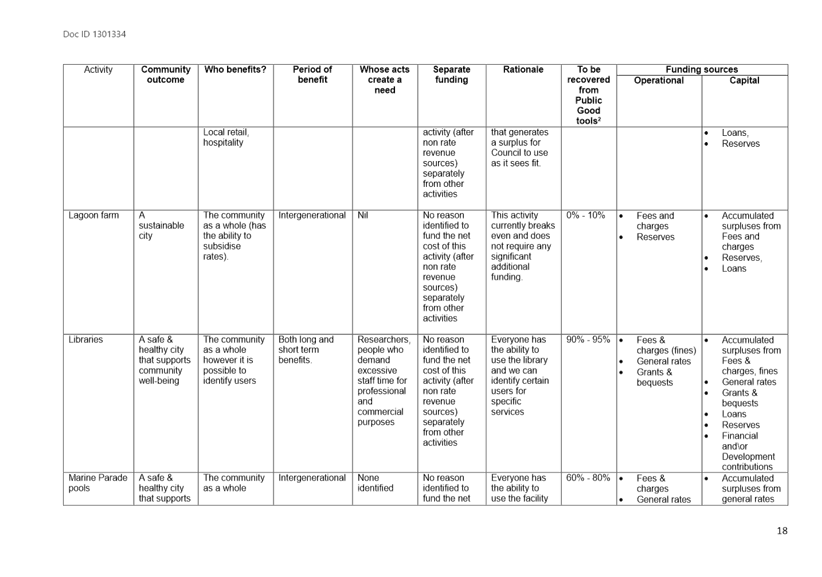

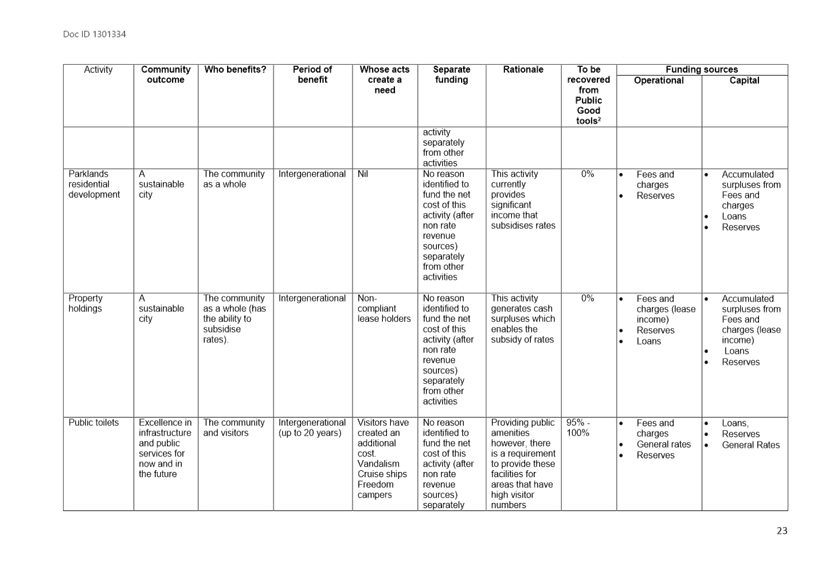

Activity |

Funding sources |

|

|

Operational |

Capital |

|

|

Housing |

Primary source · Fees & charges 100% (rentals) · Other sources · General Rates · Loans |

· Accumulated surpluses · Fees & charges (rentals) · Loans · Grants · Reserves · General Rates |

1.4 Significance and Engagement

Public consultation will be required and undertaken as a separate consultation in parallel with the Long Term Plan 2021-2031. For the purposes of the development of the Long Term Plan, loan funding of the above issues have been included in the plan.

1.5 Implications

Financial

The proposed amendments will allow housing costs to be funded through borrowings. Where loans are used to fund capital expenditure, the proposed amendments will allow for loan repayments to be paid from General Rates.

Social & Policy

The amendment to the Revenue & Financing Policy provides for loan funding of operating costs.

Risk

For Council the risk lies in short-term funding issues not being addressed over the longer term. In that scenario, a portion of operational cost would continue to rely on debt as a funding source and is not considered financially prudent. Council must ensure that any debt funding is contained within its income to debt benchmark.

1.6 Options

The options available to Council are as follows:

a. Accept the proposed amendments.

b. Accept selected amendments / make amendments.

c. Accept none of the proposed amendments.

1.7 Development of Preferred Option

a. Accept the proposed amendments

The preferred option has been developed in conjunction with work conducted on the Long Term Plan 2021-2031 and has included the proposed changes to the funding for the housing activity until such time that further separate consultation has been undertaken with the community.

a Proposed Revenue & Financing Policy ⇩

b Consultation Plan ⇩

2. Consultation - Rating Policy

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

1301081 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager Adele Henderson, Director Corporate Services |

2.1 Purpose of Report

To review and update the policy to clarify amendments to the fire protection rate, storm water rate for commercial and industrial, and to present the consultation plan for approval. Any desirable changes arising from public feedback will then be incorporated, and the final policy adopted in June as part of Council’s Long Term Plan 2021/31.

|

That Council: a. Note that the unconnected (but within 100m) Fire Protection Rate for Other Rating Units remains at 50%. b. Note that the Storm Water Rate for Commercial & Industrial remains at 250% (compared to General Rate of 260%) and Rural Residential at 100% (compared to General Rate of 90%). i. Note that the Storm Water Rate will not be phased over 3 years. c. Approve the draft Rating Policy (attached) for public consultation. d. Note that the draft Rating Policy may be subject to minor corrections and any changes arising from the consultation process. e. Approve the consultation plan for the Rating Policy.

|

As part of the review of the Revenue & Financing Policy February 2021, Council formalised a Rating policy that forms a bridge between the Revenue and Financing Policy and the Funding Impact Statement. As part of the Long Term Plan 2021-31 review, changes are required to align the policies as outlined.

The proposed changes to the Rating Policy will come into effect on the 1st of July 2021.

2.3 Issues

In response to a review of the Revenue and Financing Policy, a Rating Policy was introduced and adopted on the 16th of February 2021.

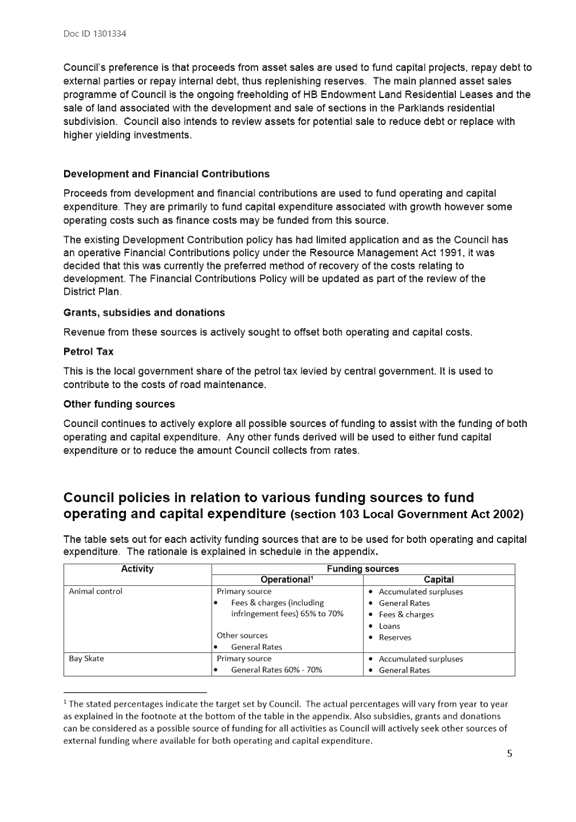

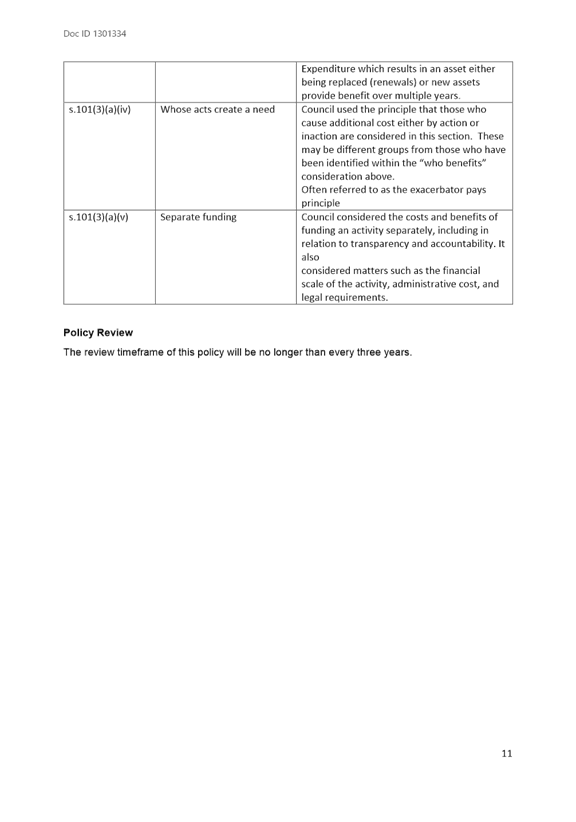

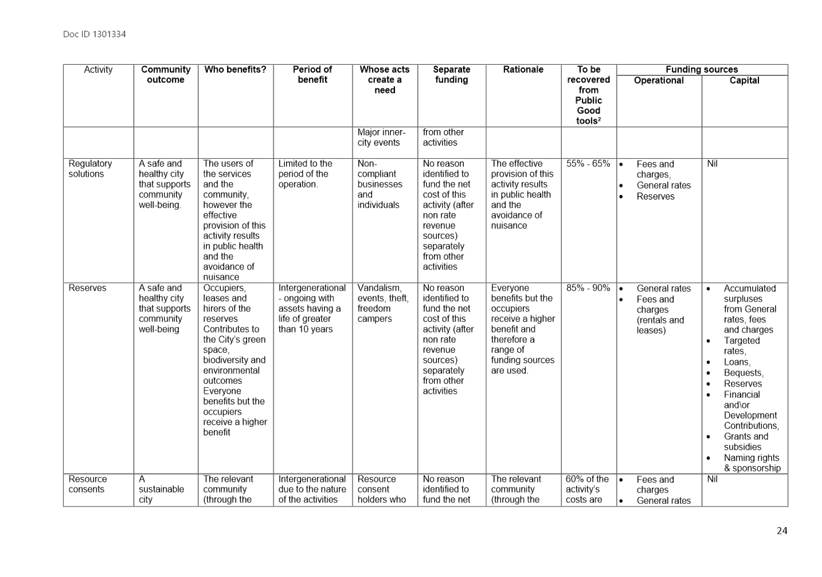

Due to significant increases being experienced for certain property types, it was agreed that General Rate differentials will be phased in over 3 years from the start of the 2021/22 ratings year. The calculation is based on the difference between the old differential (as defined in the 2020/21 Annual Plan) and the target differential, split into 3 equal stages. The schedule for phasing is as follows:

|

Old Differentials |

Old Code |

Old Differential Rate |

New Differential Rate |

New Code |

Differential Rate |

2021/22 |

2022/23 |

2023/24 |

|

City Residential |

1 |

100.00% |

Residential/Other |

1 |

100.00% |

100.00% |

100.00% |

100.00% |

|

Commercial & Industrial |

2 |

268.09% |

Commercial & Industrial |

2 |

260.00% |

265.39% |

262.70% |

260.00% |

|

Miscellaneous |

3 |

100.00% |

Residential/Other |

1 |

100.00% |

100.00% |

100.00% |

100.00% |

|

Miscellaneous |

3 |

100.00% |

Commercial & Industrial |

2 |

260.00% |

153.33% |

206.67% |

260.00% |

|

Miscellaneous |

3 |

100.00% |

Rural |

3 |

85.00% |

95.00% |

90.00% |

85.00% |

|

Miscellaneous |

3 |

100.00% |

Rural Residential |

4 |

90.00% |

96.67% |

93.33% |

90.00% |

|

Ex City Rural |

4 |

63.47% |

Residential/Other |

1 |

100.00% |

75.65% |

87.82% |

100.00% |

|

Ex City Rural |

4 |

63.47% |

Rural Residential |

4 |

90.00% |

72.31% |

81.16% |

90.00% |

|

Ex City Rural |

4 |

63.47% |

Rural |

3 |

85.00% |

70.65% |

77.82% |

85.00% |

|

Other Rural |

5 |

63.47% |

Residential/Other |

1 |

100.00% |

75.65% |

87.82% |

100.00% |

|

Other Rural |

5 |

63.47% |

Rural Residential |

4 |

90.00% |

72.31% |

81.16% |

90.00% |

|

Other Rural |

5 |

63.47% |

Commercial & Industrial |

2 |

260.00% |

128.98% |

194.49% |

260.00% |

|

Other Rural |

5 |

63.47% |

Rural |

3 |

85.00% |

70.65% |

77.82% |

85.00% |

|

Bay View |

6 |

72.80% |

Residential/Other |

1 |

100.00% |

81.87% |

90.93% |

100.00% |

|

Bay View |

6 |

72.80% |

Commercial & Industrial |

2 |

260.00% |

135.20% |

197.60% |

260.00% |

|

Bay View |

6 |

72.80% |

Rural Residential |

4 |

90.00% |

78.53% |

84.27% |

90.00% |

Commercial and Industrial properties

As a result of property revaluations that occurred in December 2020 (and fell outside of the Revenue & Financing Policy review), it was identified that Commercial property had an average Land Value increase of 76.2% over the last 3 years and Industrial property had an increase of 84.4% over the same period. As the average Land Value increase for Napier is 44.5% over the last 3 years, this represents a significant increase for Commercial & Industrial property. Rate changes proposed in the Long Term Plan 2021-2031 will act in tandem with the property revaluations, with a particular impact on Commercial & Industrial property owners.

With 1,995 properties identified, Commercial & Industrial property is the second largest property group and accounts for 17% of the total Land Value for Napier (Residential property is 71% of the total Land Value).

Further information will be provided directly to these property owners with the opportunity for the community to provide feedback through the Long Term Plan process.

Proposed changes for consultation

As there were a large number of changes adopted with the new rating system, Council is seeking guidance and confirmation on the following points:

· The unconnected rate for the Fire Protection Rate for Other Rating Units remains at 50%: Council decided to keep the unconnected water rate at 50% (rather than the proposed 70%). The Fire Protection Rate was not addressed in the resolutions.

· The Storm water Rate for Commercial and Industrial remains at 250%: this was originally in line with the proposed General Rate differential of 250%. The differential was increased to 260% but the Storm Water Rate was not.

· The Storm Water Rate for Rural Residential remains at 100%: this was originally in line with the proposed General Rate when there was no Rural Residential differential. The Rural Residential differential was introduced at 90% but the Storm Water Rate is currently 100%.

2.4 Significance and Engagement

Public consultation on the proposed amendments will be undertaken with the Long Term Plan 2021-2031.

2.5 Implications

Financial

The impact for Council is neutral as the proposed amendments do not impact on the amount of General Rates collected.

Social & Policy

The proposed changes will have a minor impact on the Rating Policy.

Risk

Public feedback is sought prior to a final Council decision being made, particularly for the Commercial sector where revaluations have had a significant impact on this group. This will somewhat mitigate the risk inherent in adopting final General Rate differentials prior to the 2021/22 rating year.

To mitigate this risk, the Commercial ratepayers are being advised of the impacts separately, and will be invited to submit to the Long Term Plan and implications of this policy as well as all the other ratepayers of Napier City.

2.6 Options

The options available to Council are as follows:

a. Accept the proposed changes to the Rating Policy for consultation.

b. Propose alternative information for consultation.

2.7 Development of Preferred Option

Option a. Accept the proposed changes to the Rating Policy for consultation.

a Proposed Rating Policy ⇩

b Consultation Plan ⇩

3. Review - Rates Remission and Postponement on Māori Freehold Land

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

1301033 |

|

Reporting Officer/s & Unit: |

Garry Hrustinsky, Investment and Funding Manager |

3.1 Purpose of Report

The purpose of this report is to review the Rates Remission and Postponement on Māori Freehold Land policy (Doc ID 1301531).

|

That Council: a. Adopt the current Rates Remission and Postponement on Māori Freehold Land policy with no changes. b. Note that amendments proposed in the Local Government (Rating of Whenua Māori) Amendment Bill will impact on the Local Government (Rating) Act 2002 from 1 July 2021 if it receives Royal Assent. |

The Rates Remission and Postponement on Māori Freehold Land policy must be reviewed no longer than every three years. The last review was performed on 29 June 2018.

3.3 Issues

No issues.

3.4 Significance and Engagement

Changes to the policy require public consultation. No changes are recommended in this review.

3.5 Implications

Financial

There are no financial implications.

Social & Policy

Napier City Council has very few known rating units that occupy Māori freehold land. Changes proposed in the Local Government (Rating of Whenua Māori) Amendment Bill state that this policy must support the principles set out in the Preamble to Te Ture Whenua Maori Act 1993. However, the target date for the Bill becoming law is 1 July 2021.

Risk

Risk is considered very low.

3.6 Options

The options available to Council are as follows:

a. Accept the policy with no recommended changes.

b. Request changes be made to the policy.

3.7 Development of Preferred Option

The preferred option has been developed in review of the current policy, a review of Māori freehold land to identify whether any significant changes have occurred over the last three years, and with consideration for the Local Government (Rating of Whenua Māori) Amendment Bill.

a Rates Remission and Postponement on Māori Freehold Land ⇩

Ordinary Meeting of Council - 08 April 2021 - Open Agenda Item 4

4. Consultation - Rates Remission Policy

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government (Rating) Act 2002 |

|

Document ID: |

1300033 |

|

Reporting Officer/s & Unit: |

Adele Henderson, Director Corporate Services |

4.1 Purpose of Report

To review and update the policy to clarify delegations, remove the Remission for Residential Land in Commercial or Industrial Areas, and present the consultation plan for approval.

|

That Council: a. Approve the proposed removal of the Remission for Residential Land in Commercial or Industrial Areas. b. Approve the delegation of sign-off for the Remission of Refuse Collection and/or Kerbside Recycling Targeted Rates to the Chief Financial Officer. c. Approve the consultation plan for the Rates Remission Policy. |

Further review of the Rates Postponement Policy has identified that the Remission for Residential Land in Commercial or Industrial Areas is redundant. Residential land in commercial or industrial areas is treated as residential property for rating purposes. No remission is required. The provision proposed for removal reads as follows:

“Remission for Residential Land in Commercial or Industrial Areas

Objective

To ensure that owners of rating units situated in commercial or industrial areas are not unduly penalised by the zoning decisions of this Council and previous local authorities.

Conditions and Criteria

To qualify for remission under this part of the policy the rating unit must:

· Be situated within an area of land that has been zoned for commercial or industrial use. Ratepayers can determine where their property has been zoned by inspecting the City of Napier District Plan, copies of which are available from the Council office.

· Be listed as a ‘residential’ property for differential rating purposes. Ratepayers wishing to ascertain whether their property is treated as a residential property may inspect the Council’s rating information database at the Council office.

· Be residential construction with a Building Consent that has been granted under Section 49 of the Building Act 2004.

Ratepayers wishing to claim remission under this part of the policy must make an application in writing addressed to the Chief Financial Officer.

The application for rates remission must be made to the Council by the 30th of April prior to the commencement of the rating year. Applications received during a rating year will be applicable from the commencement of the following rating year. Applications will not be backdated.

The amount remitted will be the difference between the rates calculated on a Residential differential and a Commercial and Industrial differential”.

The Remission of Refuse Collection and/or Kerbside Recycling Targeted Rates does not currently have a delegation for sign-off. To provide clarity, it is proposed that advice of application come from Environmental Solutions to the Chief Financial Officer for sign-off.

The proposed inclusion is as follows:

Applications must be made to Environmental Solutions. Applications will be advised to the Chief Financial Officer for approval.

4.3 Issues

There is no significant issue for retaining a Remission for Residential Land in Commercial or Industrial Areas. However, the remission will remain unused.

At present there is insufficient clarity regarding delegation on who can sign off Remission of Refuse Collection and/or Kerbside Recycling Targeted Rates. Final authorisation should remain within the Finance Department (and Chief Financial Officer) as this is where rating matters reside.

A Remission for Council Property is required as an accounting adjustment is currently performed to adjust/allow for the additional Council rates. In practical terms the proposed remission will allow Council to properly rate Council property, then apply a credit to total rates representing Council rates. This is a simpler approach that will also increase transparency for reporting purposes.

4.4 Significance and Engagement

There has been no external consultation on the proposed changes. If approved, public consultation will be required and undertaken as a separate consultation in parallel with the Long Term Plan 2021-2031.

4.5 Implications

Financial

There is no financial implication for the proposed amendments highlighted in this report.

Council provides a budget for rates remission in our Annual Plan and Long Term Plan. The amount budgeted is not significant (<0.5% of total rates).

Social & Policy

This is a proposed policy amendment. Social implications are negligible.

Risk

Beyond clarifying internal procedures, the implications of accepting or rejecting the proposed amendments are low.

4.6 Options

The options available to Council are as follows:

a. Accept all of the proposed changes.

b. Accept selected proposed changes / make amendments.

c. Accept none of the proposed changes.

4.7 Development of Preferred Option

Approve the proposed removal of the Remission for Residential Land in Commercial or Industrial Areas.

Approve the delegation of sign-off for the Remission of Refuse Collection and/or Kerbside Recycling Targeted Rates to the Chief Financial Officer.

Approve the consultation plan for the Rates Remission Policy.

a Proposed Rates Remission Policy ⇩

b Consultation Plan ⇩

5. Draft Financial Contributions Policy

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

1298026 |

|

Reporting Officer/s & Unit: |

Paulina Wilhelm, Manager City Development Catherine Bayly, Manager, 3 Waters Reform Retha du Preez, Team Leader Development and Standards |

5.1 Purpose of Report

The purpose of this report is to provide detail around the Financial Contributions Policy, and recommend that the draft Policy be approved for public consultation. Any desirable changes arising from public feedback will then be incorporated, and the final policy adopted in June as part of Council’s Long Term Plan 2021/31.

|

That Council: a. Approve the draft Financial Contributions Policy (Doc ID 1301563 attached) for public consultation. b. Note that the draft Financial Contributions Policy may be subject to minor corrections and any changes arising from the consultation process. c. Note that a final Financial Contributions Policy will be adopted in June 2021. d. Approve the attached consultation plan for the Financial Contributions Policy

|

Section 102 of the Local Government Act, requires Council to adopt funding and financial policies including a policy on development or financial contributions.

Through Council workshops and the review of the existing policy, Council wish to move to a Financial Contributions policy. In addition, include remission/waiver options for certain types of residential development in the CBD and/or CBD fringe.

This approach is now outlined in a concise draft financial contributions policy that will be consulted in parallel to the LTP consultation process.

5.3 Issues

Council are currently charging financial contributions for both residential and non-residential developments under the existing provisions in the District Plan. To do this, we are noting variances to the current Financial and Development Contributions Policy for non-residential developments. A full review of the Policy has been undertaken to provide a sound basis for charging going forward, noting that growth is increasing across the city. The recommended approach, which is to continue to charge financial contributions under the existing provisions in the District Plan, follows an extensive review completed by infrastructure consultants, Utility Ltd, over the last six months.

5.4 Significance and Engagement

Engagement on the proposed revised policy changes will be undertaken as a separate consultation concurrently with the Long Term Plan for community feedback.

5.5 Implications

Financial

NCC currently does not have any growth-related debt. This is most likely due to a combination of reasons, and there is limited value in revisiting previous cost allocations.

The purpose of the contributions is to fund the growth/capacity capital cost of infrastructure for future development. These costs are projected to be around $105M over the next 10 years of which $40m will be debt funded to support growth at the end of the 10 years (excluding financing costs). Managing the timing of the infrastructure investments will be an important consideration.

Some of these costs will be funded from development that occurs outside the 10 year period covered by the 2021 LTP.

The estimated revenue over the 10 year LTP period is between $50M and $65M, depending on where and when the development occurs. The uptake in areas where an exemption may apply will also affect this revenue.

Although exemptions have been identified as part of this new policy, it is anticipated that any new residential development in commercial areas will not require any further network upgrades to accommodate this growth. For this reason we have not quantified lost revenue from exemptions.

Social & Policy

Growth projections suggest that up to 4,600 new residential units may be required in Napier over the next 30 years. This is an increase of around 20% from the current 26,000 houses. This demand is to be met by infill/intensification, existing structure plan/greenfield areas (Te Awa, Parklands, Mission Development) and potential further greenfield development.

The incentives proposed in the policy and discussed below as the preferred option, will contribute to the delivery of Council’s strategic objective of a ‘Vibrant City Centre’ and promote inner city living. These incentives will also promote a ‘compact city” by encouraging multi-unit developments in areas that are within walking distance from neighbourhood commercial centres across Napier.

We are proposing to continue to charge financial contributions under the existing Financial Contributions section of the District plan.

Risks

The key risks of the recommended approach are:

· The existing District Plan provisions mean there are potential limitations on the quantum of contributions for large non-residential developments.

· The exemptions will reduce the financial contribution revenue that Council receive, however this is off-set by the benefits from in-fill and intensification development. Typically, existing infrastructure has been provisioned to accommodate more growth in the city centres, or the change in land use does not create a significant increase in demand of services.

· Any possible future legislative changes that impact on the ability to charge for financial or development contributions.

5.6 Options

The options available to Council are as follows:

a. Maintain the existing Development and Financial Contributions policy.

b. Adopt a financial contribution policy.

c. Adopt a financial contribution policy, with a wide range of exemptions.

d. Adopt a financial contribution policy, with specific exemptions within certain locations.

5.7 Development of Preferred Option

The preferred option is d. Adopt a financial contribution policy, with specific exemptions within certain locations.

Financial Contributions will be charged using the existing conditions in section 65 of the District Plan, however Council will modify the amount required in certain circumstances to encourage more intensive residential development around existing commercial areas.

Council wishes to encourage residential growth in certain areas in order to revitalise the city centres. Therefore, the exemptions to financial contributions detailed in Section 1.7 have been included in the draft policy. These are considered to be a simple and equitable means of achieving Council’s strategic objectives related to providing capacity for housing development, and balancing the needs of funding for infrastructure.

The exemptions are listed below.

City Centre

Council wishes to encourage residential growth in certain areas in order to revitalise the city centres. Accordingly, the exemptions to financial contributions below shall apply for the following developments:

2. Any multi-unit residential development within Fringe Commercial Zone and Taradale Suburban Commercial Zone shall be exempt 50% of the financial contribution.

3. Any multi-unit residential development within the main commercial centres in Marewa, Napier South, Onekawa, Greenmeadows, Maraenui, Taradale and Tamatea (as per map attached in draft Financial Contribution Policy) shall be assessed based on the number of bedrooms in each apartment/unit. This is considered a fair way to reflect the lower demand typically created by smaller apartments compared to a residential dwelling. The exemptions shall be:

· One bedroom unit 50% exemption

· Two bedroom unit 33% exemption

· Three or more bedroom unit 0% exemption

The greater of the above exemptions shall be applied, however, a single development may only be granted one exemption. The approval of an exemption should be agreed prior to resource consent being granted so the exemption is made clear in the conditions of consent.

Continuing with the existing Development and Financial Contributions policy is not considered to be a viable option as this does not match the current, or desired future approach of Council.

a Proposed Financial Contribution Policy ⇩

b Consultation Plan ⇩

6. Adoption of the Long Term Plan 2021-31 Consultation Document

|

Type of Report: |

Legal and Operational |

|

Legal Reference: |

Local Government Act 2002 |

|

Document ID: |

1285391 |

|

Reporting Officer/s & Unit: |

Adele Henderson, Director Corporate Services |

|

Please note that circulation of this report (and associated attachments) is pending as we await information from Audit New Zealand. The report will be circulated prior to the meeting.

|

Ordinary Meeting of Council - 08 April 2021 - Open Agenda Item 7

7. Amendments to the 2021 Council/Committee Meeting Schedule

|

Type of Report: |

Procedural |

|

Legal Reference: |

Enter Legal Reference |

|

Document ID: |

1287728 |

|

Reporting Officer/s & Unit: |

Helen Barbier, Team Leader Governance |

7.1 Purpose of Report

The purpose of this report is to approve a change to the schedule of Council and Committee meetings for 2021 as set out below. The amendments are indicated in red on the meeting schedule appended to this report (Attachment 1 – Doc Id 1300212).

Additional Meetings :

|

· Hearings Committee (Dogs) |

11 May 2021 (1pm) |

|

· Council Hearing (Revenue & Financing Policy and the Development Contributions Policy) |

Commencing 1 June 2021 (1pm) |

|

That Council: a. Receive the report “Amendment to the 2021 Council/Committee Meeting Schedule”. b. Adopt the amendment to the 2021 Meeting Schedule as below: Additional Meetings:

|

The Local Government Act 2002, Schedule 7, Clause 19 states:

…

(4) A local authority must hold meetings at the times and places that it appoints.

(5) …

(6) If a local authority adopts a schedule of meetings -

a) The schedule-

i) may cover any future period that the local authority considers appropriate, and

ii) may be amended; and

b) notification of the schedule or of any amendment to that schedule constitutes a notification of every meeting to the schedule or amendment.

Although a local authority must hold the ordinary meetings as scheduled, Council may at a meeting, amend the schedule of dates, times and number of meetings to enable business to be managed in an effective way.

Although staff attempt to meet the needs of Council it is inevitable that the schedule will need to be amended from time to time and these amendments will be notified to elected members via the Councillor diary as they arise.

While the schedule serves to give elected members notice of the upcoming meetings there is still a requirement under the Local Government Official Information and Meetings Act 1987 for the public to be advised on a regular basis of the meetings scheduled for the next month.

The schedule includes the meetings of all committees not only so that members can plan ahead, but also to ensure that meetings days are in fact available and not later taken up by other meetings. Where scheduled meetings are not required cancellations will be advised to members as early as possible.

7.3 Issues

This report is being presented directly to Council for a decision as the meeting cycle does not allow a passage through the Standing Committees prior to meeting deadlines.

7.4 Significance and Engagement

This matter, of an amendment to the schedule of meetings, does not trigger Council’s Significance and Engagement Policy or any other consultation requirements.

Refer to the individual report(s) for the relevant meeting for comments related to the Significance and Engagement Policy.

7.5 Implications

Financial

There will be minor additional costs for venue hire and live streaming of the additional meetings.

Social & Policy

N/A

Risk

Further changes to the schedule could result in difficulty finding a suitable venue and increased costs.

7.6 Options

The options available to Council are as follows:

a) To adopt the amended 2021 meeting schedule as proposed

b) To propose further amendments to the meeting schedule

7.7 Development of Preferred Option

It is recommended that the amended 2021 meeting schedule be adopted as proposed.

a 2021 Amended Council/Committee Meeting Schedule ⇩

Ordinary Meeting of Council - 08 April 2021 - Open Agenda

That the public be excluded from the following parts of the proceedings of this meeting, namely:

Agenda Items

1. Procurement of Electricity Supply 2021-2024

The general subject of each matter to be considered while the public was excluded, the reasons for passing this resolution in relation to each matter, and the specific grounds under Section 48(1) of the Local Government Official Information and Meetings Act 1987 for the passing of this resolution were as follows:

|

General subject of each matter to be considered. |

Reason for passing this resolution in relation to each matter. |

Ground(s) under section 48(1) to the passing of this resolution. |

|

Agenda Items |

||

|

1. Procurement of Electricity Supply 2021-2024 |

7(2)(b)(ii) Protect information where the making available of the information would be likely unreasonably to prejudice the commercial position of the person who supplied or who is the subject of the information 7(2)(h) Enable the local authority to carry out, without prejudice or disadvantage, commercial activities |

48(1)A That the public conduct

of the whole or the relevant part of the proceedings of the meeting would be

likely to result in the disclosure of information for which good reason for

withholding would exist: |